Miami-Dade Florida Hardship Letter to Mortgagor or Lender to Prevent Foreclosure: A Miami-Dade Florida hardship letter to the mortgagor or lender is a crucial communication tool for homeowners facing financial difficulties that may lead to foreclosure. This letter provides a detailed explanation of the applicant's financial hardship and the steps being taken to prevent foreclosure. By outlining the circumstances and requesting assistance, homeowners aim to garner the lender's empathy and cooperation in finding a mutually beneficial solution. Below, we discuss different types of Miami-Dade Florida hardship letters: 1. Unemployment Hardship Letter: In Miami-Dade, many homeowners may find themselves out of work due to economic downturns or job loss. A hardship letter in such cases highlights the sudden income loss, discusses efforts to secure new employment, and proposes alternative solutions to maintain mortgage payments. 2. Medical Hardship Letter: Health issues can significantly impact a borrower's ability to make mortgage payments. This type of hardship letter explains the medical condition, any resulting loss of income, and evidence of treatments or ongoing medical expenses. It emphasizes the homeowner's commitment to recovery and exploration of available financial resources. 3. Divorce or Separation Hardship Letter: Divorce or separation can lead to financial strain, making it challenging to meet mortgage obligations. This hardship letter addresses the change in household income, increased expenses, property division issues, and possible plans for refinancing or selling the property. 4. Natural Disaster Hardship Letter: Miami-Dade experiences hurricanes and other natural disasters that may devastate homeowners financially. This hardship letter outlines the damages incurred, potential insurance coverage, and any government assistance received or pending, aiming to convey the homeowner's commitment to rebuilding and securing their property. 5. Death or Disability Hardship Letter: In the unfortunate event of a homeowner's death or severe disability, a hardship letter explains the resulting financial burden, such as loss of income or increased medical expenses. It may discuss life insurance coverage, disability benefits, or survivor benefits as potential sources to continue mortgage payments. Regardless of the specific type, a Miami-Dade Florida hardship letter should include essential elements such as detailed financial information, explanations of the hardship's cause, a clear request for assistance, supporting documentation, and the homeowner's commitment to cooperation and exploring viable solutions. By submitting a well-crafted and persuasive hardship letter, homeowners in Miami-Dade Florida can increase their chances of receiving lender support, potentially leading to loan modification, forbearance, or other foreclosure prevention options. Seeking legal or financial advice from professionals familiar with the local regulations and procedures can further enhance the effectiveness of the letter and guide homeowners through the challenging foreclosure prevention process.

