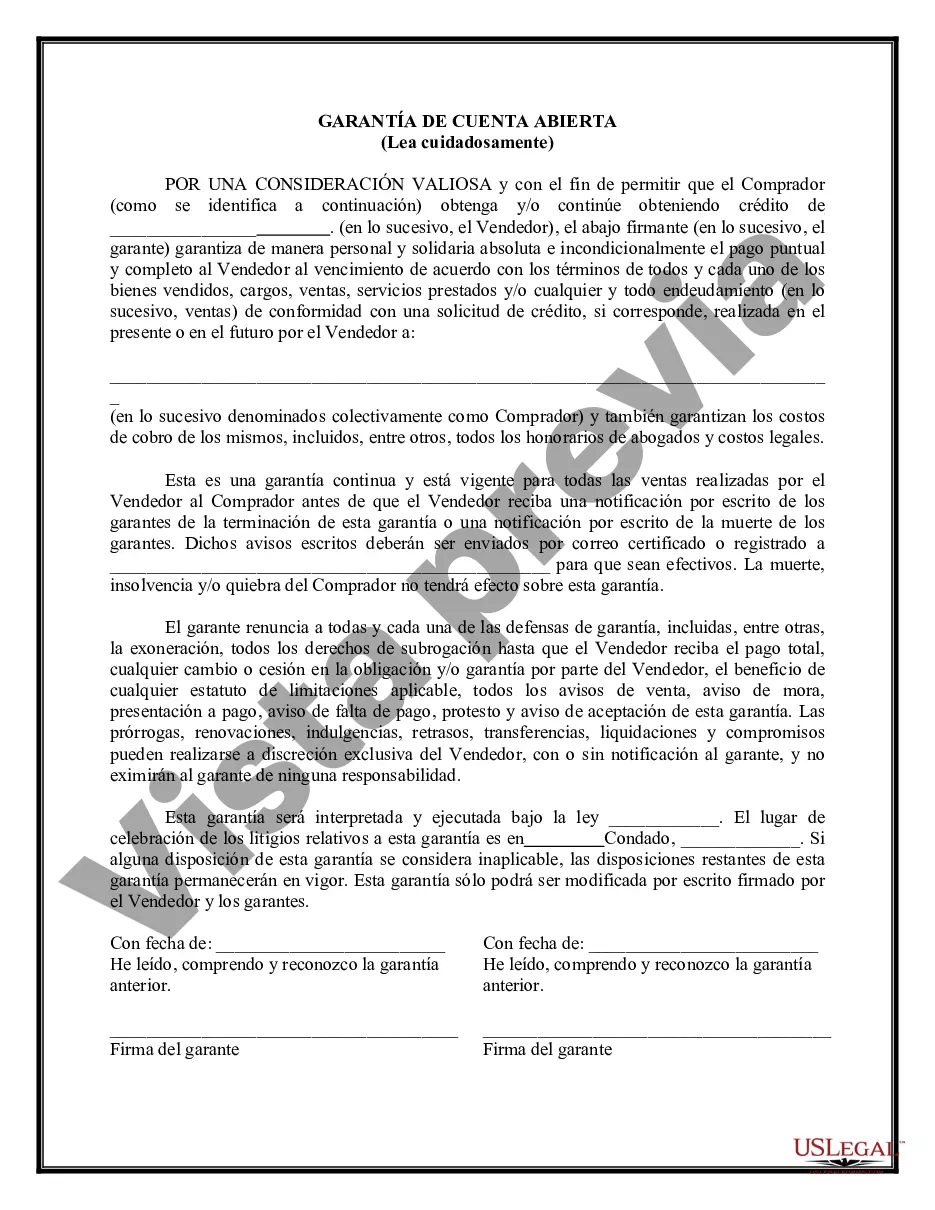

Miami-Dade Florida Guaranty of Payment of Open Account is a legally binding document that serves as a guarantee or assurance of payment for an open account. It is a commitment made by a party known as the guarantor to ensure that the debts or obligations of another party, known as the debtor, are paid in full and on time. In Miami-Dade County, which is located in the southeastern part of Florida, the Guaranty of Payment of Open Account is commonly used in business transactions to provide security and mitigate risks associated with extending credit or allowing customers to make purchases on account. This agreement is particularly relevant in industries such as manufacturing, wholesale trade, and retail, where the buying and selling of goods on credit terms are prevalent. The Miami-Dade Guaranty of Payment of Open Account outlines the rights and responsibilities of the guarantor and establishes the terms and conditions of the guarantee. It typically includes important details such as: 1. Parties Involved: The agreement identifies both the guarantor and the debtor, including their legal names, addresses, and contact information. 2. Account Information: The open account that is being guaranteed is described, including the account number, date of establishment, and any specific terms or restrictions associated with it. 3. Payment Obligations: The guarantor pledges to pay the debts owed by the debtor on the open account to the designated creditor or beneficiary in case the debtor fails to fulfill their payment obligations. This ensures that the creditor still receives the owed amount even if the debtor defaults. 4. Limitations and Exclusions: The Guaranty may define any limitations or exclusions that apply to the guarantee. This can include restrictions on the maximum amount guaranteed, time limitations, or specific conditions that must be met for the guarantee to be enforceable. Different variations of the Miami-Dade Florida Guaranty of Payment of Open Account may exist depending on the specific requirements and preferences of the parties involved. Some possible types or variations may include: 1. Limited Guaranty: This type of guaranty restricts the liability of the guarantor to a predetermined amount or specific time period. It provides a level of protection for the guarantor by limiting their responsibility for the debtor's debts. 2. Unlimited Guaranty: In contrast to a limited guaranty, an unlimited guaranty holds the guarantor fully responsible for the debtor's debts, with no predetermined limits or restrictions. This provides the creditor with greater assurance of payment and is often required when dealing with higher-risk transactions. 3. Joint and Several guaranties: This type of guaranty involves multiple guarantors who are collectively and individually responsible for the debtor's debts. If one guarantor fails to pay, the others are still liable for the full amount owed. It is important for all parties involved to carefully review and understand the terms and implications of a Miami-Dade Florida Guaranty of Payment of Open Account before entering into any agreement. Seeking legal advice or consulting with an attorney specializing in business law can help ensure that the terms are fair, clear, and enforceable.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Garantía de Pago de Cuenta Abierta - Guaranty of Payment of Open Account

Category:

State:

Multi-State

County:

Miami-Dade

Control #:

US-FS-872

Format:

Word

Instant download

Description

Garantía para ayudar a terceros a obtener una cuenta.

Miami-Dade Florida Guaranty of Payment of Open Account is a legally binding document that serves as a guarantee or assurance of payment for an open account. It is a commitment made by a party known as the guarantor to ensure that the debts or obligations of another party, known as the debtor, are paid in full and on time. In Miami-Dade County, which is located in the southeastern part of Florida, the Guaranty of Payment of Open Account is commonly used in business transactions to provide security and mitigate risks associated with extending credit or allowing customers to make purchases on account. This agreement is particularly relevant in industries such as manufacturing, wholesale trade, and retail, where the buying and selling of goods on credit terms are prevalent. The Miami-Dade Guaranty of Payment of Open Account outlines the rights and responsibilities of the guarantor and establishes the terms and conditions of the guarantee. It typically includes important details such as: 1. Parties Involved: The agreement identifies both the guarantor and the debtor, including their legal names, addresses, and contact information. 2. Account Information: The open account that is being guaranteed is described, including the account number, date of establishment, and any specific terms or restrictions associated with it. 3. Payment Obligations: The guarantor pledges to pay the debts owed by the debtor on the open account to the designated creditor or beneficiary in case the debtor fails to fulfill their payment obligations. This ensures that the creditor still receives the owed amount even if the debtor defaults. 4. Limitations and Exclusions: The Guaranty may define any limitations or exclusions that apply to the guarantee. This can include restrictions on the maximum amount guaranteed, time limitations, or specific conditions that must be met for the guarantee to be enforceable. Different variations of the Miami-Dade Florida Guaranty of Payment of Open Account may exist depending on the specific requirements and preferences of the parties involved. Some possible types or variations may include: 1. Limited Guaranty: This type of guaranty restricts the liability of the guarantor to a predetermined amount or specific time period. It provides a level of protection for the guarantor by limiting their responsibility for the debtor's debts. 2. Unlimited Guaranty: In contrast to a limited guaranty, an unlimited guaranty holds the guarantor fully responsible for the debtor's debts, with no predetermined limits or restrictions. This provides the creditor with greater assurance of payment and is often required when dealing with higher-risk transactions. 3. Joint and Several guaranties: This type of guaranty involves multiple guarantors who are collectively and individually responsible for the debtor's debts. If one guarantor fails to pay, the others are still liable for the full amount owed. It is important for all parties involved to carefully review and understand the terms and implications of a Miami-Dade Florida Guaranty of Payment of Open Account before entering into any agreement. Seeking legal advice or consulting with an attorney specializing in business law can help ensure that the terms are fair, clear, and enforceable.

Free preview