The Montgomery Maryland Temporary Worker Agreement — Self-Employed Independent Contractor is a legal document that outlines the terms and conditions between a temporary worker and an employer in Montgomery County, Maryland. It serves as a binding agreement that specifies the rights, responsibilities, and obligations of both parties involved. In Montgomery Maryland, there are multiple types of Temporary Worker Agreement for Self-Employed Independent Contractors, including: 1. General Temporary Worker Agreement: This type of agreement applies to various industries and positions where temporary workers are engaged on a project-specific or short-term basis. It covers roles such as administrative support, customer service, event staffing, and manual labor. 2. IT/Technical Temporary Worker Agreement: Specifically designed for the Information Technology (IT) industry, this agreement caters to independent contractors specializing in computer programming, software development, system administration, and other technical roles. It may include clauses related to intellectual property, confidentiality, and data security. 3. Healthcare Temporary Worker Agreement: Unique to the healthcare sector, this agreement pertains to self-employed independent contractors operating in fields such as nursing, medical billing, home health care, or allied health professions. It may contain provisions regarding patient privacy, compliance with health regulations, and liability insurance requirements. 4. Construction Temporary Worker Agreement: Tailored for the construction industry, this agreement applies to self-employed contractors engaged in tasks like carpentry, electrical work, plumbing, or general construction. It may include provisions related to safety protocols, equipment usage, and project timelines. Regardless of the specific type of agreement, the Montgomery Maryland Temporary Worker Agreement — Self-Employed Independent Contractor typically includes the following key elements: 1. Identification of the parties involved: This section provides the legal names, contact information, and addresses of both the worker (contractor) and the employer. 2. Project or assignment details: It outlines the specific scope of work, duration of engagement, and any relevant milestones or deadlines that the contractor is expected to meet. 3. Compensation and payment terms: This section specifies the agreed-upon rate, frequency of payment, and any additional expenses or reimbursements that the employer will provide. 4. Independent contractor status: This highlights that the worker is not an employee of the company and that they retain control over their work methods, schedule, and tools. 5. Confidentiality and non-disclosure: This clause may require the contractor to maintain the confidentiality of proprietary information, trade secrets, and client data. 6. Intellectual property rights: If applicable, this section outlines the ownership and rights to any intellectual property created or used during the engagement. 7. Termination and dispute resolution: It covers the conditions under which either party can terminate the agreement and specifies the procedures for resolving potential disputes. It is important to note that the Montgomery Maryland Temporary Worker Agreement — Self-Employed Independent Contractor must comply with relevant laws and regulations, such as employment standards, tax obligations, and local ordinances governing temporary employment. Consultation with legal professionals is recommended to ensure compliance and protect the interests of both parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Montgomery Maryland Acuerdo de Trabajador Temporal - Contratista Independiente Trabajador por Cuenta Propia - Temporary Worker Agreement - Self-Employed Independent Contractor

Description

How to fill out Montgomery Maryland Acuerdo De Trabajador Temporal - Contratista Independiente Trabajador Por Cuenta Propia?

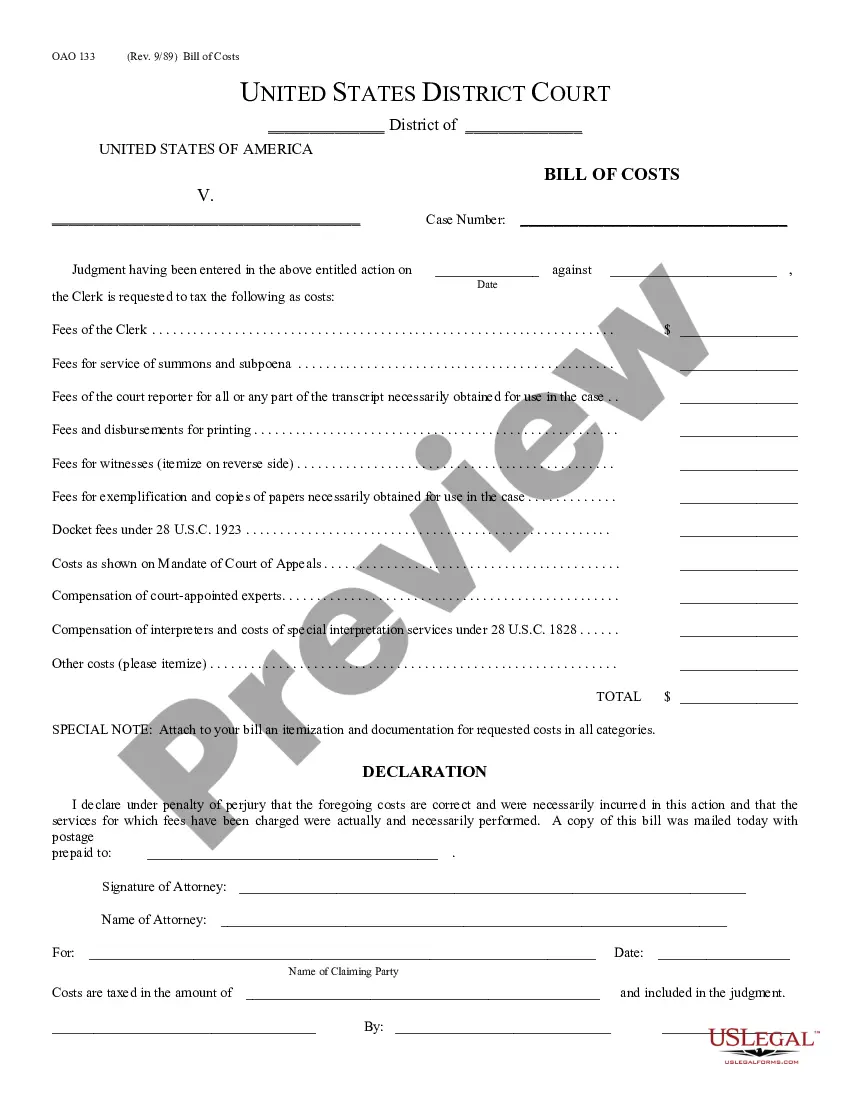

Creating legal forms is a must in today's world. Nevertheless, you don't always need to seek professional help to draft some of them from the ground up, including Montgomery Temporary Worker Agreement - Self-Employed Independent Contractor, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to select from in different categories ranging from living wills to real estate papers to divorce documents. All forms are organized according to their valid state, making the searching process less challenging. You can also find information materials and guides on the website to make any tasks associated with paperwork completion straightforward.

Here's how you can find and download Montgomery Temporary Worker Agreement - Self-Employed Independent Contractor.

- Go over the document's preview and outline (if provided) to get a basic information on what you’ll get after getting the form.

- Ensure that the document of your choice is adapted to your state/county/area since state laws can impact the legality of some records.

- Examine the related forms or start the search over to find the correct file.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a needed payment gateway, and purchase Montgomery Temporary Worker Agreement - Self-Employed Independent Contractor.

- Choose to save the form template in any offered file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Montgomery Temporary Worker Agreement - Self-Employed Independent Contractor, log in to your account, and download it. Of course, our platform can’t take the place of an attorney completely. If you need to deal with an exceptionally difficult case, we advise getting a lawyer to check your form before signing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of customers. Join them today and purchase your state-specific paperwork effortlessly!