Harris County, Texas is a populous county located in the southeastern part of the state. It encompasses the city of Houston, making it the largest county in Texas and the third-largest in the United States. Known for its diverse population, booming economy, and vibrant cultural scene, Harris County offers its residents and visitors numerous opportunities for work, education, and entertainment. One important aspect of living in Harris County, Texas, is being aware of your rights under the Fair Credit Reporting Act (FCRA). The FCRA is a federal law that regulates the collection, dissemination, and use of consumer credit information. It aims to protect individuals from inaccurate, incomplete, or outdated information being reported by credit reporting agencies. As a resident of Harris County, Texas, it is crucial to understand the various types and implications of the A Summary of Your Rights Under the Fair Credit Reporting Act. These may include: 1. Initial Notice: Any consumer reporting agency that furnishes reports containing credit information must provide consumers with an initial notice. This notice explains a consumer's right to obtain a copy of their credit report and how to dispute inaccuracies. 2. Adverse Action Notice: If a consumer is denied credit, employment, insurance, or any other adverse action based on information from a credit report, they are entitled to receive an adverse action notice. This notice informs individuals of the specific reasons behind the adverse action and the credit reporting agency responsible for providing the information. 3. Instructions for Disputing Information: The FCRA provides consumers with the right to dispute any information on their credit report that they believe is inaccurate or incomplete. The summary should include detailed instructions on how to initiate a dispute with credit reporting agencies, including providing relevant supporting documentation. 4. Access to Free Credit Reports: Consumer reporting agencies must provide consumers with a free copy of their credit report once every 12 months upon request. This right allows individuals to monitor their credit history, identify errors, and detect any suspicious activity. 5. Identity Theft Victims' Rights: The FCRA provides specific rights for individuals who have been victims of identity theft. These include the right to place fraud alerts on their credit reports, block fraudulent information resulting from identity theft, and obtain free credit reports regularly to monitor for fraudulent activity. Understanding and exercising your rights under the Fair Credit Reporting Act is essential for residents of Harris County, Texas, as it empowers individuals to protect their financial reputation and maintain accurate credit information. By staying informed about these rights, residents can take proactive steps towards ensuring fair and reliable credit reporting.

Harris Texas A Summary of Your Rights Under the Fair Credit Reporting Act

Description

How to fill out Harris Texas A Summary Of Your Rights Under The Fair Credit Reporting Act?

Laws and regulations in every sphere differ throughout the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Harris A Summary of Your Rights Under the Fair Credit Reporting Act, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's a perfect solution for professionals and individuals searching for do-it-yourself templates for different life and business occasions. All the forms can be used many times: once you pick a sample, it remains available in your profile for further use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Harris A Summary of Your Rights Under the Fair Credit Reporting Act from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Harris A Summary of Your Rights Under the Fair Credit Reporting Act:

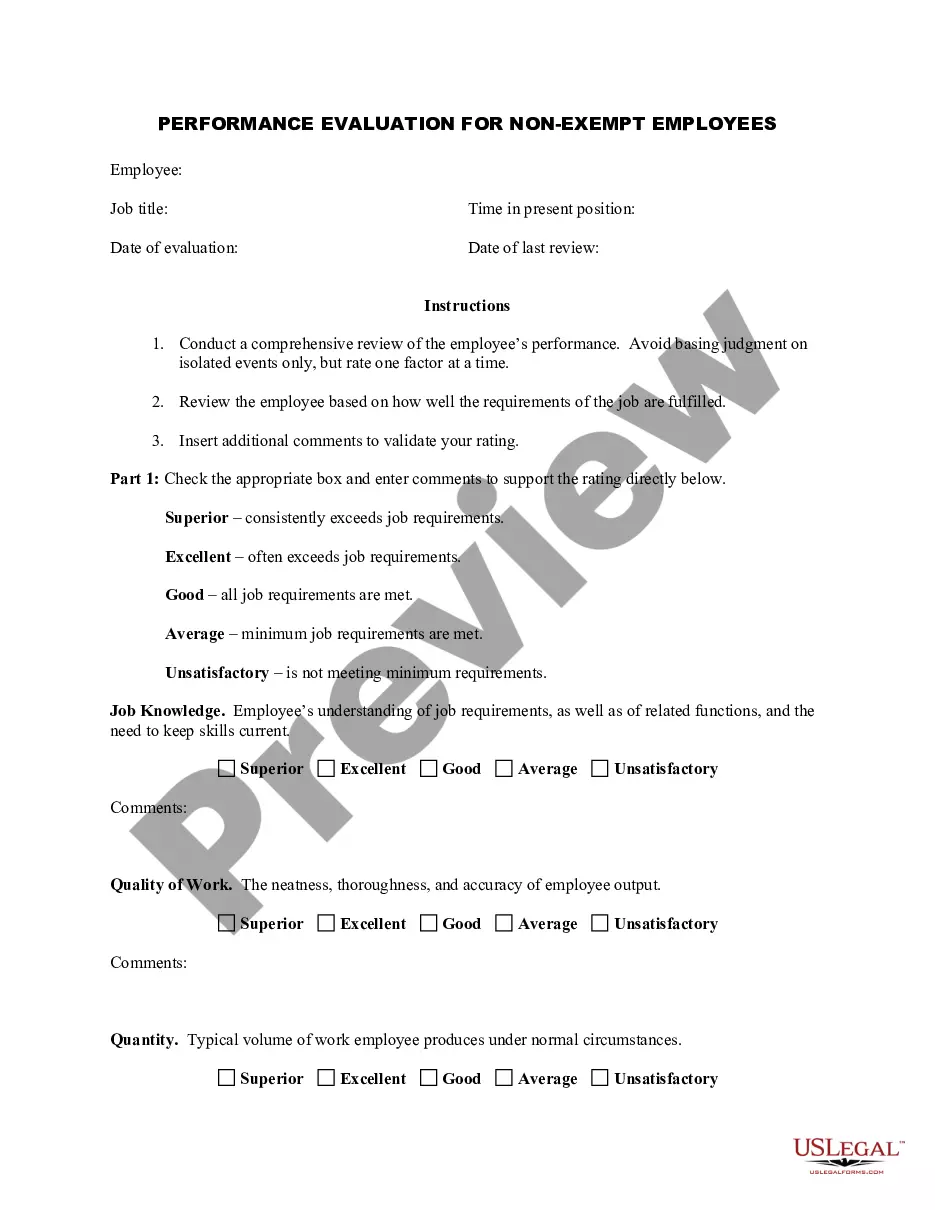

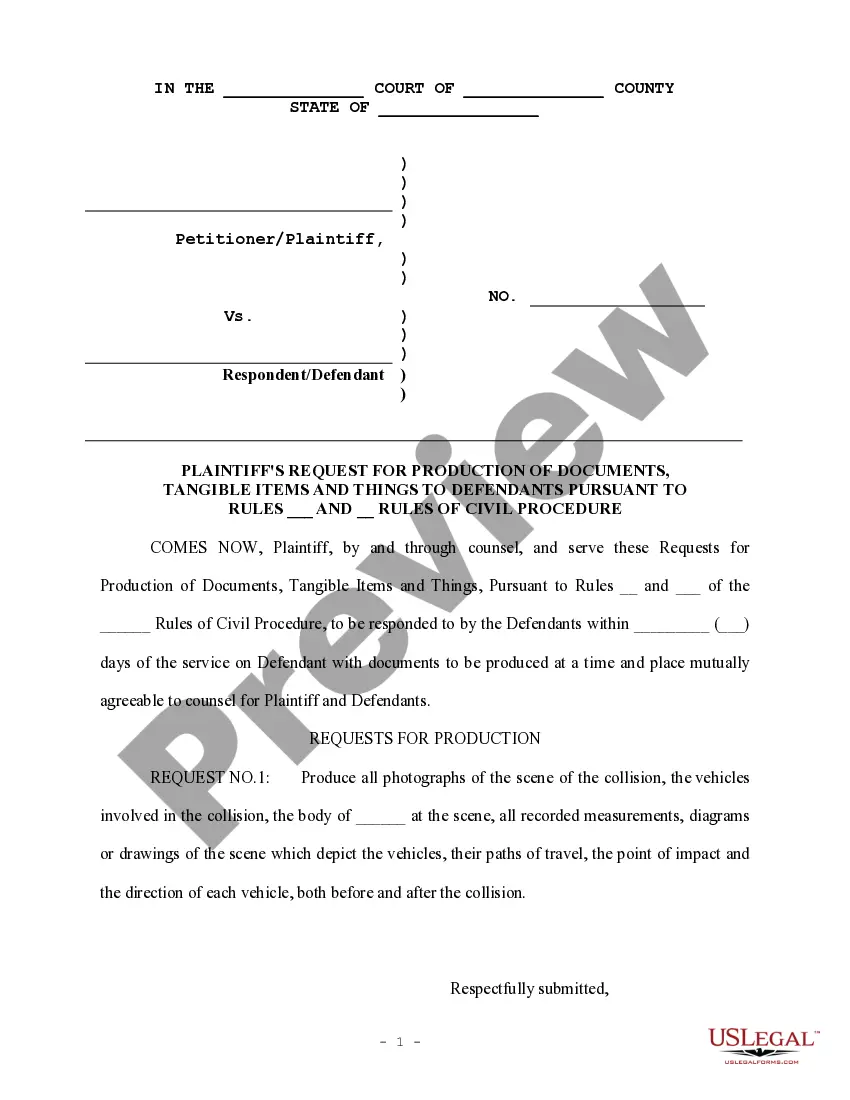

- Examine the page content to make sure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the document once you find the correct one.

- Choose one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!