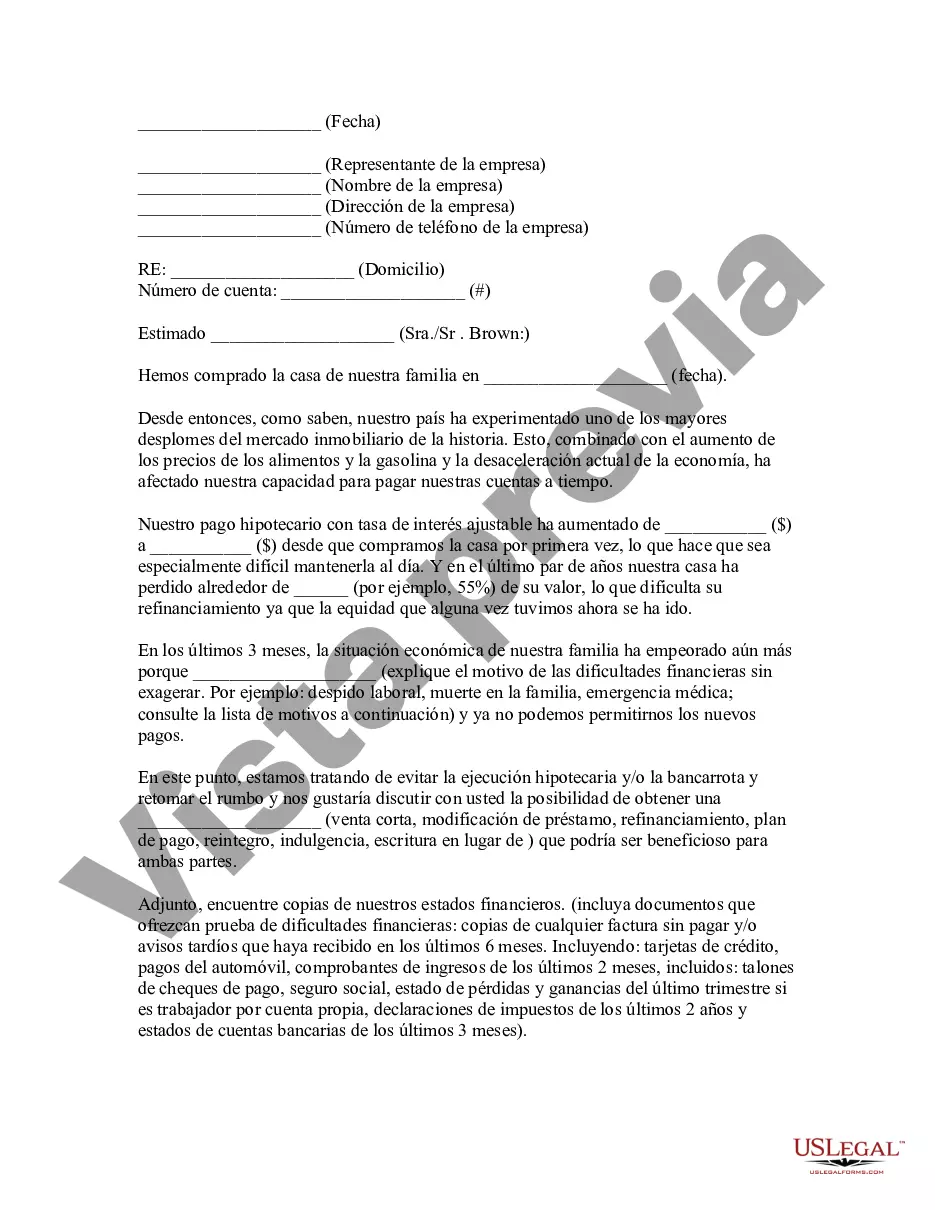

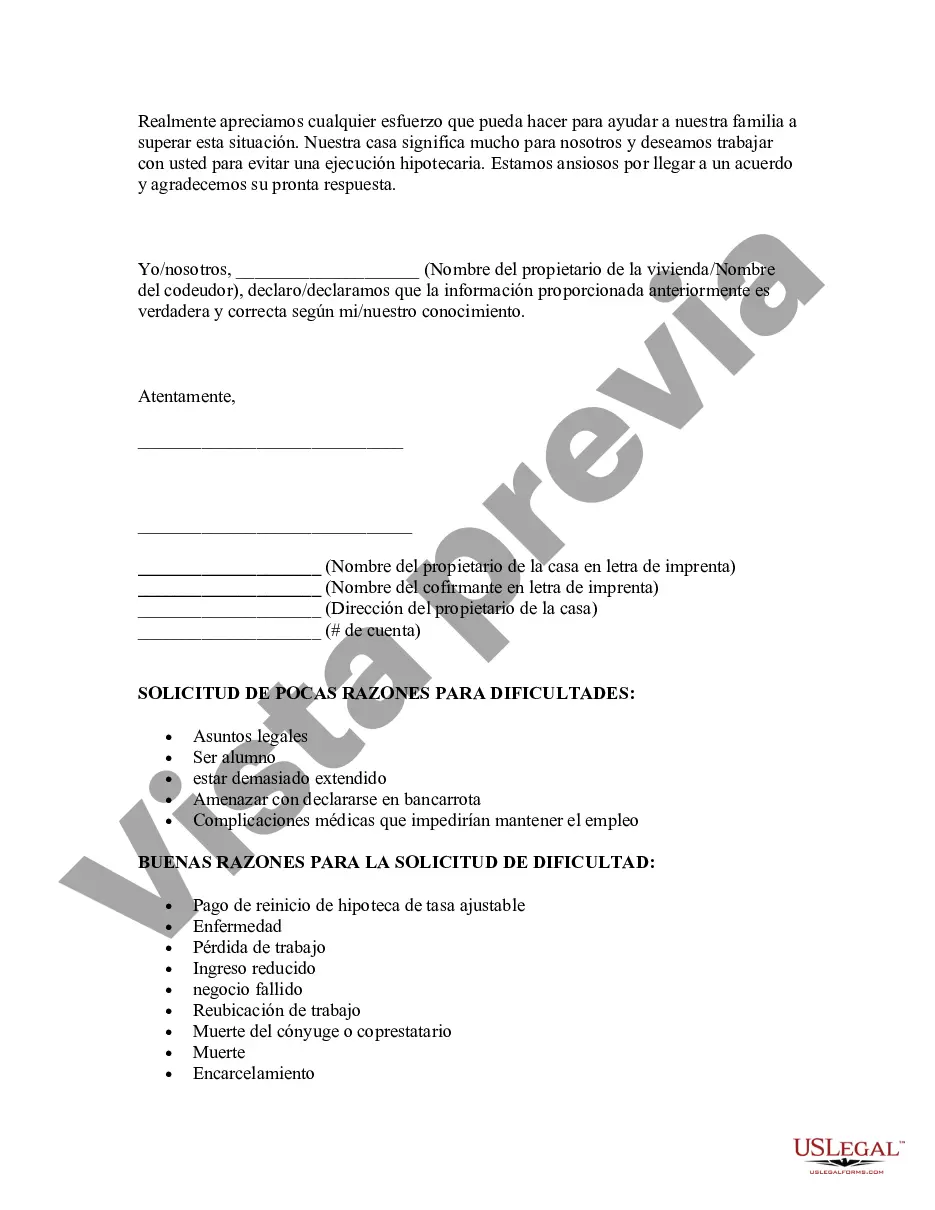

Cuyahoga Ohio Hardship Letter to Mortgagor or Lender to Prevent Foreclosure is a vital communication tool used by homeowners facing financial difficulties in Cuyahoga County, Ohio, to plead for assistance in preventing the foreclosure of their properties. This letter serves as a plea, providing a detailed explanation of the homeowner's financial hardship and their inability to make timely mortgage payments. The goal is to convince the lender to work out an alternative solution to foreclosure, such as loan modification, repayment plans, or forbearance. There are various types of Cuyahoga Ohio Hardship Letters to Mortgagor or Lender to Prevent Foreclosure, each suitable for different scenarios a homeowner may face: 1. Cuyahoga Ohio Job Loss Hardship Letter: This type of hardship letter is utilized when the homeowner loses their job, leading to a significant decrease in income and the inability to meet mortgage obligations. 2. Cuyahoga Ohio Medical Hardship Letter: When a homeowner faces unforeseen medical expenses, significant health issues, or disabilities impacting their ability to work, a medical hardship letter is employed to request assistance from the lender. 3. Cuyahoga Ohio Divorce or Separation Hardship Letter: In cases of divorce or separation, where the homeowner's financial situation becomes strained due to the loss of a partner's income or increased expenses, this type of hardship letter is appropriate. 4. Cuyahoga Ohio Natural Disaster Hardship Letter: When a homeowner's property is affected by natural disasters such as floods, hurricanes, or fires, a natural disaster hardship letter requests forbearance or loan modifications to help the homeowner recover and prevent foreclosure. 5. Cuyahoga Ohio Military Service Hardship Letter: This kind of hardship letter caters to homeowners who are on active military duty, highlighting the unique financial challenges faced by service members and requesting appropriate assistance. Regardless of the type of hardship letter used in Cuyahoga Ohio, it is essential to include relevant keywords such as "Cuyahoga County," "Ohio," "hardship letter," "mortgagor," "lender," "foreclosure prevention," and specific elements related to the homeowner's circumstances, for example, "job loss," "medical expenses," "divorce," "natural disaster," or "military service." Crafting a detailed and compelling hardship letter with these keywords will increase its chances of effectively conveying the homeowner's situation and appealing to the lender for assistance.