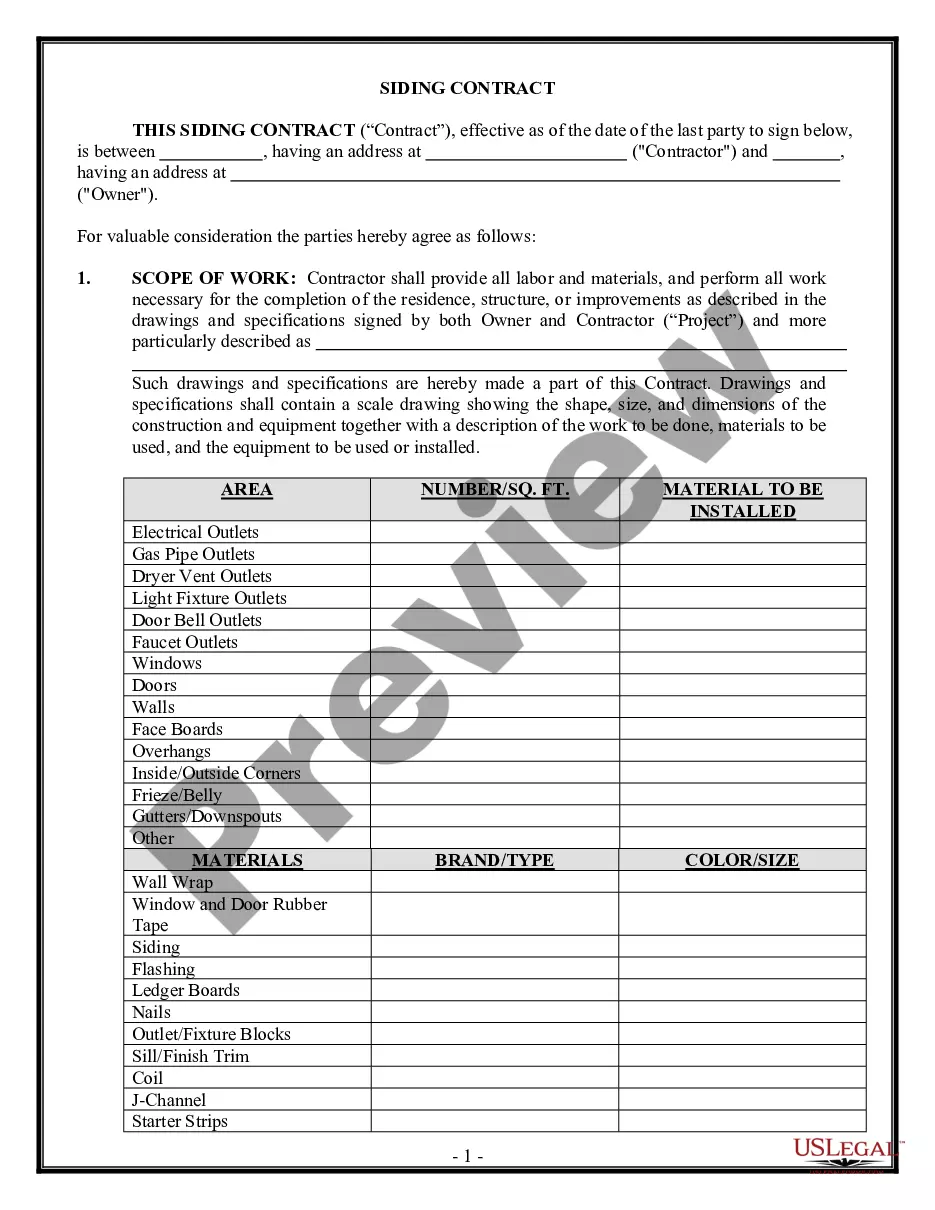

Chicago Illinois Underwriter Agreement — Self-Employed Independent Contractor: A Comprehensive Overview The Chicago Illinois Underwriter Agreement for Self-Employed Independent Contractors is a legal document that establishes the terms and conditions between an underwriter and a self-employed individual operating in the insurance industry within the state of Illinois. This agreement outlines the responsibilities, obligations, and rights of both parties involved in order to ensure a mutually beneficial working relationship. Key Components of the Chicago Illinois Underwriter Agreement — Self-Employed Independent Contractor: 1. Parties Involved: This section identifies the underwriter, typically an insurance agency, and the self-employed independent contractor who will be responsible for underwriting activities. Both parties' legal names, contact information, and business addresses are specified. 2. Nature of the Relationship: It is crucial to emphasize that the underwriter and the self-employed independent contractor are entering into an independent contractor relationship, not an employer-employee relationship. This section clarifies that the contractor maintains their status as an independent business entity, responsible for their own tax obligations, licenses, and insurance coverage. 3. Scope of Work: Here, the agreement specifies the underwriting services the contractor will provide. This may include assessing insurance applications, determining risks, reviewing documents, conducting underwriting evaluations, and making recommendations or decisions based on established guidelines. 4. Compensation: This section provides details on how the contractor will be compensated for their underwriting services. It outlines the payment structure, whether it is a fixed fee, commission-based, or a combination of both. Specific payment terms, such as frequency and method, are also stated. 5. Confidentiality and Non-Disclosure: Given the sensitive nature of insurance underwriting, this section ensures that the contractor understands the importance of maintaining confidentiality. It outlines the obligation to handle all client and company information with the utmost discretion and prohibits the contractor from disclosing any such information to third parties without prior written consent. 6. Termination: This portion outlines the conditions under which either party may terminate the agreement. It may include provisions such as a notice period, breach of contract, or termination for convenience. Types of Chicago Illinois Underwriter Agreements — Self-Employed Independent Contractor: 1. Life Insurance Underwriter Agreement: Specifically tailored for self-employed underwriters primarily engaged in evaluating life insurance applications, assessing risks, and determining policy eligibility. 2. Commercial Insurance Underwriter Agreement: Designed for self-employed underwriters specializing in evaluating commercial insurance policies, such as property and casualty insurance, liability coverage, and workers' compensation insurance. 