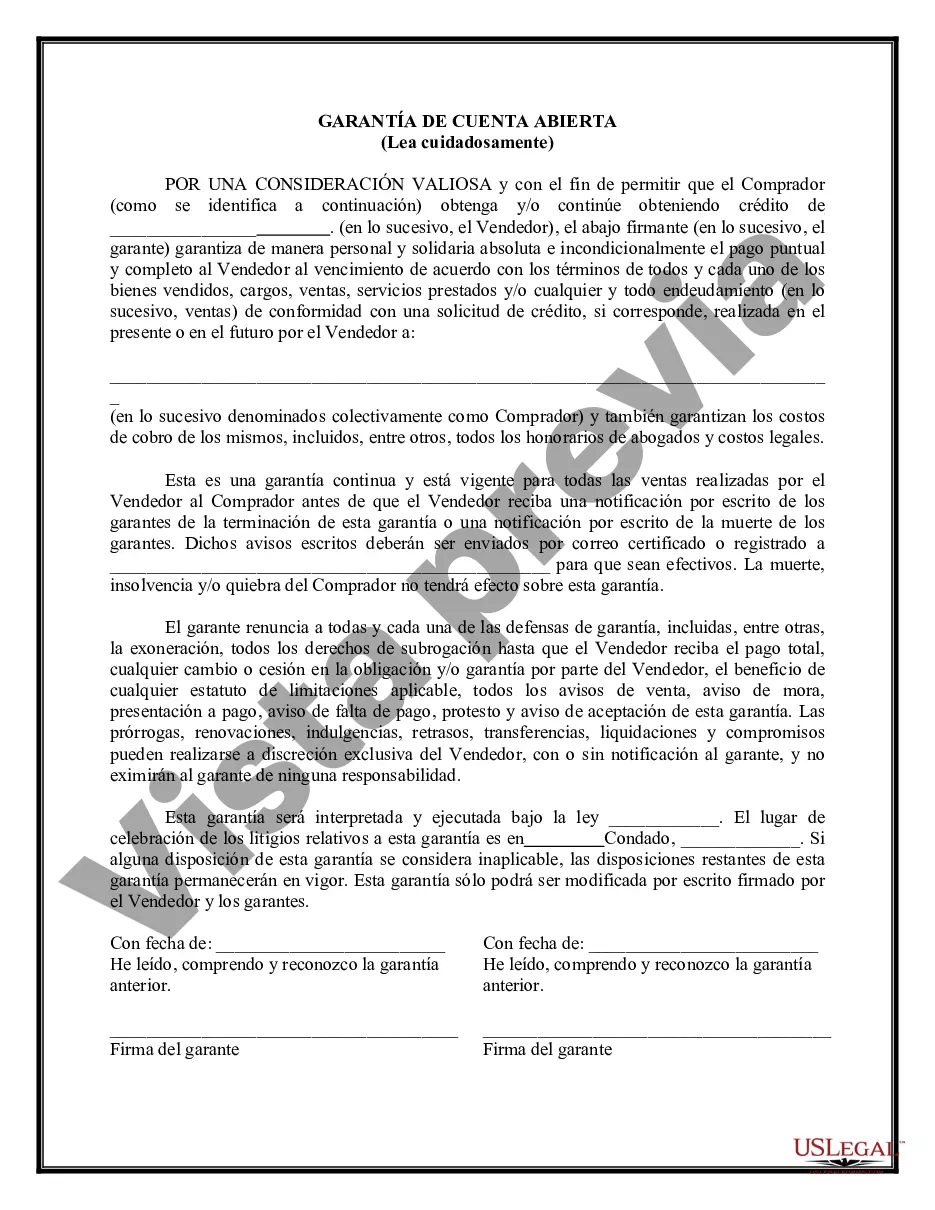

Alameda California Guaranty of Payment of Open Account is a legally binding document that involves a financial agreement between two parties, namely the creditor and the guarantor. This agreement is specific to the state of California, outlining the terms and conditions under which the guarantor pledges to guarantee the payment of an open account held by the debtor. In Alameda County, California, there are several types of Guaranty of Payment of Open Account, each designed to cater to specific situations and needs: 1. Limited Guaranty of Payment of Open Account: As the name suggests, this type of guarantee places a predetermined limit on the amount for which the guarantor is liable. The guarantor is responsible for paying only up to the specified sum, beyond which they are released from any additional liability. 2. Continuing Guaranty of Payment of Open Account: This type of guarantee covers all present and future obligations of the debtor to the creditor. It remains in effect until the guarantor provides a written notice of termination or until the obligations have been fulfilled. 3. Unconditional Guaranty of Payment of Open Account: In this form of guarantee, the guarantor assumes complete and unconditional liability for all outstanding debts owed by the debtor. The guarantor undertakes to pay any amounts due without any conditions or restrictions. 4. Joint and Several Guaranty of Payment of Open Account: This type of guarantee involves two or more guarantors who jointly accept liability and can each be held responsible for the full amount owed. The creditor can choose to pursue any or all of the guarantors for payment, based on their convenience or preference. The Alameda California Guaranty of Payment of Open Account provides protection to creditors, ensuring that they have an additional source of payment in case the debtor fails to honor their financial obligations. It offers peace of mind to creditors by offering an avenue to recover their outstanding debt. It is essential for all parties involved in such agreements to clearly understand the terms stated in the document. This prevents any future disputes or misunderstanding regarding the obligations and liabilities of the guarantor. Seeking legal advice and guidance while drafting or entering into a guaranty agreement in Alameda, California, is advisable to ensure compliance with state laws and regulations. By utilizing an Alameda California Guaranty of Payment of Open Account, creditors can have increased confidence in conducting business transactions, knowing they have additional protection and a means to collect outstanding debts.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Alameda California Garantía de Pago de Cuenta Abierta - Guaranty of Payment of Open Account

Description

How to fill out Alameda California Garantía De Pago De Cuenta Abierta?

Preparing legal documentation can be difficult. In addition, if you decide to ask an attorney to draft a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce papers, or the Alameda Guaranty of Payment of Open Account, it may cost you a lot of money. So what is the most reasonable way to save time and money and draft legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario gathered all in one place. Therefore, if you need the recent version of the Alameda Guaranty of Payment of Open Account, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Alameda Guaranty of Payment of Open Account:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now when you find the required sample and pick the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the document format for your Alameda Guaranty of Payment of Open Account and download it.

Once done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever purchased many times - you can find your templates in the My Forms tab in your profile. Give it a try now!