The Nassau New York Registration Rights Agreement between Shell, Inc. and Mole Incorporated is a legal document that governs the registration of securities issued by Shell, Inc. to Mole Incorporated in connection with a business transaction. This agreement ensures that Mole Incorporated, as an investor in Shell, Inc., has certain rights and protections regarding the registration and public offering of these securities. Keywords: Nassau New York, Registration Rights Agreement, Shell, Inc., Mole Incorporated, securities, investor, business transaction, registration, public offering. There could be different types of Nassau New York Registration Rights Agreement between Shell, Inc. and Mole Incorporated, tailored to specific circumstances or provisions. Some of these variations may include: 1. Standard Registration Rights Agreement: This is the most common type of agreement that grants Mole Incorporated certain preemptive rights to request Shell, Inc. to register its securities with the Securities and Exchange Commission (SEC) for public offering. 2. Piggyback Registration Rights Agreement: In this type of agreement, Mole Incorporated has the right to include its securities in any registration statement filed by Shell, Inc. with the SEC for a public offering. This allows Mole Incorporated to piggyback on Shell, Inc.'s registration process and benefit from a broader investor base. 3. Demand Registration Rights Agreement: Under this agreement, Mole Incorporated has the right to request Shell, Inc. to initiate the registration of its securities with the SEC for a public offering, subject to certain conditions and limitations. This type of agreement provides Mole Incorporated with more control over when and how its securities are registered. 4. Shelf Registration Rights Agreement: In certain cases, Shell, Inc. may agree to file a shelf registration statement with the SEC, allowing Mole Incorporated to periodically sell its securities in the open market. This type of agreement provides flexibility to Mole Incorporated in managing its investment. It's important to note that the specific terms and provisions of the Nassau New York Registration Rights Agreement between Shell, Inc. and Mole Incorporated may vary depending on the negotiations and requirements of both parties involved.

Nassau New York Registration Rights Agreement between Sheldahl, Inc. and Molex Incorporated

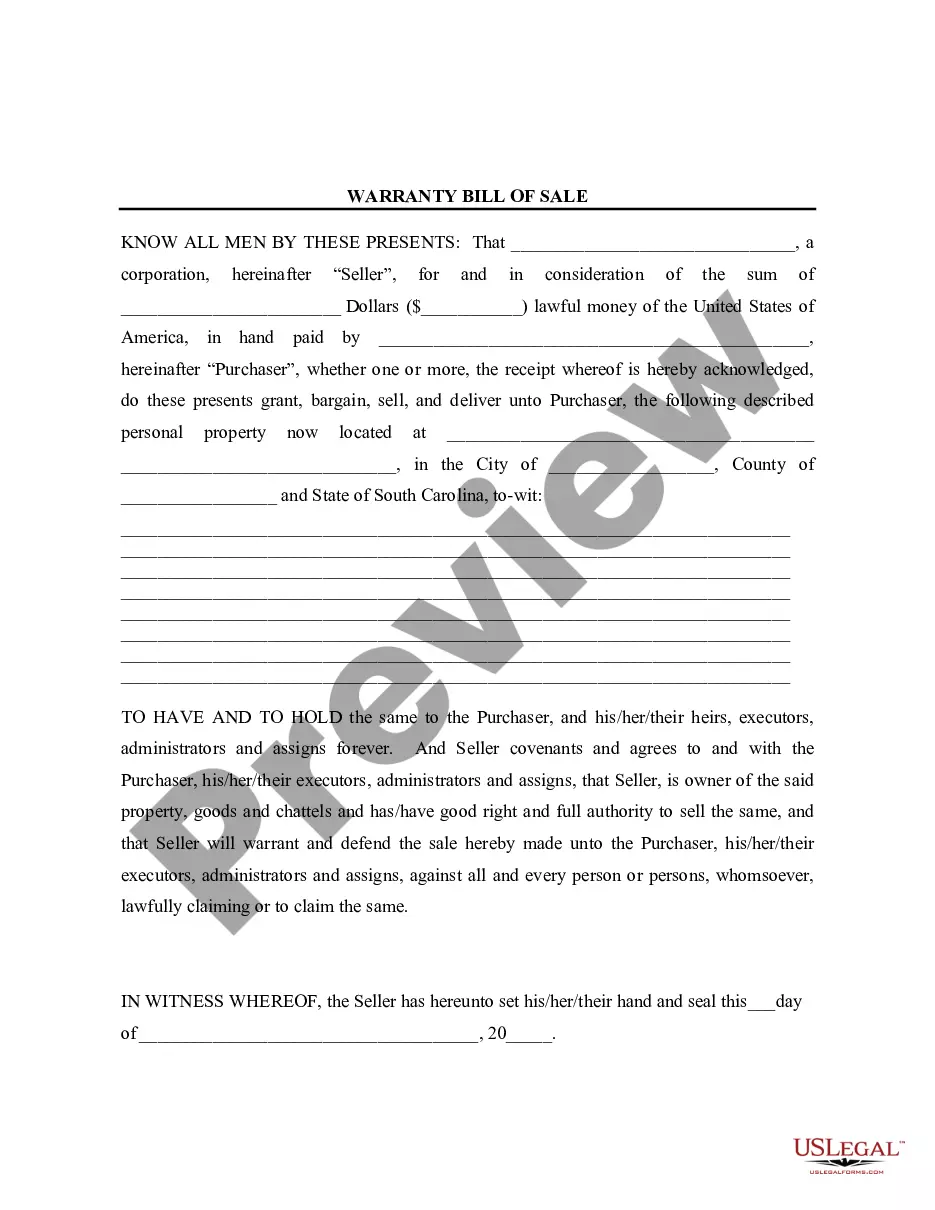

Description

How to fill out Nassau New York Registration Rights Agreement Between Sheldahl, Inc. And Molex Incorporated?

Do you need to quickly create a legally-binding Nassau Registration Rights Agreement between Sheldahl, Inc. and Molex Incorporated or maybe any other form to take control of your own or corporate affairs? You can go with two options: contact a legal advisor to draft a legal paper for you or create it completely on your own. Luckily, there's another solution - US Legal Forms. It will help you receive neatly written legal papers without having to pay unreasonable fees for legal services.

US Legal Forms provides a rich collection of over 85,000 state-compliant form templates, including Nassau Registration Rights Agreement between Sheldahl, Inc. and Molex Incorporated and form packages. We provide documents for a myriad of use cases: from divorce papers to real estate documents. We've been on the market for more than 25 years and got a spotless reputation among our customers. Here's how you can become one of them and get the necessary document without extra hassles.

- To start with, double-check if the Nassau Registration Rights Agreement between Sheldahl, Inc. and Molex Incorporated is tailored to your state's or county's regulations.

- If the document comes with a desciption, make sure to verify what it's suitable for.

- Start the searching process again if the document isn’t what you were hoping to find by using the search box in the header.

- Select the subscription that is best suited for your needs and proceed to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, find the Nassau Registration Rights Agreement between Sheldahl, Inc. and Molex Incorporated template, and download it. To re-download the form, simply go to the My Forms tab.

It's easy to find and download legal forms if you use our catalog. Additionally, the templates we offer are reviewed by law professionals, which gives you greater peace of mind when dealing with legal affairs. Try US Legal Forms now and see for yourself!