A San Diego California Nonqualified Defined Benefit Deferred Compensation Agreement refers to a contractual agreement between an employer and an employee which allows them to defer a portion of their compensation until a future date. Nonqualified defined benefit plans are generally designed to complement qualified retirement plans, providing additional benefits beyond those offered by traditional pension plans. These agreements are commonly used by employers in San Diego, California, to attract and retain top talent by offering additional retirement benefits. A Nonqualified Defined Benefit Deferred Compensation Agreement in San Diego, California, provides employees with the opportunity to contribute a predetermined percentage of their salary or a fixed dollar amount to a separate account. This allows employees to accumulate retirement savings on a tax-deferred basis until they choose to receive the funds. These agreements typically offer more flexibility in terms of contribution amounts and timing than traditional qualified plans like 401(k)s or pensions. In San Diego, California, there may be various types of Nonqualified Defined Benefit Deferred Compensation Agreements depending on the specific terms offered by employers. Some common variations include: 1. Salary Deferral Agreements: These agreements allow employees to defer a portion of their salary into a nonqualified defined benefit plan, providing an additional retirement savings vehicle beyond their regular compensation. 2. Bonus Deferral Agreements: This type of agreement allows employees to defer a portion of their annual bonus or other non-salary compensation to a nonqualified defined benefit plan, offering potential tax advantages and increased retirement savings. 3. Supplemental Executive Retirement Plans (SERPs): SERPs are designed specifically for highly compensated executives and key employees. They provide additional retirement benefits beyond what is allowed under qualified plans, aiming to recruit and retain top-level talent in San Diego, California. 4. Top-Hat Plans: These plans specifically target a select group of highly compensated employees, often executives or key management personnel. Top-hat plans provide similar benefits to other nonqualified defined benefit plans but are subject to fewer IRS regulations and restrictions. 5. Rabbi Trusts: A rabbi trust is a common funding vehicle for nonqualified deferred compensation plans. This irrevocable trust serves as a repository for contributed funds, creating security for participants by setting aside assets to ensure their deferred compensation remains available as promised. In conclusion, a San Diego California Nonqualified Defined Benefit Deferred Compensation Agreement is an attractive retirement benefit offered by employers to supplement qualified retirement plans. It allows employees to defer a portion of their compensation until retirement, providing tax advantages and increased flexibility in retirement savings. The different types of nonqualified defined benefit deferred compensation agreements include salary deferral agreements, bonus deferral agreements, supplemental executive retirement plans (SERPs), top-hat plans, and rabbi trusts.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Diego California Acuerdo de compensación diferida de beneficios definidos no calificados - Nonqualified Defined Benefit Deferred Compensation Agreement

Description

How to fill out San Diego California Acuerdo De Compensación Diferida De Beneficios Definidos No Calificados?

Preparing papers for the business or personal needs is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state laws and regulations of the specific region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it stressful and time-consuming to generate San Diego Nonqualified Defined Benefit Deferred Compensation Agreement without expert assistance.

It's possible to avoid spending money on lawyers drafting your paperwork and create a legally valid San Diego Nonqualified Defined Benefit Deferred Compensation Agreement by yourself, using the US Legal Forms web library. It is the largest online catalog of state-specific legal documents that are professionally cheched, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to save the necessary document.

If you still don't have a subscription, adhere to the step-by-step instruction below to obtain the San Diego Nonqualified Defined Benefit Deferred Compensation Agreement:

