Nassau New York Translator and Interpreter Agreement — Self-Employed Independent Contractor In Nassau, New York, professional translators and interpreters often enter into agreements to establish effective working relationships with their clients. The Nassau New York Translator and Interpreter Agreement serves as a crucial document that outlines the key terms and conditions under which these independent contractors operate. This legal agreement helps ensure a clear understanding between both parties involved and protects the rights and obligations of the translator or interpreter. Keywords: Nassau New York, translator, interpreter, agreement, self-employed, independent contractor, professional, terms, conditions, working relationship, legal document, rights, obligations. Different Types: 1. General Translator and Interpreter Agreement: This is a comprehensive agreement that covers all essential aspects of the professional relationship between a translator or interpreter and their client. It includes clauses related to confidentiality, payment terms, scope of work, termination, and any specific requirements unique to the client's industry or field. 2. Medical Translator and Interpreter Agreement: This agreement focuses specifically on translators and interpreters providing language services in medical settings. It may address the sensitivity of patient information, adherence to medical ethics and standards, compliance with healthcare regulations, and confidentiality protocols regarding patient data. 3. Legal Translator and Interpreter Agreement: This type of agreement is tailored for translators and interpreters working in legal settings, like courts or law firms. It may cover areas such as attorney-client privilege, confidentiality of legal documents, accuracy in legal translations, and the understanding of specific legal terminology. 4. Business Translator and Interpreter Agreement: As the name suggests, this agreement is designed for translators and interpreters working in corporate or business contexts. It outlines the terms related to non-disclosure agreements, intellectual property rights, market research confidentiality, and industry-specific terminology. 5. Conference Interpreter Agreement: Conference interpreters often require a specialized agreement that takes into account the unique nature of their work. This agreement may include provisions on equipment requirements, team collaboration, strict time schedules, and event logistics such as travel arrangements or accommodation. It is important for both translators and interpreters in Nassau, New York, as self-employed independent contractors, to have a solid and well-drafted agreement in place to protect their rights and establish clear working conditions with their clients.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nassau New York Contrato de Traductor e Intérprete - Contratista independiente autónomo - Translator And Interpreter Agreement - Self-Employed Independent Contractor

Description

How to fill out Nassau New York Contrato De Traductor E Intérprete - Contratista Independiente Autónomo?

