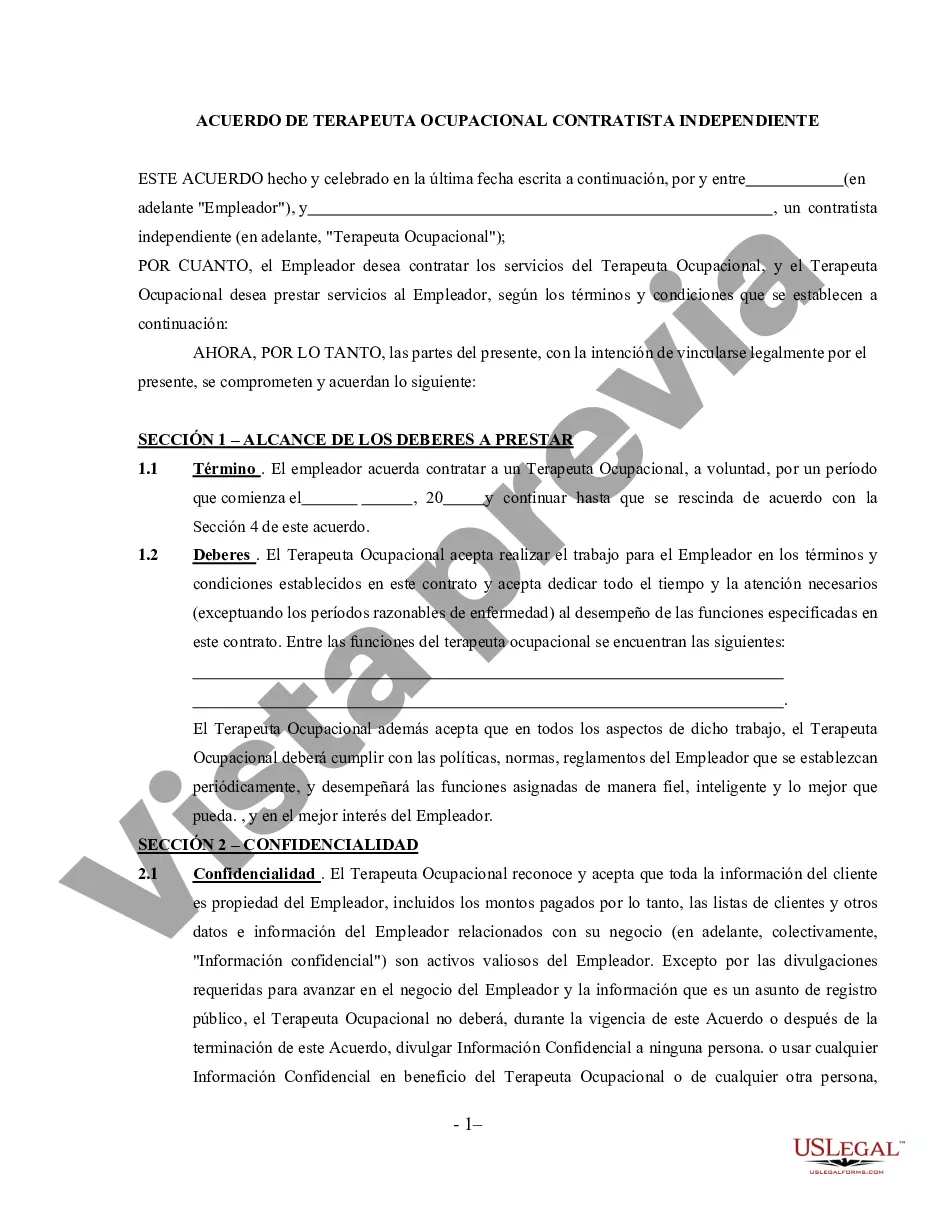

The Franklin Ohio Occupational Therapist Agreement — Self-Employed Independent Contractor is a legal document that outlines the terms and conditions of the working relationship between an occupational therapist and the client in Franklin, Ohio. This agreement is specifically designed for occupational therapists who work as independent contractors, providing their services on a self-employed basis. Keywords: — Franklin Ohio: The agreement pertains to occupational therapists working in the city of Franklin, Ohio. It considers the specific legal requirements and regulations applicable to this location. — Occupational Therapist: The agreement is tailored for professionals in the field of occupational therapy. It may cover various aspects of their work, including evaluation, treatment, and rehabilitation of patients with physical, mental, or developmental disabilities. — Agreement: The document serves as a contractual agreement between the occupational therapist and the client. It establishes the rights, obligations, and expectations of both parties. — Self-Employed: The agreement pertains to occupational therapists who operate as self-employed individuals. This means that they have their own business and work independently, rather than as employees of an organization. — Independent Contractor: The agreement further specifies the occupational therapist's status as an independent contractor. This means they are responsible for their own taxes, insurance, and liability. — Terms and Conditions: The agreement outlines the terms of the occupational therapist's engagement, including their responsibilities, working hours, payment terms, and termination conditions. — Services: The agreement may detail the specific services offered by the occupational therapist, such as individual therapy sessions, group therapy, assessments, or consultations. — Confidentiality: The agreement may include provisions regarding the confidentiality of patient information and the protection of sensitive data in accordance with relevant laws and regulations. — Liability and Insurance: The agreement may specify the occupational therapist's liability insurance requirements or the need for professional indemnity insurance to protect against potential claims. — Compensation: The agreement addresses the financial aspects of the occupational therapist's services, including the fee structure, payment schedule, and any additional expenses. — Termination: The agreement outlines the conditions under which either party can terminate the agreement, such as breach of contract, non-payment, or mutual agreement. Different types of Franklin Ohio Occupational Therapist Agreement — Self-Employed Independent Contractor might include specific variations based on the nature of services provided or the scope of practice. For example, there could be separate agreements for pediatric occupational therapists, mental health occupational therapists, or those specializing in rehabilitation. Each agreement may cater to the unique requirements and specialties within the field of occupational therapy.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Franklin Ohio Contrato de Terapeuta Ocupacional - Contratista Independiente Trabajador por Cuenta Propia - Occupational Therapist Agreement - Self-Employed Independent Contractor

