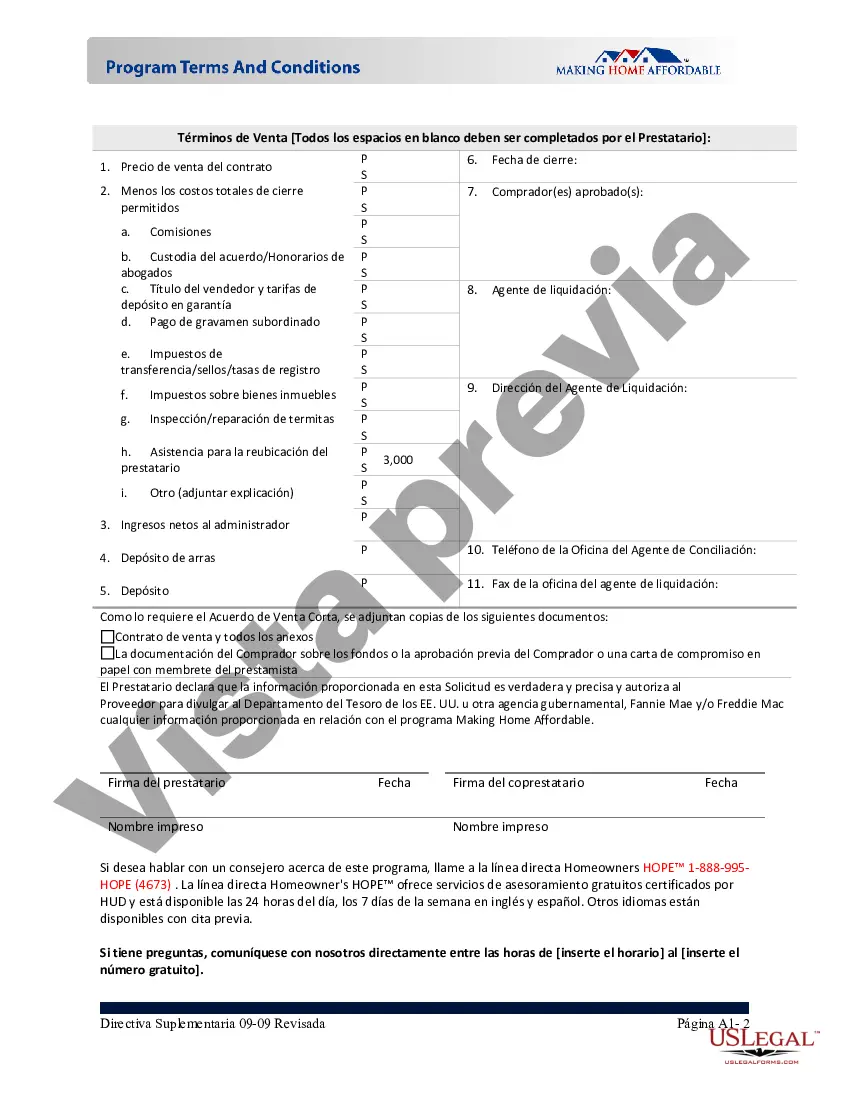

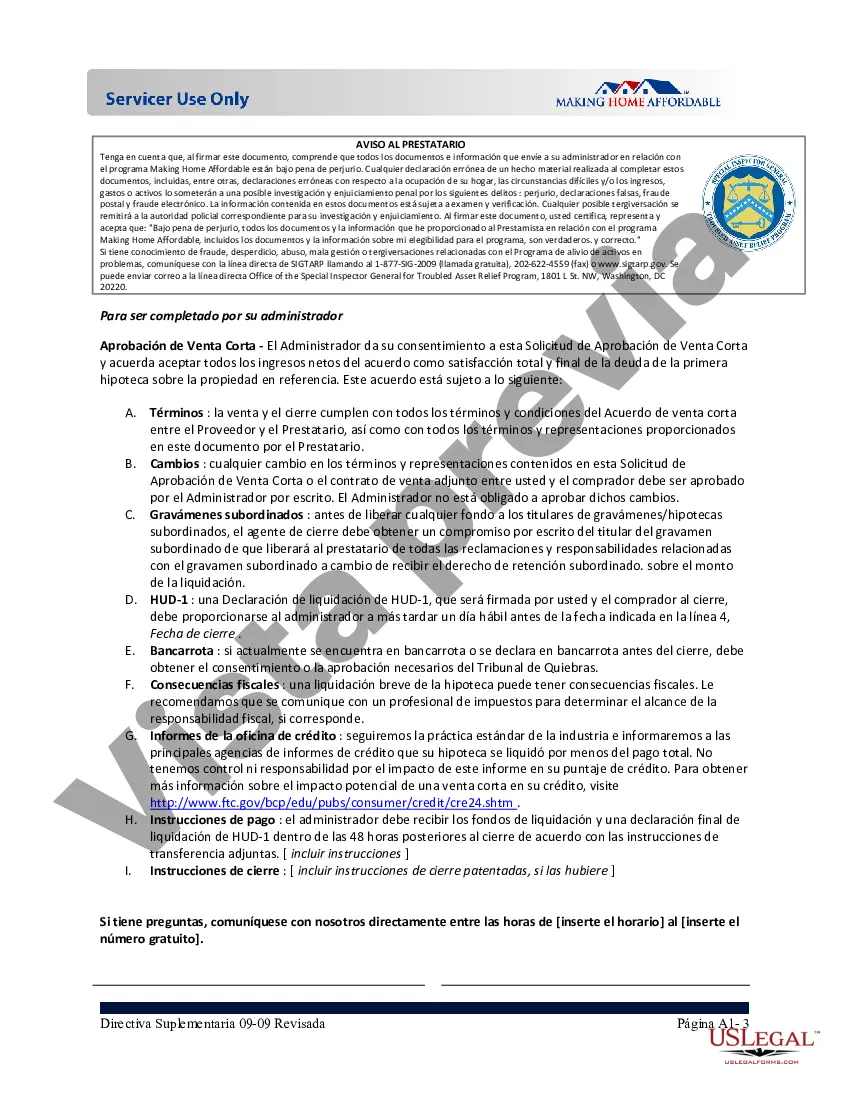

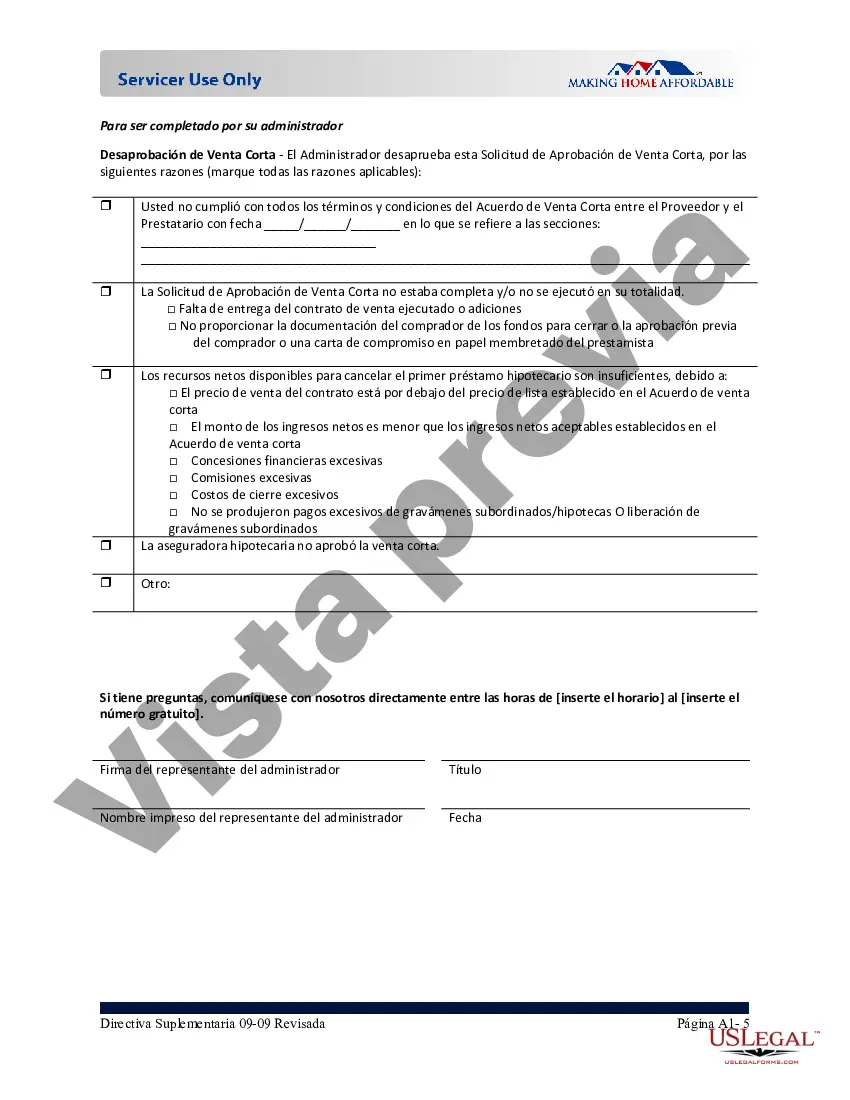

San Jose, California MA Request for Short Sale Process: A Comprehensive Guide If you are a homeowner in San Jose, California, facing financial hardship and struggling to make your mortgage payments, the MA (Making Home Affordable) Request for Short Sale program could be a viable option for you. A short sale allows you to sell your home for less than the outstanding mortgage balance, with your lender's approval, to avoid the foreclosure process. In San Jose, this program is specifically designed to assist homeowners in distress and mitigate the impact of the housing crisis. San Jose California MA Request for Short Sale Eligibility: 1. Financial Hardship: To qualify for the MA Request for Short Sale, you must be able to demonstrate genuine financial hardship, such as loss of a job, medical expenses, divorce, or a significant decrease in income. 2. Owner-Occupancy: The property in question must be your primary residence. 3. Mortgage Origination Date: The mortgage loan must have originated on or before January 1, 2009. 4. Loan Limitations: The outstanding mortgage balance must not exceed a certain limit determined by the program guidelines. Steps to Submitting a San Jose California MA Request for Short Sale: 1. Consultation with a Qualified Real Estate Agent: Seek the guidance of a real estate agent experienced in short sales who can assist you throughout the process and ensure you meet the program's requirements. 2. Gather Required Documentation: Prepare essential documents including financial statements, proof of income, bank statements, tax returns, hardship letter, and any other paperwork requested by the lender. 