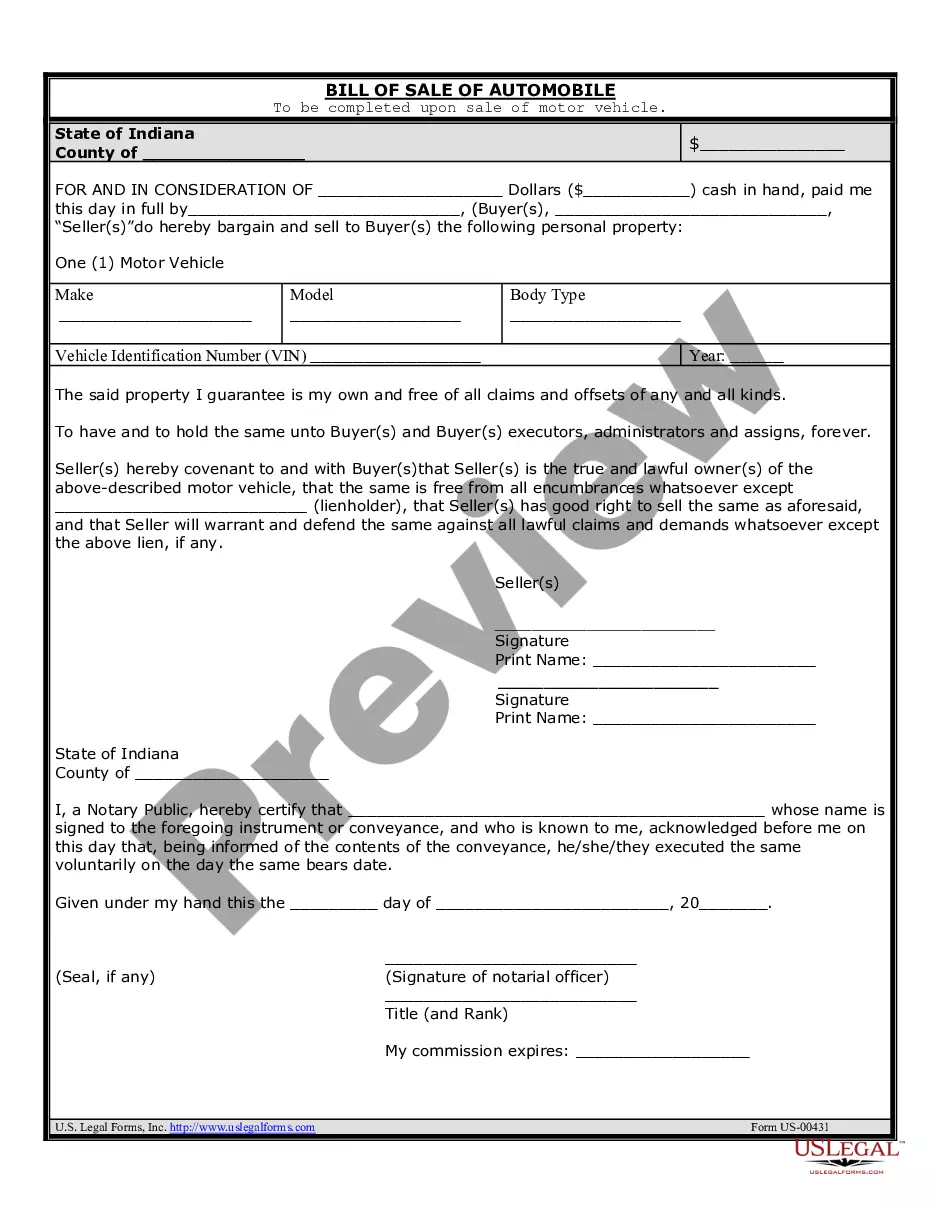

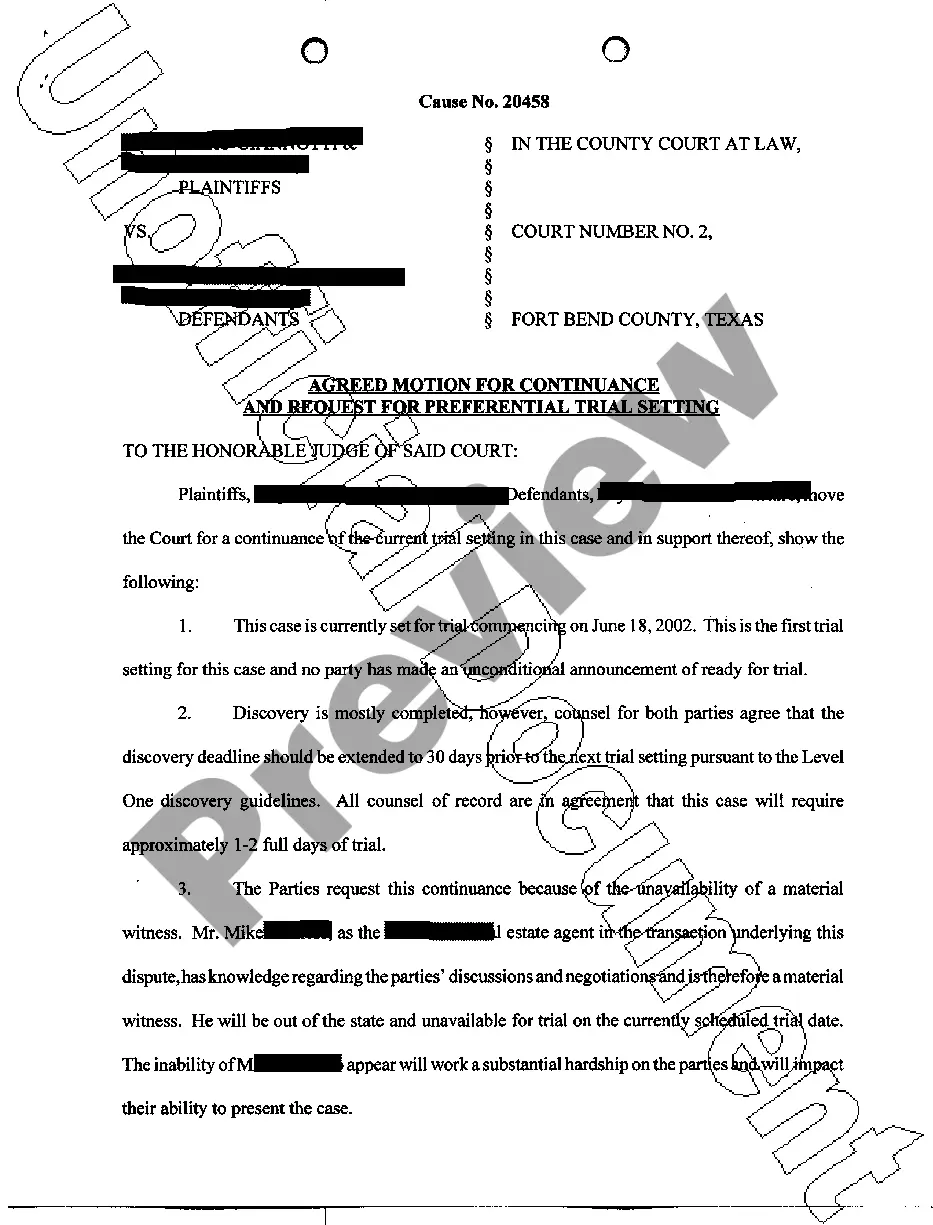

Whether you plan to open your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal issues, you must prepare certain paperwork corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal templates for any personal or business occasion. All files are grouped by state and area of use, so picking a copy like Nassau Translator And Interpreter Agreement - Self-Employed Independent Contractor is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a few more steps to obtain the Nassau Translator And Interpreter Agreement - Self-Employed Independent Contractor. Follow the guidelines below:

- Make certain the sample fulfills your personal needs and state law requirements.

- Read the form description and check the Preview if there’s one on the page.

- Use the search tab providing your state above to locate another template.

- Click Buy Now to obtain the sample once you find the proper one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Nassau Translator And Interpreter Agreement - Self-Employed Independent Contractor in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you can access all of your earlier acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!

Form popularity

FAQ

El trabajador realiza un trabajo que esta fuera del curso habitual del negocio de la entidad contratante; y. El trabajador se dedica habitualmente a un oficio, ocupacion o negocio establecido de forma independiente de la misma naturaleza que el relacionado con el trabajo realizado.

¿Que es el impuesto para empleado por cuenta propia? Es un impuesto que representa 15.3% de sus ingresos como trabajador independiente. Este procentaje se divide asi: 12.04% es para cubrir impuestos del seguro social.

Conozca a continuacion tips para alcanzar el exito como contratista: Opere con las mejores practicas empresariales:Evalue su organizacion interna:Tener disposicion:Asociese con mas personas de la industria:Haga marketing:Atraiga mas fondos:Sea flexible:Encuentre un mentor:

Al contratista le hacen una retencion del 11%, y este debe pagar en su totalidad las cuotas para pension y salud. Por pension debe pagar el el 6,6% sobre el valor total del contrato. En cuanto a salud, debe pagar el 4,8% sobre el total del contrato.

