Cook Illinois Professional Fundraiser Services Contract — Self-Employed is a legally binding agreement between Cook Illinois, a professional fundraising company based in Illinois, and an individual who wishes to work as a self-employed fundraiser for the company. This contract outlines the terms and conditions under which the self-employed fundraiser will operate and the responsibilities of both parties involved. The Cook Illinois Professional Fundraiser Services Contract — Self-Employed provides a comprehensive understanding of the expectations and requirements for the self-employed fundraiser working with Cook Illinois. It covers various aspects such as compensation, work schedule, fundraising targets, and confidentiality. The contract aims to ensure a fair and transparent working relationship between Cook Illinois and the self-employed fundraiser. Some important keywords related to Cook Illinois Professional Fundraiser Services Contract — Self-Employed include: 1. Professional Fundraiser: A person or company hired to raise funds on behalf of a nonprofit organization or cause. 2. Self-Employed: Refers to an individual who works for themselves and is not an employee of Cook Illinois. 3. Cook Illinois: A professional fundraising company based in Illinois that offers its services to nonprofit organizations. 4. Contract: A legally binding agreement between parties specifying the terms and conditions of their working relationship. 5. Responsibilities: The duties and tasks that the self-employed fundraiser is expected to perform as outlined in the contract. 6. Compensation: The payment or remuneration the self-employed fundraiser is entitled to receive for their fundraising efforts. 7. Work Schedule: The agreed-upon hours and days during which the self-employed fundraiser will be actively engaged in fundraising activities. 8. Fundraising Targets: The specific monetary goals and objectives that the self-employed fundraiser is expected to achieve within a given time frame. 9. Confidentiality: The requirement for the self-employed fundraiser to maintain confidentiality regarding sensitive information, donor data, and fundraising strategies. 10. Nonprofit Organization: A tax-exempt organization that operates for a charitable, educational, or public benefit purpose and relies on fundraising for financial support. While there may not be different types of Cook Illinois Professional Fundraiser Services Contract — Self-Employed, variations in the terms and conditions can exist depending on specific agreements or negotiations between Cook Illinois and the self-employed fundraiser. It is essential for both parties to carefully review and understand the contract before signing to ensure clarity and mutual agreement on all aspects of the working relationship.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Contrato de Servicios Profesionales de Recaudación de Fondos - Autónomos - Professional Fundraiser Services Contract - Self-Employed

Description

How to fill out Cook Illinois Contrato De Servicios Profesionales De Recaudación De Fondos - Autónomos?

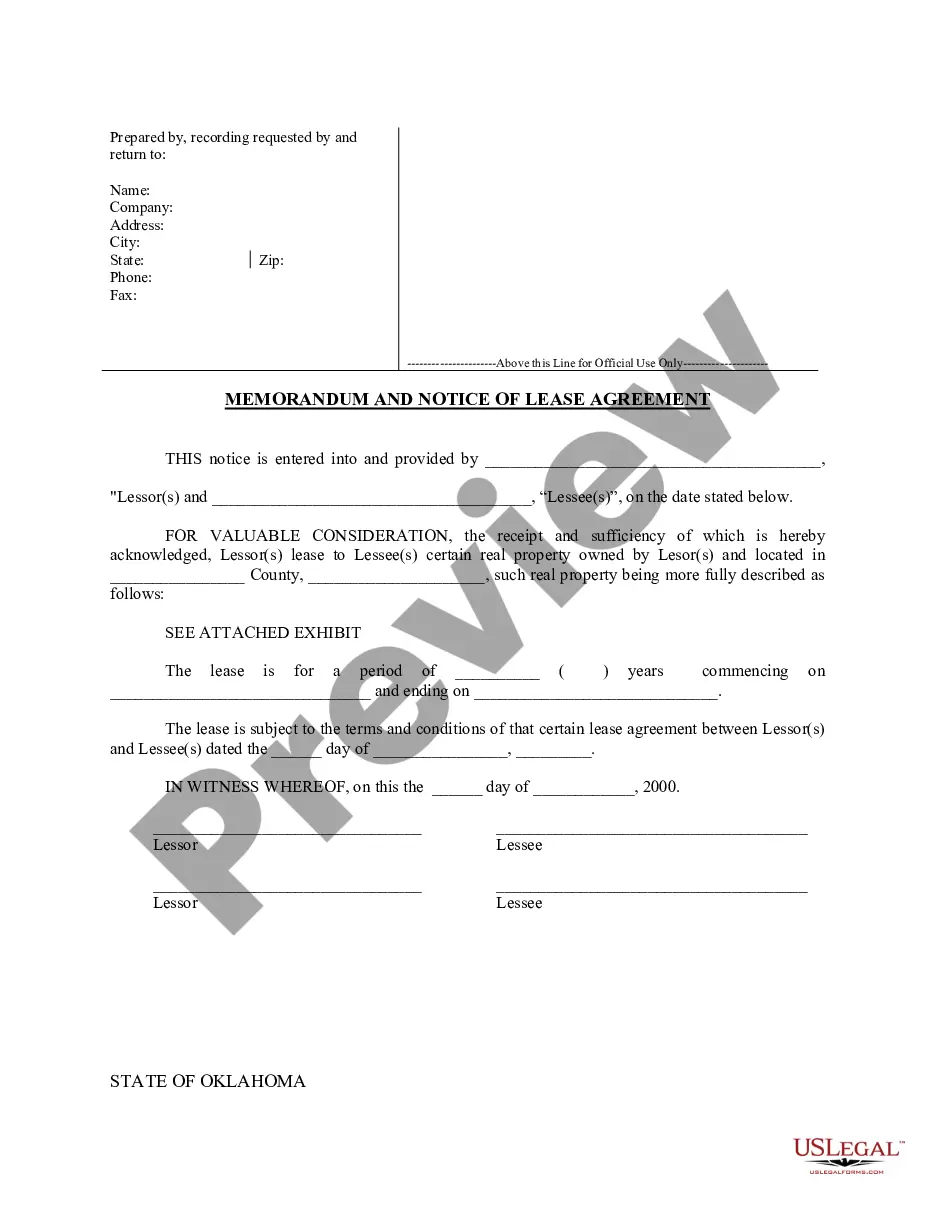

Are you looking to quickly draft a legally-binding Cook Professional Fundraiser Services Contract - Self-Employed or maybe any other document to take control of your own or business affairs? You can select one of the two options: hire a legal advisor to write a legal document for you or create it completely on your own. The good news is, there's another option - US Legal Forms. It will help you get professionally written legal documents without having to pay unreasonable prices for legal services.

US Legal Forms offers a rich collection of more than 85,000 state-compliant document templates, including Cook Professional Fundraiser Services Contract - Self-Employed and form packages. We offer templates for an array of life circumstances: from divorce paperwork to real estate documents. We've been on the market for more than 25 years and gained a spotless reputation among our customers. Here's how you can become one of them and get the necessary document without extra troubles.

- First and foremost, double-check if the Cook Professional Fundraiser Services Contract - Self-Employed is adapted to your state's or county's laws.

- If the document includes a desciption, make sure to check what it's intended for.

- Start the searching process again if the form isn’t what you were seeking by utilizing the search box in the header.

- Select the subscription that is best suited for your needs and proceed to the payment.

- Choose the file format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the Cook Professional Fundraiser Services Contract - Self-Employed template, and download it. To re-download the form, simply go to the My Forms tab.

It's stressless to find and download legal forms if you use our services. Additionally, the templates we offer are reviewed by law professionals, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!