Orange California Stock Tender Agreement is a legally binding document that outlines the terms and conditions for the acquisition of shares in a company located in Orange, California. In this case, the agreement is specifically between EMC Corp., Eagle Merger Corp., Computer Concepts Corp., and potentially other parties involved in the transaction. The tender agreement serves as a crucial instrument to ensure a smooth and transparent transaction process. It covers various aspects, including the purchase price, the number of shares to be acquired, and the timeline for completion. Additionally, it may encompass provisions related to the treatment of stock options, voting rights, and the transfer of shares. There can be different types of Orange California Stock Tender Agreements, depending on the nature of the transaction and the parties involved. Some common variations include: 1. All Cash Tender Offer: This type of tender offer involves the acquiring company, EMC Corp. in this case, purchasing the target company's shares for a specific cash amount per share. 2. Exchange Offer: An exchange offer allows the acquiring company, such as Eagle Merger Corp., to offer its own shares in exchange for the target company's shares. This type of offer enables the parties involved to benefit from potential synergies and future growth prospects. 3. Partial Tender Offer: A partial tender offer occurs when the acquiring company offers to purchase only a portion of the target company's outstanding shares. This type of agreement allows the target company's shareholders to choose whether to sell their shares or retain ownership in the company. 4. Hostile Takeover Tender Offer: In some cases, a tender offer can be categorized as a hostile takeover attempt. This happens when the management or board of the target company, like Computer Concepts Corp., opposes the acquisition but the acquiring company proceeds with the tender offer, often aiming to directly contact the target company's shareholders. These are just a few examples of the possible types of Orange California Stock Tender Agreements between EMC Corp., Eagle Merger Corp., Computer Concepts Corp., and other parties involved. It is crucial for all parties to seek legal and financial advice to ensure compliance with relevant laws and regulations.

Orange California Stock Tender Agreement between EMC Corp., Eagle Merger Corp., Computer Concepts Corp., et al.

Description

How to fill out Orange California Stock Tender Agreement Between EMC Corp., Eagle Merger Corp., Computer Concepts Corp., Et Al.?

Whether you plan to open your company, enter into a contract, apply for your ID update, or resolve family-related legal concerns, you need to prepare certain documentation meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal templates for any individual or business case. All files are collected by state and area of use, so picking a copy like Orange Stock Tender Agreement between EMC Corp., Eagle Merger Corp., Computer Concepts Corp., et al. is quick and easy.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several more steps to get the Orange Stock Tender Agreement between EMC Corp., Eagle Merger Corp., Computer Concepts Corp., et al.. Follow the instructions below:

- Make sure the sample meets your personal needs and state law requirements.

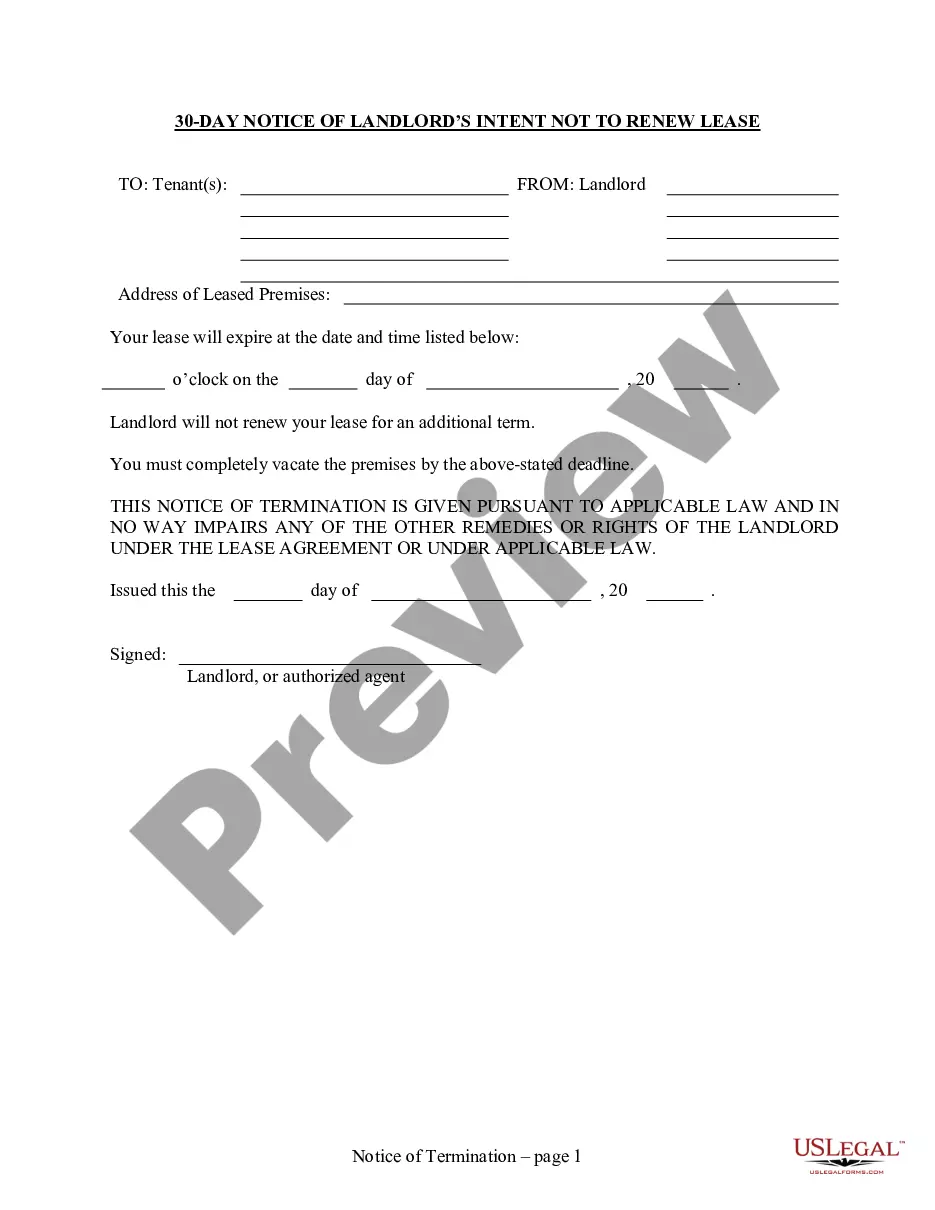

- Look through the form description and check the Preview if available on the page.

- Make use of the search tab specifying your state above to locate another template.

- Click Buy Now to get the file once you find the correct one.

- Opt for the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Orange Stock Tender Agreement between EMC Corp., Eagle Merger Corp., Computer Concepts Corp., et al. in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you are able to access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!