San Antonio Texas Pooling and Servicing Agreement of New Century Mortgage Securities, Inc.

Description

How to fill out Pooling And Servicing Agreement Of New Century Mortgage Securities, Inc.?

Creating documents for personal or business purposes is consistently a significant obligation.

While formulating a contract, a public service inquiry, or a power of attorney, it is essential to consider all national and local laws and regulations of the particular area.

However, smaller counties and even municipalities also have legislative processes that you need to take into account.

To locate the one that fulfills your requirements, employ the search tab located in the header of the page.

- All these factors contribute to the difficulty and duration of drafting the San Antonio Pooling and Servicing Agreement of New Century Mortgage Securities, Inc. without professional help.

- You can potentially save money by drafting your documents independently and create a legally sound San Antonio Pooling and Servicing Agreement of New Century Mortgage Securities, Inc. on your own by utilizing the US Legal Forms online library.

- It represents the largest internet collection of state-specific legal documents that have been professionally verified, ensuring their authenticity when you select a template for your county.

- Previously subscribed users just need to Log In to their accounts to retrieve the necessary form.

- If you do not yet possess a subscription, follow the detailed instructions below to obtain the San Antonio Pooling and Servicing Agreement of New Century Mortgage Securities, Inc.

- Browse the page you have accessed to check if it houses the template you require.

