Maricopa, Arizona Investment Advisory Agreement between BNY Hamilton Large Growth CRT Fund and The Bank of New York The Maricopa, Arizona Investment Advisory Agreement is a legally binding contract established between BNY Hamilton Large Growth CRT Fund (hereinafter referred to as "the Fund") and The Bank of New York (hereinafter referred to as "the Advisor"), which outlines the terms and conditions of their investment advisory relationship in Maricopa, Arizona. This agreement serves as a guide for the Fund's investment strategy and objectives, as well as the Advisor's role in managing and providing professional investment advice. It aims to optimize the performance and profitability of the Fund's assets while adhering to specific guidelines and compliance regulations. Keywords: Maricopa, Arizona, Investment Advisory Agreement, BNY Hamilton Large Growth CRT Fund, The Bank of New York, investment strategy, investment objectives, investment advice, performance, profitability, assets, guidelines, compliance regulations. Different Types of Maricopa, Arizona Investment Advisory Agreements between BNY Hamilton Large Growth CRT Fund and The Bank of New York: 1. General Investment Advisory Agreement: This type of agreement encompasses all aspects of the advisory services provided by The Bank of New York to the BNY Hamilton Large Growth CRT Fund. It outlines the responsibilities, duties, and compensation of both parties involved. 2. Customized Investment Advisory Agreement: In certain cases, the Fund may require a specialized investment strategy tailored to its specific needs. The customized agreement enables the Advisor to develop an individualized approach, taking into consideration the Fund's unique investment goals and risk tolerance. 3. Performance-Based Investment Advisory Agreement: This type of agreement may be established if the Fund and the Advisor agree to a performance-based fee structure. The Advisor's compensation is directly linked to the investment performance, encouraging the implementation of strategies and actions to maximize returns. 4. Fixed-Term Investment Advisory Agreement: In some cases, the Fund and the Advisor may agree on a fixed-term arrangement, whereby the agreement is valid for a specified period. This type of agreement provides stability and certainty to both parties involved in the investment advisory relationship. 5. Comprehensive Investment Advisory Agreement: A comprehensive agreement covers various investment-related aspects, including asset allocation, risk management, portfolio diversification, and reporting requirements. It aims to ensure that the Advisor has a comprehensive understanding of the Fund's objectives and preferences. Keywords: Maricopa, Arizona, Investment Advisory Agreement, BNY Hamilton Large Growth CRT Fund, The Bank of New York, general, customized, performance-based, fixed-term, comprehensive.

Maricopa Arizona Investment Advisory Agreement between BNY Hamilton Large Growth CRT Fund and The Bank of New York

Description

How to fill out Maricopa Arizona Investment Advisory Agreement Between BNY Hamilton Large Growth CRT Fund And The Bank Of New York?

Drafting papers for the business or personal needs is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to take into account all federal and state regulations of the specific region. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it tense and time-consuming to create Maricopa Investment Advisory Agreement between BNY Hamilton Large Growth CRT Fund and The Bank of New York without expert assistance.

It's easy to avoid wasting money on lawyers drafting your documentation and create a legally valid Maricopa Investment Advisory Agreement between BNY Hamilton Large Growth CRT Fund and The Bank of New York by yourself, using the US Legal Forms online library. It is the largest online catalog of state-specific legal templates that are professionally cheched, so you can be sure of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to save the necessary form.

If you still don't have a subscription, follow the step-by-step instruction below to obtain the Maricopa Investment Advisory Agreement between BNY Hamilton Large Growth CRT Fund and The Bank of New York:

