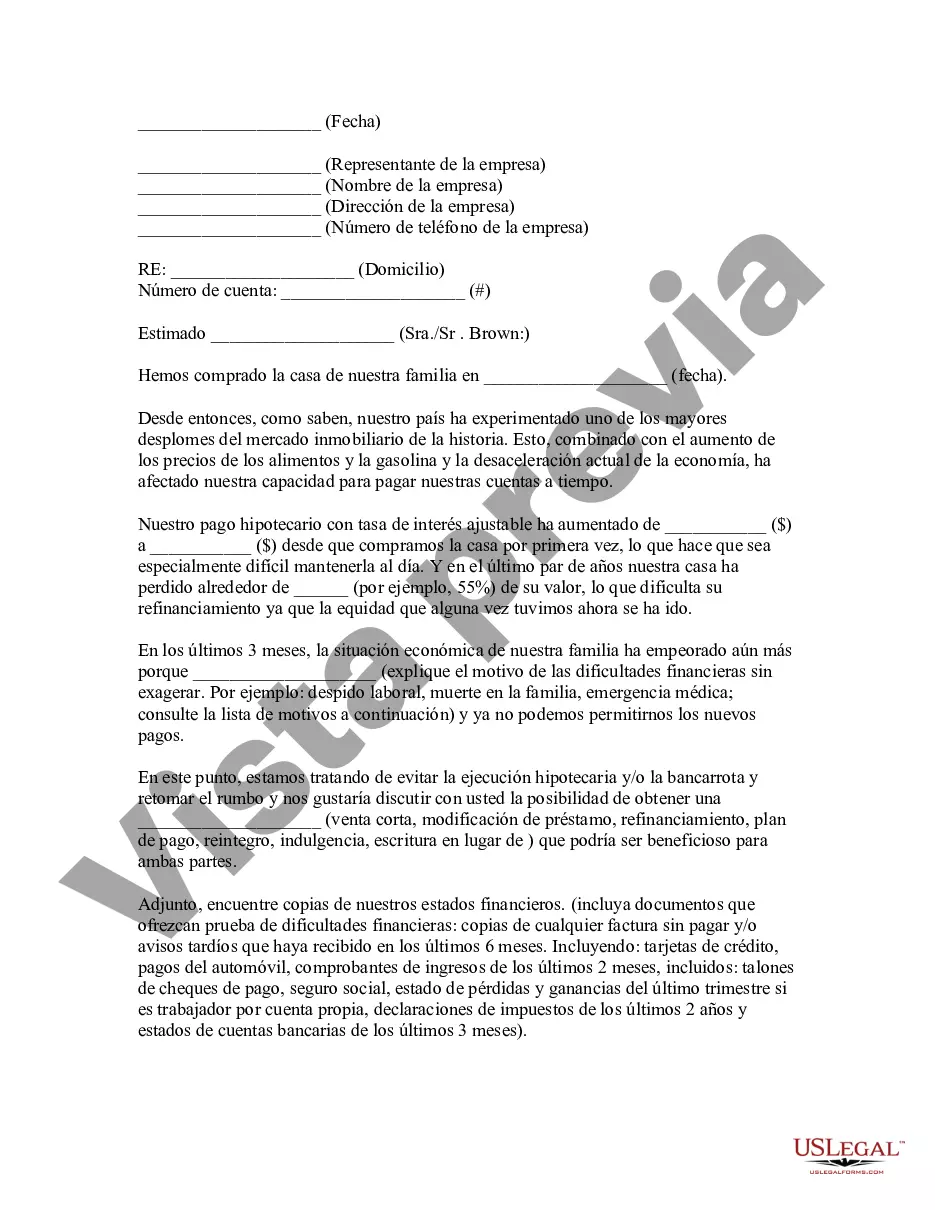

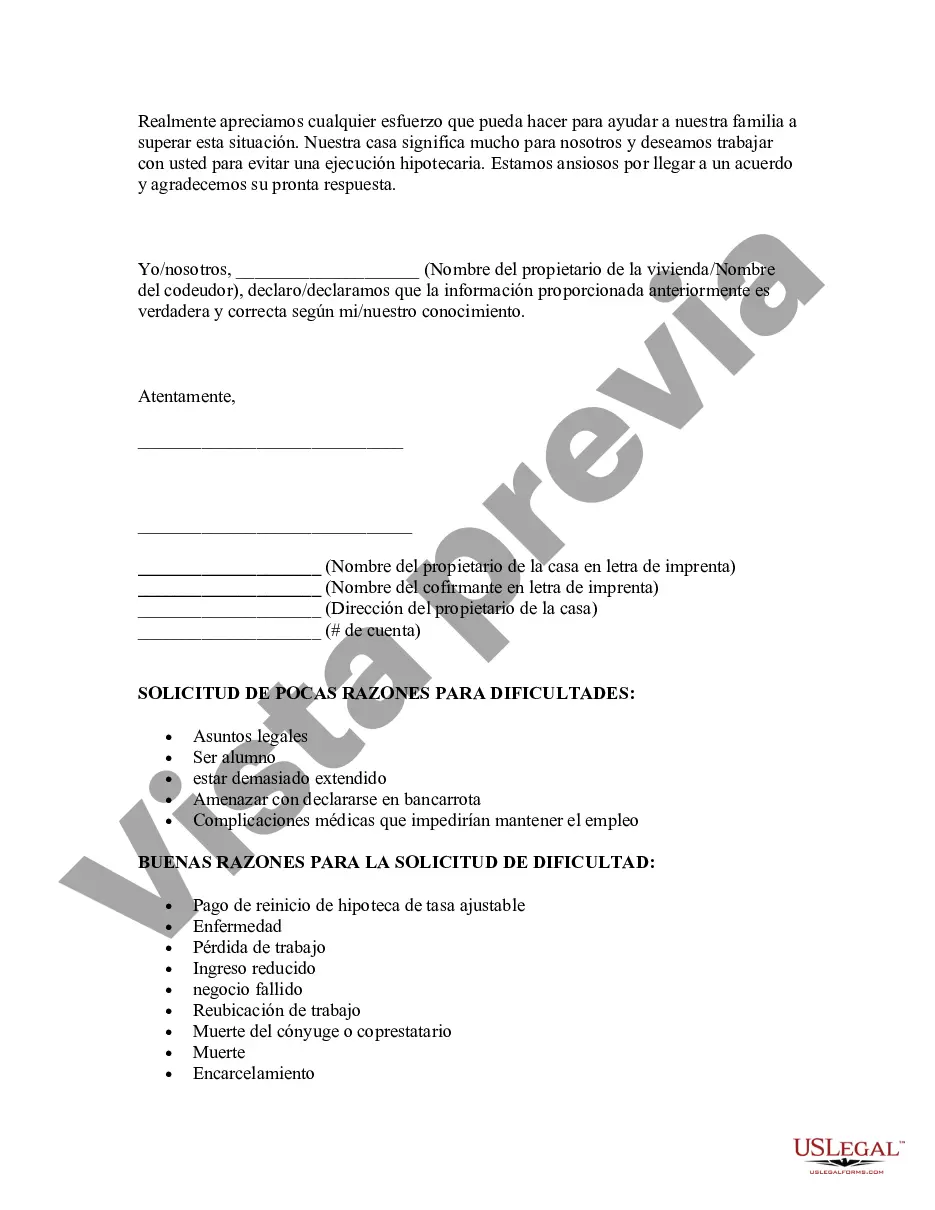

Los Angeles California is a bustling and vibrant city located on the West Coast of the United States. As the most populous city in California and the second-most populous city in the country, it offers a diverse range of opportunities and experiences. From its iconic landmarks like the Hollywood Sign and the Walk of Fame to its beautiful beaches and thriving entertainment industry, Los Angeles attracts millions of residents, tourists, and aspiring actors alike. However, amidst the glitz and glamour, some homeowners in Los Angeles may face financial difficulties that could potentially lead to foreclosure. In such situations, a hardship letter becomes an essential tool for homeowners to communicate their concerns and seek assistance from their mortgagor or lender. A Los Angeles California hardship letter is a written document that outlines the borrower's current financial hardships and presents a compelling case to the mortgagor or lender, requesting alternative solutions to foreclosure. It should be informative, concise, and well-structured, making use of appropriate keywords to effectively convey the homeowner's predicament. Here are a few types of hardship letters that one may come across in Los Angeles: 1. Financial Hardship Letter: This type of hardship letter focuses on the borrower's financial struggles, such as job loss, reduction in income, medical expenses, or unexpected emergencies. It thoroughly explains the reasons for the homeowner's inability to make timely mortgage payments. 2. Divorce or Separation Hardship Letter: In instances where a divorce or separation leads to significant financial strain, a letter addressing these circumstances can be beneficial. The letter may detail the division of assets, changes in income or expenses, and the resulting challenges in meeting mortgage obligations. 3. Illness or Medical Hardship Letter: This type of letter highlights the homeowner's health-related issues, either their own or that of a family member. It may provide medical documentation and describe the impact of medical bills or treatment costs on the borrower's ability to pay their mortgage. 4. Natural Disaster Hardship Letter: When a natural disaster strikes, such as an earthquake or wildfire, homeowners in Los Angeles may experience considerable property damage and financial setbacks. This letter would outline the damage incurred, include relevant insurance claim information, and explain how it has adversely affected the ability to maintain mortgage payments. 