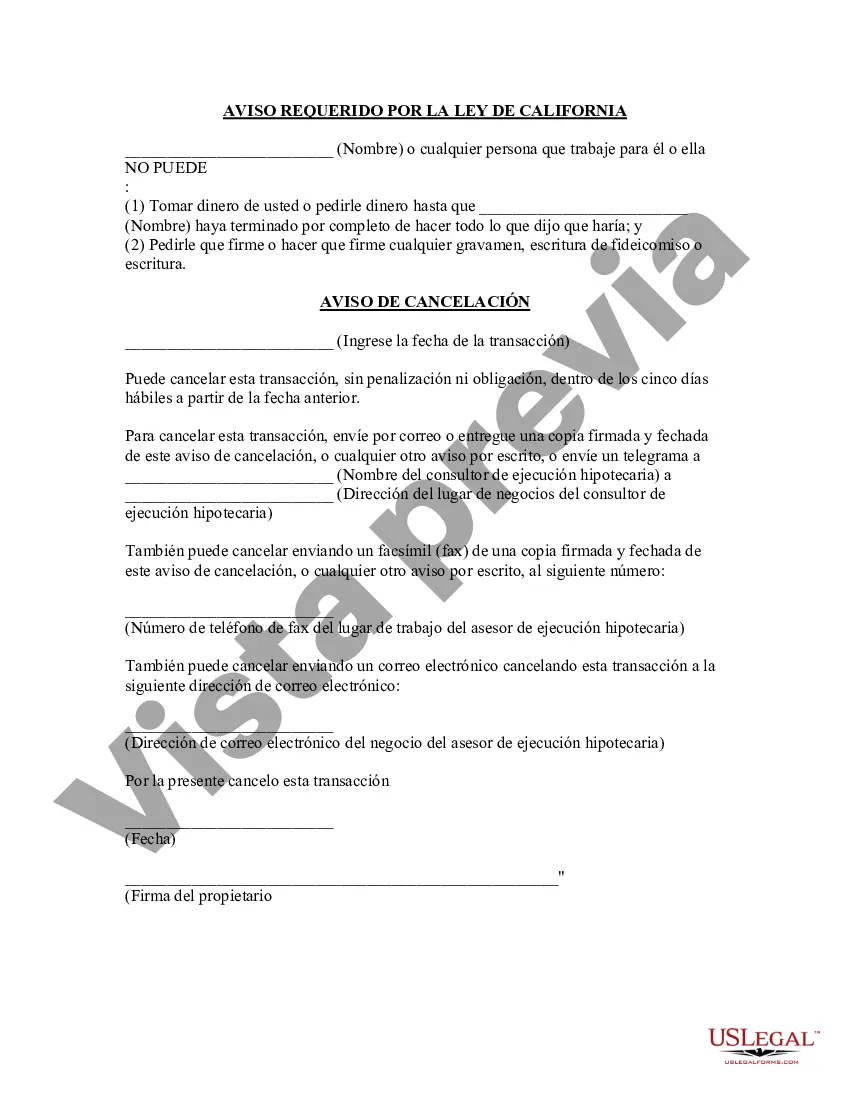

Nassau New York Statutory Notices Required for California Foreclosure Consultants In the realm of California foreclosure consulting services, Nassau New York statutory notices play a crucial role in ensuring compliance with legal requirements. These notices act as a means of informing both consultants and homeowners about various important aspects of the foreclosure process and their rights and responsibilities. By adhering to these requirements, foreclosure consultants can maintain transparency and protect the interests of homeowners throughout California. One essential type of Nassau New York statutory notice for California foreclosure consultants is the Notice of Default (NOD). This notice initiates the formal foreclosure proceedings and must be recorded and delivered to the homeowner within a specific timeframe. It should include detailed information about the property, the default amount, and the actions required to cure the default. Another critical type of notice is the Notice of Trustee Sale (NTS). This notice must be issued to the homeowner and publicly posted, indicating the date, time, and location of the foreclosure sale. It is crucial for foreclosure consultants to follow the specific guidelines for delivering this notice to ensure its effectiveness and compliance with California law. In addition to the NOD and NTS, Nassau New York statutory notices also require a Notice of Rescission. This notice comes into play when the foreclosure process is canceled or put on hold. It must be sent to both the homeowner and the trustee responsible for handling the foreclosure proceedings. Furthermore, foreclosure consultants in California are obliged to provide homeowners with a Notice of Right to Cancel. This notice allows homeowners a specific period to rescind any contract or agreement they have entered into with the consultant. It highlights the homeowner's right to cancel the agreement without penalty or obligation. It is important to note that compliance with these Nassau New York statutory notices is crucial for California foreclosure consultants. Failure to provide these notices accurately and in a timely manner can lead to severe legal repercussions and potential harm to homeowners. To sum up, Nassau New York statutory notices required for California foreclosure consultants include the Notice of Default, Notice of Trustee Sale, Notice of Rescission, and Notice of Right to Cancel. By understanding and implementing these notices correctly, foreclosure consultants can ensure transparency, protect homeowners' rights, and navigate the foreclosure process in a lawful and ethical manner.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nassau New York Avisos legales requeridos para los consultores de ejecución hipotecaria de California - Statutory Notices Required for California Foreclosure Consultants

