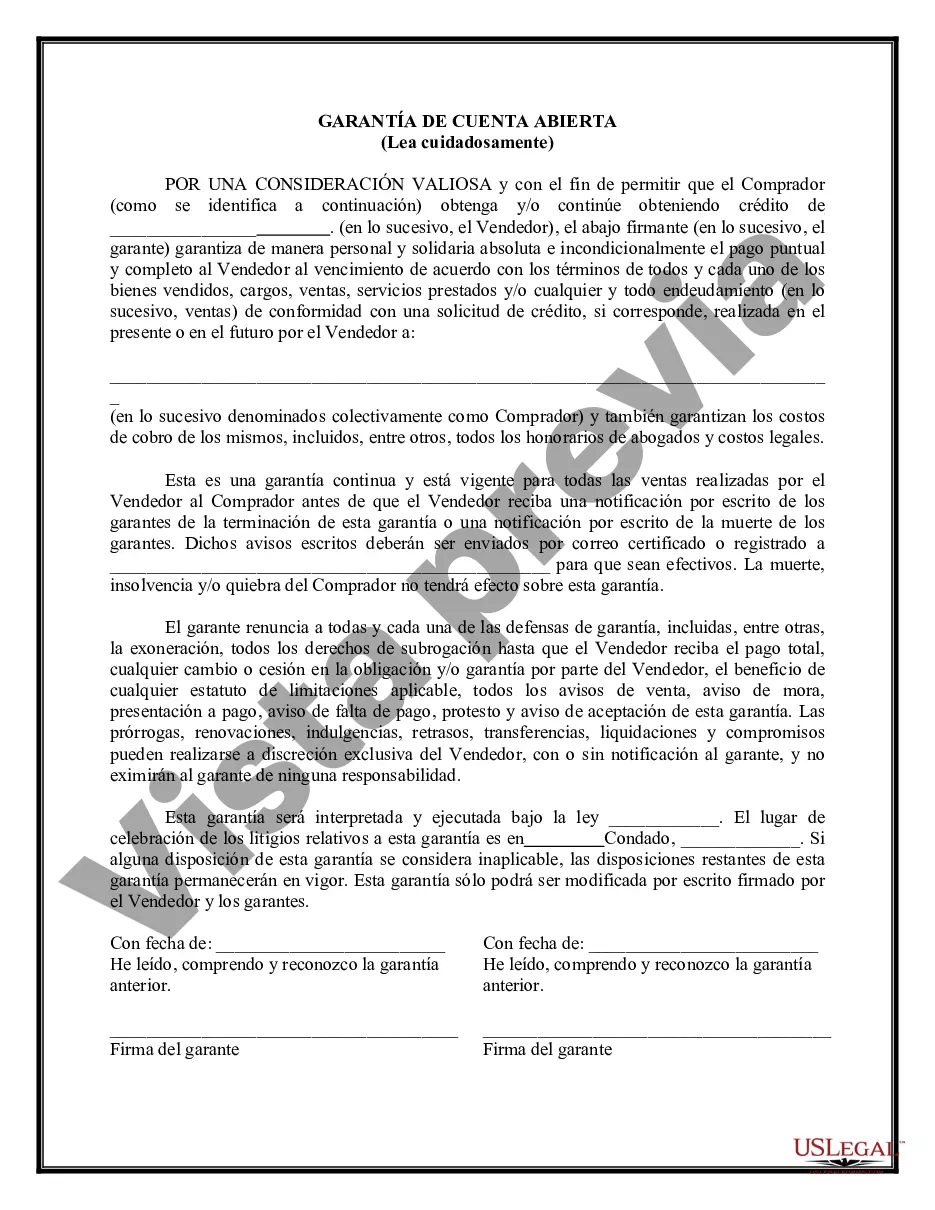

Suffolk New York Guaranty of Payment of Open Account is a legal document that serves as a safeguard for creditors in ensuring payment for goods or services provided on credit. This guarantee holds the guarantor liable for any outstanding debt owed by the debtor on an open account. A Suffolk New York Guaranty of Payment of Open Account can be categorized into two types: individual guarantees and corporate guarantees. Individual Guaranty of Payment of Open Account in Suffolk New York involves a person acting as the guarantor for a specific debtor. This type of guarantee applies when a creditor extends credit to an individual or a sole proprietorship, and the guarantor assumes personal responsibility for the debtor's outstanding balance in case of default. The creditor can then seek payment from the guarantor directly, ensuring that the debt is satisfied. On the other hand, Corporate Guaranty of Payment of Open Account in Suffolk New York involves a business entity acting as the guarantor. This type of guarantee applies when credit is extended to a corporation or a limited liability company (LLC). The corporate guarantor assumes responsibility for the outstanding debt owed by the debtor entity and guarantees its payment. If the debtor fails to make the necessary payments, the creditor can pursue the corporate guarantor for the debt, protecting their financial interests. Suffolk New York Guaranty of Payment of Open Account can also include various terms and conditions. These may specify the maximum liability of the guarantor, the timeframe within which the creditor can seek payment, interest rates on overdue payments, and any additional fees or costs that can be recovered. It is essential for both the guarantor and the creditor to carefully review and understand all the provisions outlined in the guaranty in order to ensure clear communication and legal compliance. In summary, a Suffolk New York Guaranty of Payment of Open Account provides an avenue for creditors to secure payment for goods or services provided on credit. With individual and corporate guarantee options available, it allows transparency and clarity in defining the liable parties in case of default. Proper understanding and adherence to the terms set in the agreement are crucial for all parties involved to protect their interests and maintain a healthy financial relationship.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Suffolk New York Garantía de Pago de Cuenta Abierta - Guaranty of Payment of Open Account

Description

How to fill out Suffolk New York Garantía De Pago De Cuenta Abierta?

Laws and regulations in every sphere vary throughout the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the Suffolk Guaranty of Payment of Open Account, you need a verified template valid for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for different life and business scenarios. All the forms can be used multiple times: once you purchase a sample, it remains available in your profile for future use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Suffolk Guaranty of Payment of Open Account from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Suffolk Guaranty of Payment of Open Account:

- Take a look at the page content to ensure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the template once you find the right one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your documentation in order with the US Legal Forms!