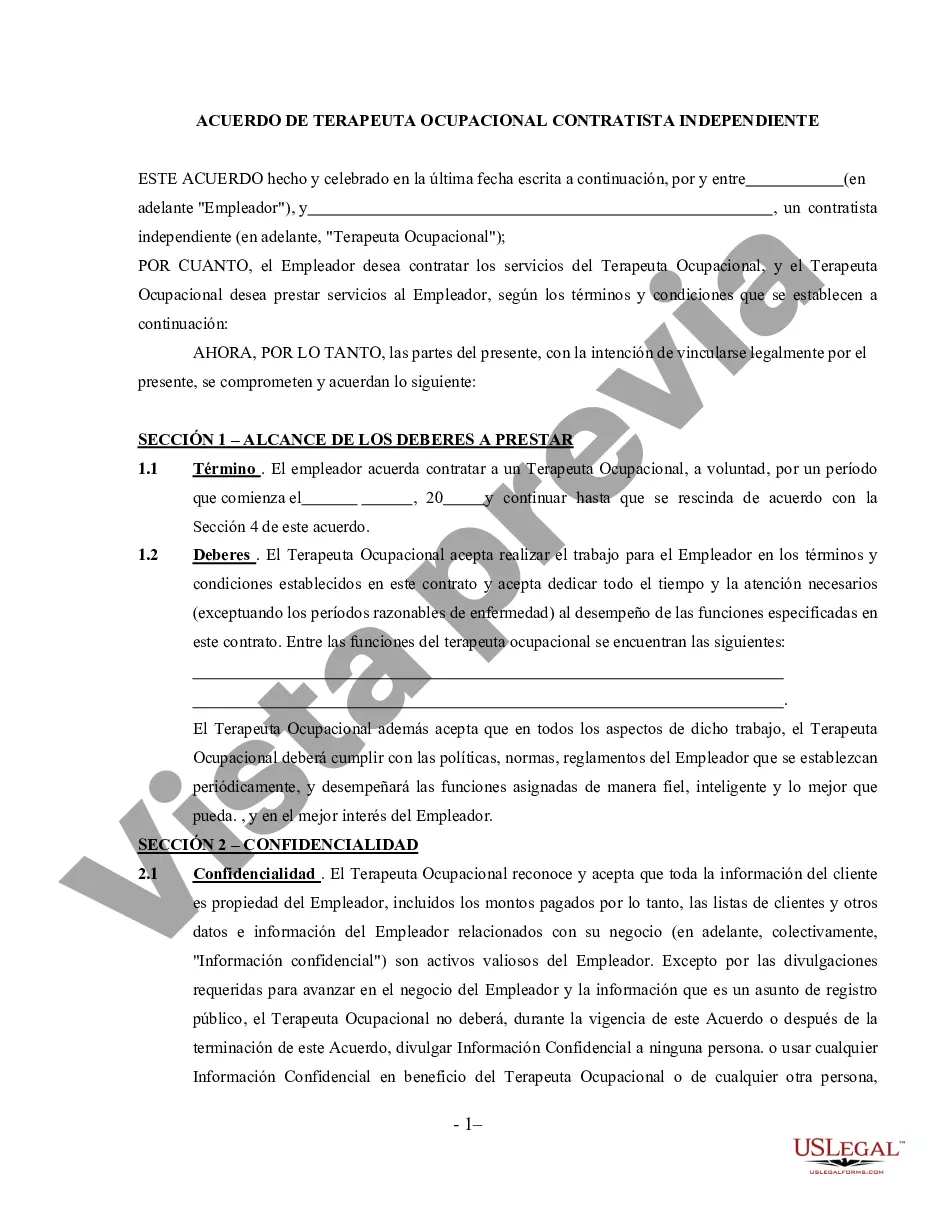

Chicago Illinois Occupational Therapist Agreement — Self-Employed Independent Contractor is a legal document that outlines the terms and conditions of the working relationship between an occupational therapist and their clients or employers. This agreement is specifically tailored for occupational therapists residing and working in Chicago, Illinois who operate as self-employed independent contractors. It establishes the rights, responsibilities, duties, and expectations of both parties involved, ensuring a clear understanding and a legally binding agreement. Keywords: Chicago Illinois, Occupational Therapist Agreement, Self-Employed Independent Contractor. Types of Chicago Illinois Occupational Therapist Agreement — Self-Employed Independent Contractor can include: 1. General Occupational Therapist Agreement: This type of agreement outlines the standard terms and conditions that govern the working relationship between an occupational therapist and their clients or employers in Chicago, Illinois. It covers important aspects such as scope of work, compensation, confidentiality, liability, and termination clauses. 2. Home Healthcare Occupational Therapist Agreement: This agreement is specifically designed for occupational therapists who provide their services in individuals' homes within the Chicago, Illinois area. It includes provisions relating to client's residence access, safety, and equipment, as well as additional information on HIPAA compliance and regulations pertaining to providing medical care in a non-traditional setting. 3. School-Based Occupational Therapist Agreement: This variant of the occupational therapist agreement is specifically tailored for occupational therapists working in educational settings such as schools in Chicago, Illinois. It includes provisions related to collaboration with school personnel, Individualized Education Program (IEP) implementation, and adherence to state and federal laws pertaining to special education services. 4. Rehabilitation Center Occupational Therapist Agreement: Occupational therapists who work in rehabilitation centers, clinics, or other healthcare facilities in Chicago, Illinois may utilize this specific type of agreement. It addresses the unique considerations and requirements associated with rehabilitation practices, such as working with a multidisciplinary team and adhering to facility policies and procedures. 5. Telehealth Occupational Therapist Agreement: With the rise of telehealth services, occupational therapists in Chicago, Illinois may choose to provide remote therapy sessions to their clients. This type of agreement ensures that both parties understand the expectations, guidelines, and technological requirements for remote occupational therapy services, while also addressing issues such as privacy and informed consent. It is important for occupational therapists in Chicago, Illinois to have a comprehensive Occupational Therapist Agreement — Self-Employed Independent Contractor in place to protect their rights, establish clear expectations, and ensure a mutually beneficial working relationship. Consulting with a legal professional specializing in healthcare contracts is advisable to ensure that the agreement meets all legal and regulatory requirements in Illinois.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Contrato de Terapeuta Ocupacional - Contratista Independiente Trabajador por Cuenta Propia - Occupational Therapist Agreement - Self-Employed Independent Contractor

Description

How to fill out Chicago Illinois Contrato De Terapeuta Ocupacional - Contratista Independiente Trabajador Por Cuenta Propia?