5. Military Deployment Hardship Letter: For members of the armed forces stationed in Los Angeles, sudden deployment or reassignment can disrupt their financial stability. A hardship letter in this scenario would address the reduced income during deployment and the need for support to prevent foreclosure while they serve. By tailoring the hardship letter to the specific circumstances faced by the borrower, they can demonstrate their genuine intentions to resolve the situation and salvage their homeownership. It is crucial to use relevant keywords and phrases throughout the letter to not only capture the lender's attention but also showcase their commitment towards finding a resolution.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Los Angeles California Carta de Dificultades para el Deudor Hipotecario o el Prestamista para Evitar la Ejecución Hipotecaria - Hardship Letter to Mortgagor or Lender to Prevent Foreclosure

Description

How to fill out Los Angeles California Carta De Dificultades Para El Deudor Hipotecario O El Prestamista Para Evitar La Ejecución Hipotecaria?

How much time does it typically take you to draft a legal document? Because every state has its laws and regulations for every life sphere, finding a Los Angeles Hardship Letter to Mortgagor or Lender to Prevent Foreclosure suiting all local requirements can be tiring, and ordering it from a professional lawyer is often costly. Numerous web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web catalog of templates, grouped by states and areas of use. In addition to the Los Angeles Hardship Letter to Mortgagor or Lender to Prevent Foreclosure, here you can find any specific document to run your business or personal affairs, complying with your county requirements. Specialists verify all samples for their validity, so you can be sure to prepare your documentation properly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed form, and download it. You can get the document in your profile at any time later on. Otherwise, if you are new to the platform, there will be a few more actions to complete before you get your Los Angeles Hardship Letter to Mortgagor or Lender to Prevent Foreclosure:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document using the related option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Los Angeles Hardship Letter to Mortgagor or Lender to Prevent Foreclosure.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!