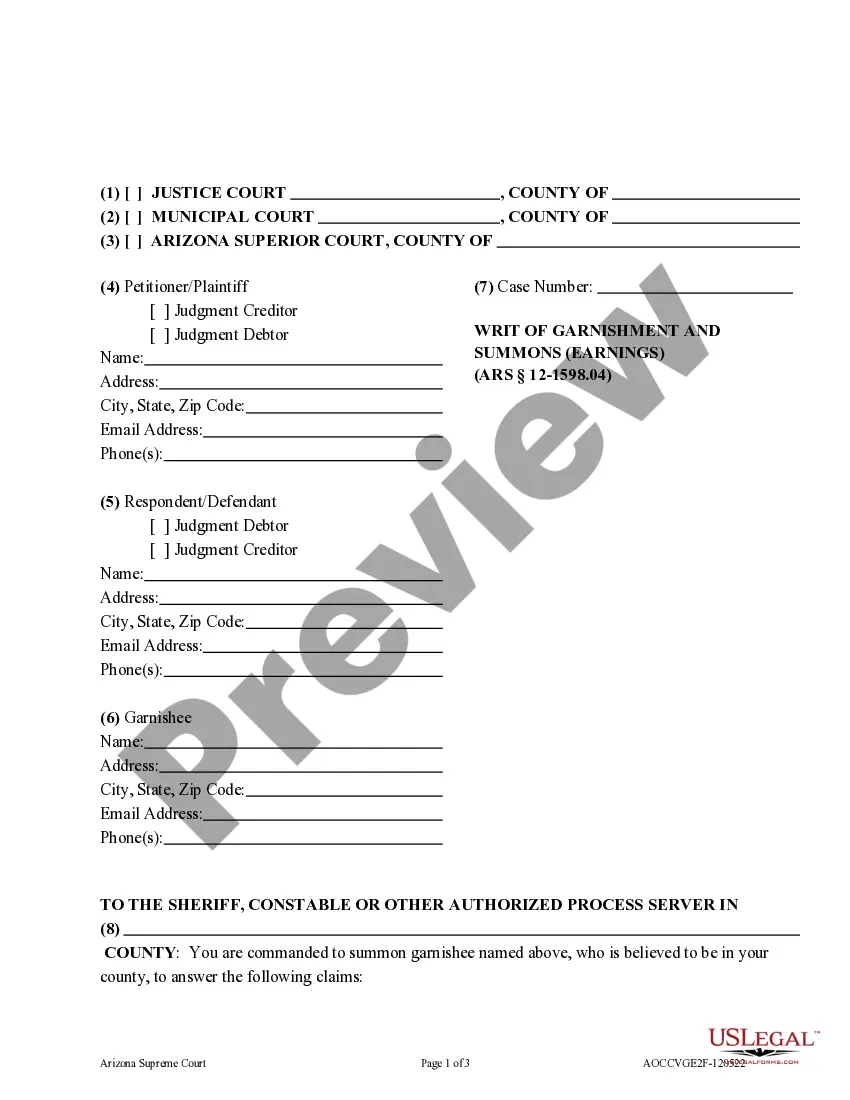

- To confirm this, utilize the form description and preview if these features are available.

Form popularity

FAQ

Pooling assets into asset-backed securities is known as asset securitization. This practice allows various assets, like mortgages, to be grouped together and sold as securities, providing liquidity and offering investment opportunities. The San Antonio Texas Pooling and Servicing Agreement of New Century Mortgage Securities, Inc. exemplifies this strategy, enabling better capital flow in the mortgage market.

Pooling and servicing agreements can be public documents, but they may also contain sections that are confidential, protecting proprietary information. This means that while certain aspects of the San Antonio Texas Pooling and Servicing Agreement of New Century Mortgage Securities, Inc. might be available to the public, details about specific terms and conditions could be restricted. Understanding this can aid prospective investors in their research.

Mortgage-backed securities are also commonly referred to as MBS. These financial instruments represent an ownership stake in a pool of mortgages, as is evident in the San Antonio Texas Pooling and Servicing Agreement of New Century Mortgage Securities, Inc. Understanding this terminology can help investors navigate the complexities of real estate investments more effectively.

The act of pooling mortgages and subsequently selling them as mortgage-backed securities is generally referred to as securitization. In the context of the San Antonio Texas Pooling and Servicing Agreement of New Century Mortgage Securities, Inc., this process allows financial institutions to convert illiquid assets into liquid investments. This facilitates broader access to capital and enhances liquidity in the real estate market.

Yes, mortgage agreements are generally considered public records. This means they can be accessed by anyone interested in reviewing them. For specific documents related to the San Antonio Texas Pooling and Servicing Agreement of New Century Mortgage Securities, Inc., you may visit local government offices or utilize online record-keeping services to obtain the necessary details.

To find your pooling and servicing agreement, you can start by checking with your mortgage servicer or any related financial institution. They often maintain copies of these agreements. Additionally, you can explore resources like the San Antonio Texas Pooling and Servicing Agreement of New Century Mortgage Securities, Inc. through online platforms or legal document services for easier access to essential information.

A pooling service agreement is a contract that outlines the management and servicing of pooled mortgage loans. This arrangement ensures that all parties involved, including investors and servicers, understand their roles and responsibilities. Specifically, the San Antonio Texas Pooling and Servicing Agreement of New Century Mortgage Securities, Inc. serves as a vital document that details the terms and conditions associated with the underlying mortgage-backed securities.

To find a pooling and servicing agreement on the SEC website, you can start by visiting the SEC's EDGAR database. Search using specific terms like 'San Antonio Texas Pooling and Servicing Agreement of New Century Mortgage Securities, Inc.' or the associated CUSIP number for quicker results. This tool allows users to access important financial documents and agreements efficiently.

A service agreement functions as a roadmap, delineating the roles and expectations of all parties involved in a service relationship. Within the framework of the San Antonio Texas Pooling and Servicing Agreement of New Century Mortgage Securities, Inc., the agreement stipulates how the servicer will perform duties, manage funds, and maintain compliance, ensuring smooth operations.

A mortgage servicing agreement is a contract that assigns responsibilities for managing mortgage loans to a servicer. In the case of the San Antonio Texas Pooling and Servicing Agreement of New Century Mortgage Securities, Inc., this agreement ensures proper handling of payments, communication with borrowers, and management of delinquent accounts, creating a reliable system for investors.