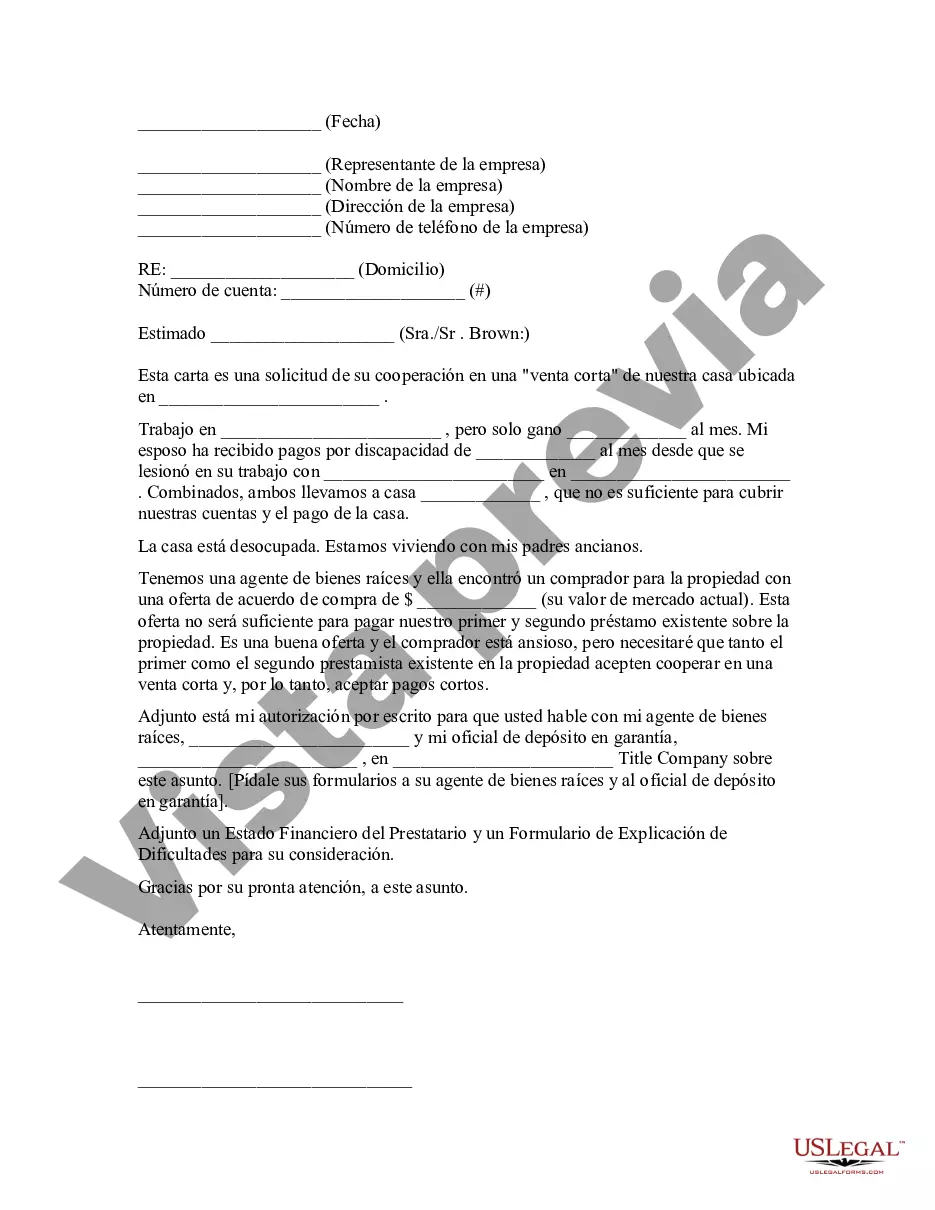

Los Angeles, California is a sprawling city located in Southern California. Known for its vibrant entertainment industry and stunning beaches, it is one of the most famous cities in the United States. Los Angeles offers a vast array of cultural, recreational, and social opportunities to its residents and visitors alike. When it comes to the real estate market, homeowners facing financial difficulties may find themselves in need of a short sale. A short sale is an agreement between the homeowner and the lender, where the lender agrees to accept less than the full amount owed on the mortgage, allowing the homeowner to sell the property and avoid foreclosure. In Los Angeles, residents who are considering a short sale often reach out to their lender with a formal request letter. This letter is crucial in initiating the short sale process and should contain specific information and follow a proper format. Below are a few types of Los Angeles, California Sample Letter for Short Sale Request to Lender that homeowners may choose from, based on their individual circumstances: 1. Financial Hardship Sample Letter: This type of letter is typically used by homeowners who have experienced a significant financial hardship, such as the loss of a job, a reduction in income, or a medical emergency. It should detail the current financial situation and explain why a short sale is the best option to avoid foreclosure. 2. Investment Property Sample Letter: Homeowners who are facing financial troubles with an investment property in Los Angeles may need a specific type of short sale request letter. This letter should focus on the property's rental income, expenses, and the overall negative impact it has on the homeowner's financial stability. It should also explain why a short sale is necessary to protect the investment portfolio. 3. Letter for Relocation Assistance: In some cases, homeowners who are eligible for a short sale may be approved for relocation assistance from the lender. This type of letter should emphasize the need for financial support to aid in the relocation process after the short sale is completed. It should provide the lender with specific details on the expected relocation expenses, such as moving costs, security deposits, and temporary housing. 4. Letter for Co-Borrower or Jointly Owned Property: When a property is jointly owned or has co-borrowers, it's important to include all relevant parties in the short sale request letter. This type of letter should outline the financial situation of all owners involved, explain their shared responsibility for the mortgage, and express the need for a short sale to protect everyone's interests. By utilizing a properly formatted and well-drafted Los Angeles, California Sample Letter for Short Sale Request to Lender, homeowners can increase their chances of successfully navigating the short sale process and securing a favorable outcome. It is important to consult with legal and real estate professionals to ensure accuracy and completeness in the letter, as the specific requirements may vary depending on the lender.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Los Angeles California Ejemplo de carta de solicitud de venta corta al prestamista - Sample Letter for Short Sale Request to Lender

Description

How to fill out Los Angeles California Ejemplo De Carta De Solicitud De Venta Corta Al Prestamista?

A document routine always goes along with any legal activity you make. Creating a company, applying or accepting a job offer, transferring property, and lots of other life situations require you prepare official documentation that varies throughout the country. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal templates. On this platform, you can easily find and get a document for any individual or business objective utilized in your county, including the Los Angeles Sample Letter for Short Sale Request to Lender.

Locating templates on the platform is remarkably straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. After that, the Los Angeles Sample Letter for Short Sale Request to Lender will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guideline to obtain the Los Angeles Sample Letter for Short Sale Request to Lender:

- Make sure you have opened the correct page with your local form.

- Utilize the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template corresponds to your needs.

- Look for another document via the search option if the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Decide on the appropriate subscription plan, then log in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Los Angeles Sample Letter for Short Sale Request to Lender on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal documents. All the templates provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!