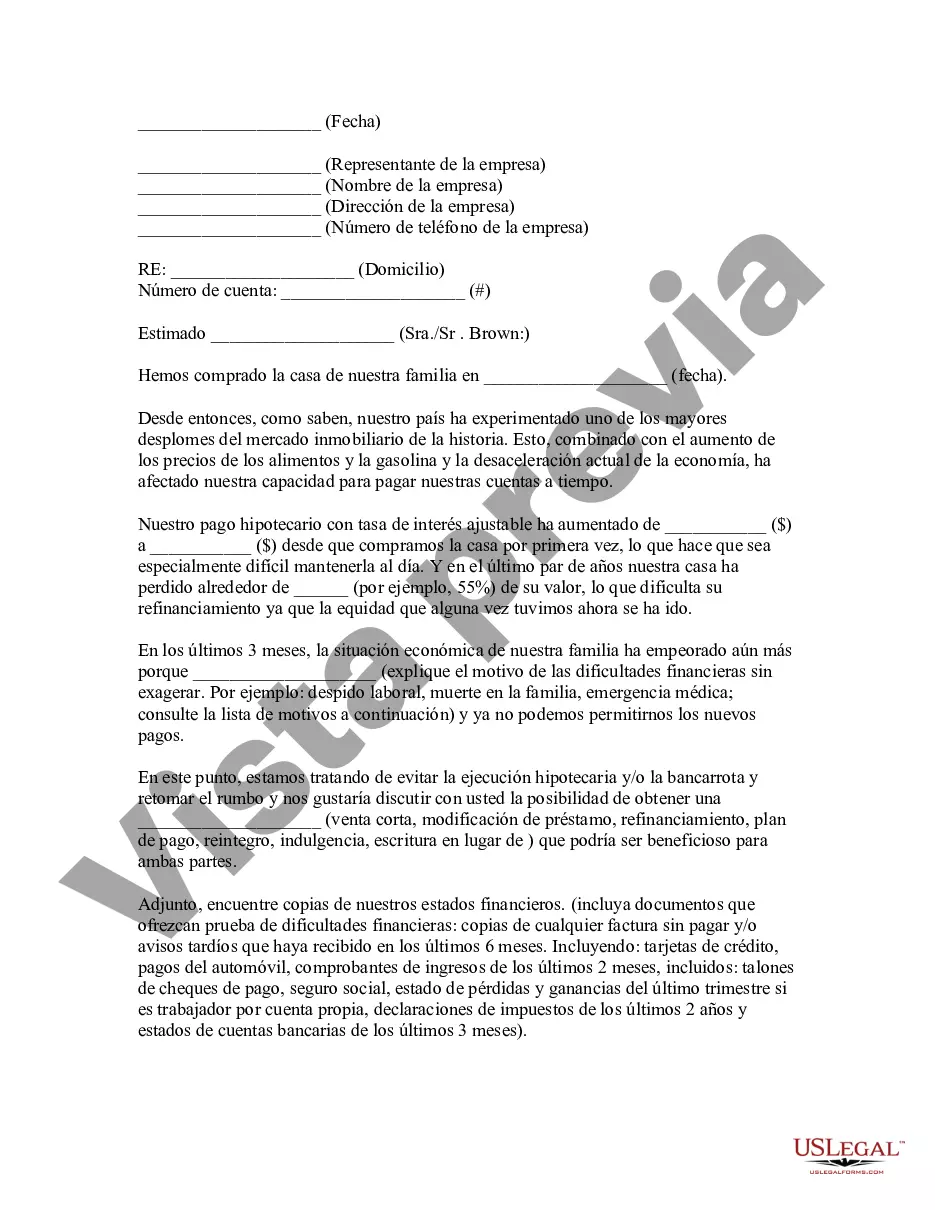

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Carta de Dificultades para el Deudor Hipotecario o el Prestamista para Evitar la Ejecución Hipotecaria - Hardship Letter to Mortgagor or Lender to Prevent Foreclosure

State:

Multi-State

County:

Miami-Dade

Control #:

US-FORECL-07

Format:

Word

Instant download

Description

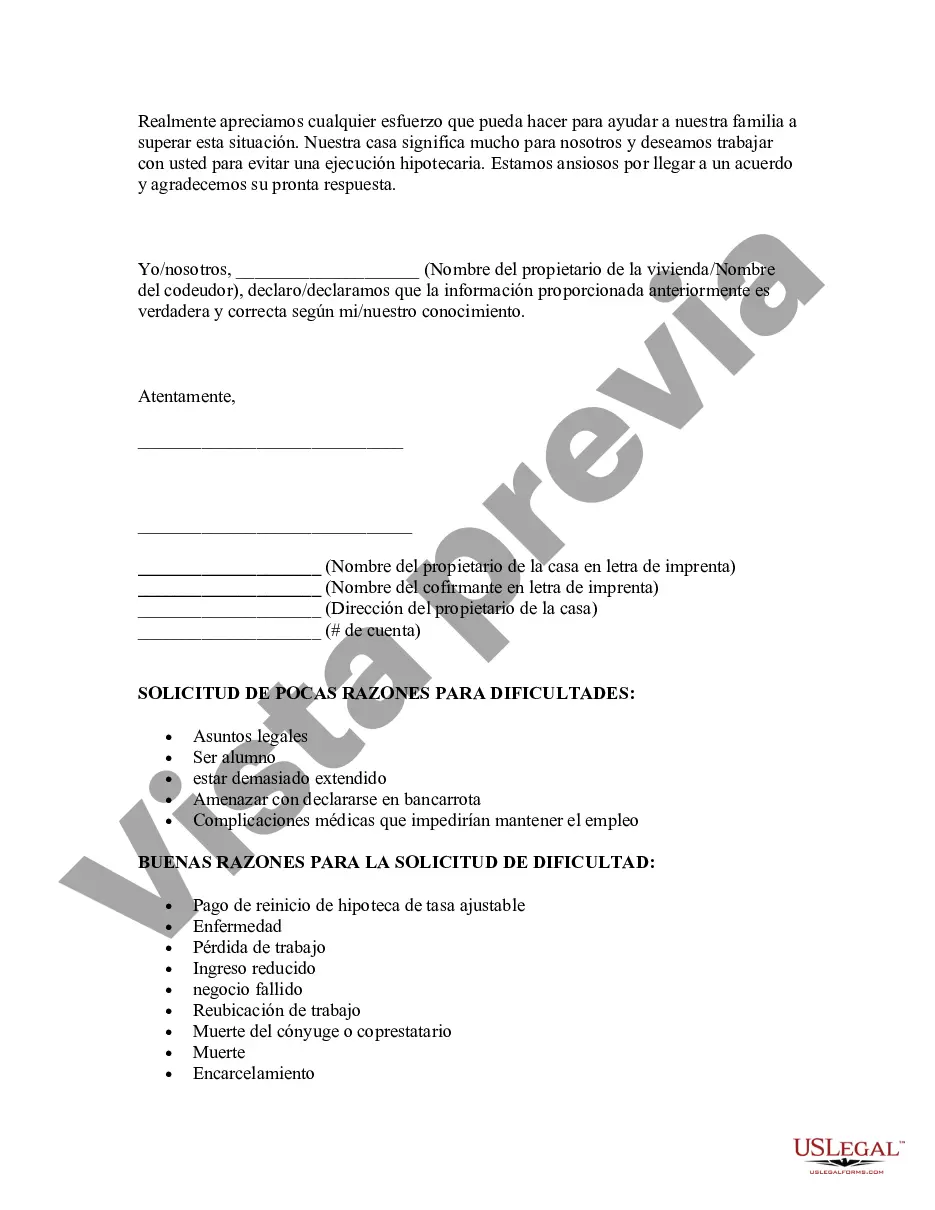

This is a hardship letter that may be sent to a lender to prevent foreclosure by requesting their assistance with a short sale, loan modification, refinance, repayment plan, reinstatement, forbearance, or deed in lieu. Examples of hardship explanations are provided.

Miami-Dade Florida Hardship Letter to Mortgagor or Lender to Prevent Foreclosure: A Miami-Dade Florida hardship letter to the mortgagor or lender is a crucial communication tool for homeowners facing financial difficulties that may lead to foreclosure. This letter provides a detailed explanation of the applicant's financial hardship and the steps being taken to prevent foreclosure. By outlining the circumstances and requesting assistance, homeowners aim to garner the lender's empathy and cooperation in finding a mutually beneficial solution. Below, we discuss different types of Miami-Dade Florida hardship letters: 1. Unemployment Hardship Letter: In Miami-Dade, many homeowners may find themselves out of work due to economic downturns or job loss. A hardship letter in such cases highlights the sudden income loss, discusses efforts to secure new employment, and proposes alternative solutions to maintain mortgage payments. 2. Medical Hardship Letter: Health issues can significantly impact a borrower's ability to make mortgage payments. This type of hardship letter explains the medical condition, any resulting loss of income, and evidence of treatments or ongoing medical expenses. It emphasizes the homeowner's commitment to recovery and exploration of available financial resources. 3. Divorce or Separation Hardship Letter: Divorce or separation can lead to financial strain, making it challenging to meet mortgage obligations. This hardship letter addresses the change in household income, increased expenses, property division issues, and possible plans for refinancing or selling the property. 4. Natural Disaster Hardship Letter: Miami-Dade experiences hurricanes and other natural disasters that may devastate homeowners financially. This hardship letter outlines the damages incurred, potential insurance coverage, and any government assistance received or pending, aiming to convey the homeowner's commitment to rebuilding and securing their property. 5. Death or Disability Hardship Letter: In the unfortunate event of a homeowner's death or severe disability, a hardship letter explains the resulting financial burden, such as loss of income or increased medical expenses. It may discuss life insurance coverage, disability benefits, or survivor benefits as potential sources to continue mortgage payments. Regardless of the specific type, a Miami-Dade Florida hardship letter should include essential elements such as detailed financial information, explanations of the hardship's cause, a clear request for assistance, supporting documentation, and the homeowner's commitment to cooperation and exploring viable solutions. By submitting a well-crafted and persuasive hardship letter, homeowners in Miami-Dade Florida can increase their chances of receiving lender support, potentially leading to loan modification, forbearance, or other foreclosure prevention options. Seeking legal or financial advice from professionals familiar with the local regulations and procedures can further enhance the effectiveness of the letter and guide homeowners through the challenging foreclosure prevention process.

Free preview