Description

How to fill out Nassau New York Avisos Legales Requeridos Para Los Consultores De Ejecución Hipotecaria De California?

If you need to find a reliable legal paperwork supplier to get the Nassau Statutory Notices Required for California Foreclosure Consultants, look no further than US Legal Forms. Whether you need to start your LLC business or manage your asset distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed form.

- You can browse from more than 85,000 forms arranged by state/county and situation.

- The self-explanatory interface, variety of supporting materials, and dedicated support team make it simple to locate and execute various papers.

- US Legal Forms is a trusted service providing legal forms to millions of customers since 1997.

Simply select to search or browse Nassau Statutory Notices Required for California Foreclosure Consultants, either by a keyword or by the state/county the form is created for. After locating needed form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to start! Simply find the Nassau Statutory Notices Required for California Foreclosure Consultants template and check the form's preview and description (if available). If you're confident about the template’s language, go ahead and click Buy now. Register an account and choose a subscription plan. The template will be immediately available for download once the payment is processed. Now you can execute the form.

Handling your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our extensive variety of legal forms makes this experience less pricey and more affordable. Create your first business, organize your advance care planning, draft a real estate contract, or complete the Nassau Statutory Notices Required for California Foreclosure Consultants - all from the convenience of your home.

Sign up for US Legal Forms now!

Form popularity

FAQ

Si no cumple con los pagos de su hipoteca, usted podria correr el riesgo de perder su casa. Este proceso se llama ejecucion hipotecaria o foreclosure. Mediante esta medida, el banco o agencia de credito puede desalojarlo de su vivienda y venderla.

Es el procedimiento por el cual el acreedor hipotecario (suele ser una entidad financiera) pueda cobrar su deuda mediante la ejecucion de la garantia (la vivienda hipotecada) si el deudor no cumple con su obligacion de pagar las cuotas.

El contrato de compraventa y el credito hipotecario se formalizan ante notario publico y se asientan en la misma escritura, la cual se inscribe en el Registro Publico de la Propiedad de tu localidad por el notario.

Hay ejecucion hipotecaria, te quitan el piso, proceso que dura entre seis y ocho meses. Esto si la casa no es vivienda habitual. Si lo es, hay la rehabilitacion del prestamo si el dueno paga las cuotas pendientes mas los gastos.

Diez consejos para evitar una ejecucion hipotecaria No ignore el problema.Contacte a su prestamista en cuanto se de cuenta de que tiene un problema.Responda y abra toda su correspondencia proveniente de su prestamista.Conozca sus derechos hipotecarios.Entienda las opciones para evitar una ejecucion hipotecaria.

¿Cuanto tarda una ejecucion hipotecaria? La ejecucion hipotecaria depende del juzgado. Desde que se deja de pagar es posible que este entre 12 -14 meses finalizada. Por este motivo es necesario actuar de forma rapida ante el inicio de cualquier comunicacion por parte de la entidad financiera o juzgado.

Si no cumple con los pagos de su hipoteca, usted podria correr el riesgo de perder su casa. Este proceso se llama ejecucion hipotecaria o foreclosure. Mediante esta medida, el banco o agencia de credito puede desalojarlo de su vivienda y venderla.

Con la documentacion lista, se inicia el proceso de ejecucion judicial de garantia hipotecaria (PEJGH) que consta de las siguientes 6 etapas: i) presentacion y admision de la demanda; ii) orden de ejecucion; iii) convocatoria a remate; iv) remate; v) adjudicacion y recuperacion de credito; y, vi) cobro de honorarios

Las 5 etapas de una Ejecucion hipotecaria Reclamacion extrajudicial. Demanda de ejecucion hipotecaria y Oposicion. Subasta judicial y adjudicacion del inmueble. Tasacion de costas y liquidacion de intereses. Lanzamiento o desahucio.