Ten en cuenta que un contratista independiente es la persona natural o juridica (otra organizacion) que es contratada por tu empresa para ejecutar las actividades o servicios que le encargues.

Una contratista independiente es una persona que es contratada para hacer un trabajo especifico. Se dice que es su propia jefa porque controla como y donde se realiza el trabajo. Estas personas tienen mayor libertad y solo se comprometen a hacer la funcion especifica que acordaron con la persona duena de una compania.

Un contratista es la persona o empresa que es contratada por otra organizacion o particular para la construccion de un edificio, carretera, instalacion o algun trabajo especial, como refinerias o plataformas petroleras por ejemplo.

Un contratista es responsable de proporcionar todos los materiales, equipo (vehiculos y herramientas) y la mano de obra necesarios para la construccion del proyecto; aunque dado el caso puede proporcionar, por ejemplo, solamente el recurso humano.

Como ser un contratista independiente con exito Nombrar y registrar su negocio. ( El registro solo es necesario en algunos estados) Registrarse para obtener una licencia profesional (si es necesario) y un certificado fiscal. Asegurese de pagar sus impuestos estimados a lo largo del ano.

Interesting Questions

More info

See NLRB Forms, Seese‡. see NLRB Forms. see NLRB Forms. If you are currently employed by a government agency or a union, you may be subject to an agency-wide classification in the event you lose your government employment — including an agency-wide classification for service at other government agencies. As stated, many workers classify themselves as independent contractors as opposed to employees because the employer pays them a lower wage. But the Department of Labor makes a distinction between these two types of arrangements. Independent contractors have no rights under the Fair Labor Standards Act because they receive no wages. Employees will typically be classified as employees if paid hourly wages or if the employer pays them based on self-employment income.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.