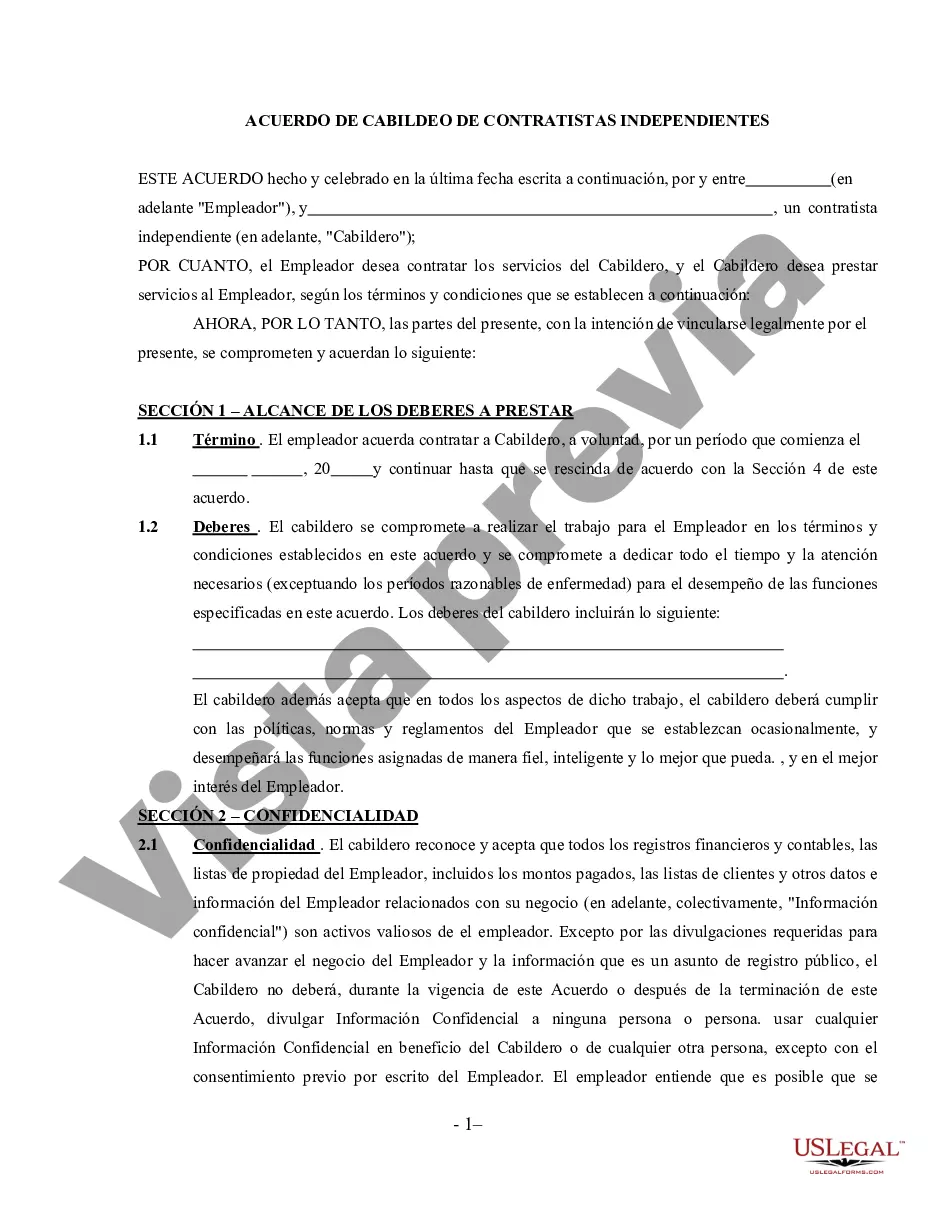

Travis Texas Lobbyist Agreement — Self-Employed Independent Contractor is a legal document that outlines the terms and conditions between a lobbyist and a client in the Travis County, Texas area. This agreement is specifically designed for self-employed independent contractors who provide lobbying services in the region. Key terms included in the Travis Texas Lobbyist Agreement — Self-Employed Independent Contractor may encompass: 1. Scope of Services: This section describes the nature of the lobbying services to be provided by the self-employed independent contractor. It outlines the specific tasks and objectives that the lobbyist will undertake on behalf of the client. 2. Compensation: This part outlines the payment terms agreed upon between the lobbyist and client. It may cover the hourly rate or a fixed fee that the self-employed independent contractor will charge for their services. 3. Confidentiality: This clause ensures that both the lobbyist and the client will maintain strict confidentiality regarding any sensitive information shared during the course of the engagement. It may include measures to protect proprietary data, trade secrets, and other confidential information. 4. Non-Compete: This section outlines any restrictions on the lobbyist's ability to engage in similar lobbying activities for other clients within a specific timeframe or geographical area. It aims to protect the client's interests and prevent conflicts of interest. 5. Term and Termination: This part defines the duration of the agreement and the conditions under which either party can terminate the contract. It may include provisions for early termination, notice periods, and any applicable penalties or liabilities. Different types of Travis Texas Lobbyist Agreement — Self-Employed Independent Contractor may include variations based on specific industry sectors or areas of expertise. For instance: 1. Healthcare Lobbyist Agreement: Tailored for lobbyists representing healthcare-related organizations or professionals, this agreement may include additional provisions specific to the healthcare industry, such as compliance with healthcare regulations and policies. 2. Environmental Lobbyist Agreement: Designed for lobbyists working on behalf of environmental advocacy groups or organizations, this agreement may focus on advocating for environmental policies, conservation efforts, and sustainable practices. 3. Technology Lobbyist Agreement: Aimed at lobbyists specializing in technology-related issues, this agreement may cover lobbying activities pertaining to intellectual property rights, cybersecurity regulations, data privacy legislation, and emerging technologies. In conclusion, the Travis Texas Lobbyist Agreement — Self-Employed Independent Contractor is a crucial legal document that details the working relationship between a lobbyist and a client in Travis County, Texas. Customizations can be made based on the specific industry sector or expertise of the independent contractor, such as healthcare, environment, or technology lobbying.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Acuerdo de Lobbistas - Contratista Independiente Trabajador por Cuenta Propia - Lobbyist Agreement - Self-Employed Independent Contractor

Description

How to fill out Travis Texas Acuerdo De Lobbistas - Contratista Independiente Trabajador Por Cuenta Propia?

A document routine always goes along with any legal activity you make. Staring a business, applying or accepting a job offer, transferring ownership, and many other life scenarios demand you prepare official documentation that varies throughout the country. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily find and get a document for any individual or business purpose utilized in your region, including the Travis Lobbyist Agreement - Self-Employed Independent Contractor.

