Orange California Investment Management Agreement is a legal document that outlines the terms and conditions for engaging Morgan Stanley Dean Witter Advisors, Inc. as an investment manager and advisor. This agreement defines the relationship between the client and Morgan Stanley, ensuring transparency and setting expectations for both parties involved. Keywords: Orange California, Investment Management Agreement, Morgan Stanley Dean Witter Advisors, management and investment advisory services There are different types of Orange California Investment Management Agreements that can be tailored to address specific client needs. Some variations in these agreements may include: 1. Standard Investment Management Agreement: This is a general agreement that covers the essential terms of the engagement between the client and Morgan Stanley. It outlines the responsibilities of both parties and sets the framework for investment strategies, risk management, and reporting requirements. 2. Customized Investment Management Agreement: This agreement is tailored to meet specific client requirements and preferences. It allows clients to have a more personalized approach to investing, taking into consideration their financial goals, risk tolerance, and investment preferences. 3. Wrap Fee Investment Management Agreement: This type of agreement involves a bundled fee structure that includes both investment management and advisory services. Clients pay a single comprehensive fee, which covers portfolio management, financial planning, and transaction costs. 4. Discretionary Investment Management Agreement: This agreement grants Morgan Stanley the authority to make investment decisions on behalf of the client without requiring prior approval. The client entrusts the investment manager with the discretion to execute trades and manage the portfolio based on pre-determined investment objectives. 5. Non-Discretionary Investment Management Agreement: In this type of agreement, Morgan Stanley provides investment advice and recommendations to the client, but the final investment decisions are made by the client. The investment manager does not have the authority to execute trades without explicit client consent. Regardless of the specific type of Orange California Investment Management Agreement, the primary objective is to establish a professional relationship between the client and Morgan Stanley Dean Witter Advisors, Inc. The agreement helps in defining the scope of services, fee structure, performance benchmarks, and the roles and responsibilities of both parties, ensuring a transparent and mutually beneficial partnership. Note: The information provided above is for general informational purposes only and does not constitute legal or financial advice. It is important to consult with a qualified attorney or financial advisor when considering an investment management agreement.

Orange California Investment Management Agreement regarding the employment of Morgan Stanley Dean Witter Advisors, Inc. to render management and investment advisory services

Description

How to fill out Orange California Investment Management Agreement Regarding The Employment Of Morgan Stanley Dean Witter Advisors, Inc. To Render Management And Investment Advisory Services?

