Cook Illinois Simple Agreement for Future Equity (SAFE) is a financial instrument that allows investors to inject capital into early-stage companies in exchange for the potential to receive equity in the future. It is a popular funding mechanism used by startups and emerging businesses to raise funds without going through the traditional process of issuing shares. The Cook Illinois SAFE is a contract between the investor and the company, outlining the terms of the investment and the rights and obligations of both parties. Unlike traditional equity investments, which involve the purchase of shares at a fixed price, the SAFE does not determine the exact number or price of the future equity. Instead, it provides a framework for the conversion of the investment into equity at a future financing round or other specified events. This innovative instrument addresses some challenges faced by startups in valuing their business at an early stage. It eliminates the need for immediate valuation, allowing companies to secure capital without determining a specific price per share. The Cook Illinois SAFE also simplifies the investment process, reducing legal and administrative costs compared to traditional equity financings. There are different types of Cook Illinois Simple Agreements for Future Equity, depending on the specific features and conditions outlined in the agreement. These variations include: 1. Valuation cap SAFE: This type of SAFE caps the conversion price at which the investment converts into equity, ensuring that the investor receives the best possible terms if the company achieves a higher valuation in the future. 2. Discount SAFE: With a discount SAFE, the investor receives a predetermined discount on the price per share in the future financing round. This gives them an advantage over later investors, incentivizing early-stage investment. 3. MFN (Most Favored Nation) SAFE: The MFN SAFE grants the investor the right to benefit from any better terms or conditions offered to future investors in subsequent financing rounds. This ensures that the investor is not disadvantaged by subsequent investments receiving more favorable terms. 4. Performance-based SAFE: This type of SAFE sets certain performance milestones that the company must achieve for the investment to convert into equity. It aligns the interests of the investor and the company by incentivizing the achievement of specific targets. The Cook Illinois SAFE provides flexibility for both investors and companies, allowing them to customize the terms of the agreement to meet their specific needs. By using this instrument, startups can secure funding from investors while deferring the determination of valuation until a later financing round, enabling them to focus on growth and development in the early stages of their journey.

Cook Illinois Simple Agreement for Future Equity

Description

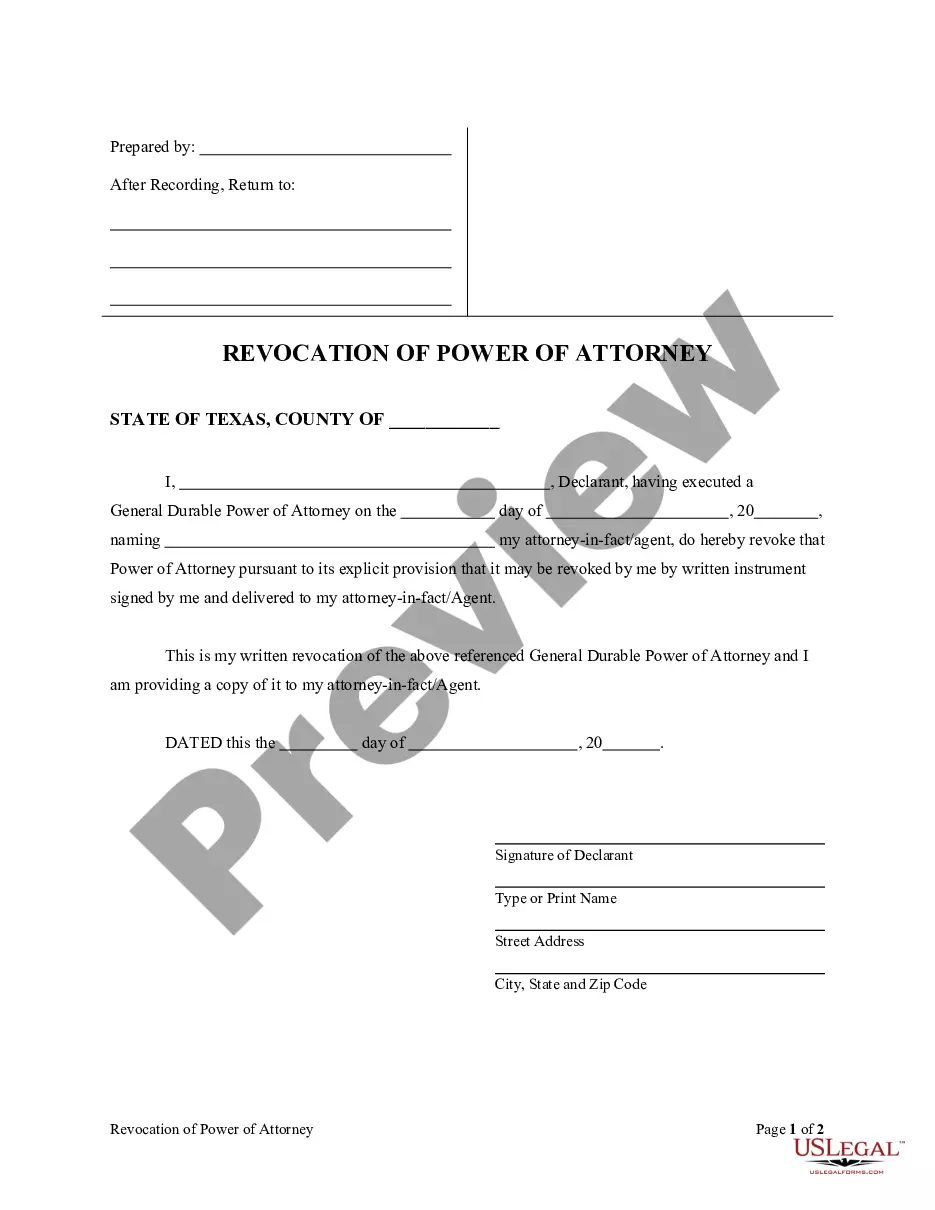

How to fill out Cook Illinois Simple Agreement For Future Equity?

Draftwing documents, like Cook Simple Agreement for Future Equity, to take care of your legal matters is a difficult and time-consumming process. A lot of cases require an attorney’s participation, which also makes this task expensive. However, you can take your legal matters into your own hands and handle them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal documents created for a variety of scenarios and life circumstances. We make sure each document is in adherence with the laws of each state, so you don’t have to be concerned about potential legal pitfalls compliance-wise.

If you're already aware of our services and have a subscription with US, you know how effortless it is to get the Cook Simple Agreement for Future Equity template. Simply log in to your account, download the template, and customize it to your needs. Have you lost your document? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new customers is fairly easy! Here’s what you need to do before downloading Cook Simple Agreement for Future Equity:

- Make sure that your document is compliant with your state/county since the regulations for writing legal documents may vary from one state another.

- Learn more about the form by previewing it or going through a brief intro. If the Cook Simple Agreement for Future Equity isn’t something you were looking for, then use the header to find another one.

- Log in or create an account to start utilizing our service and get the document.

- Everything looks great on your end? Click the Buy now button and choose the subscription option.

- Select the payment gateway and type in your payment details.

- Your form is all set. You can try and download it.

It’s an easy task to find and buy the needed template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich collection. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!