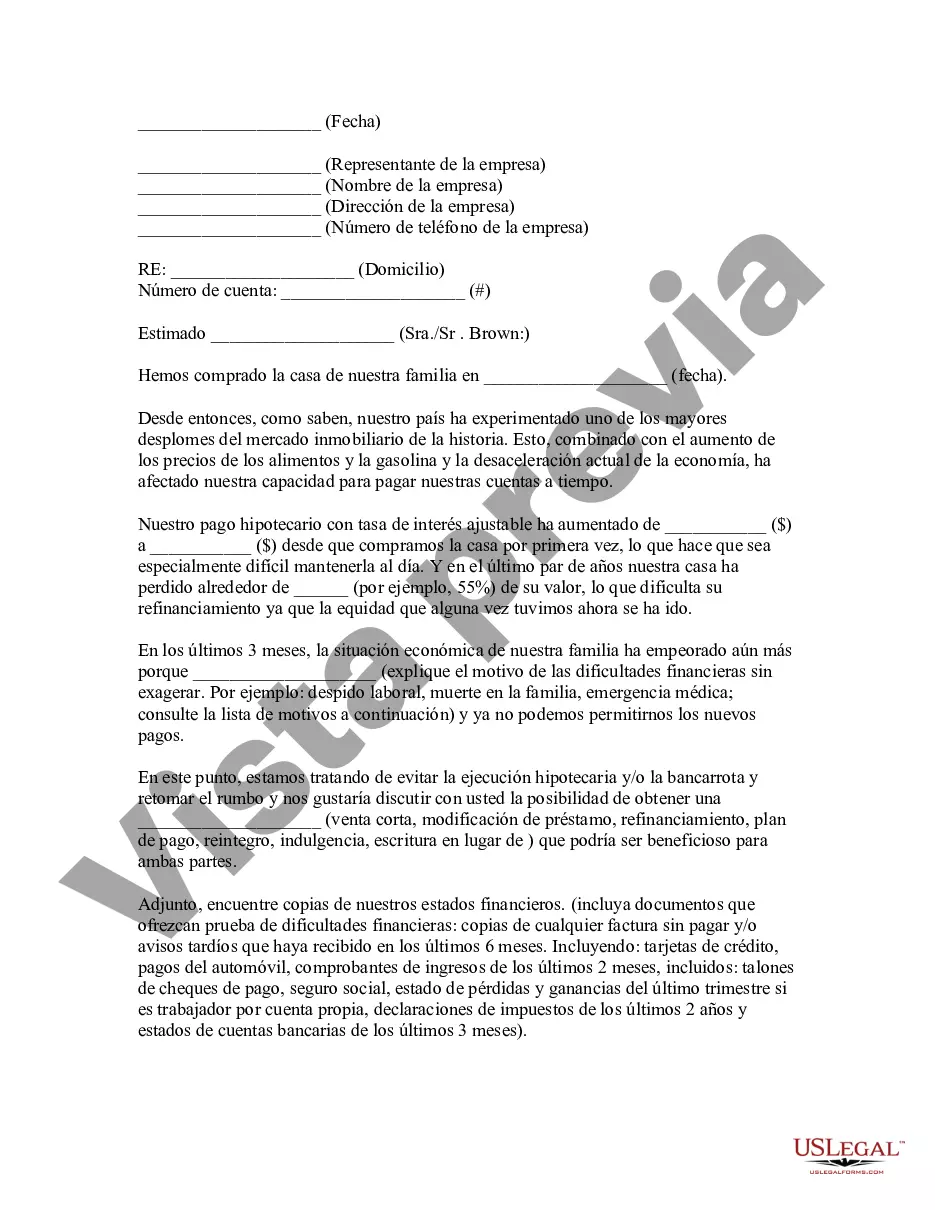

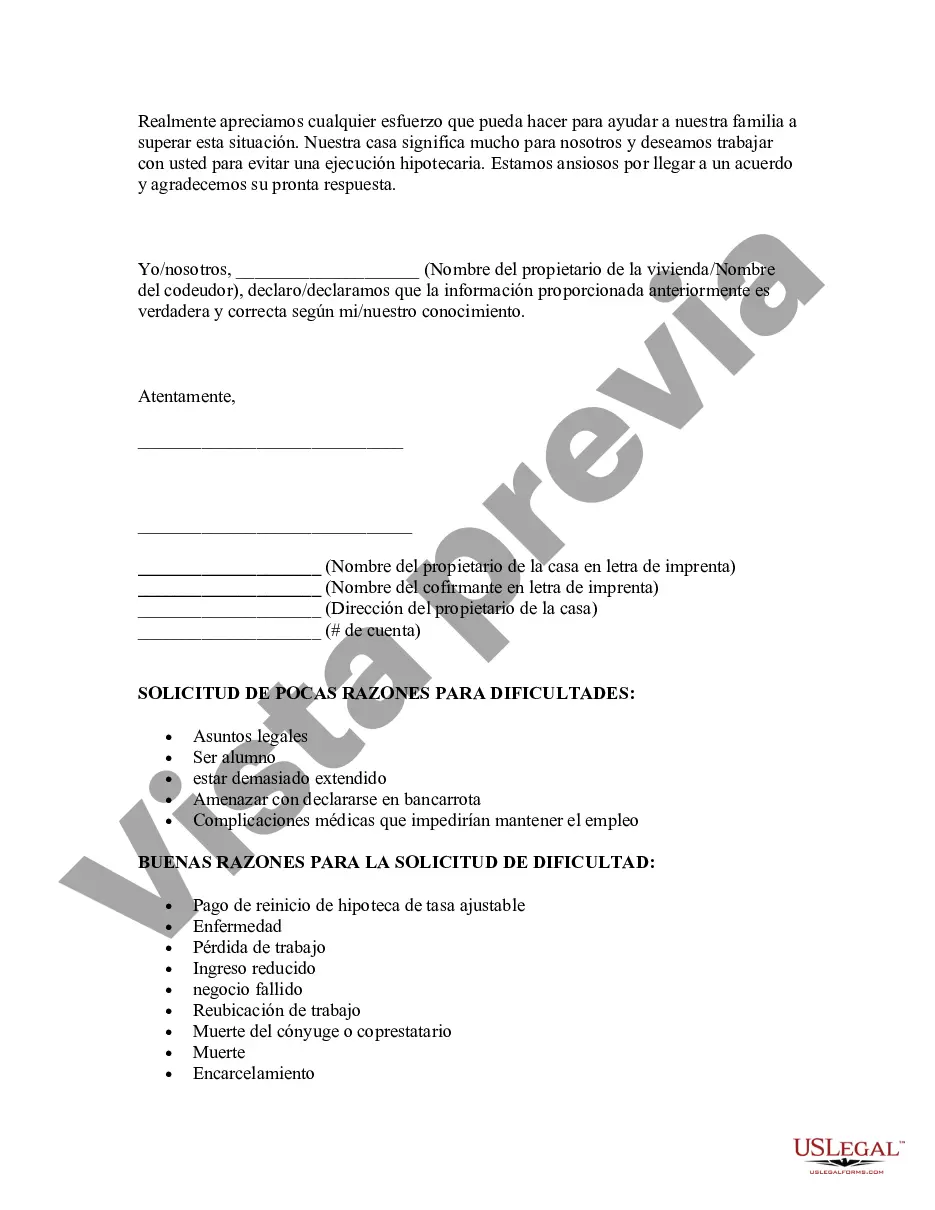

Fairfax Virginia Hardship Letter to Mortgagor or Lender to Prevent Foreclosure is a formal letter that homeowners can send to their lenders or mortgage companies explaining their financial difficulties and requesting assistance to avoid foreclosure. This letter highlights the specific hardships faced by homeowners in Fairfax, Virginia, and includes relevant keywords to ensure its specificity and effectiveness. There are different types of Fairfax Virginia Hardship Letters based on the nature of the homeowner's hardship, such as: 1. Job Loss Hardship Letter: In this type of hardship letter, homeowners explain the loss of employment and the resulting financial strain they are experiencing. Keywords: unemployment, termination, layoff, job loss, income reduction. 2. Divorce or Separation Hardship Letter: Homeowners facing divorce or separation discuss the impact of these circumstances on their ability to maintain mortgage payments while dealing with legal fees and reduced household income. Keywords: divorce, separation, legal expenses, spousal support, child support. 3. Medical Hardship Letter: Homeowners dealing with significant medical expenses, illness, or disability explain how these challenges have affected their ability to make mortgage payments. Keywords: medical bills, healthcare costs, chronic illness, disability, healthcare insurance. 4. Natural Disaster Hardship Letter: Homeowners affected by natural disasters, such as hurricanes or floods, outline the damage to their property and the resulting financial burden that prevents them from making mortgage payments. Keywords: natural disaster, property damage, insurance claim, FEMA assistance, emergency repairs. 5. Decreased Income Hardship Letter: Homeowners experiencing a significant decrease in income due to reduced work hours, pay cuts, or financial setbacks explain the financial struggle they face and their inability to afford mortgage payments. Keywords: reduced income, pay cut, reduced hours, financial setback, economic downturn. 