3. Specialized Underwriter Agreements: Depending on the underwriter's expertise, there may be agreements focused on specific insurance lines, such as health insurance, auto insurance, or professional liability insurance. These types of Chicago Illinois Underwriter Agreements may differ in specific clauses and requirements based on the insurance sector they address. It is crucial to ensure that the selected agreement aligns with the nature of the underwriter's work and the insurance products under consideration. Seeking legal advice or consulting an attorney when drafting or signing an underwriter agreement is always recommended ensuring compliance with relevant laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Acuerdo de Suscriptor - Contratista Independiente que Trabaja por Cuenta Propia - Underwriter Agreement - Self-Employed Independent Contractor

Description

How to fill out Chicago Illinois Acuerdo De Suscriptor - Contratista Independiente Que Trabaja Por Cuenta Propia?

Creating documents, like Chicago Underwriter Agreement - Self-Employed Independent Contractor, to take care of your legal affairs is a difficult and time-consumming task. A lot of cases require an attorney’s participation, which also makes this task expensive. However, you can take your legal issues into your own hands and manage them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal forms crafted for a variety of scenarios and life situations. We ensure each form is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal problems associated with compliance.

If you're already aware of our services and have a subscription with US, you know how easy it is to get the Chicago Underwriter Agreement - Self-Employed Independent Contractor template. Simply log in to your account, download the form, and personalize it to your needs. Have you lost your form? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is fairly simple! Here’s what you need to do before getting Chicago Underwriter Agreement - Self-Employed Independent Contractor:

- Ensure that your form is compliant with your state/county since the regulations for creating legal papers may differ from one state another.

- Find out more about the form by previewing it or reading a quick intro. If the Chicago Underwriter Agreement - Self-Employed Independent Contractor isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Log in or create an account to start using our website and download the document.

- Everything looks great on your side? Click the Buy now button and choose the subscription plan.

- Pick the payment gateway and enter your payment details.

- Your form is good to go. You can go ahead and download it.

It’s an easy task to find and buy the needed document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive library. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!