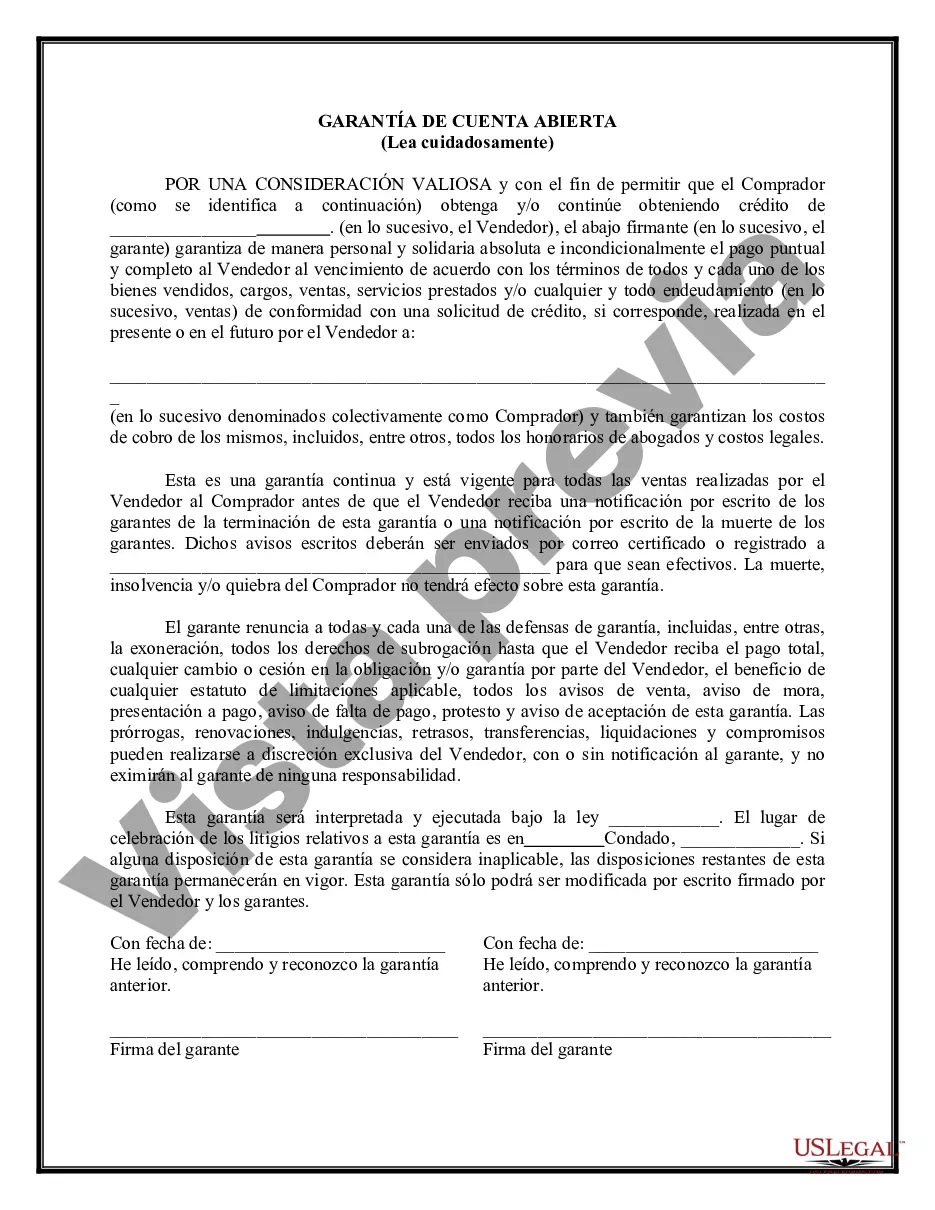

Oakland Michigan Guaranty of Payment of Open Account is a legal document designed to ensure that payment obligations on open accounts will be fulfilled. This type of guaranty serves as a binding agreement between a creditor, usually a business, and a guarantor, who guarantees the payment of an outstanding balance incurred by a debtor on an open account. Keywords: Oakland Michigan, Guaranty of Payment, Open Account, legal document, payment obligations, guarantee, creditor, business, outstanding balance, debtor. Different types of Oakland Michigan Guaranty of Payment of Open Account: 1. Personal Guaranty of Payment of Open Account: This type of guaranty involves a personal guarantee provided by an individual to guarantee the payment of an open account on behalf of a debtor. The guarantor becomes personally liable for the outstanding balance in the event that the debtor fails to fulfill their payment obligations. 2. Corporate Guaranty of Payment of Open Account: In this case, a corporation or business entity acts as the guarantor for the open account obligations of another entity or individual. By signing the guaranty, the corporation assumes responsibility for ensuring timely payment of the outstanding balance on the open account. 3. Limited Guaranty of Payment of Open Account: This type of guaranty limits the liability of the guarantor to a specified maximum amount or a specific period. The guarantor is only liable for the outstanding balance up to the agreed-upon limit or within the stated timeframe. 4. Continuing Guaranty of Payment of Open Account: A continuing guaranty establishes an ongoing commitment by the guarantor to guarantee the payment of any open account obligations that may arise in the future. This ensures that the guarantor remains responsible for all outstanding balances on the open account, even for transactions occurring after the signing of the guaranty. 5. Unconditional Guaranty of Payment of Open Account: With an unconditional guaranty, the guarantor assumes full responsibility for the payment of the outstanding balance on the open account, without any conditions or limitations. The guarantor is obligated to fulfill the payment obligations regardless of any disputes or changes in circumstances between the creditor and the debtor. In conclusion, an Oakland Michigan Guaranty of Payment of Open Account is a significant legal document that outlines the responsibility of a guarantor in ensuring the payment of an outstanding balance on an open account. It is crucial for all parties involved to fully understand the terms and conditions of the guaranty before entering into the agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oakland Michigan Garantía de Pago de Cuenta Abierta - Guaranty of Payment of Open Account

Description

How to fill out Oakland Michigan Garantía De Pago De Cuenta Abierta?

How much time does it typically take you to draw up a legal document? Given that every state has its laws and regulations for every life scenario, finding a Oakland Guaranty of Payment of Open Account meeting all local requirements can be tiring, and ordering it from a professional attorney is often expensive. Many online services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online catalog of templates, grouped by states and areas of use. Aside from the Oakland Guaranty of Payment of Open Account, here you can get any specific document to run your business or personal deeds, complying with your regional requirements. Professionals check all samples for their actuality, so you can be sure to prepare your paperwork properly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed form, and download it. You can retain the document in your profile anytime later on. Otherwise, if you are new to the website, there will be some extra actions to complete before you get your Oakland Guaranty of Payment of Open Account:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document utilizing the related option in the header.

- Click Buy Now once you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Oakland Guaranty of Payment of Open Account.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!