6. Military Hardship Letter: Homeowners serving in the military explain how their military service obligations, such as deployment or relocation, have affected their ability to meet mortgage obligations. Keywords: military deployment, relocation, active duty, deployment orders, military transfers. In each type of Fairfax Virginia Hardship Letter, it is crucial to provide supporting documentation, such as bank statements, medical bills, termination letters, or divorce papers, to substantiate the claims made in the letter. The letter must be written sincerely, provide a detailed account of the hardships, and express the homeowner's willingness to work with the lender to find a feasible solution to prevent foreclosure.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fairfax Virginia Carta de Dificultades para el Deudor Hipotecario o el Prestamista para Evitar la Ejecución Hipotecaria - Hardship Letter to Mortgagor or Lender to Prevent Foreclosure

Description

How to fill out Fairfax Virginia Carta De Dificultades Para El Deudor Hipotecario O El Prestamista Para Evitar La Ejecución Hipotecaria?

Laws and regulations in every area vary throughout the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Fairfax Hardship Letter to Mortgagor or Lender to Prevent Foreclosure, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for various life and business scenarios. All the documents can be used many times: once you pick a sample, it remains accessible in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Fairfax Hardship Letter to Mortgagor or Lender to Prevent Foreclosure from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Fairfax Hardship Letter to Mortgagor or Lender to Prevent Foreclosure:

- Take a look at the page content to ensure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the template when you find the right one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

La Ficha de Informacion Precontractual, mas conocida como FIPRE, es un documento informativo totalmente generico y transparente que los bancos estan obligados a entregar a los consumidores cuando solicita informacion sobre un prestamo hipotecario.

