Franklin Ohio Acoustical Contractor Agreement — Self-Employed is a legal document that outlines the terms and conditions between an acoustical contractor and a client in Franklin, Ohio. This agreement is specifically designed for self-employed individuals offering acoustical contracting services in the region. Key terms and clauses included in the Franklin Ohio Acoustical Contractor Agreement — Self-Employed are: 1. Parties: Clearly identifies the contracting parties, including the contractor's name, address, and contact information, as well as the client's details. 2. Scope of Work: Describes in detail the specific acoustical contracting services that will be provided by the contractor. It may include elements such as soundproofing, noise control, ceiling installations, insulation, and acoustical evaluation. 3. Payment Terms: Outlines the payment structure, including the total project cost, payment schedule, and accepted payment methods. It may also address any additional expenses or change orders that may arise during the project. 4. Duration and Termination: Specifies the project start and completion dates, as well as conditions under which either party can terminate the agreement. It may also address delay penalties and dispute resolution mechanisms. 5. Materials and Equipment: Addresses the responsibility of the contractor to provide all necessary materials, equipment, and tools required for the project. It may also detail any requirements for the client to provide certain materials. 6. Insurance and Liability: Outlines the insurance coverage held by the contractor and any liability limitations. It may require the contractor to provide proof of insurance and indemnify the client against any damages or claims arising from the work. 7. Ownership and intellectual property: Clarifies who retains ownership of any work products or intellectual property developed during the project. 8. Confidentiality: Includes provisions to ensure the confidentiality of any sensitive information shared during the course of the project. 9. Governing Law: Specifies the applicable laws and jurisdiction under which any disputes arising from the agreement will be resolved. Examples of different types of Franklin Ohio Acoustical Contractor Agreements — Self-Employed may include: 1. Residential Acoustical Contractor Agreement — Self-Employed: Designed for contractors providing acoustical services primarily for residential properties. 2. Commercial Acoustical Contractor Agreement — Self-Employed: Geared towards contractors specializing in acoustical solutions for commercial buildings, offices, or retail spaces. 3. Industrial Acoustical Contractor Agreement — Self-Employed: Tailored for contractors offering acoustical services in industrial settings such as factories, warehouses, or manufacturing plants. 4. Custom Acoustical Contractor Agreement — Self-Employed: A flexible agreement that can be customized to meet specific project requirements or unique client needs. These are just a few examples, and the specific types of agreements may vary depending on the context, scale, and specialization of the acoustical contractor's services in Franklin, Ohio.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Franklin Ohio Acuerdo de contratista acústico - Trabajador por cuenta propia - Acoustical Contractor Agreement - Self-Employed

Description

How to fill out Franklin Ohio Acuerdo De Contratista Acústico - Trabajador Por Cuenta Propia?

If you need to find a trustworthy legal document supplier to obtain the Franklin Acoustical Contractor Agreement - Self-Employed, look no further than US Legal Forms. Whether you need to launch your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the needed template.

- You can search from over 85,000 forms arranged by state/county and situation.

- The self-explanatory interface, number of supporting resources, and dedicated support team make it easy to locate and execute different documents.

- US Legal Forms is a reliable service providing legal forms to millions of customers since 1997.

Simply select to look for or browse Franklin Acoustical Contractor Agreement - Self-Employed, either by a keyword or by the state/county the document is intended for. After locating required template, you can log in and download it or save it in the My Forms tab.

