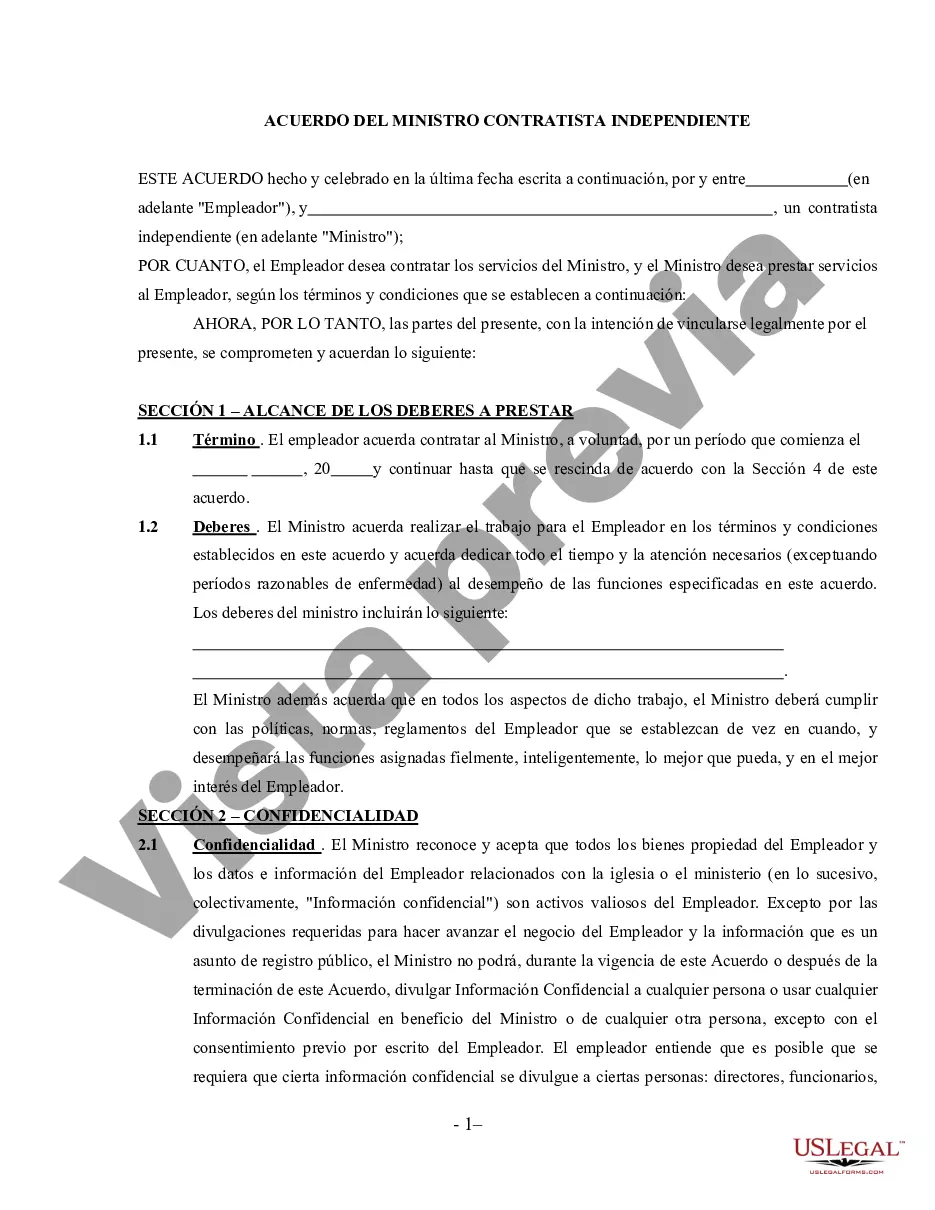

Miami-Dade Florida Minister Agreement — Self-Employed Independent Contractor is a legally binding contract that establishes the relationship between a self-employed minister and the entity or organization they serve. This agreement outlines the terms and conditions under which the minister operates, ensuring clear expectations and protection for both parties involved. Keywords: Miami-Dade Florida, Minister Agreement, Self-Employed, Independent Contractor 1. Definition: The Miami-Dade Florida Minister Agreement — Self-Employed Independent Contractor defines the role and responsibilities of a self-employed minister in the Miami-Dade County region of Florida. It is designed to address legal aspects regarding the employment relationship between the minister and the entity they serve. 2. Contractual Terms: This agreement outlines important contractual terms, including the duration of the arrangement, compensation structure, payment terms, and provisions for termination or renewal based on mutual agreement. 3. Scope of Work: The agreement specifies the nature of services to be performed by the minister as an independent contractor. It may include delivering sermons, conducting religious ceremonies, providing spiritual guidance, and organizing religious events as deemed necessary. 4. Compensation: The compensation section defines how the minister will be compensated for their services, including any fixed salary, honorarium, or benefits. It may also cover expense reimbursements and the process for submitting invoices and receiving payments. 5. Intellectual Property: If the minister creates original content such as sermons, speeches, or written materials, the agreement should address the ownership and usage rights. It may provide guidelines on intellectual property rights, copyright, and fair use. 6. Confidentiality and Non-Disclosure: To maintain confidentiality and protect sensitive information, this agreement may include provisions for the minister to uphold strict confidentiality regarding organizational matters, internal affairs, and any discussions or decisions made in confidence. 7. Independent Contractor Status: The agreement clarifies that the minister is considered a self-employed independent contractor, not an employee, and is responsible for their own taxes, insurance, benefits, and liabilities, in compliance with applicable laws. Different types of Miami-Dade Florida Minister Agreement — Self-Employed Independent Contractor may include variations based on specific religious organizations or their governing bodies. These agreements may include additional provisions specific to certain denominations or sects, while still encompassing the basic terms mentioned above. By having a robust and comprehensive Miami-Dade Florida Minister Agreement — Self-Employed Independent Contractor in place, both the minister and the entity they serve can ensure a clear understanding of their roles, expectations, and legal rights, fostering a harmonious and professional working relationship.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Acuerdo Ministerial - Contratista Independiente Autónomo - Minister Agreement - Self-Employed Independent Contractor