3. Contact Your Lender: Notify your lender about your intention to pursue a short sale. They will provide you with specific instructions to initiate the process. 4. Complete the MA Request for Short Sale Package: Fill out the necessary paperwork provided by your lender, including the Request for Short Sale Affidavit. 5. Submit the Package: Submit the completed package, ensuring you provide all the required documentation and forms accurately and promptly. 6. Lender's Evaluation: Your lender will review the submitted package, assess your financial situation, and determine whether you meet the eligibility criteria for the MA Request for Short Sale. 7. Negotiate with the Lender: If your request is approved, you can work with the lender's representatives and your real estate agent to negotiate the terms and conditions of the short sale. 8. Market the Property: Once the terms and conditions are agreed upon, actively market your property to find potential buyers. 9. Accept an Offer: Evaluate offers from interested buyers with your real estate agent and choose the most suitable one. 10. Closing the Sale: After accepting an offer, coordinate with your lender, real estate agent, and the buyer's representative to finalize the short sale process, including necessary documentation and closing procedures. Types of San Jose California MA Request for Short Sale: 1. Traditional Short Sale: This is the standard MA Request for Short Sale program that applies to most homeowners facing financial hardship and meet the eligibility criteria. 2. HAIFA Short Sale: The Home Affordable Foreclosure Alternatives (HAIFA) program provides additional incentives to borrowers who are unable to qualify for a loan modification under MA. It offers standardized procedures, pre-approved short sale terms, and relocation assistance. In San Jose, California, the MA Request for Short Sale program aims to provide struggling homeowners with a viable alternative to foreclosure and an opportunity to recover from financial difficulties. By understanding and following the established guidelines and steps, homeowners can navigate the process confidently and increase their chances of finding a favorable resolution during these challenging times.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Jose California Solicitud de MHA para venta corta - MHA Request for Short Sale

Description

How to fill out San Jose California Solicitud De MHA Para Venta Corta?

Preparing papers for the business or personal demands is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to consider all federal and state laws and regulations of the specific region. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to draft San Jose MHA Request for Short Sale without professional help.

It's easy to avoid spending money on lawyers drafting your documentation and create a legally valid San Jose MHA Request for Short Sale on your own, using the US Legal Forms online library. It is the largest online collection of state-specific legal documents that are professionally cheched, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to save the required form.

In case you still don't have a subscription, follow the step-by-step instruction below to get the San Jose MHA Request for Short Sale:

- Examine the page you've opened and verify if it has the sample you require.

- To do so, use the form description and preview if these options are available.

- To locate the one that suits your requirements, utilize the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal forms for any situation with just a few clicks!