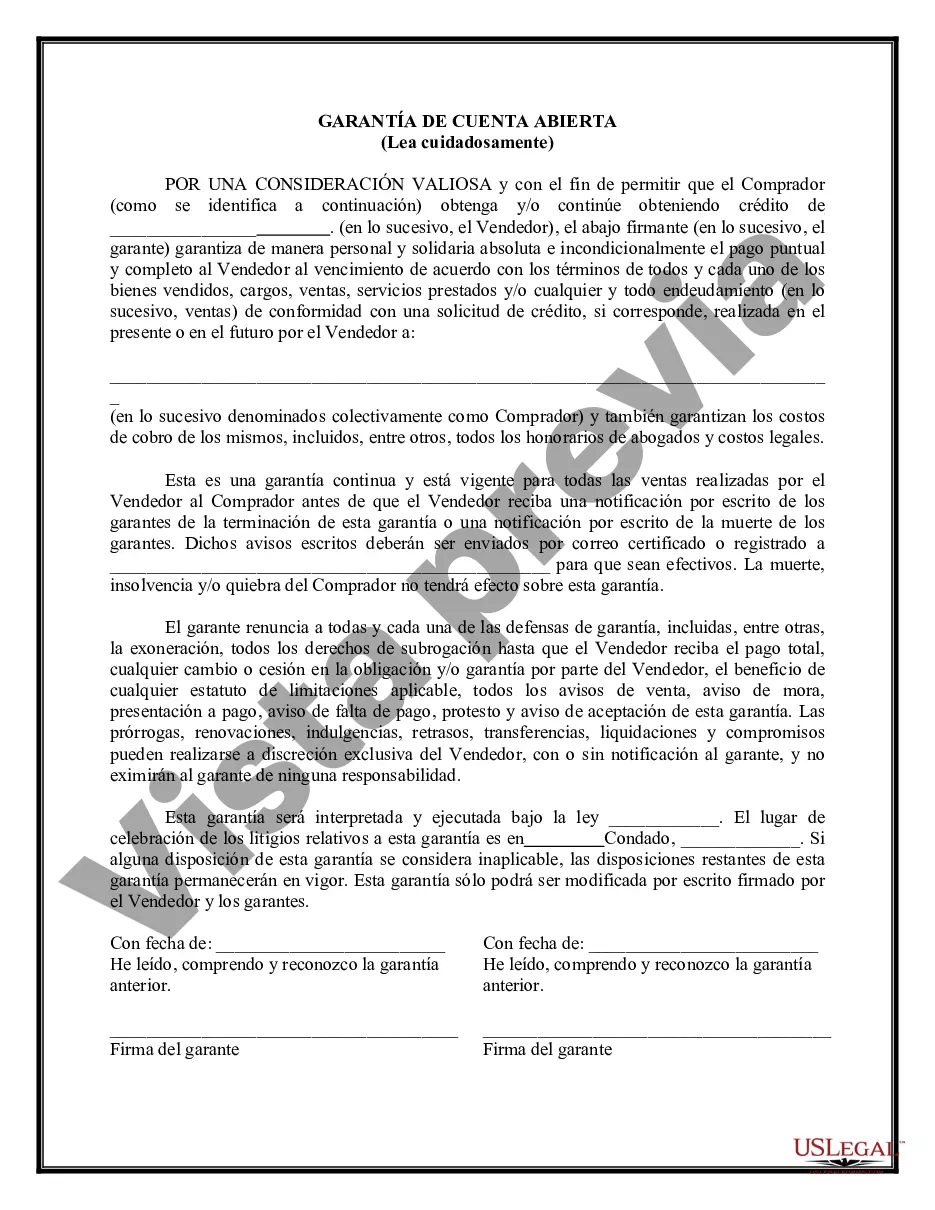

Santa Clara California Guaranty of Payment of Open Account is a legal document designed to secure the payment of an open account between a creditor and debtor in Santa Clara, California. This type of agreement ensures that the account holder will be responsible for any outstanding debts and will guarantee payment as agreed upon. The Santa Clara California Guaranty of Payment of Open Account serves as a binding contract between both parties and protects the creditor by providing an additional agreement of payment beyond the primary debtor. This document helps to minimize the risk of non-payment and provides a sense of security to the creditor when extending credit. The main purpose of a Santa Clara California Guaranty of Payment of Open Account is to establish a secondary source of payment in case the primary debtor defaults on their financial obligations. By requiring a guarantor, the creditor has a backup option to rely on in case of non-payment, increasing the likelihood of obtaining repayment for the goods or services provided. There are several types of Santa Clara California Guaranty of Payment of Open Account: 1. Limited Guaranty: This type of guaranty is limited to a specific amount or time frame, providing a cap on the guarantor's responsibility. Once the specified limit is reached, the guarantor is no longer obligated to cover any additional debt. 2. Continuing Guaranty: In contrast to a limited guaranty, a continuing guaranty covers the entire open account balance until the debt is fully paid off or the agreement is terminated. This type of guaranty provides ongoing protection for the creditor. 3. Absolute Guaranty: An absolute guaranty is an unconditional promise by the guarantor to be responsible for the full amount owed on the open account. The guarantor has no limitations or restrictions, and the creditor can pursue payment without any limitations or restrictions. 4. Conditional Guaranty: A conditional guaranty is contingent upon a specific event or circumstance. It may specify conditions that must be met for the guarantor to be obligated, such as the debtor's bankruptcy or failure to pay within a certain time frame. Overall, a Santa Clara California Guaranty of Payment of Open Account offers protection to the creditor by securing payment and reducing the risk of non-payment. It ensures that the debtor is held accountable for their outstanding debts and provides a legal recourse for the creditor to pursue payment.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Santa Clara California Garantía de Pago de Cuenta Abierta - Guaranty of Payment of Open Account

Description

How to fill out Santa Clara California Garantía De Pago De Cuenta Abierta?

Whether you plan to start your company, enter into an agreement, apply for your ID update, or resolve family-related legal issues, you must prepare certain paperwork meeting your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal templates for any personal or business case. All files are grouped by state and area of use, so opting for a copy like Santa Clara Guaranty of Payment of Open Account is fast and simple.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a few more steps to obtain the Santa Clara Guaranty of Payment of Open Account. Adhere to the guidelines below:

- Make sure the sample meets your personal needs and state law requirements.

- Read the form description and check the Preview if available on the page.

- Utilize the search tab providing your state above to locate another template.

- Click Buy Now to get the file when you find the proper one.

- Opt for the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Santa Clara Guaranty of Payment of Open Account in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you can access all of your previously purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!