How much time does it usually take you to create a legal document? Considering that every state has its laws and regulations for every life scenario, locating a Chicago Occupational Therapist Agreement - Self-Employed Independent Contractor suiting all local requirements can be exhausting, and ordering it from a professional lawyer is often costly. Many web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web catalog of templates, gathered by states and areas of use. In addition to the Chicago Occupational Therapist Agreement - Self-Employed Independent Contractor, here you can find any specific document to run your business or personal deeds, complying with your county requirements. Specialists verify all samples for their actuality, so you can be certain to prepare your paperwork correctly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed form, and download it. You can get the document in your profile anytime later on. Otherwise, if you are new to the website, there will be some extra steps to complete before you get your Chicago Occupational Therapist Agreement - Self-Employed Independent Contractor:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document using the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Chicago Occupational Therapist Agreement - Self-Employed Independent Contractor.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

Se consideraran trabajadores independientes o por cuenta propia las personas naturales que ejecutan algun trabajo o desarrollan alguna actividad, industria o comercio, sea independientemente o asociados o en colaboracion con otros, tengan o no capital propio y sea que en sus profesiones, labores u oficios predomine el

En general, los contribuyentes deben pagar al menos el 90 por ciento (sin embargo, vea el Alivio de Multas de 2018, a continuacion) de sus impuestos durante todo el ano mediante retenciones, pagos de impuestos estimados o adicionales, o una combinacion de ambos.

Al contratista le hacen una retencion por honorarios que es del 10% para las personas no declarantes y del 11% paras las declarantes y le descuentan un 1% adicional para el impuesto de Industria y Comercio Agregado (ICA). Los trabajadores independientes tambien deben pagar su totalidad pension y salud.

El trabajador realiza un trabajo que esta fuera del curso habitual del negocio de la entidad contratante; y. El trabajador se dedica habitualmente a un oficio, ocupacion o negocio establecido de forma independiente de la misma naturaleza que el relacionado con el trabajo realizado.

Contratista: Una persona o compania que ejecuta un contrato para suministrar materiales o mano de obra para prestar un servicio o para realizar un trabajo. Empleado: Una persona empleada a cambio de un salario o pago.

¿Que es el impuesto para empleado por cuenta propia? Es un impuesto que representa 15.3% de sus ingresos como trabajador independiente. Este procentaje se divide asi: 12.04% es para cubrir impuestos del seguro social.

Personas natural que realiza una profesion, oficio o actividad economica con o sin trabajadores a su cargo y sin estar sujeto a un contrato laboral en el desarrollo de dicha actividad.

Los expertos recomiendan que se guarde por lo menos 25% de su ingreso del trabajo para pago de impuestos. Como contratista independiente debe usar los formularios 1099-MISC recibidos de sus clientes, asi sabra el total a declarar en impuestos. Despues debe presentar la declaracion con el formulario 1040.

Una contratista independiente es una persona que es contratada para hacer un trabajo especifico. Se dice que es su propia jefa porque controla como y donde se realiza el trabajo. Estas personas tienen mayor libertad y solo se comprometen a hacer la funcion especifica que acordaron con la persona duena de una compania.

Trabajadores independientes que pueden declarar costos y gastos....Deducciones especiales en los trabajadores independientes. Intereses por prestamos de vivienda. Los pagos por salud (medicina prepagada, seguros privados de salud) Deduccion por concepto de dependientes. Gravamen a los movimientos financieros (4x1.000).