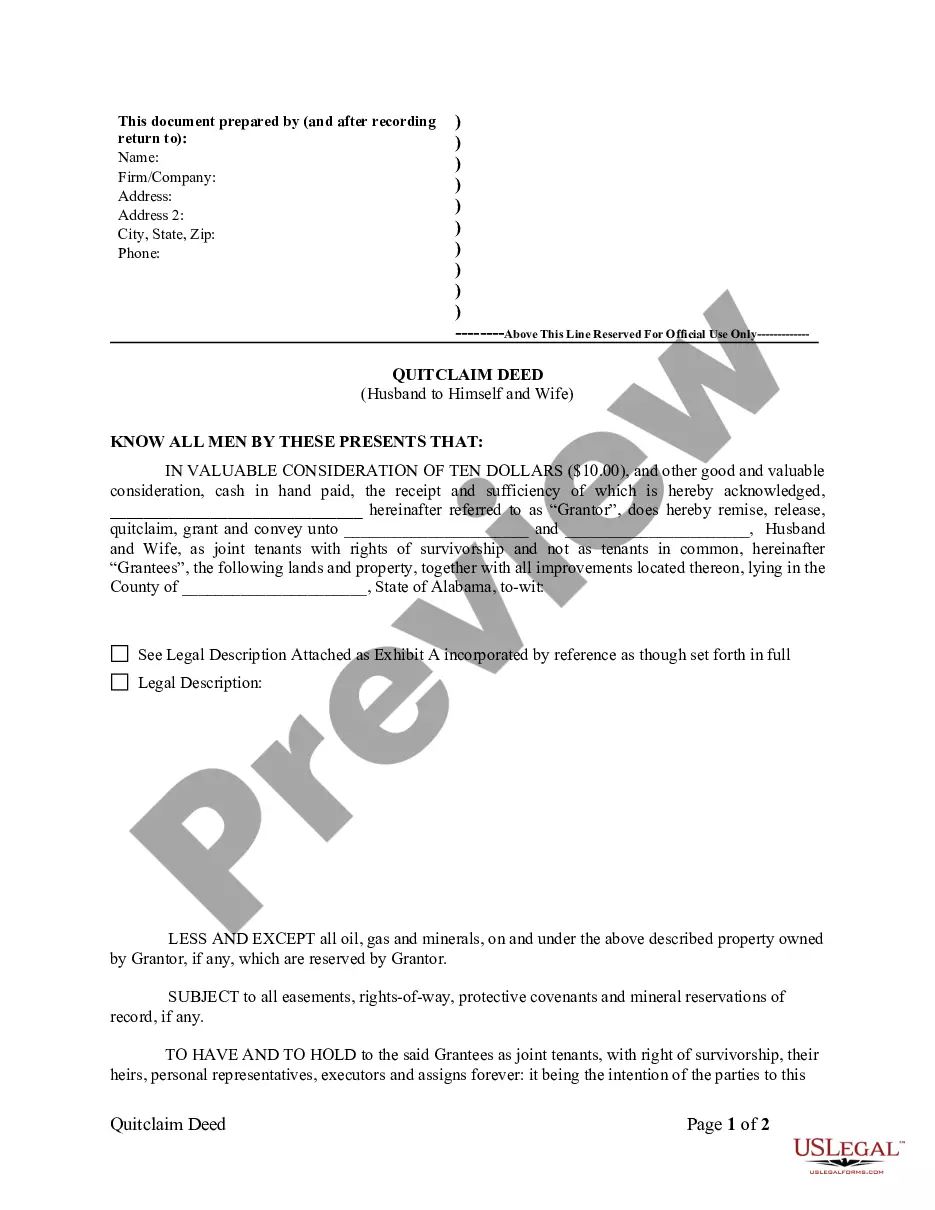

Are you looking to quickly create a legally-binding Orange Investment Management Agreement regarding the employment of Morgan Stanley Dean Witter Advisors, Inc. to render management and investment advisory services or maybe any other form to manage your personal or business affairs? You can go with two options: contact a legal advisor to draft a legal document for you or draft it completely on your own. The good news is, there's a third solution - US Legal Forms. It will help you get professionally written legal documents without paying unreasonable prices for legal services.

US Legal Forms provides a huge catalog of more than 85,000 state-specific form templates, including Orange Investment Management Agreement regarding the employment of Morgan Stanley Dean Witter Advisors, Inc. to render management and investment advisory services and form packages. We provide documents for an array of use cases: from divorce paperwork to real estate documents. We've been out there for more than 25 years and gained a spotless reputation among our clients. Here's how you can become one of them and obtain the necessary template without extra troubles.

- First and foremost, carefully verify if the Orange Investment Management Agreement regarding the employment of Morgan Stanley Dean Witter Advisors, Inc. to render management and investment advisory services is adapted to your state's or county's regulations.

- If the document includes a desciption, make sure to check what it's suitable for.

- Start the search again if the document isn’t what you were hoping to find by using the search box in the header.

- Choose the plan that best fits your needs and proceed to the payment.

- Choose the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the Orange Investment Management Agreement regarding the employment of Morgan Stanley Dean Witter Advisors, Inc. to render management and investment advisory services template, and download it. To re-download the form, simply go to the My Forms tab.

It's stressless to buy and download legal forms if you use our services. Moreover, the paperwork we offer are reviewed by law professionals, which gives you greater confidence when writing legal matters. Try US Legal Forms now and see for yourself!