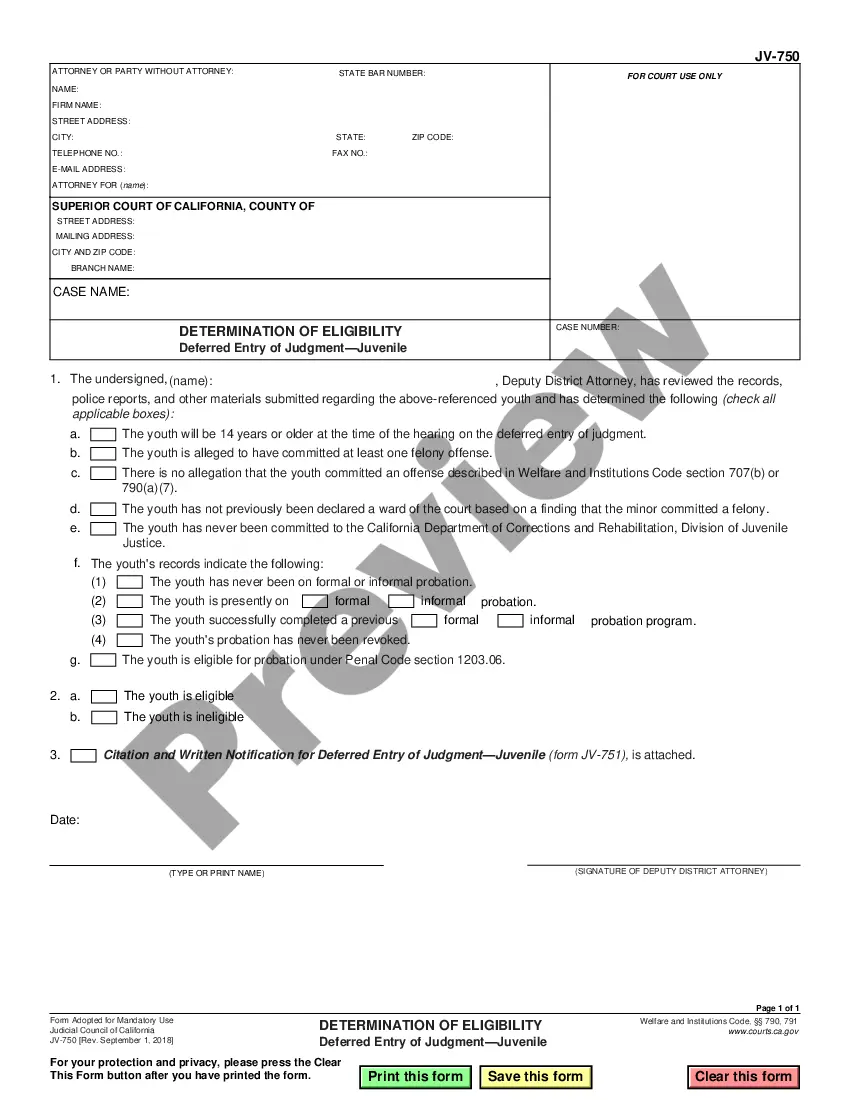

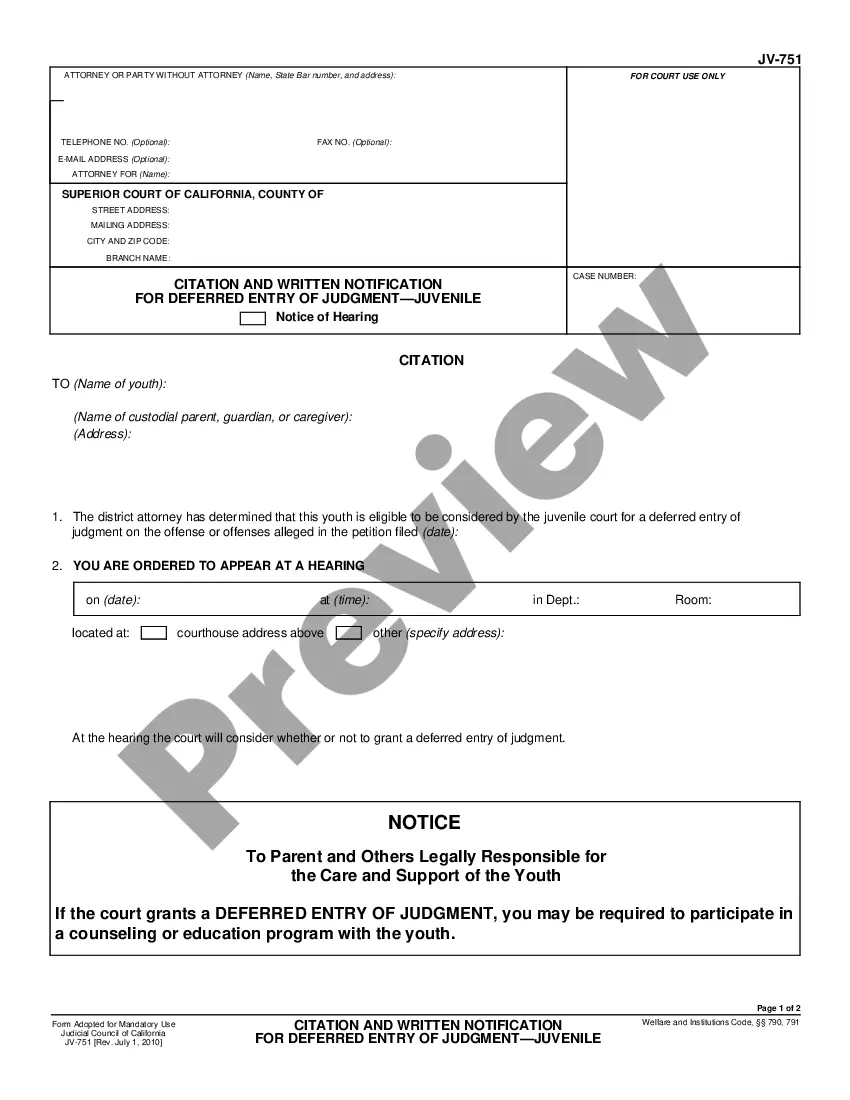

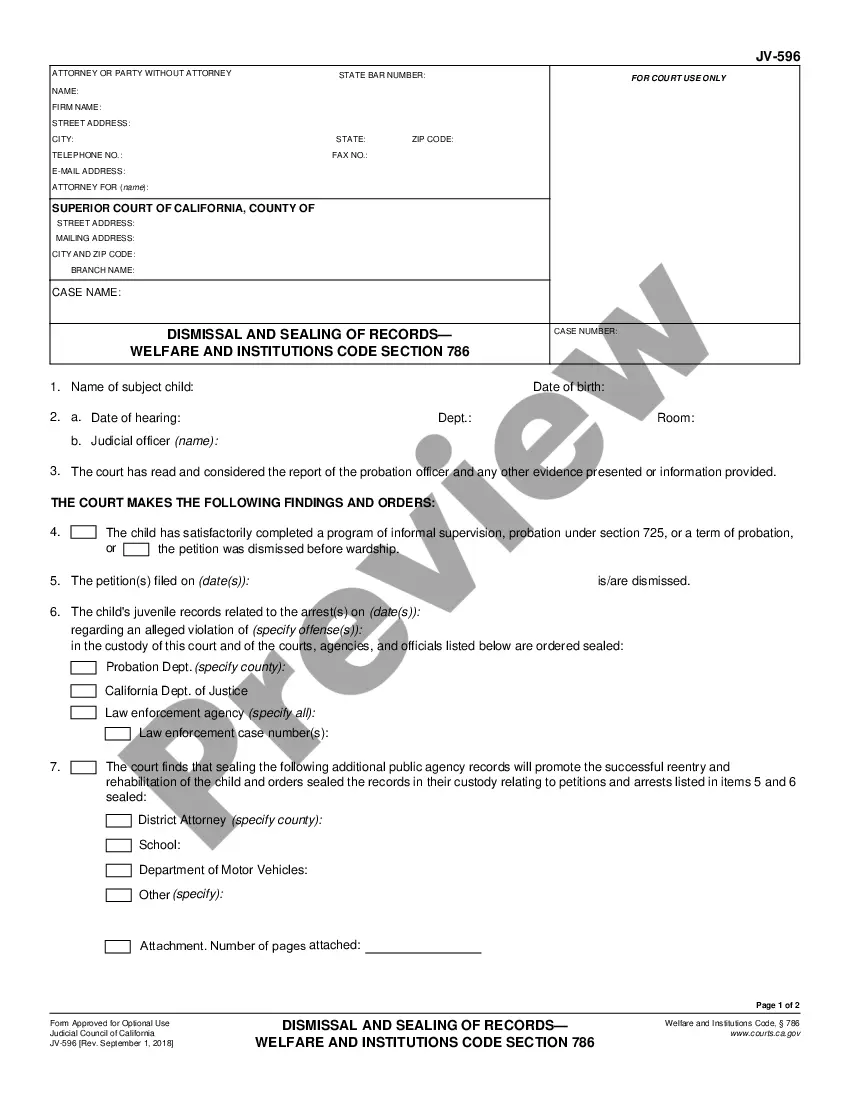

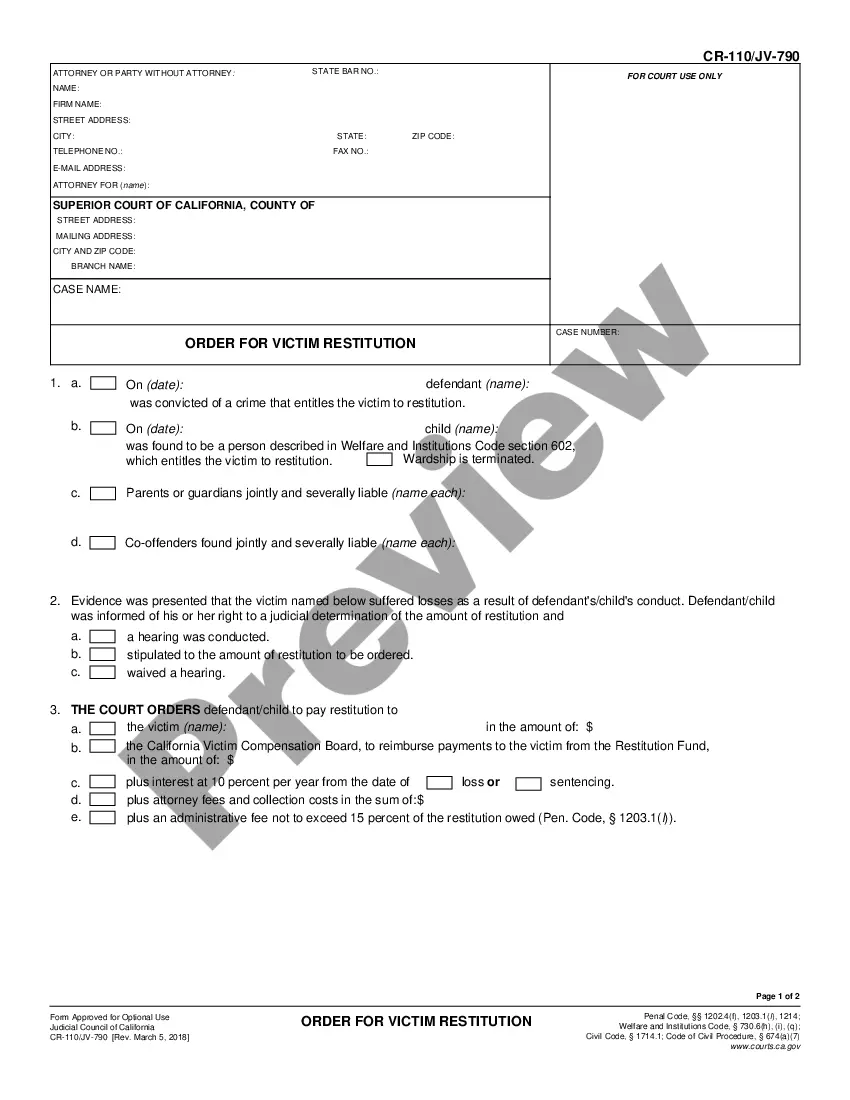

- Look through the page you've opened and verify if it has the document you need.

- To do so, use the form description and preview if these options are presented.

- To locate the one that fits your requirements, use the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Pick the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal templates for any situation with just a few clicks!