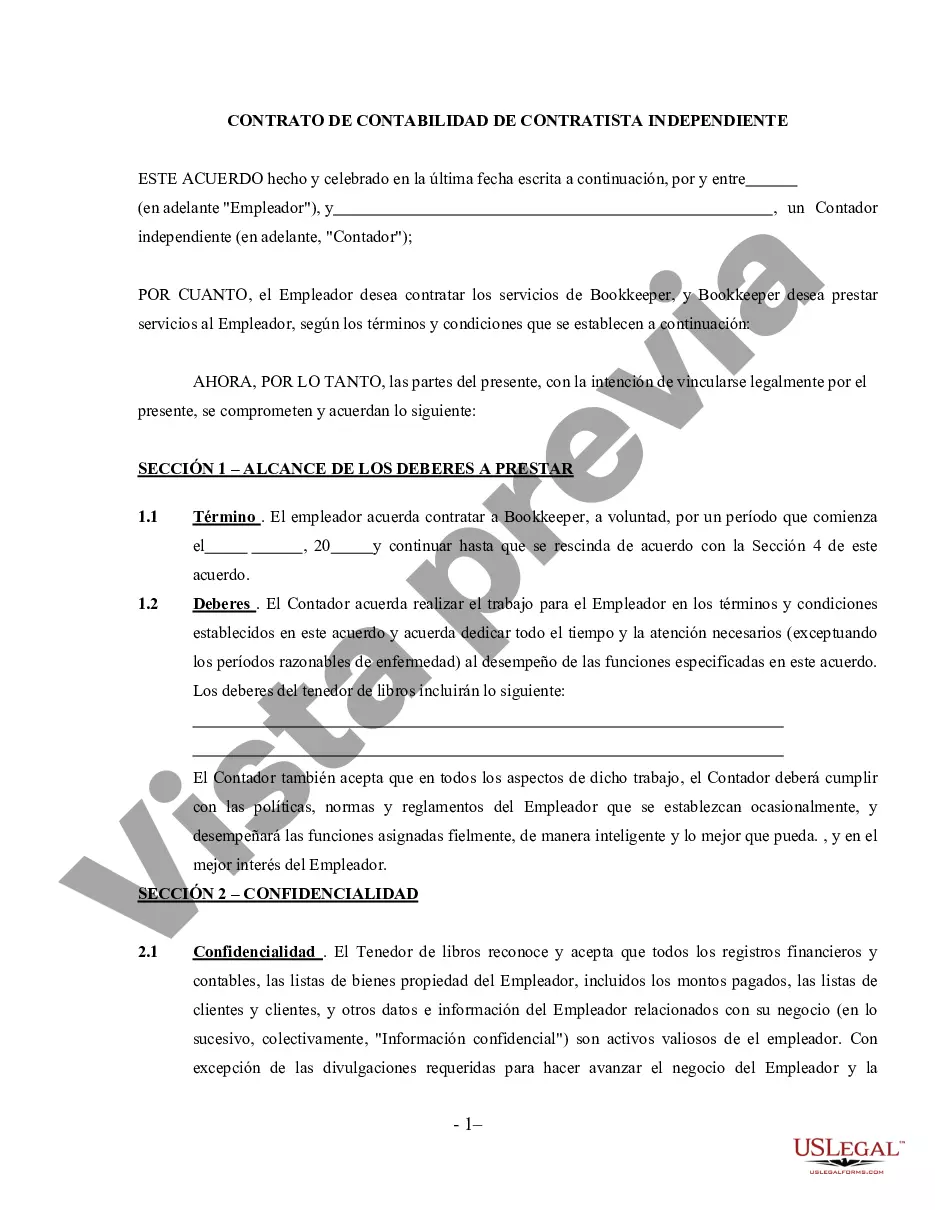

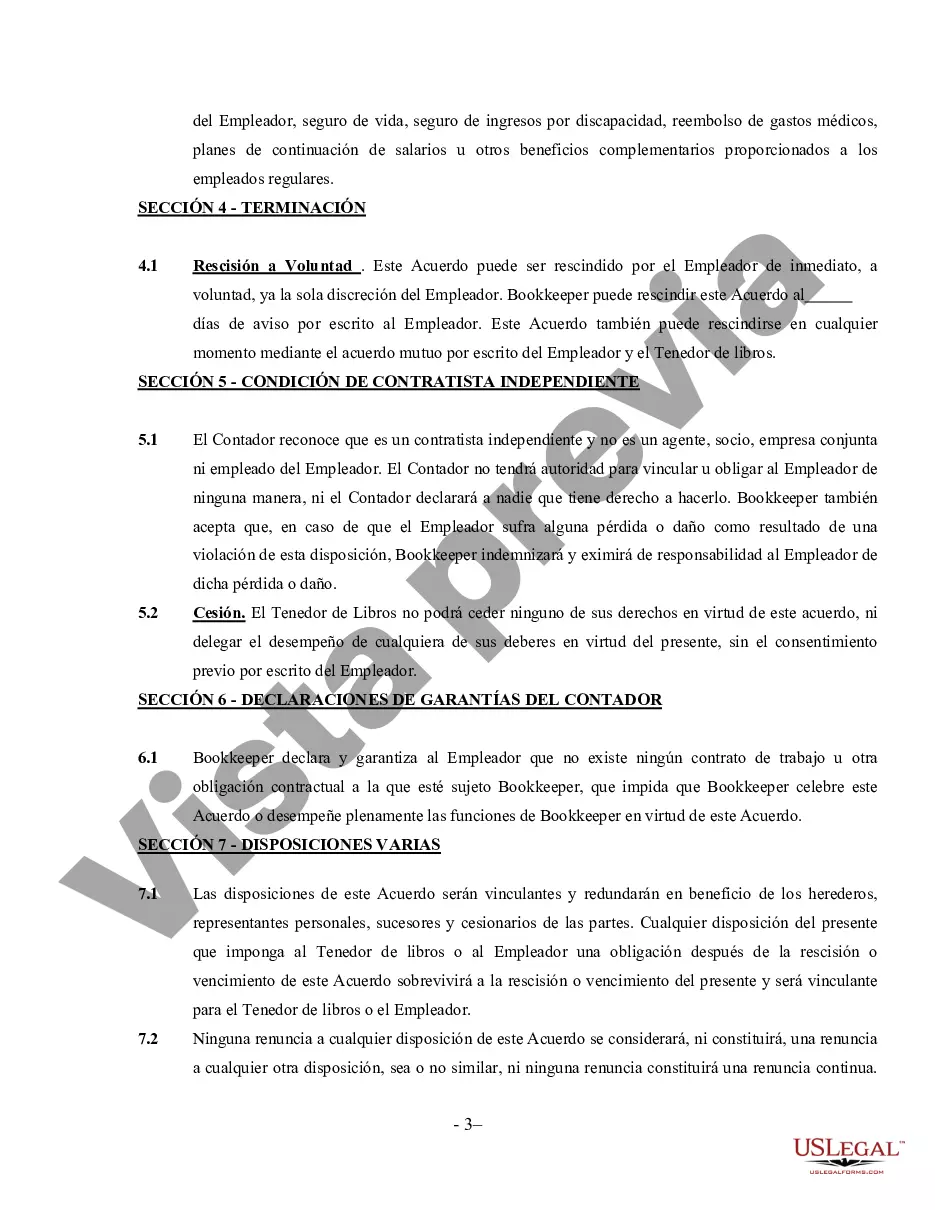

A Maricopa Arizona Bookkeeping Agreement — Self-Employed Independent Contractor is a legally binding document that outlines the terms and conditions between a bookkeeper and a self-employed independent contractor in Maricopa, Arizona. This agreement establishes a professional relationship and ensures transparency and clarity regarding the bookkeeping services provided. In this agreement, several key elements are typically included to protect both parties involved. The agreement should clearly state the scope of work, such as the specific bookkeeping services the contractor will provide, the agreed-upon fee structure, and the payment terms. Additionally, the agreement should address confidentiality to protect any sensitive financial information shared during the course of the contractor's work. It may include a clause regarding the non-disclosure of any client information, ensuring that the bookkeeper maintains strict confidentiality. Furthermore, a Maricopa Arizona Bookkeeping Agreement — Self-Employed Independent Contractor may include a termination clause, defining the circumstances under which either party can end the agreement. This ensures that both parties are aware of the conditions, protecting both the contractor and the client. Different types of Maricopa Arizona Bookkeeping Agreement — Self-Employed Independent Contractor may include: 1. Full-Service Bookkeeping Agreement: This type of agreement may encompass a wide range of bookkeeping tasks, such as accounts payable and receivable, financial statement preparation, bank reconciliation, payroll processing, and tax preparation assistance. 2. Limited Bookkeeping Agreement: This agreement may focus on specific bookkeeping tasks requested by the client. It may involve tasks like bank reconciliation, financial statement preparation, or invoicing. 3. Tax Preparation Bookkeeping Agreement: In this type of agreement, the bookkeeper specializes in tax preparation services, helping the self-employed independent contractor navigate the complexities of tax laws and ensuring compliance. It may include services like tax return preparation, tax planning, and filing assistance. 4. Industry-Specific Bookkeeping Agreement: This type of agreement is tailored to specific industries, such as healthcare, construction, or retail. The bookkeeper may have specialized knowledge in the unique financial requirements of these industries, such as tracking inventory, managing sales tax, or handling insurance reimbursements. In conclusion, a Maricopa Arizona Bookkeeping Agreement — Self-Employed Independent Contractor is a vital contractual agreement that establishes the terms and expectations between a bookkeeper and a self-employed independent contractor. By clarifying the scope of work, fees, confidentiality, and termination conditions, both parties can confidently move forward in their professional relationship.