Santa Clara California Underwriting Agreement between print, Inc. regarding the Issue and Sale of Shares of Common Stock is a legally binding contract that outlines the terms and conditions of the underwriting process for the sale of print, Inc.'s common stock in Santa Clara, California. This agreement governs the relationship between print, Inc. as the issuer of the shares and the underwriter(s) responsible for facilitating the sale. The agreement covers various aspects of the underwriting process, including the number of shares to be issued/sold, the price per share, and any applicable discounts or commissions. It also outlines the responsibilities and obligations of both parties involved. The Santa Clara California Underwriting Agreement provides clarity on the timeline for the issuance and sale of the shares as well as any specific conditions that need to be met. This may include obtaining any necessary regulatory approvals or conducting due diligence processes. Additionally, the agreement may specify the circumstances under which the underwriters have the option to purchase additional shares (often known as the green shoe option), which allows them to fulfill excess demand for the stock. It may also address how the underwriters will handle the allotment of shares between different investors. Different types of Santa Clara California Underwriting Agreement between print, Inc. regarding the Issue and Sale of Shares of Common Stock may include: 1. Firm Commitment Agreement: This type of underwriting agreement ensures that the underwriter(s) commit to purchasing all the offered shares from print, Inc., even if they are unable to resell them immediately. 2. The Best Efforts Agreement: In this type of agreement, the underwriter(s) do not commit to purchasing all the shares but are responsible for making their best efforts in selling them. They will only purchase and resell the shares that find buyers. 3. All-or-None Agreement: This agreement sets a condition that all the shares must be sold as a whole, or the underwriter(s) will not purchase any. This type of agreement provides more certainty to the issuer in the sale process. 4. Mini-Max Agreement: This agreement sets a minimum and maximum number of shares that must be sold. The underwriter(s) are obligated to buy and resell shares within this range, ensuring a certain level of capital is raised. Overall, the Santa Clara California Underwriting Agreement between print, Inc. regarding the Issue and Sale of Shares of Common Stock is a critical document that establishes the rights and obligations of both print, Inc. and the underwriter(s) involved in the underwriting process. It safeguards the interests of both parties and facilitates the successful sale of shares in Santa Clara, California.

Santa Clara California Underwriting Agreement between iPrint, Inc. regarding the Issue and Sale of Shares of Common Stock

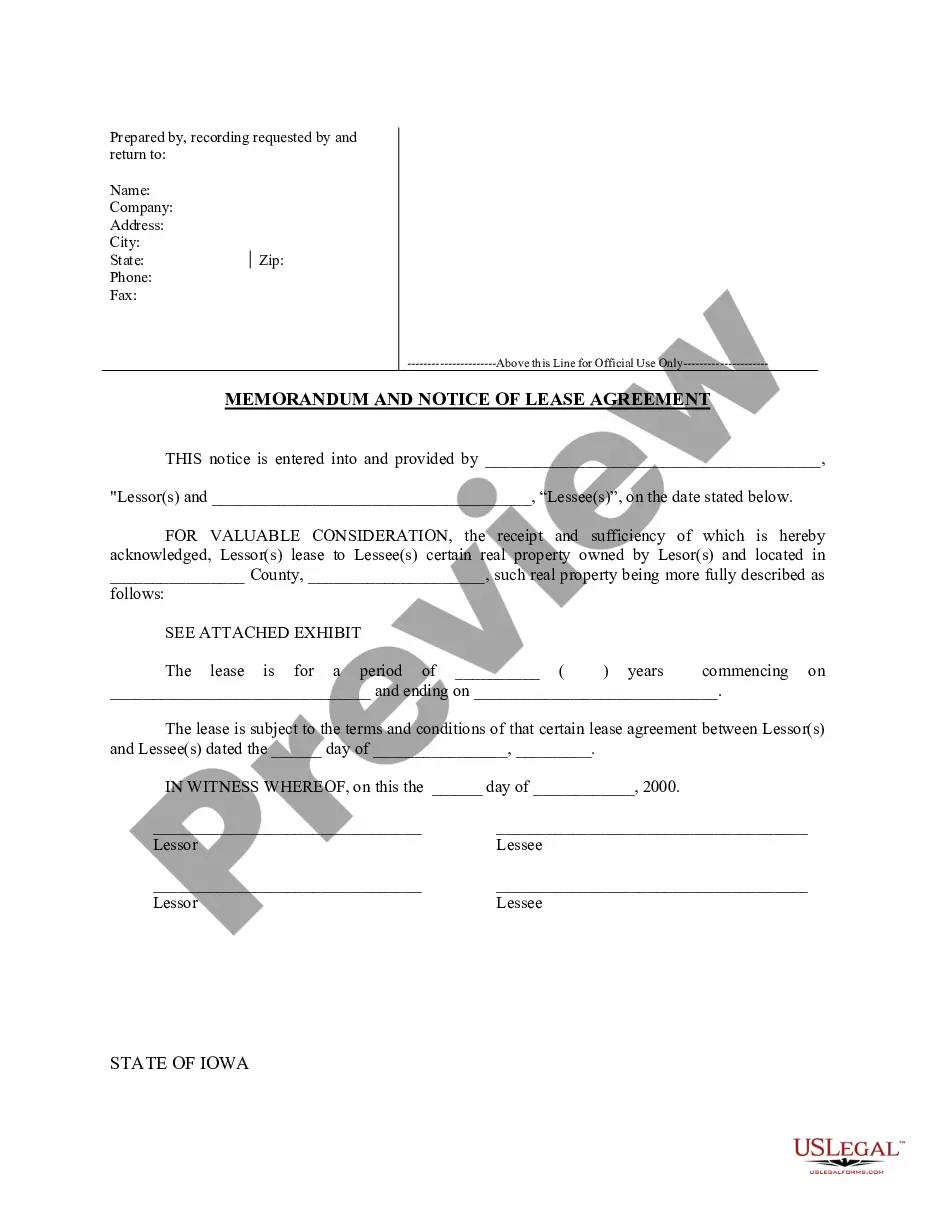

Description

How to fill out Santa Clara California Underwriting Agreement Between IPrint, Inc. Regarding The Issue And Sale Of Shares Of Common Stock?

Dealing with legal forms is a must in today's world. However, you don't always need to look for professional help to draft some of them from the ground up, including Santa Clara Underwriting Agreement between iPrint, Inc. regarding the Issue and Sale of Shares of Common Stock, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to pick from in different categories ranging from living wills to real estate papers to divorce documents. All forms are organized according to their valid state, making the searching process less overwhelming. You can also find information resources and tutorials on the website to make any activities related to document completion simple.

Here's how to find and download Santa Clara Underwriting Agreement between iPrint, Inc. regarding the Issue and Sale of Shares of Common Stock.

- Take a look at the document's preview and description (if provided) to get a basic idea of what you’ll get after downloading the form.

- Ensure that the template of your choosing is adapted to your state/county/area since state laws can affect the legality of some records.

- Examine the similar forms or start the search over to find the right file.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the option, then a needed payment gateway, and buy Santa Clara Underwriting Agreement between iPrint, Inc. regarding the Issue and Sale of Shares of Common Stock.

- Choose to save the form template in any available format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Santa Clara Underwriting Agreement between iPrint, Inc. regarding the Issue and Sale of Shares of Common Stock, log in to your account, and download it. Of course, our platform can’t take the place of a lawyer entirely. If you need to deal with an extremely difficult case, we recommend getting a lawyer to examine your form before signing and filing it.

With over 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of users. Join them today and purchase your state-compliant documents effortlessly!