Houston Texas Writ of Execution: A Comprehensive Overview In the legal realm, a Writ of Execution serves as an important tool for enforcing judgments and securing debts owed by individuals or entities in Houston, Texas. It acts as a court order that authorizes the seizure and sale of the debtor's property in order to satisfy the outstanding debt. This article will delve into the intricacies of the Houston Texas Writ of Execution and shed light on its various types. A Writ of Execution carries significant weight in the post-judgment process, enabling creditors to collect what is owed to them through levying the debtor's assets. Houston, Texas, being the largest city in the Lone Star State with a thriving economy, experiences a notable number of debt collection cases, amplifying the importance of understanding the Writ of Execution system for both creditors and debtors. There are several types of Houston Texas Writs of Execution, each tailored to specific circumstances and assets that can be seized to satisfy the judgment. These variations include: 1. Personal Property Writ of Execution: This type of writ allows for the seizure and sale of tangible items owned by the debtor such as vehicles, jewelry, furniture, and electronics. These assets can be auctioned off to recover the outstanding debt. 2. Real Estate Writ of Execution: When the debtor owns real property in Houston, Texas, a Writ of Execution can be used to initiate a sale through the county sheriff's office. The proceeds from the sale are then used to satisfy the judgment amount. 3. Garnishment Writ of Execution: In cases where the debtor's wages or bank accounts are the primary sources of income, a garnishment writ may be sought. This allows the creditor to collect a portion of the debtor's earnings directly from their employer or financial institution. 4. Turnover Writ of Execution: If the debtor possesses assets that are not easily seized through simple levies, such as stocks, bonds, or business interests, a turnover writ can be utilized. This compels the debtor to surrender these assets for liquidation. It is essential to note that the issuance and execution of Writs of Execution in Houston, Texas must adhere to strict legal procedures and guidelines provided by state law. These guidelines ensure that the rights of all parties involved are protected and upheld, preventing any undue harm or abuse of power. Navigating the legal landscape of Houston, Texas, and understanding the intricacies of Writs of Execution can prove to be a daunting task. Therefore, it is advisable for both creditors and debtors to seek the assistance of experienced attorneys specializing in debt collection and judgment enforcement to ensure proper compliance and safeguard their interests. In conclusion, Houston Texas Writs of Execution play a crucial role in enforcing judgments and recovering outstanding debts in the state's largest city. With varying types of Writs available, creditors have options to seize different types of assets owned by the debtor. However, it is essential to seek legal advice to navigate this complex process successfully and protect the rights of all parties involved.

Houston Texas Writ of Execution

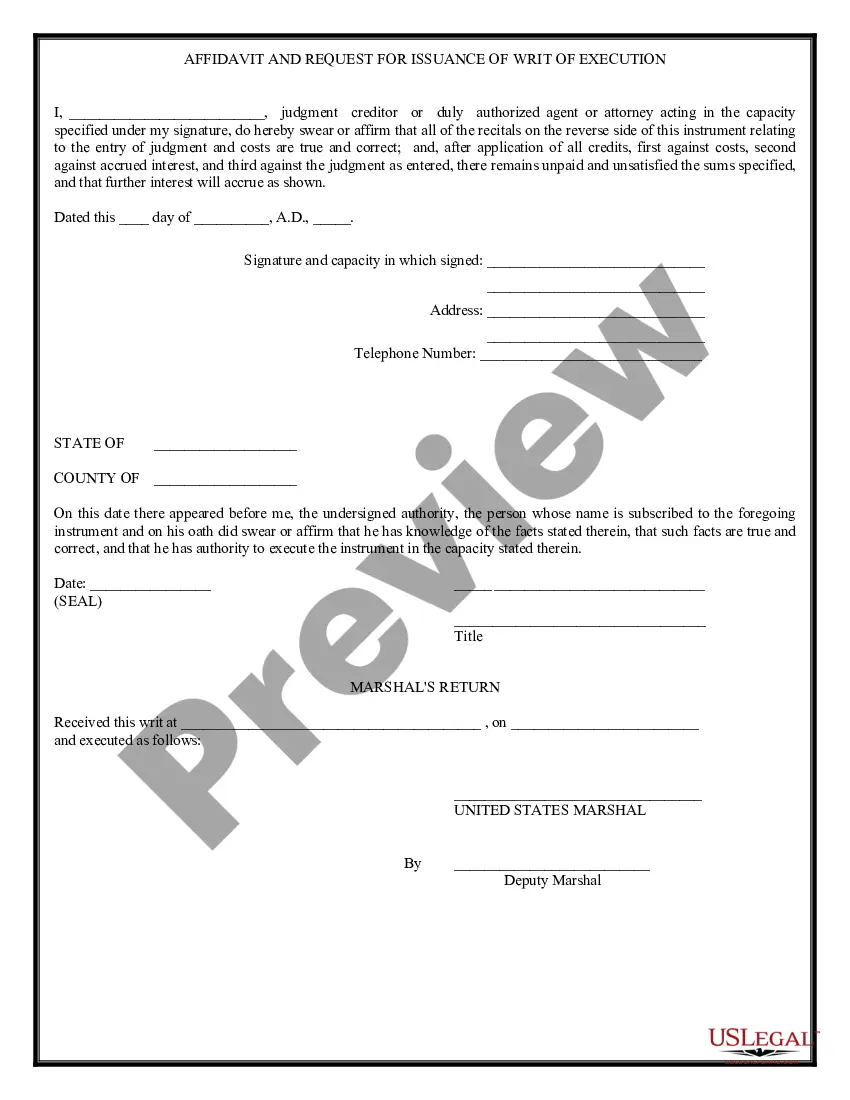

Description

How to fill out Houston Texas Writ Of Execution?

Creating forms, like Houston Writ of Execution, to take care of your legal affairs is a difficult and time-consumming process. Many circumstances require an attorney’s participation, which also makes this task expensive. However, you can take your legal affairs into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal forms crafted for various cases and life circumstances. We make sure each form is compliant with the laws of each state, so you don’t have to be concerned about potential legal problems compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how straightforward it is to get the Houston Writ of Execution form. Go ahead and log in to your account, download the template, and personalize it to your needs. Have you lost your form? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new customers is just as easy! Here’s what you need to do before downloading Houston Writ of Execution:

- Ensure that your form is specific to your state/county since the regulations for writing legal documents may differ from one state another.

- Find out more about the form by previewing it or going through a brief description. If the Houston Writ of Execution isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or register an account to begin using our service and download the form.

- Everything looks great on your end? Click the Buy now button and select the subscription plan.

- Pick the payment gateway and enter your payment details.

- Your template is all set. You can go ahead and download it.

It’s easy to find and purchase the appropriate template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich collection. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!