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Acuerdo de teneduría de libros - Contratista independiente que trabaja por cuenta propia - Bookkeeping Agreement - Self-Employed Independent Contractor

Description

How to fill out Maricopa Arizona Acuerdo De Teneduría De Libros - Contratista Independiente Que Trabaja Por Cuenta Propia?

Creating paperwork, like Maricopa Bookkeeping Agreement - Self-Employed Independent Contractor, to manage your legal affairs is a difficult and time-consumming process. A lot of circumstances require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can get your legal issues into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website features over 85,000 legal forms crafted for different cases and life situations. We make sure each document is in adherence with the laws of each state, so you don’t have to be concerned about potential legal problems compliance-wise.

If you're already aware of our services and have a subscription with US, you know how easy it is to get the Maricopa Bookkeeping Agreement - Self-Employed Independent Contractor form. Simply log in to your account, download the template, and customize it to your needs. Have you lost your document? Don’t worry. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new customers is fairly simple! Here’s what you need to do before getting Maricopa Bookkeeping Agreement - Self-Employed Independent Contractor:

- Ensure that your document is specific to your state/county since the regulations for writing legal paperwork may differ from one state another.

- Find out more about the form by previewing it or reading a brief intro. If the Maricopa Bookkeeping Agreement - Self-Employed Independent Contractor isn’t something you were hoping to find, then use the header to find another one.

- Sign in or create an account to begin utilizing our service and get the document.

- Everything looks great on your end? Click the Buy now button and select the subscription plan.

- Select the payment gateway and type in your payment details.

- Your template is all set. You can try and download it.

It’s easy to find and buy the needed template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive collection. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!