The Wayne Michigan Investment Advisory Agreement between Hamilton Small Cap Growth CRT Fund and The Bank of New York is a vital document that establishes a partnership between these two entities. This agreement outlines the terms and conditions under which The Bank of New York provides investment advisory services to the Hamilton Small Cap Growth CRT Fund. Keywords: Wayne Michigan, Investment Advisory Agreement, Hamilton Small Cap Growth CRT Fund, The Bank of New York The Wayne Michigan Investment Advisory Agreement is a legally binding contract that ensures a transparent and well-regulated investment process. It defines the roles, responsibilities, and obligations of both parties involved. This agreement is crucial to safeguard the interests of both the Hamilton Small Cap Growth CRT Fund and The Bank of New York. Under the terms of this agreement, The Bank of New York serves as the investment advisor to the Hamilton Small Cap Growth CRT Fund, providing valuable expertise in managing investment portfolios. This partnership aims to enhance investment strategies, maximize returns, and manage risks effectively. The Agreement covers various important aspects such as investment objectives, guidelines, and the type of securities that may be considered for investment. It also highlights the fund's investment strategy, including the target assets, sectors, and geographic regions for investment. The Bank of New York, as the investment advisor, is responsible for developing and implementing investment policies that align with the fund's objectives. This specific Investment Advisory Agreement includes provisions for regular reporting, monitoring, and assessment of investment performance. The Bank of New York is expected to provide timely and accurate reports to the Hamilton Small Cap Growth CRT Fund, detailing portfolio holdings, investment performance, and compliance with the agreed-upon investment strategy. Additionally, the agreement may specify the fees and compensation structure for The Bank of New York's services. These fees may be based on a percentage of assets under management or a flat fee. The agreement may also outline any potential conflicts of interest and disclose the procedures in place to manage such conflicts. While there may not be different types of Wayne Michigan Investment Advisory Agreements between Hamilton Small Cap Growth CRT Fund and The Bank of New York, the specific terms and conditions within the agreement can be customized based on the unique requirements of the fund and its investment objectives. In summary, the Wayne Michigan Investment Advisory Agreement between Hamilton Small Cap Growth CRT Fund and The Bank of New York establishes a partnership that aims to effectively manage the fund's investment portfolio. This agreement provides clarity, accountability, and legal protection for both parties involved while enhancing the potential for successful investment outcomes.

Wayne Michigan Investment Advisory Agreement between Hamilton Small Cap Growth CRT Fund and The Bank of New York

Description

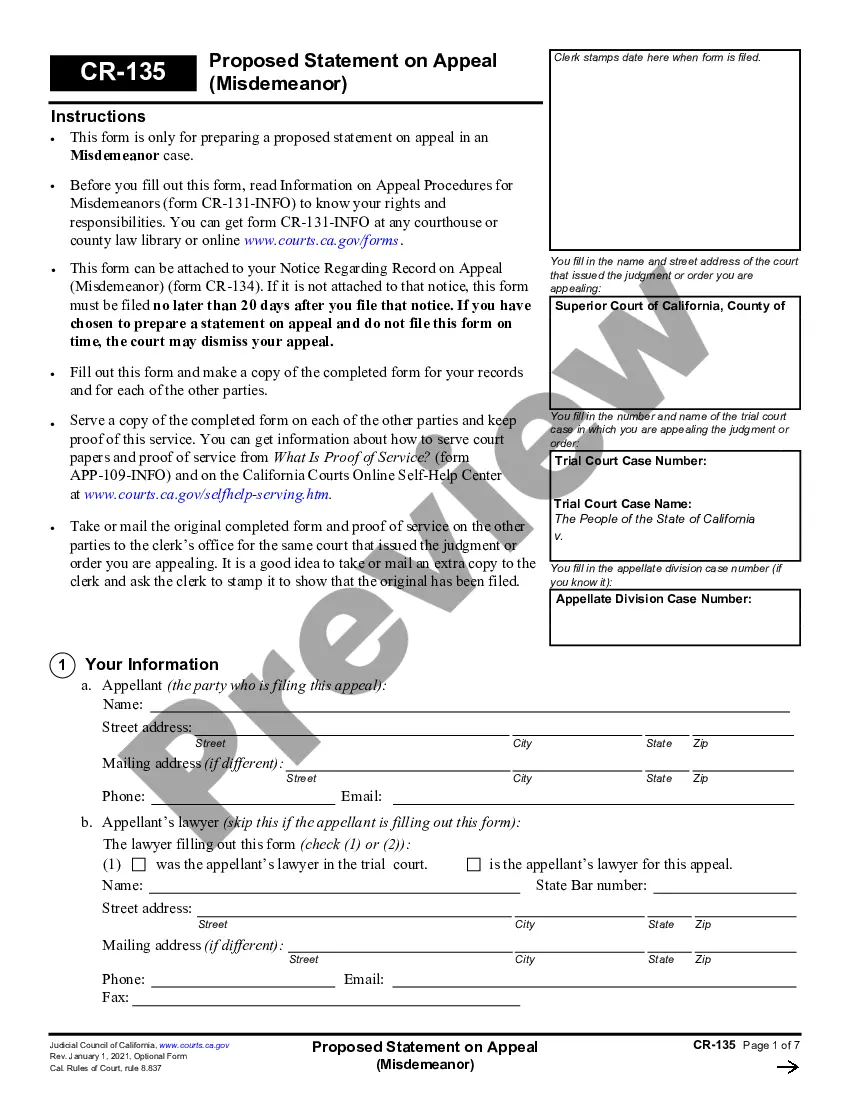

How to fill out Wayne Michigan Investment Advisory Agreement Between Hamilton Small Cap Growth CRT Fund And The Bank Of New York?

Preparing legal documentation can be difficult. In addition, if you decide to ask an attorney to draft a commercial contract, documents for ownership transfer, pre-marital agreement, divorce papers, or the Wayne Investment Advisory Agreement between Hamilton Small Cap Growth CRT Fund and The Bank of New York, it may cost you a lot of money. So what is the best way to save time and money and draft legitimate documents in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario accumulated all in one place. Therefore, if you need the recent version of the Wayne Investment Advisory Agreement between Hamilton Small Cap Growth CRT Fund and The Bank of New York, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Wayne Investment Advisory Agreement between Hamilton Small Cap Growth CRT Fund and The Bank of New York:

- Look through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now once you find the required sample and pick the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the document format for your Wayne Investment Advisory Agreement between Hamilton Small Cap Growth CRT Fund and The Bank of New York and save it.

Once done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever purchased many times - you can find your templates in the My Forms tab in your profile. Give it a try now!