State:

Multi-State

County:

Miami-Dade

Control #:

US-INDC-217

Format:

Word

Instant download

Description

Contrato de trabajo entre el empleador y el ministro como contratista independiente.

Miami-Dade Florida Minister Agreement — Self-Employed Independent Contractor is a legally binding contract that establishes the relationship between a self-employed minister and the entity or organization they serve. This agreement outlines the terms and conditions under which the minister operates, ensuring clear expectations and protection for both parties involved. Keywords: Miami-Dade Florida, Minister Agreement, Self-Employed, Independent Contractor 1. Definition: The Miami-Dade Florida Minister Agreement — Self-Employed Independent Contractor defines the role and responsibilities of a self-employed minister in the Miami-Dade County region of Florida. It is designed to address legal aspects regarding the employment relationship between the minister and the entity they serve. 2. Contractual Terms: This agreement outlines important contractual terms, including the duration of the arrangement, compensation structure, payment terms, and provisions for termination or renewal based on mutual agreement. 3. Scope of Work: The agreement specifies the nature of services to be performed by the minister as an independent contractor. It may include delivering sermons, conducting religious ceremonies, providing spiritual guidance, and organizing religious events as deemed necessary. 4. Compensation: The compensation section defines how the minister will be compensated for their services, including any fixed salary, honorarium, or benefits. It may also cover expense reimbursements and the process for submitting invoices and receiving payments. 5. Intellectual Property: If the minister creates original content such as sermons, speeches, or written materials, the agreement should address the ownership and usage rights. It may provide guidelines on intellectual property rights, copyright, and fair use. 6. Confidentiality and Non-Disclosure: To maintain confidentiality and protect sensitive information, this agreement may include provisions for the minister to uphold strict confidentiality regarding organizational matters, internal affairs, and any discussions or decisions made in confidence. 7. Independent Contractor Status: The agreement clarifies that the minister is considered a self-employed independent contractor, not an employee, and is responsible for their own taxes, insurance, benefits, and liabilities, in compliance with applicable laws. Different types of Miami-Dade Florida Minister Agreement — Self-Employed Independent Contractor may include variations based on specific religious organizations or their governing bodies. These agreements may include additional provisions specific to certain denominations or sects, while still encompassing the basic terms mentioned above. By having a robust and comprehensive Miami-Dade Florida Minister Agreement — Self-Employed Independent Contractor in place, both the minister and the entity they serve can ensure a clear understanding of their roles, expectations, and legal rights, fostering a harmonious and professional working relationship.

Free preview