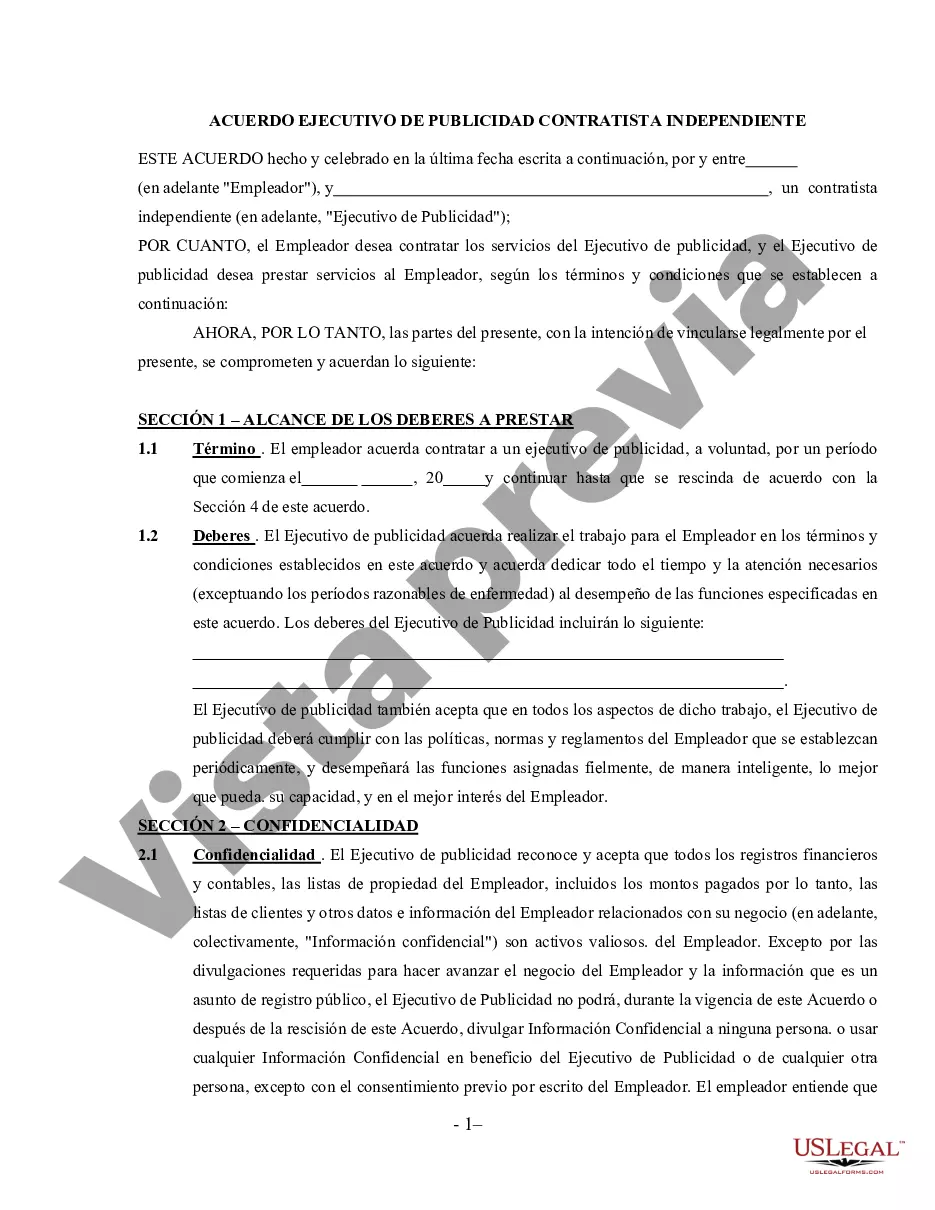

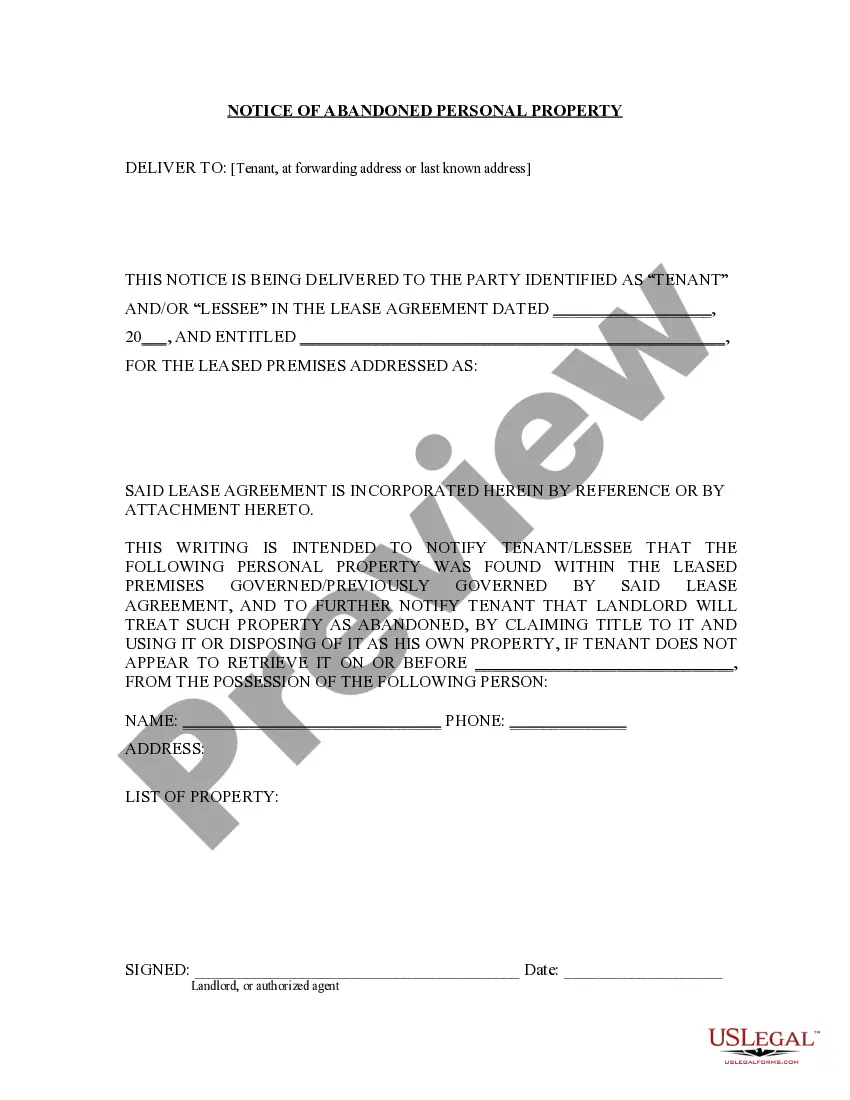

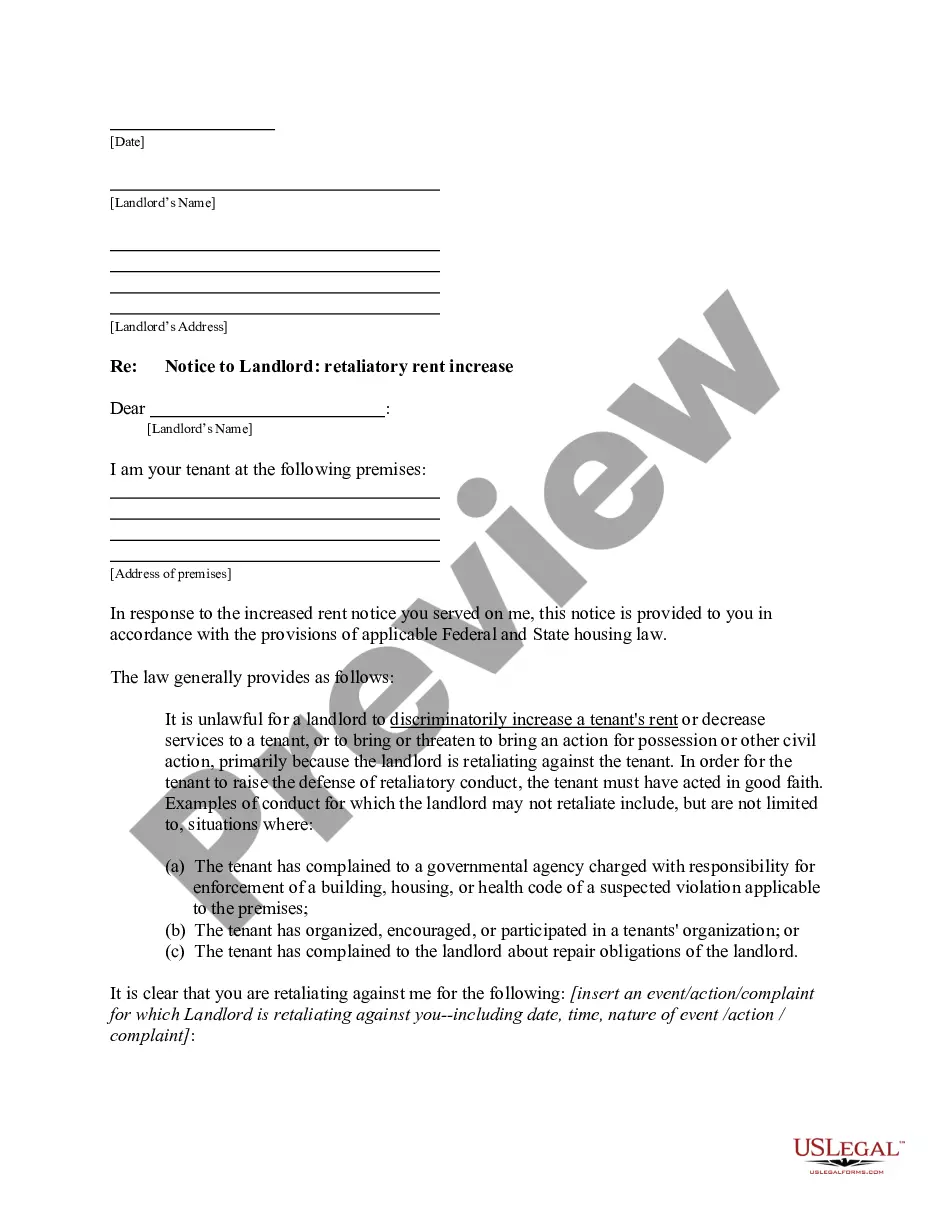

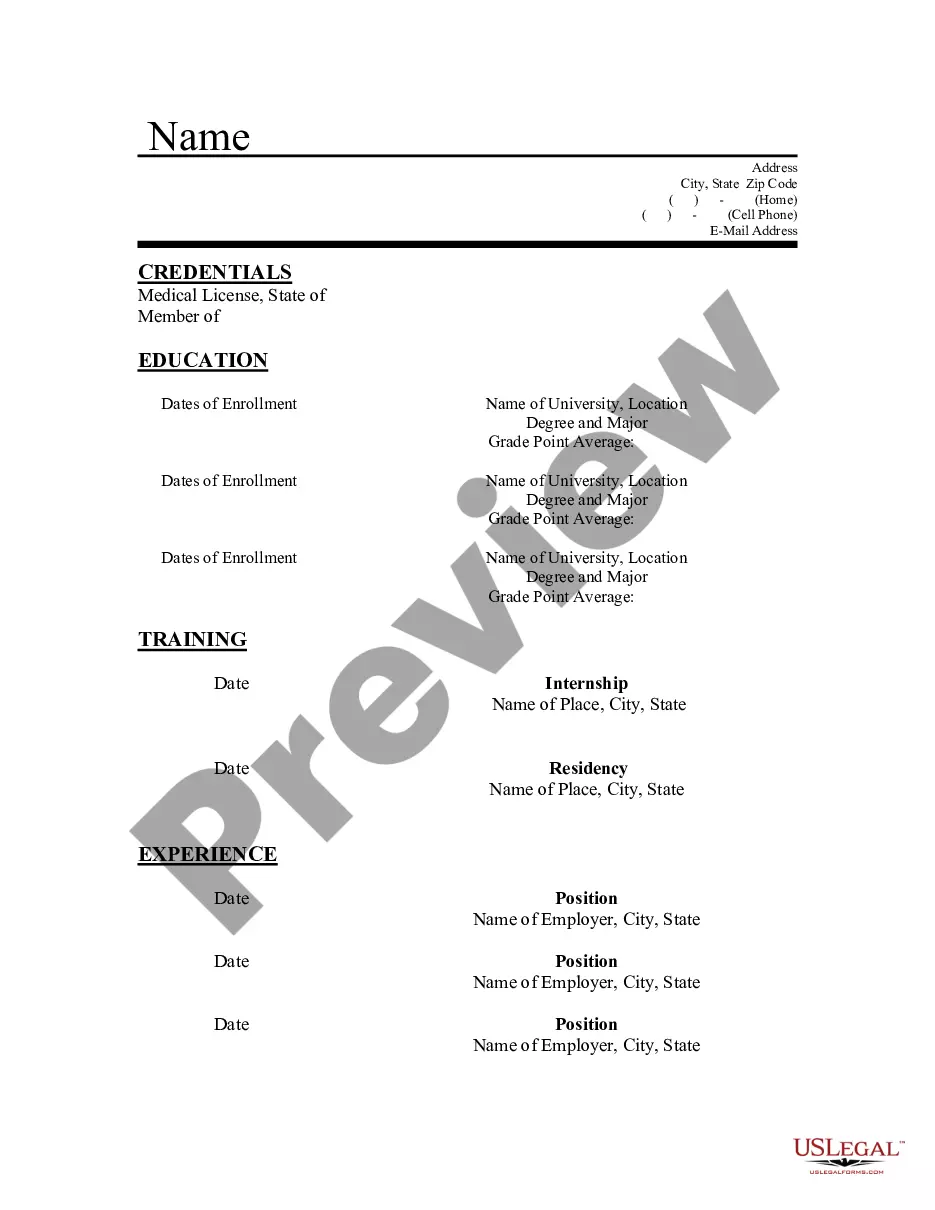

Bexar Texas Advertising Executive Agreement — Self-Employed Independent Contractor is a legally binding document that outlines the terms and conditions between an advertising executive and a client in Bexar County, Texas. This agreement establishes the expectations, rights, and responsibilities of both parties involved in a professional advertising arrangement. It serves as a blueprint for the successful execution of advertising projects and ensures a mutually beneficial relationship between the advertising executive and the client. In this agreement, the advertising executive is considered a self-employed independent contractor. This means that they are not an employee of the client but rather a separate entity who offers their advertising services on a contractual basis. This distinction is significant