Fairfax Virginia Catering Services Contract — Self-Employed Independent Contractor is a legal agreement between a catering service provider and a client or event organizer in the Fairfax, Virginia area. This contract outlines the terms and conditions under which the independent contractor will provide catering services for various events, such as weddings, corporate parties, social gatherings, and more. Keywords: Fairfax Virginia, catering services, contract, self-employed, independent contractor, legal agreement, terms and conditions, event organizer, client, wedding, corporate parties, social gatherings. Types of Fairfax Virginia Catering Services Contracts — Self-Employed Independent Contractor: 1. Wedding Catering Contract: This type of contract is specifically tailored for catering services provided at weddings in Fairfax, Virginia. It includes specific details about the menu options, beverages, decorations, service staff, and timing requirements. 2. Corporate Event Catering Contract: This contract focuses on catering services for corporate events, such as conferences, seminars, and business meetings in Fairfax, Virginia. It highlights the specific requirements of the corporate client like dietary restrictions, presentation styles, and any additional services required. 3. Social Gathering Catering Contract: This type of contract covers catering services for various social gatherings, including birthday parties, anniversaries, and family reunions, taking place in Fairfax, Virginia. It may include specifics such as theme-based menus, special dietary accommodations, and event logistics. 4. Non-Profit Event Catering Contract: This contract pertains to catering services provided at non-profit events, fundraisers, and charity galas in Fairfax, Virginia. It may include considerations for reduced pricing or donations, customization based on the event cause, and coordination with event stakeholders. 5. Holiday Party Catering Contract: This contract is specifically designed for catering services during holiday celebrations in Fairfax, Virginia. It outlines seasonal menu choices, additional services like decorations, and provisions for accommodating special requests during the festive period. These variations of Fairfax Virginia Catering Services Contracts for Self-Employed Independent Contractors ensure that the unique needs of different types of events are met, providing clarity and protection for both the catering service provider and the client.