La ejecucion hipotecaria ocurre cuando el prestamista recupera la propiedad debido a que el propietario de una vivienda deja de hacer los pagos de una hipoteca. Los procesos de ejecucion hipotecaria varian segun el estado.

Solicite la cancelacion del PMI Debe hacer su solicitud por escrito. Debe tener buen historial de pagos y estar al dia con ellos. Su prestamista podria exigirle que certifique que no tiene un junior lien o segunda hipoteca, sobre su vivienda.

Luego de vender su garantia para pagar su prestamo, cualquier cantidad que aun deba es denominada 'deficiencia'. El prestamista puede demandar al consumidor (llevar al consumidor ante el tribunal) para obtener una sentencia en su contra, conocida como sentencia de deficiencia.

¿Que es la escritura de un prestamo hipotecario? Este es un documento que contiene los datos del solicitante del prestamo hipotecario, las condiciones y las responsabilidades. La firma se hace ante un notario, el solicitante y el representante de la entidad financiera.

Informacion a modo de cuestionario cumplimentado que el futuro franquiciador debe entregar al franquiciado veinte dias antes de la firma del contrato. Estos datos se refieren al franquiciador como persona juridica, contenido del contrato, duracion, exclusividad 2026

Una propiedad en Pre-Foreclosure o antes de la ejecucion hipotecaria es una propiedad en dificultades que el prestamista aun no ha recuperado y vendido en una subasta.

Los puntos hipotecarios, tambien conocidos como puntos de descuento, son cargos que un comprador de vivienda le paga directamente al prestamista (usualmente un banco) a cambio de una tasa de interes reducida.

En este caso, la mejor solucion para evitar la ejecucion hipotecaria es devolverle al banco el dinero que le debemos y este pago debe producirse antes de que se celebre la subasta. De esta forma, conseguiriamos cancelar la ejecucion hipotecaria siempre y cuando la vivienda financiada fuera nuestra residencia habitual.

Hay ejecucion hipotecaria, te quitan el piso, proceso que dura entre seis y ocho meses. Esto si la casa no es vivienda habitual. Si lo es, hay la rehabilitacion del prestamo si el dueno paga las cuotas pendientes mas los gastos.