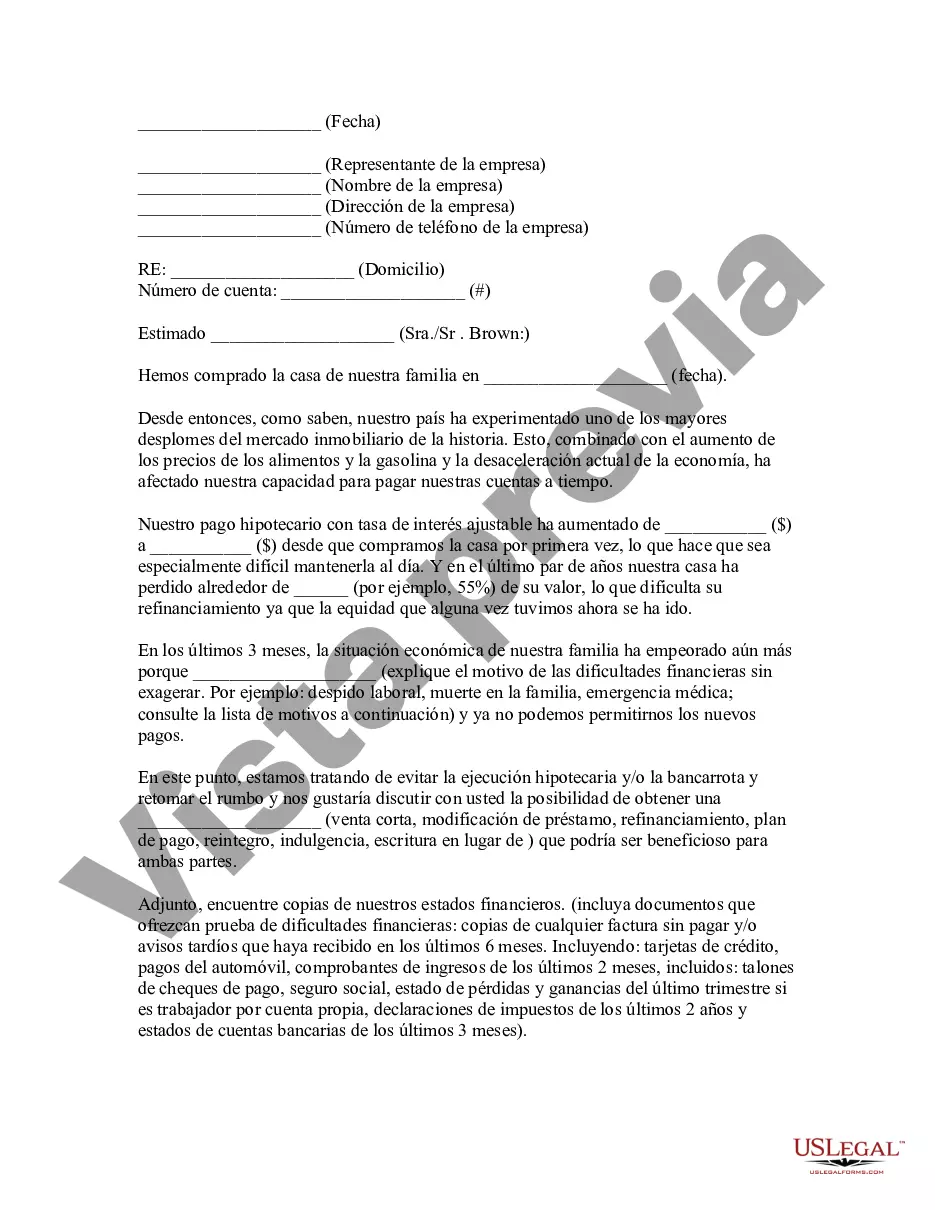

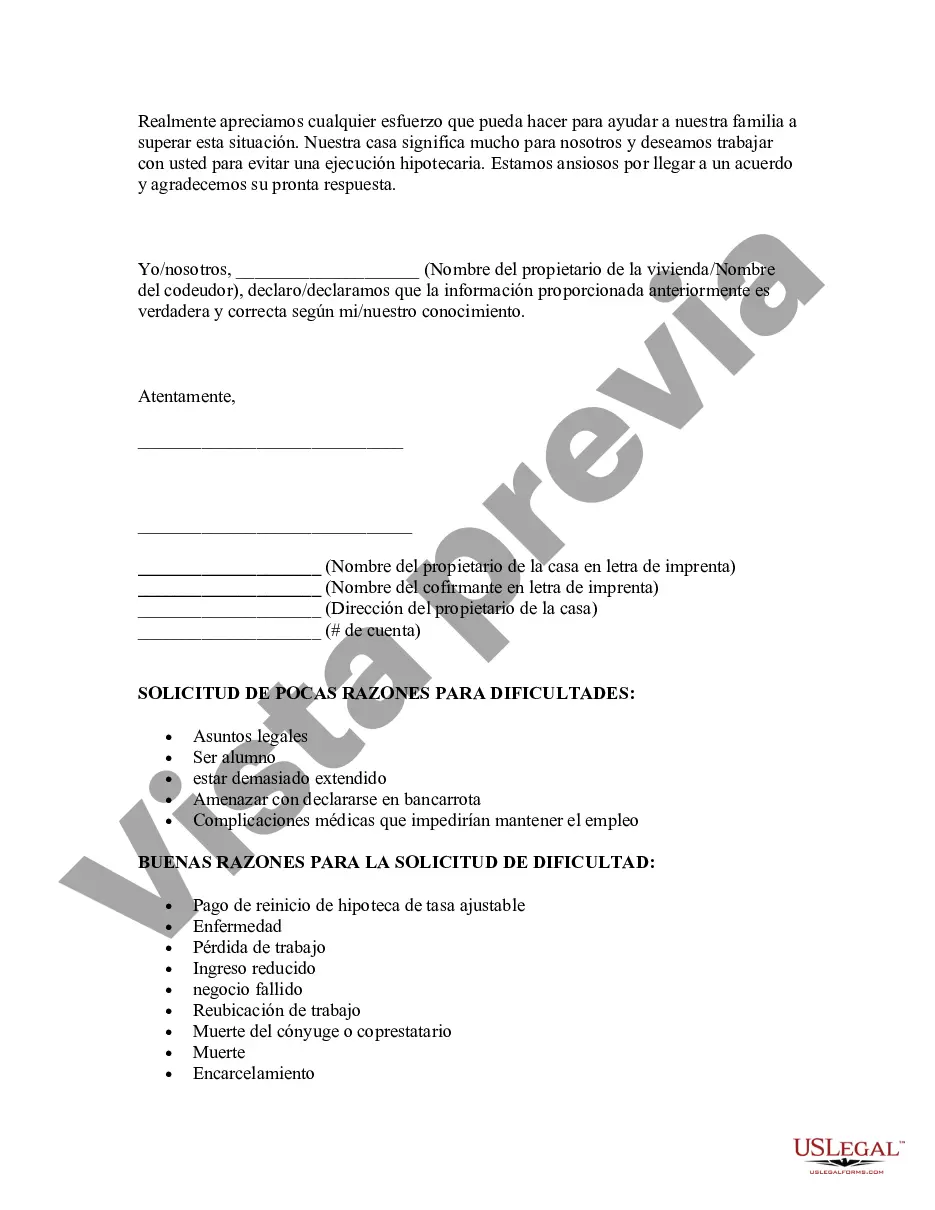

Title: Alameda California Hardship Letter to Mortgagor or Lender to Prevent Foreclosure: A Comprehensive Guide Introduction: In Alameda, California, homeowners facing financial difficulties have the option to write a hardship letter to their mortgage lender as a means to prevent foreclosure. This detailed description aims to provide an overview of Alameda California's hardship letter for homeowners who are seeking assistance to prevent foreclosure. Additionally, various types of hardship letters commonly used in such situations will be explored. 1. Understanding the Purpose of a Hardship Letter: A hardship letter is a written request sent by homeowners to their mortgage lender, explaining their current financial hardships and the circumstances that have led them to being unable to meet their mortgage obligations. The purpose of this letter is to request mortgage assistance, such as loan modification or foreclosure alternatives, in order to avoid the loss of their property. 