Locating samples on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. Following that, the Travis Lobbyist Agreement - Self-Employed Independent Contractor will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guideline to get the Travis Lobbyist Agreement - Self-Employed Independent Contractor:

- Ensure you have opened the proper page with your local form.

- Make use of the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template satisfies your needs.

- Look for another document using the search option if the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Select the appropriate subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the Travis Lobbyist Agreement - Self-Employed Independent Contractor on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal documents. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!

Form popularity

FAQ

Los expertos recomiendan que se guarde por lo menos 25% de su ingreso del trabajo para pago de impuestos. Como contratista independiente debe usar los formularios 1099-MISC recibidos de sus clientes, asi sabra el total a declarar en impuestos. Despues debe presentar la declaracion con el formulario 1040.

Puede obtener este formulario en las oficinas de la Administracion del Seguro Social o llamando al 800-772-1213. Descargue el formulario desde el sitio web Numero y tarjeta de Seguro Social.

El Formulario 1099 del IRS es una coleccion de formas tributarias que documentan diferentes tipos de pagos hechos por un individuo o negocio que tipicamente no es tu empleador. El pagador llena una forma con los detalles necesarios y envia una copia al IRS, reportando pagos hechos durante el ano.

Impuestos de los trabajadores por cuenta propia Para el 2021, los empleados pagan 7.65% de su ingreso en impuestos del Seguro Social y Medicare y sus empleadores hacen una contribucion adicional de 7.65%.

En general, los contribuyentes deben pagar al menos el 90 por ciento (sin embargo, vea el Alivio de Multas de 2018, a continuacion) de sus impuestos durante todo el ano mediante retenciones, pagos de impuestos estimados o adicionales, o una combinacion de ambos.

El trabajador realiza un trabajo que esta fuera del curso habitual del negocio de la entidad contratante; y. El trabajador se dedica habitualmente a un oficio, ocupacion o negocio establecido de forma independiente de la misma naturaleza que el relacionado con el trabajo realizado.

Como pago el impuesto sobre el trabajo por cuenta propia A los fines de pagar el impuesto sobre el trabajo por cuenta propia, usted debe tener un numero de Seguro Social (SSN, por sus siglas en ingles) o un numero de identificacion personal del contribuyente (ITIN, por sus siglas en ingles).

Los expertos recomiendan que se guarde por lo menos 25% de su ingreso del trabajo para pago de impuestos. Como contratista independiente debe usar los formularios 1099-MISC recibidos de sus clientes, asi sabra el total a declarar en impuestos. Despues debe presentar la declaracion con el formulario 1040.

Se consideraran trabajadores independientes o por cuenta propia las personas naturales que ejecutan algun trabajo o desarrollan alguna actividad, industria o comercio, sea independientemente o asociados o en colaboracion con otros, tengan o no capital propio y sea que en sus profesiones, labores u oficios predomine el

Una contratista independiente es una persona que es contratada para hacer un trabajo especifico. Se dice que es su propia jefa porque controla como y donde se realiza el trabajo. Estas personas tienen mayor libertad y solo se comprometen a hacer la funcion especifica que acordaron con la persona duena de una compania.