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuyahoga Ohio Carta de Dificultades para el Deudor Hipotecario o el Prestamista para Evitar la Ejecución Hipotecaria - Hardship Letter to Mortgagor or Lender to Prevent Foreclosure

Description

How to fill out Cuyahoga Ohio Carta De Dificultades Para El Deudor Hipotecario O El Prestamista Para Evitar La Ejecución Hipotecaria?

Do you need to quickly create a legally-binding Cuyahoga Hardship Letter to Mortgagor or Lender to Prevent Foreclosure or probably any other form to manage your personal or corporate affairs? You can go with two options: contact a professional to draft a legal document for you or create it completely on your own. The good news is, there's a third option - US Legal Forms. It will help you receive neatly written legal paperwork without having to pay sky-high fees for legal services.

US Legal Forms offers a rich catalog of over 85,000 state-compliant form templates, including Cuyahoga Hardship Letter to Mortgagor or Lender to Prevent Foreclosure and form packages. We provide documents for an array of life circumstances: from divorce paperwork to real estate documents. We've been on the market for more than 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and get the needed template without extra troubles.

- To start with, double-check if the Cuyahoga Hardship Letter to Mortgagor or Lender to Prevent Foreclosure is adapted to your state's or county's regulations.

- In case the form has a desciption, make sure to verify what it's intended for.

- Start the search over if the template isn’t what you were looking for by using the search box in the header.

- Choose the subscription that best fits your needs and move forward to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, locate the Cuyahoga Hardship Letter to Mortgagor or Lender to Prevent Foreclosure template, and download it. To re-download the form, simply head to the My Forms tab.

It's easy to find and download legal forms if you use our catalog. Moreover, the templates we offer are updated by industry experts, which gives you greater peace of mind when writing legal matters. Try US Legal Forms now and see for yourself!