as it determines the employment relationship and legal obligations between the parties. The Bexar Texas Advertising Executive Agreement — Self-Employed Independent Contractor typically includes several key clauses, which may vary depending on the specific agreement and the nature of the advertising services provided. These clauses address various aspects such as: 1. Scope of Work: This section outlines in detail the specific advertising services to be performed by the advertising executive. It includes a comprehensive description of the project, marketing objectives, timelines, and deliverables. 2. Compensation: This clause stipulates how the advertising executive will be compensated for their services. It may cover payment terms, rates, bonuses, or any additional expenses. 3. Intellectual Property: This section clarifies ownership rights of any intellectual property created during the advertising project. It defines whether the advertising executive retains the rights or transfers them to the client. 4. Confidentiality and Non-Disclosure: This clause ensures that any confidential information shared between the parties during the course of the contract remains protected and restricts the advertising executive from disclosing such information to third parties without prior consent. 5. Termination: This clause outlines the circumstances under which either party may terminate the agreement. It may include provisions for termination due to breach of contract, non-performance, or completion of the project. 6. Independent Contractor Status: This section confirms the relationship between the advertising executive and the client as that of an independent contractor. It clarifies that the advertising executive is not an employee, thereby freeing the client from certain obligations like taxes and benefits. It is important to note that variations of the Bexar Texas Advertising Executive Agreement — Self-Employed Independent Contractor may exist, tailored to specific industries or project requirements. For example, there may be separate agreements for online advertising, print media advertising, or digital marketing campaigns. These agreements typically incorporate industry-specific terms and comply with relevant laws and regulations. Ultimately, the Bexar Texas Advertising Executive Agreement — Self-Employed Independent Contractor serves as a vital document for establishing a clear understanding between an advertising executive and a client, protecting the rights and interests of both parties involved in a professional advertising relationship.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Bexar Texas Contrato Ejecutivo de Publicidad - Contratista Independiente Trabajador por Cuenta Propia - Advertising Executive Agreement - Self-Employed Independent Contractor

Description

How to fill out Bexar Texas Contrato Ejecutivo De Publicidad - Contratista Independiente Trabajador Por Cuenta Propia?