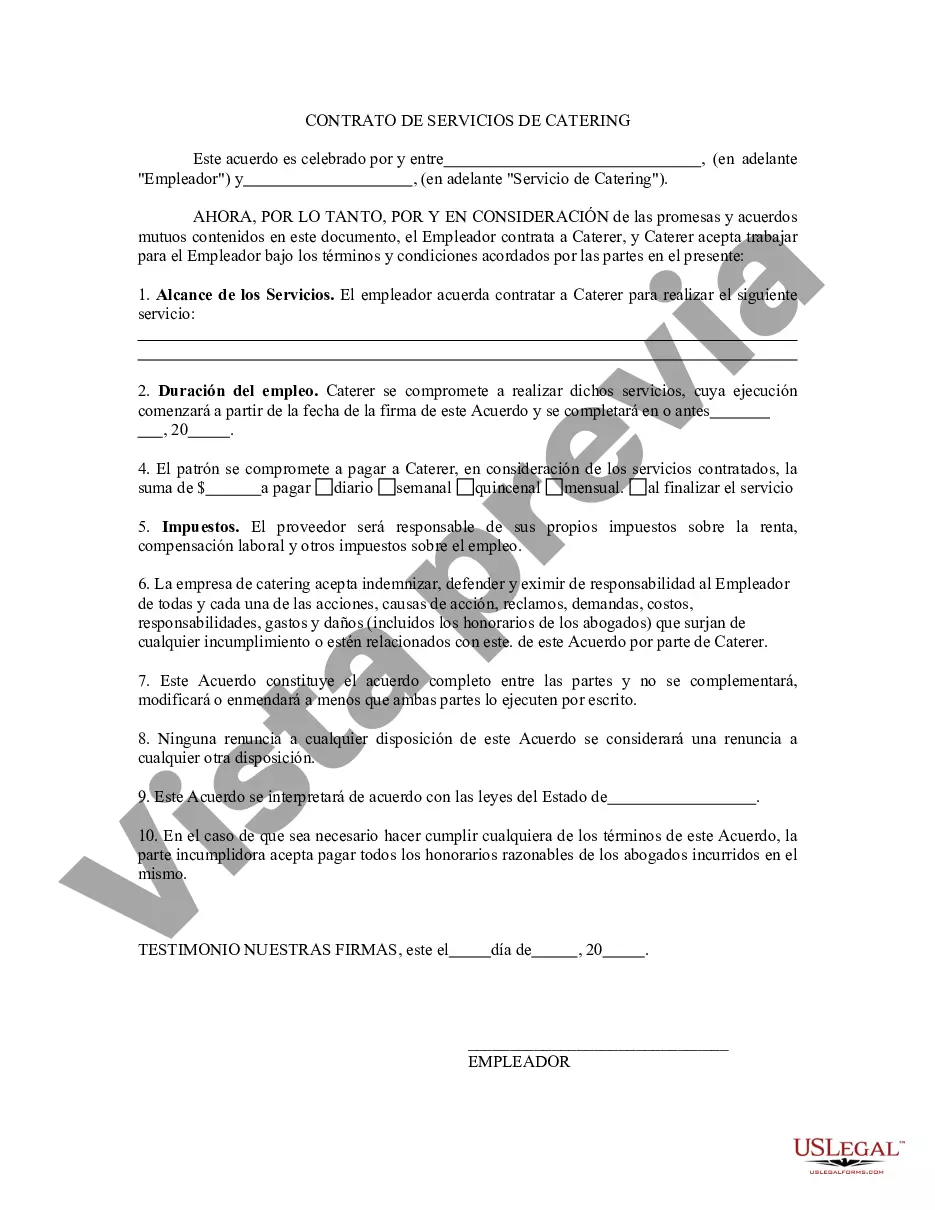

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fairfax Virginia Contrato de Servicios de Catering - Contratista Independiente Autónomo - Catering Services Contract - Self-Employed Independent Contractor

Description

How to fill out Fairfax Virginia Contrato De Servicios De Catering - Contratista Independiente Autónomo?

Creating legal forms is a must in today's world. Nevertheless, you don't always need to seek professional help to create some of them from the ground up, including Fairfax Catering Services Contract - Self-Employed Independent Contractor, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to select from in various categories ranging from living wills to real estate paperwork to divorce documents. All forms are organized based on their valid state, making the searching experience less frustrating. You can also find information resources and tutorials on the website to make any activities related to document execution simple.

Here's how you can find and download Fairfax Catering Services Contract - Self-Employed Independent Contractor.

- Take a look at the document's preview and outline (if available) to get a general information on what you’ll get after downloading the document.

- Ensure that the document of your choice is specific to your state/county/area since state regulations can impact the validity of some documents.

- Examine the similar forms or start the search over to find the correct file.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a needed payment method, and buy Fairfax Catering Services Contract - Self-Employed Independent Contractor.

- Choose to save the form template in any available format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Fairfax Catering Services Contract - Self-Employed Independent Contractor, log in to your account, and download it. Of course, our website can’t take the place of a legal professional entirely. If you need to deal with an extremely challenging case, we advise getting an attorney to examine your form before executing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of users. Become one of them today and purchase your state-specific paperwork effortlessly!

Form popularity

FAQ

Al contratista le hacen una retencion por honorarios que es del 10% para las personas no declarantes y del 11% paras las declarantes y le descuentan un 1% adicional para el impuesto de Industria y Comercio Agregado (ICA). Los trabajadores independientes tambien deben pagar su totalidad pension y salud.

Al contratista le hacen una retencion del 11%, y este debe pagar en su totalidad las cuotas para pension y salud. Por pension debe pagar el el 6,6% sobre el valor total del contrato. En cuanto a salud, debe pagar el 4,8% sobre el total del contrato.

¿Que es el impuesto para empleado por cuenta propia? Es un impuesto que representa 15.3% de sus ingresos como trabajador independiente. Este procentaje se divide asi: 12.04% es para cubrir impuestos del seguro social.

En general, los contribuyentes deben pagar al menos el 90 por ciento (sin embargo, vea el Alivio de Multas de 2018, a continuacion) de sus impuestos durante todo el ano mediante retenciones, pagos de impuestos estimados o adicionales, o una combinacion de ambos.

El trabajador realiza un trabajo que esta fuera del curso habitual del negocio de la entidad contratante; y. El trabajador se dedica habitualmente a un oficio, ocupacion o negocio establecido de forma independiente de la misma naturaleza que el relacionado con el trabajo realizado.

Desde el punto de vista laboral, el contratista independiente es la empresa o incluso persona natural, que es contratada por otra empresa o persona natural, para que desarrolle o ejecute algunas actividades a su favor.

Los expertos recomiendan que se guarde por lo menos 25% de su ingreso del trabajo para pago de impuestos. Como contratista independiente debe usar los formularios 1099-MISC recibidos de sus clientes, asi sabra el total a declarar en impuestos. Despues debe presentar la declaracion con el formulario 1040.

Se consideraran trabajadores independientes o por cuenta propia las personas naturales que ejecutan algun trabajo o desarrollan alguna actividad, industria o comercio, sea independientemente o asociados o en colaboracion con otros, tengan o no capital propio y sea que en sus profesiones, labores u oficios predomine el

Trabajadores independientes que pueden declarar costos y gastos....Deducciones especiales en los trabajadores independientes. Intereses por prestamos de vivienda. Los pagos por salud (medicina prepagada, seguros privados de salud) Deduccion por concepto de dependientes. Gravamen a los movimientos financieros (4x1.000).

Una contratista independiente es una persona que es contratada para hacer un trabajo especifico. Se dice que es su propia jefa porque controla como y donde se realiza el trabajo. Estas personas tienen mayor libertad y solo se comprometen a hacer la funcion especifica que acordaron con la persona duena de una compania.