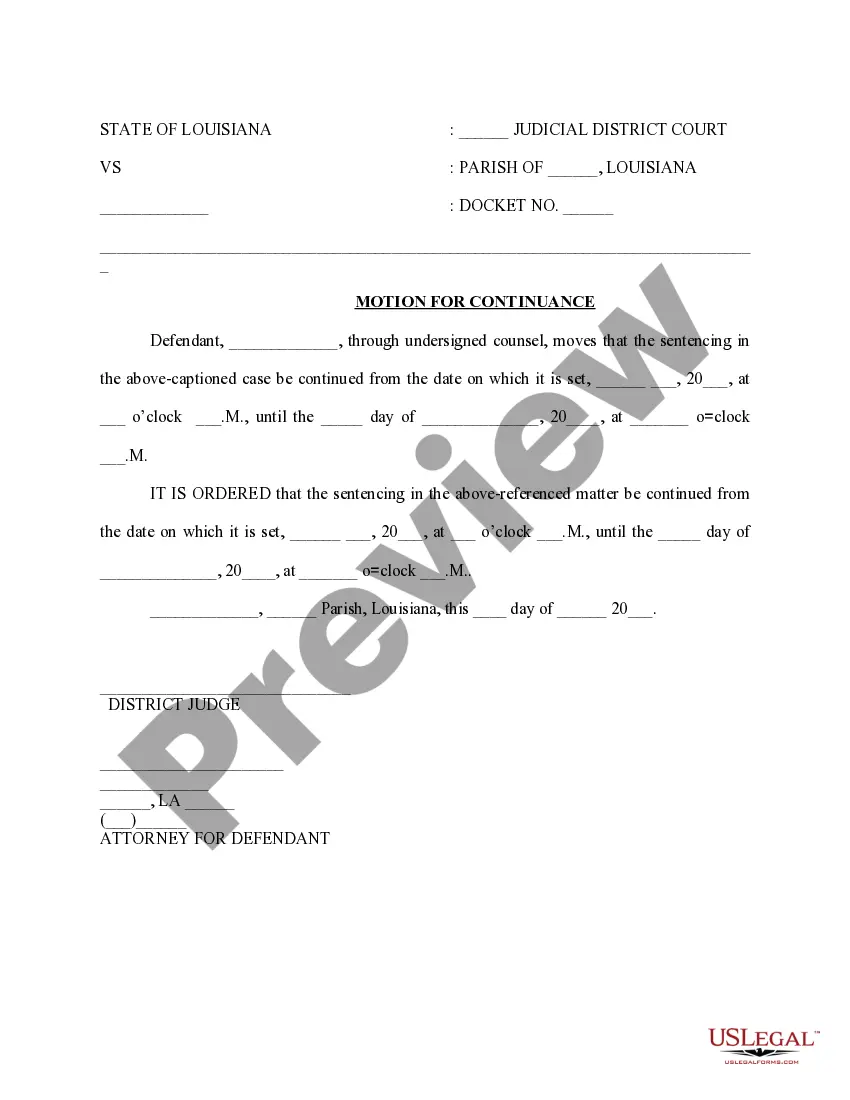

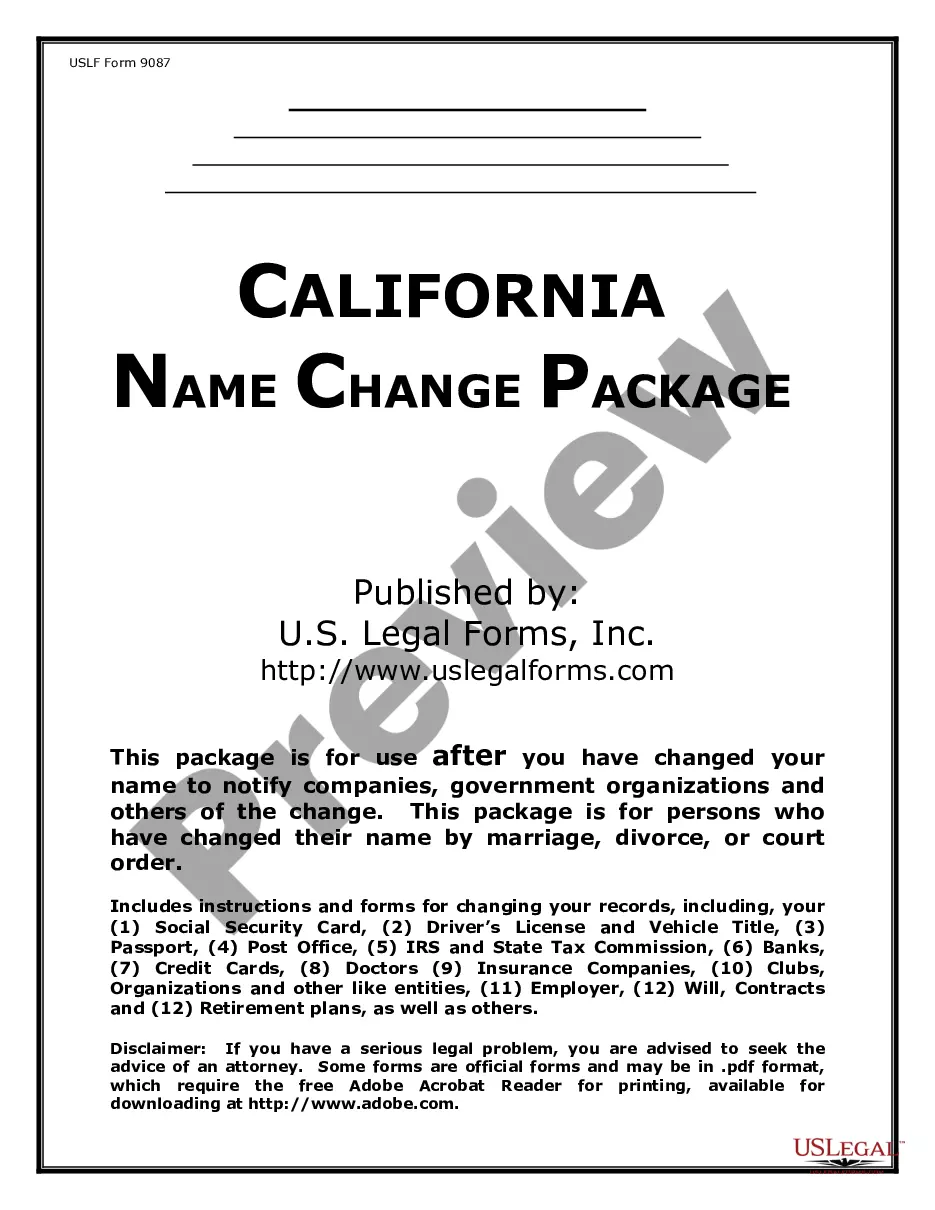

- Look through the page you've opened and check if it has the sample you require.

- To achieve this, use the form description and preview if these options are presented.

- To find the one that satisfies your needs, utilize the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Select the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal forms for any situation with just a few clicks!