Drafting papers for the business or personal demands is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's crucial to consider all federal and state regulations of the specific region. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it burdensome and time-consuming to draft Bexar Advertising Executive Agreement - Self-Employed Independent Contractor without professional assistance.

It's easy to avoid spending money on attorneys drafting your paperwork and create a legally valid Bexar Advertising Executive Agreement - Self-Employed Independent Contractor by yourself, using the US Legal Forms web library. It is the most extensive online collection of state-specific legal documents that are professionally verified, so you can be sure of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to save the necessary document.

In case you still don't have a subscription, adhere to the step-by-step guide below to obtain the Bexar Advertising Executive Agreement - Self-Employed Independent Contractor:

- Look through the page you've opened and verify if it has the document you need.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that satisfies your requirements, utilize the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal forms for any situation with just a few clicks!

Form popularity

FAQ

Al contratista le hacen una retencion por honorarios que es del 10% para las personas no declarantes y del 11% paras las declarantes y le descuentan un 1% adicional para el impuesto de Industria y Comercio Agregado (ICA). Los trabajadores independientes tambien deben pagar su totalidad pension y salud.

Como ser un contratista independiente con exito Nombrar y registrar su negocio. ( El registro solo es necesario en algunos estados) Registrarse para obtener una licencia profesional (si es necesario) y un certificado fiscal. Asegurese de pagar sus impuestos estimados a lo largo del ano.

6 pasos para contribuyentes por primera vez Vigile sus ingresos.Guarde la documentacion apropiada durante todo el ano.Este atento cuando lleguen los documentos de sus ingresos.Conozca que creditos y deducciones puede obtener.Preste atencion a sus fechas limite.Decida como presentar su declaracion de impuestos.

El trabajador realiza un trabajo que esta fuera del curso habitual del negocio de la entidad contratante; y. El trabajador se dedica habitualmente a un oficio, ocupacion o negocio establecido de forma independiente de la misma naturaleza que el relacionado con el trabajo realizado.

Se consideraran trabajadores independientes o por cuenta propia las personas naturales que ejecutan algun trabajo o desarrollan alguna actividad, industria o comercio, sea independientemente o asociados o en colaboracion con otros, tengan o no capital propio y sea que en sus profesiones, labores u oficios predomine el

Los expertos recomiendan que se guarde por lo menos 25% de su ingreso del trabajo para pago de impuestos. Como contratista independiente debe usar los formularios 1099-MISC recibidos de sus clientes, asi sabra el total a declarar en impuestos. Despues debe presentar la declaracion con el formulario 1040.

Si ganaste mas de $400 en efectivo durante el ano fiscal, el IRS te considera trabajador por cuenta propia y debes presentar un Anexo C, ingresos y gastos comerciales y pagar impuestos sobre el trabajo por cuenta propia (Seguro Social y Medicare, lo mismo que la retencion de un W-2).

Una contratista independiente es una persona que es contratada para hacer un trabajo especifico. Se dice que es su propia jefa porque controla como y donde se realiza el trabajo. Estas personas tienen mayor libertad y solo se comprometen a hacer la funcion especifica que acordaron con la persona duena de una compania.

Personas natural que realiza una profesion, oficio o actividad economica con o sin trabajadores a su cargo y sin estar sujeto a un contrato laboral en el desarrollo de dicha actividad.

Los expertos recomiendan que se guarde por lo menos 25% de su ingreso del trabajo para pago de impuestos. Como contratista independiente debe usar los formularios 1099-MISC recibidos de sus clientes, asi sabra el total a declarar en impuestos. Despues debe presentar la declaracion con el formulario 1040.