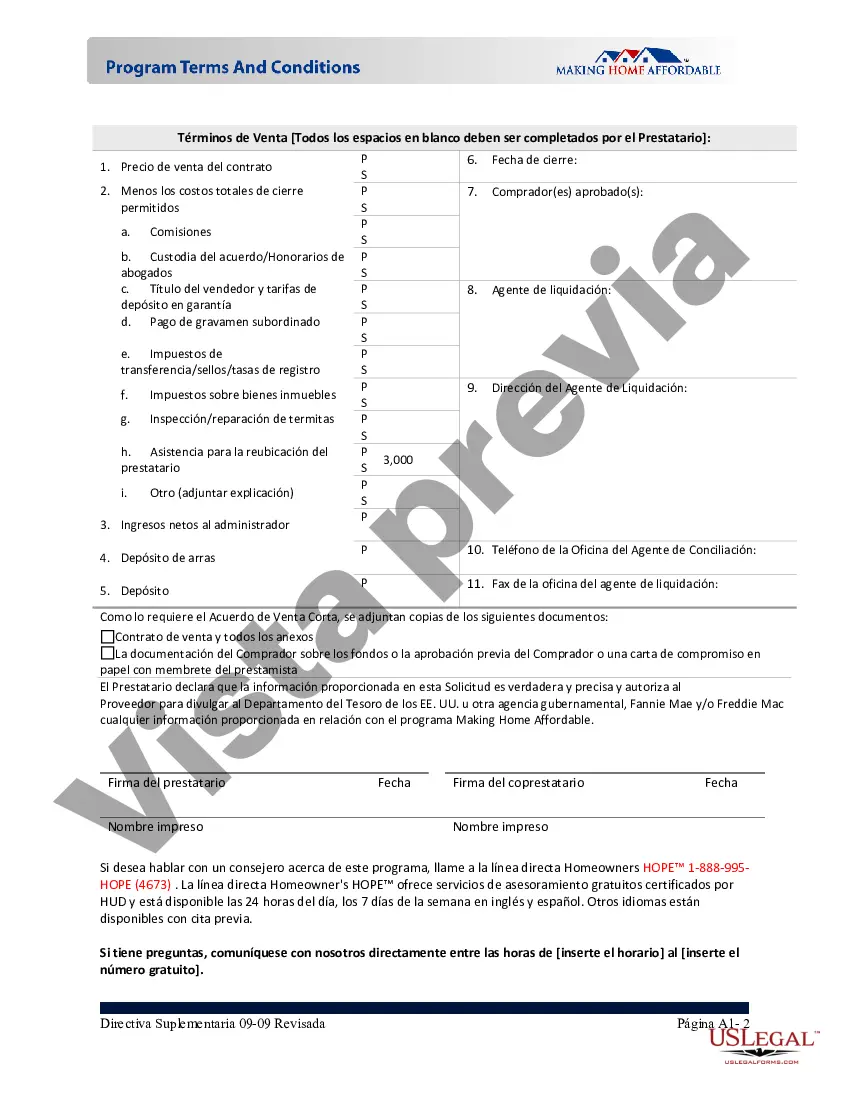

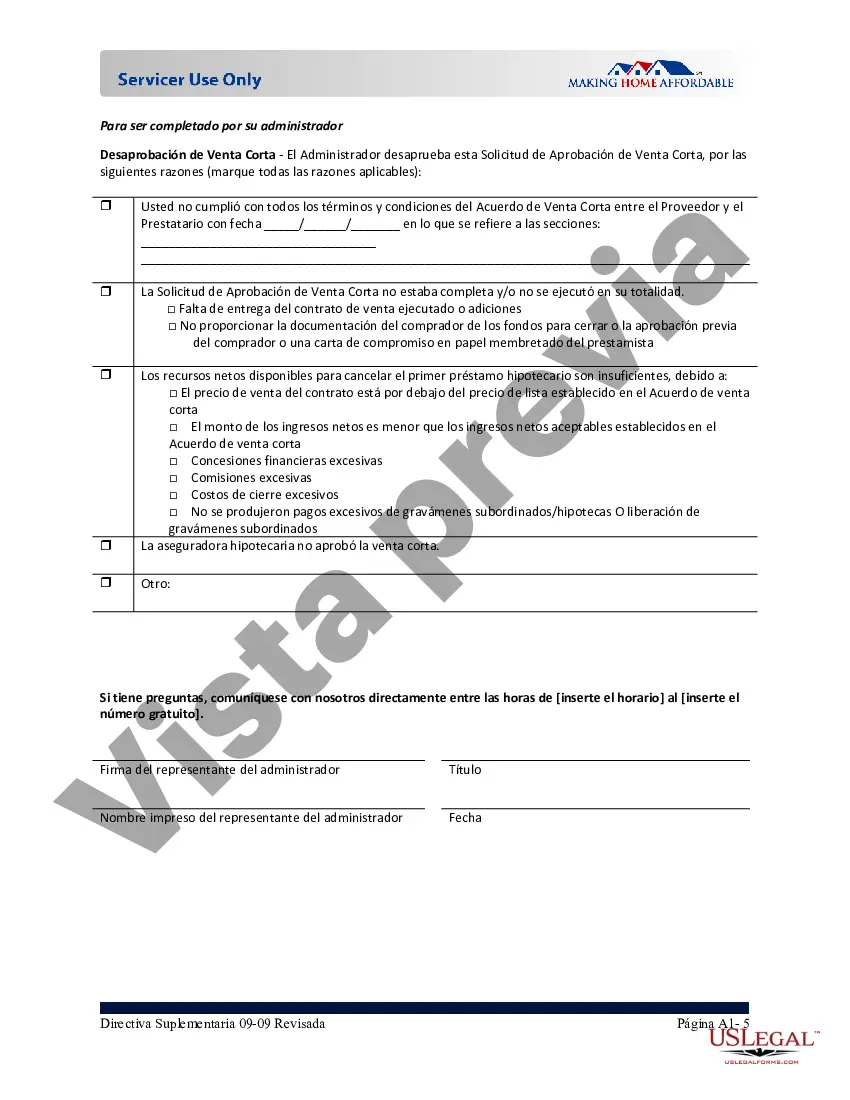

Philadelphia Pennsylvania MA Request for Short Sale is a crucial process for homeowners facing financial distress and seeking to avoid foreclosure. The Making Home Affordable (MA) program was established by the federal government to assist struggling homeowners in finding viable solutions to their mortgage problems. In the case of a short sale, homeowners are allowed to sell their property for less than the remaining mortgage balance, with the lender's approval, to relieve their financial burden. The Philadelphia Pennsylvania MA Request for Short Sale is specifically tailored to homeowners residing in Philadelphia and needing assistance with their mortgage obligations. This application is designed to initiate the short sale process and provide the necessary information for lenders to review the homeowner's eligibility. The Philadelphia Pennsylvania MA Request for Short Sale typically includes the following details: 1. Homeowner Information: This section gathers relevant personal information, such as the homeowner's full name, contact details, Social Security number, and current address. 2. Loan Information: Here, the homeowner provides vital details about the mortgage, including the lender's name, loan number, the outstanding amount, and any delinquent payment history. 3. Financial Hardship Explanation: Homeowners must provide a detailed account of the financial hardship they are facing, such as job loss, reduction in income, medical bills, divorce, or any other circumstances impacting their ability to afford their mortgage payments. 4. Proof of Income: This section requires the submission of recent pay stubs, tax returns, W-2 forms, or any other relevant documentation to verify the homeowner's income. 5. Property Information: Details regarding the property must be specified, including its address, current market value, outstanding liens or judgments, and any repairs or maintenance issues. 6. Realtor Information: Homeowners who choose to work with a realtor to facilitate the short sale process provide their realtor's contact details in this section. 7. Supporting Documents: Homeowners should attach supporting documents, such as a hardship letter explaining their financial difficulties and any other relevant paperwork required by the lender. Types of Philadelphia Pennsylvania MA Request for Short Sale can vary based on specific programs offered within the MA initiative, such as: 1. Home Affordable Foreclosure Alternatives (HAIFA): This program provides alternative options for homeowners unable to qualify or complete a loan modification. The HAIFA short sale streamlines the short sale process by providing standardized procedures and financial incentives to borrowers and services. 2. Principal Reduction Alternative (PRA): PRA aims to help homeowners with high-loan-to-value mortgages by decreasing their outstanding principal balance. This option assists in reducing the amount owed by eligible homeowners. 