2. Key Components of an Alameda California Hardship Letter: a) Introduction: Begin the letter with a formal salutation and an introduction expressing the purpose of the letter. b) Explanation of Hardship: Clearly explain the nature of the financial hardship faced by the homeowner, for example, job loss, illness, divorce, or reduction in income. c) Supporting Documentation: Include any relevant documents such as medical bills, termination letters, or divorce papers to substantiate the hardship claim. d) Financial Details: Provide a comprehensive overview of your current financial situation, including income, expenses, assets, and debts. e) Request for Assistance: Specify the type of mortgage assistance you are seeking, such as loan modification, forbearance, short sale, or deed in lieu of foreclosure. Explain how this assistance would help you prevent foreclosure and maintain homeownership. f) Conclusion: Express gratitude for the lender's consideration and provide contact information for any further correspondence. 3. Different Types of Alameda California Hardship Letters: a) Job Loss Hardship Letter: Used when the homeowner has experienced significant income loss due to unemployment or job termination. b) Medical Hardship Letter: Relevant when homeowners are facing financial strain as a result of medical bills, illness, or disability. c) Divorce or Separation Hardship Letter: Applicable in cases where homeowners encounter financial difficulties due to separation or divorce, resulting in a reassessment of income and assets. d) Income Reduction Hardship Letter: Used when homeowners experience a reduction in income, such as salary cuts or reduced working hours, affecting their ability to make mortgage payments. In conclusion, a well-drafted Alameda California hardship letter is crucial for homeowners seeking mortgage assistance to prevent foreclosure. By providing a comprehensive overview of the hardship faced, homeowners enhance their chances of securing favorable options and finding a viable solution to their financial challenges. Remember to tailor the letter to the specific situation and follow any lender-specific guidelines for the best possible outcome.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Alameda California Carta de Dificultades para el Deudor Hipotecario o el Prestamista para Evitar la Ejecución Hipotecaria - Hardship Letter to Mortgagor or Lender to Prevent Foreclosure