Description

How to fill out Franklin Ohio Contrato De Terapeuta Ocupacional - Contratista Independiente Trabajador Por Cuenta Propia?

A document routine always accompanies any legal activity you make. Creating a company, applying or accepting a job offer, transferring ownership, and lots of other life scenarios require you prepare formal documentation that varies throughout the country. That's why having it all collected in one place is so valuable.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and download a document for any personal or business purpose utilized in your region, including the Franklin Occupational Therapist Agreement - Self-Employed Independent Contractor.

Locating samples on the platform is extremely straightforward. If you already have a subscription to our service, log in to your account, find the sample using the search bar, and click Download to save it on your device. After that, the Franklin Occupational Therapist Agreement - Self-Employed Independent Contractor will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guideline to obtain the Franklin Occupational Therapist Agreement - Self-Employed Independent Contractor:

- Ensure you have opened the proper page with your regional form.

- Utilize the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template satisfies your needs.

- Search for another document via the search option if the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Select the appropriate subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Franklin Occupational Therapist Agreement - Self-Employed Independent Contractor on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most reliable way to obtain legal paperwork. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!

Form popularity

FAQ

El trabajador realiza un trabajo que esta fuera del curso habitual del negocio de la entidad contratante; y. El trabajador se dedica habitualmente a un oficio, ocupacion o negocio establecido de forma independiente de la misma naturaleza que el relacionado con el trabajo realizado.

Se consideraran trabajadores independientes o por cuenta propia las personas naturales que ejecutan algun trabajo o desarrollan alguna actividad, industria o comercio, sea independientemente o asociados o en colaboracion con otros, tengan o no capital propio y sea que en sus profesiones, labores u oficios predomine el

Los expertos recomiendan que se guarde por lo menos 25% de su ingreso del trabajo para pago de impuestos. Como contratista independiente debe usar los formularios 1099-MISC recibidos de sus clientes, asi sabra el total a declarar en impuestos. Despues debe presentar la declaracion con el formulario 1040.

10 Consejos Para Quienes Comienzan a Trabajar Por Cuenta propia Prepara un Fondo para Emergencias.Prepara Material de Promocion.La oficina en casa.No Aceptes Cada Trabajo Que se Presente.Prioriza la Calidad.Haz trabajos «pro bono» de vez en cuando.No te apresures a dar tus tarifas.Administra tus contactos.

Se denomina trabajador por cuenta propia a todo aquel que realiza una actividad economica de forma independiente y directa, sin estar sujeto a un contrato de trabajo, aunque este utilice el servicio remunerado de otras personas para llevar a cabo su actividad (empleador).

Conceptualmente se considera como trabajador independiente a la persona que explota de manera autonoma, o por cuenta propia, una actividad economica.

Una contratista independiente es una persona que es contratada para hacer un trabajo especifico. Se dice que es su propia jefa porque controla como y donde se realiza el trabajo. Estas personas tienen mayor libertad y solo se comprometen a hacer la funcion especifica que acordaron con la persona duena de una compania.

Los expertos recomiendan que se guarde por lo menos 25% de su ingreso del trabajo para pago de impuestos. Como contratista independiente debe usar los formularios 1099-MISC recibidos de sus clientes, asi sabra el total a declarar en impuestos. Despues debe presentar la declaracion con el formulario 1040.

Trabajadores independientes que pueden declarar costos y gastos....Deducciones especiales en los trabajadores independientes. Intereses por prestamos de vivienda. Los pagos por salud (medicina prepagada, seguros privados de salud) Deduccion por concepto de dependientes. Gravamen a los movimientos financieros (4x1.000).

Usted debe pagar el impuesto sobre el trabajo por cuenta propia y presentar el Anexo SE (Formulario 1040 o 1040-SR) si se da alguno de estos casos. Sus ganancias netas del trabajo por cuenta propia (sin incluir el ingreso como empleado de una iglesia) fueron de $400 o mas.