3. Home Affordable Unemployment Program (UP): Specifically targeted at unemployed homeowners, UP provides temporary assistance through reduced mortgage payments or suspension of payments for a designated period to help them get back on their feet. In conclusion, the Philadelphia Pennsylvania MA Request for Short Sale is an essential tool for distressed homeowners seeking assistance with their mortgages. By initiating this process, homeowners can work with lenders to explore the available MA programs that best suit their specific circumstances and avoid foreclosure while finding a viable solution to their financial hardship.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Philadelphia Pennsylvania Solicitud de MHA para venta corta - MHA Request for Short Sale

Description

How to fill out Philadelphia Pennsylvania Solicitud De MHA Para Venta Corta?

Whether you plan to start your business, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you must prepare specific paperwork corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal documents for any individual or business case. All files are collected by state and area of use, so picking a copy like Philadelphia MHA Request for Short Sale is quick and easy.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a couple of additional steps to obtain the Philadelphia MHA Request for Short Sale. Adhere to the instructions below:

- Make certain the sample meets your personal needs and state law requirements.

- Look through the form description and check the Preview if there’s one on the page.

- Utilize the search tab specifying your state above to find another template.

- Click Buy Now to obtain the sample once you find the right one.

- Select the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Philadelphia MHA Request for Short Sale in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you are able to access all of your previously purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!

Form popularity

Interesting Questions

More info

Responsible for completing all applications and helping to provide advice on the application process. This includes providing referrals to local lenders and making all relevant phone calls to answer questions and obtain information needed. May also work on the application for other borrowers. May also help to obtain home loan documents and help to set up all loan documents in one location. May also assist with foreclosure, and may even assist with obtaining a foreclosure sale order/notice (when it happens it is a shock to the system, and you feel like a bad person). May assist with the foreclosure, and may even assist with obtaining a forego:sure or loan modification. May be involved in an eviction/forcible entry (e.g. the police force enters the home and makes you move out) May be involved in a security and eviction, or in a forego:sure/bankruptcy case, and may assist with the foreclosure process and with setting up documents and documents of proof.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.