Description

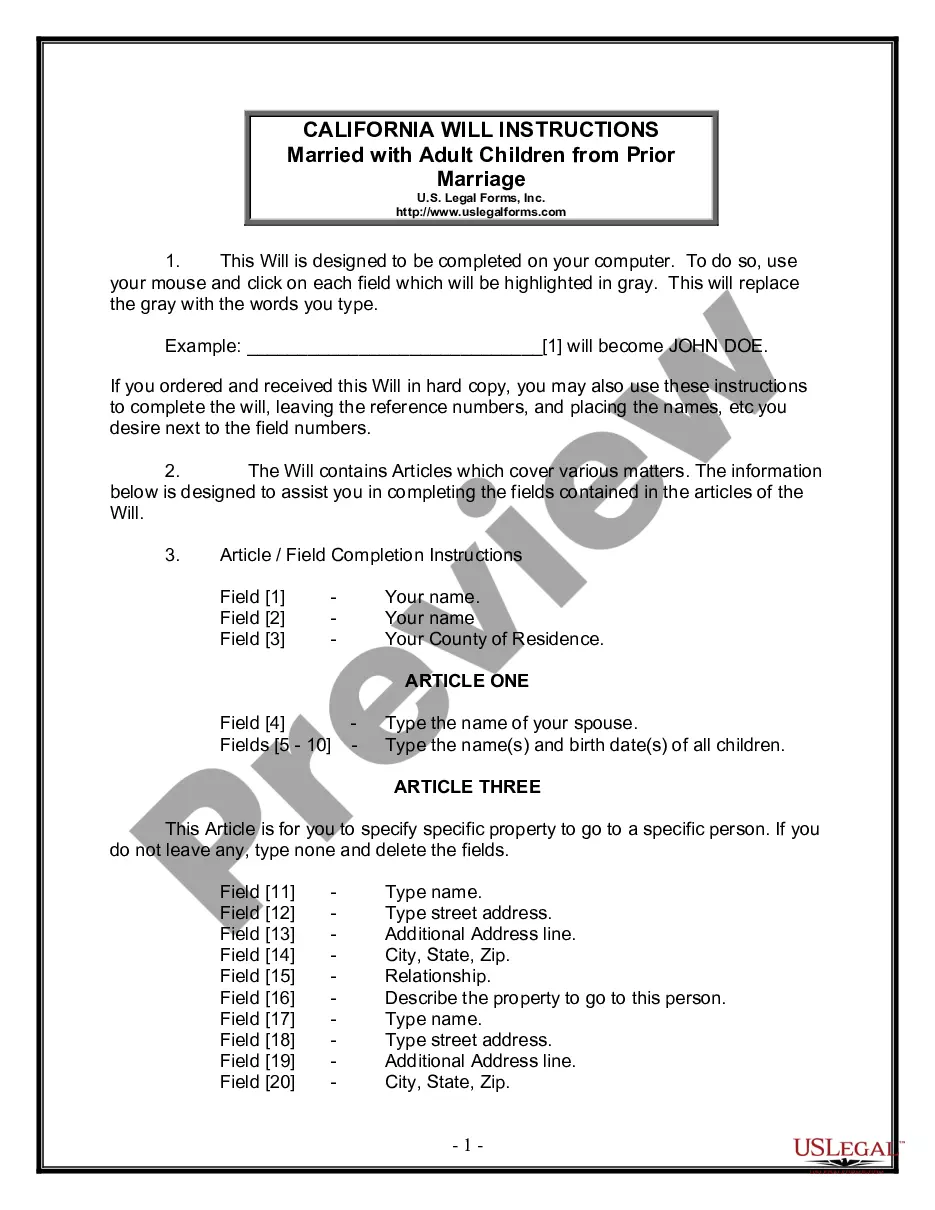

How to fill out Alameda California Carta De Dificultades Para El Deudor Hipotecario O El Prestamista Para Evitar La Ejecución Hipotecaria?

Do you need to quickly draft a legally-binding Alameda Hardship Letter to Mortgagor or Lender to Prevent Foreclosure or maybe any other form to manage your personal or business affairs? You can go with two options: contact a professional to draft a valid document for you or create it entirely on your own. Thankfully, there's a third solution - US Legal Forms. It will help you get professionally written legal papers without paying unreasonable prices for legal services.

US Legal Forms offers a rich collection of over 85,000 state-specific form templates, including Alameda Hardship Letter to Mortgagor or Lender to Prevent Foreclosure and form packages. We offer documents for an array of use cases: from divorce papers to real estate document templates. We've been out there for more than 25 years and got a spotless reputation among our clients. Here's how you can become one of them and get the needed document without extra hassles.

- First and foremost, carefully verify if the Alameda Hardship Letter to Mortgagor or Lender to Prevent Foreclosure is tailored to your state's or county's regulations.

- In case the form includes a desciption, make sure to check what it's intended for.

- Start the search over if the form isn’t what you were hoping to find by using the search bar in the header.

- Select the plan that best fits your needs and proceed to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, find the Alameda Hardship Letter to Mortgagor or Lender to Prevent Foreclosure template, and download it. To re-download the form, simply head to the My Forms tab.

It's stressless to find and download legal forms if you use our catalog. Additionally, the documents we offer are reviewed by industry experts, which gives you greater peace of mind when dealing with legal affairs. Try US Legal Forms now and see for yourself!