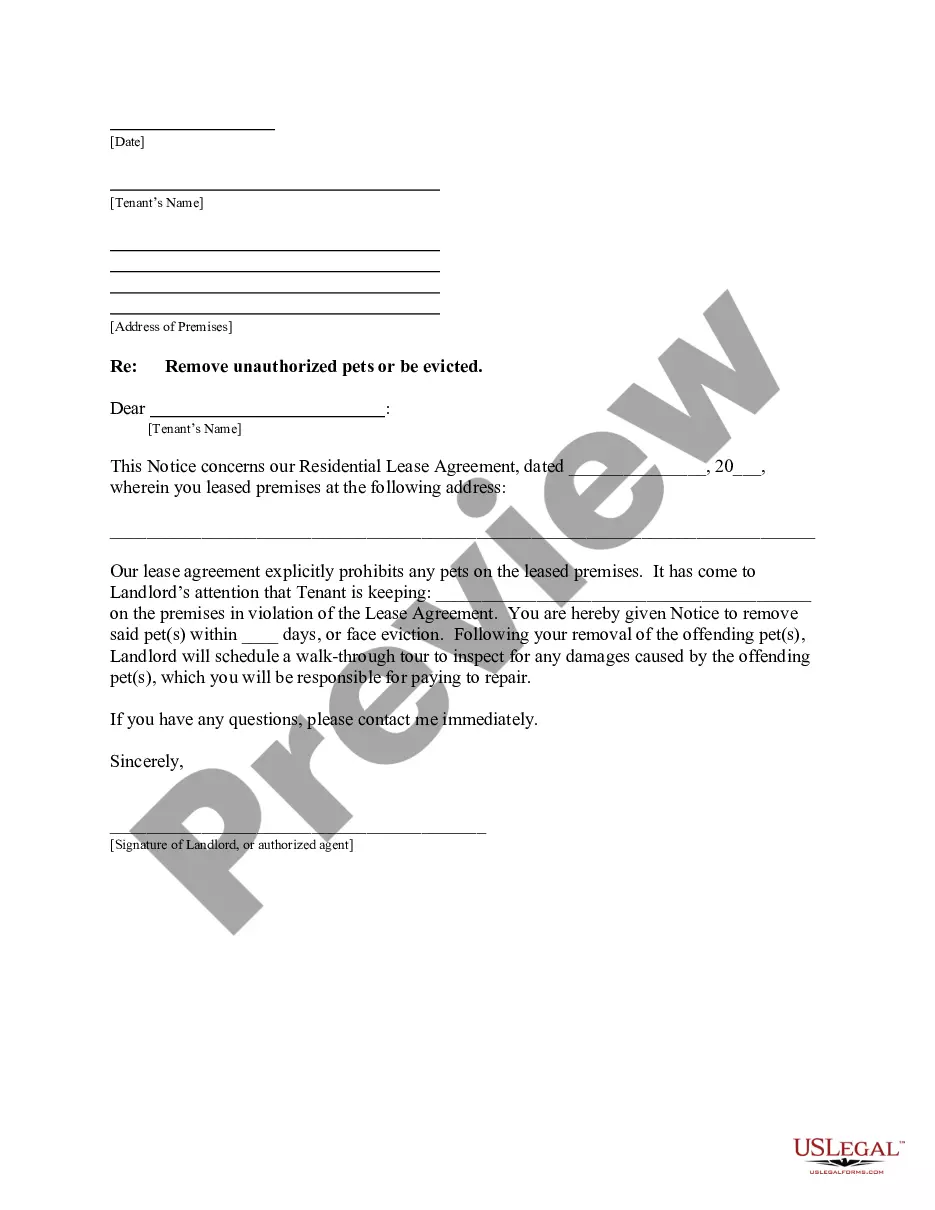

Don't have an account? It's simple to start! Simply find the Franklin Acoustical Contractor Agreement - Self-Employed template and take a look at the form's preview and description (if available). If you're comfortable with the template’s legalese, go ahead and hit Buy now. Create an account and choose a subscription plan. The template will be immediately available for download as soon as the payment is processed. Now you can execute the form.

Taking care of your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our rich collection of legal forms makes these tasks less expensive and more affordable. Create your first business, arrange your advance care planning, create a real estate agreement, or execute the Franklin Acoustical Contractor Agreement - Self-Employed - all from the comfort of your home.

Join US Legal Forms now!

Form popularity

FAQ

Si el total de ingresos durante el ano fueron en efectivo y no recibiste un formulario W-2, deberas solicitar un Formulario 1099-MISC a tu empleador al final del ano fiscal. El 1099-MISC se usa para reclamar los ingresos que recibiste como contratista independiente.

Los expertos recomiendan que se guarde por lo menos 25% de su ingreso del trabajo para pago de impuestos. Como contratista independiente debe usar los formularios 1099-MISC recibidos de sus clientes, asi sabra el total a declarar en impuestos. Despues debe presentar la declaracion con el formulario 1040.

Si ganaste mas de $400 en efectivo durante el ano fiscal, el IRS te considera trabajador por cuenta propia y debes presentar un Anexo C, ingresos y gastos comerciales y pagar impuestos sobre el trabajo por cuenta propia (Seguro Social y Medicare, lo mismo que la retencion de un W-2).

Una contratista independiente es una persona que es contratada para hacer un trabajo especifico. Se dice que es su propia jefa porque controla como y donde se realiza el trabajo. Estas personas tienen mayor libertad y solo se comprometen a hacer la funcion especifica que acordaron con la persona duena de una compania.

Se denomina trabajador por cuenta propia a todo aquel que realiza una actividad economica de forma independiente y directa, sin estar sujeto a un contrato de trabajo, aunque este utilice el servicio remunerado de otras personas para llevar a cabo su actividad (empleador).

Comenzando en el 2018, un menor que puede ser reclamado como dependiente tiene que presentar una declaracion de impuestos una vez que su ingreso exceda su deduccion estandar. Para el ano 2021, esta es lo mayor de $1,100 o la cantidad de ingreso de trabajo mas $350.

Usted debe pagar el impuesto sobre el trabajo por cuenta propia y presentar el Anexo SE (Formulario 1040 o 1040-SR) si se da alguno de estos casos. Sus ganancias netas del trabajo por cuenta propia (sin incluir el ingreso como empleado de una iglesia) fueron de $400 o mas.

Los expertos recomiendan que se guarde por lo menos 25% de su ingreso del trabajo para pago de impuestos. Como contratista independiente debe usar los formularios 1099-MISC recibidos de sus clientes, asi sabra el total a declarar en impuestos. Despues debe presentar la declaracion con el formulario 1040.

Trabajadores independientes que pueden declarar costos y gastos....Deducciones especiales en los trabajadores independientes. Intereses por prestamos de vivienda. Los pagos por salud (medicina prepagada, seguros privados de salud) Deduccion por concepto de dependientes. Gravamen a los movimientos financieros (4x1.000).