A Philadelphia, Pennsylvania Design Agreement — Self-Employed Independent Contractor is a comprehensive contract that sets out the terms and conditions of engagement between a design professional and a client located in Philadelphia, Pennsylvania. This agreement outlines the roles, responsibilities, and obligations of both parties involved in a design project. It ensures that all aspects of the project are clearly defined, protecting the rights and interests of the designer and the client. Key terms and conditions typically included in a Philadelphia Design Agreement — Self-Employed Independent Contractor may include: 1. Scope of Work: This section outlines the specific design services to be provided by the contractor. It may include details such as the project timeline, deliverables, and milestones. 2. Compensation and Payment: This section specifies the payment terms, including the agreed-upon fee, payment schedule, and any additional expenses for materials or equipment necessary for the completion of the project. 3. Intellectual Property: This clause addresses the ownership of intellectual property rights, ensuring that the client will have rights to the final design work upon full payment, while allowing the designer to showcase the project in their portfolio. 4. Independent Contractor Status: The agreement should establish that the designer is working as an independent contractor rather than an employee. This clarifies the tax and legal responsibilities of both parties. 5. Confidentiality and Non-Disclosure: This section ensures that any private or sensitive information shared between the client and the designer will remain confidential and not be disclosed to any third parties. 6. Termination and Dispute Resolution: This clause outlines the process by which either party may terminate the agreement and the procedure for resolving any disputes that may arise during the project. In terms of different types of Design Agreements specific to Philadelphia, Pennsylvania, variations may include: 1. Philadelphia Graphic Design Agreement — Self-Employed Independent Contractor: This type of agreement specifically caters to graphic designers engaged in creating visual designs for clients, including branding materials, marketing collateral, and website graphics. 2. Philadelphia Interior Design Agreement — Self-Employed Independent Contractor: This agreement is tailored for self-employed interior designers who provide services in residential or commercial interior design projects in Philadelphia, Pennsylvania. 3. Philadelphia Web Design Agreement — Self-Employed Independent Contractor: This type of agreement specifically applies to self-employed web designers who create and develop websites for clients located in Philadelphia, Pennsylvania. In summary, a Philadelphia, Pennsylvania Design Agreement — Self-Employed Independent Contractor is a crucial legal document that defines the expectations, obligations, and rights of both the designer and the client involved in a design project. It is highly recommended for design professionals and clients in Philadelphia to have a well-drafted agreement in place to ensure a smooth and successful collaboration.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Philadelphia Pennsylvania Acuerdo de Diseño - Contratista Independiente Trabajador por Cuenta Propia - Design Agreement - Self-Employed Independent Contractor

Description

How to fill out Philadelphia Pennsylvania Acuerdo De Diseño - Contratista Independiente Trabajador Por Cuenta Propia?

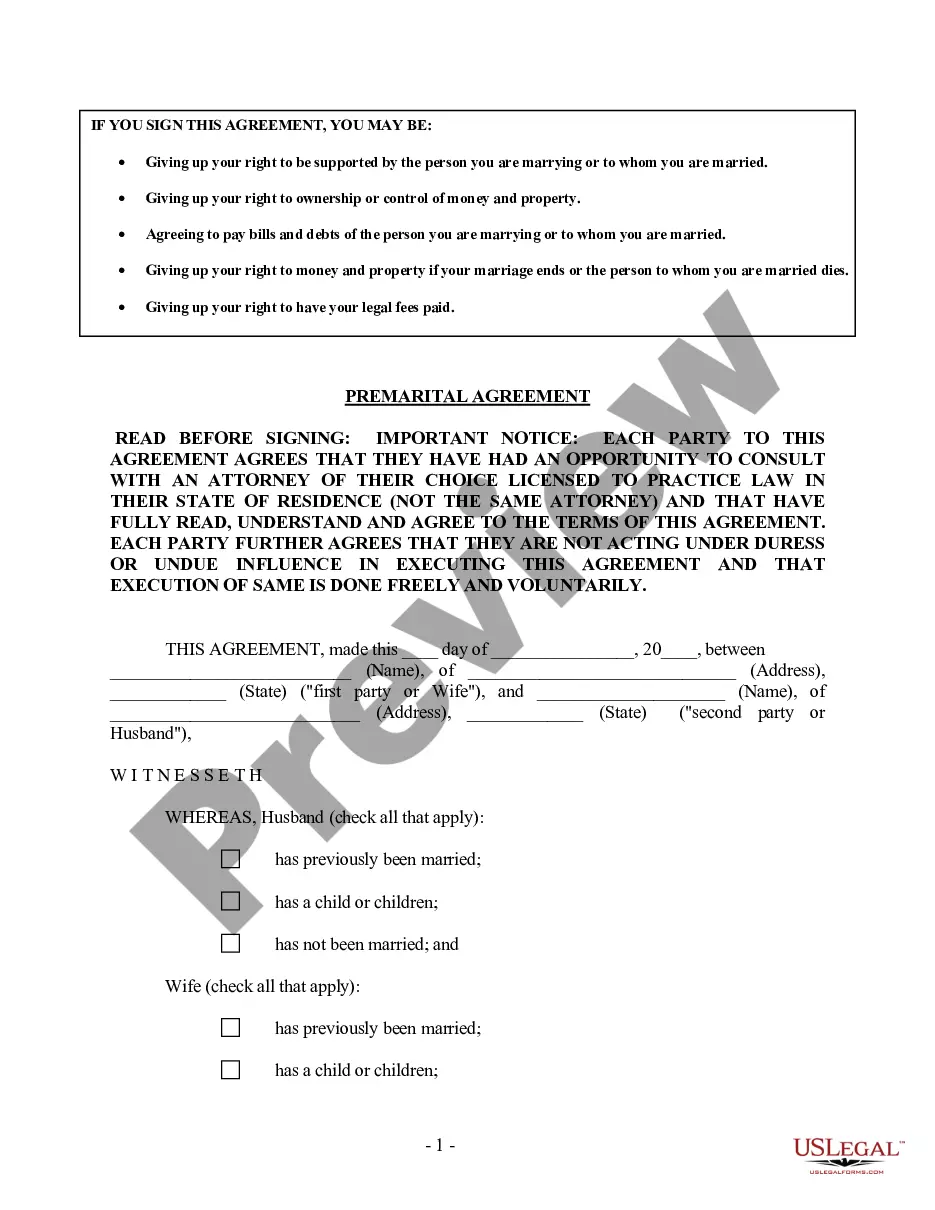

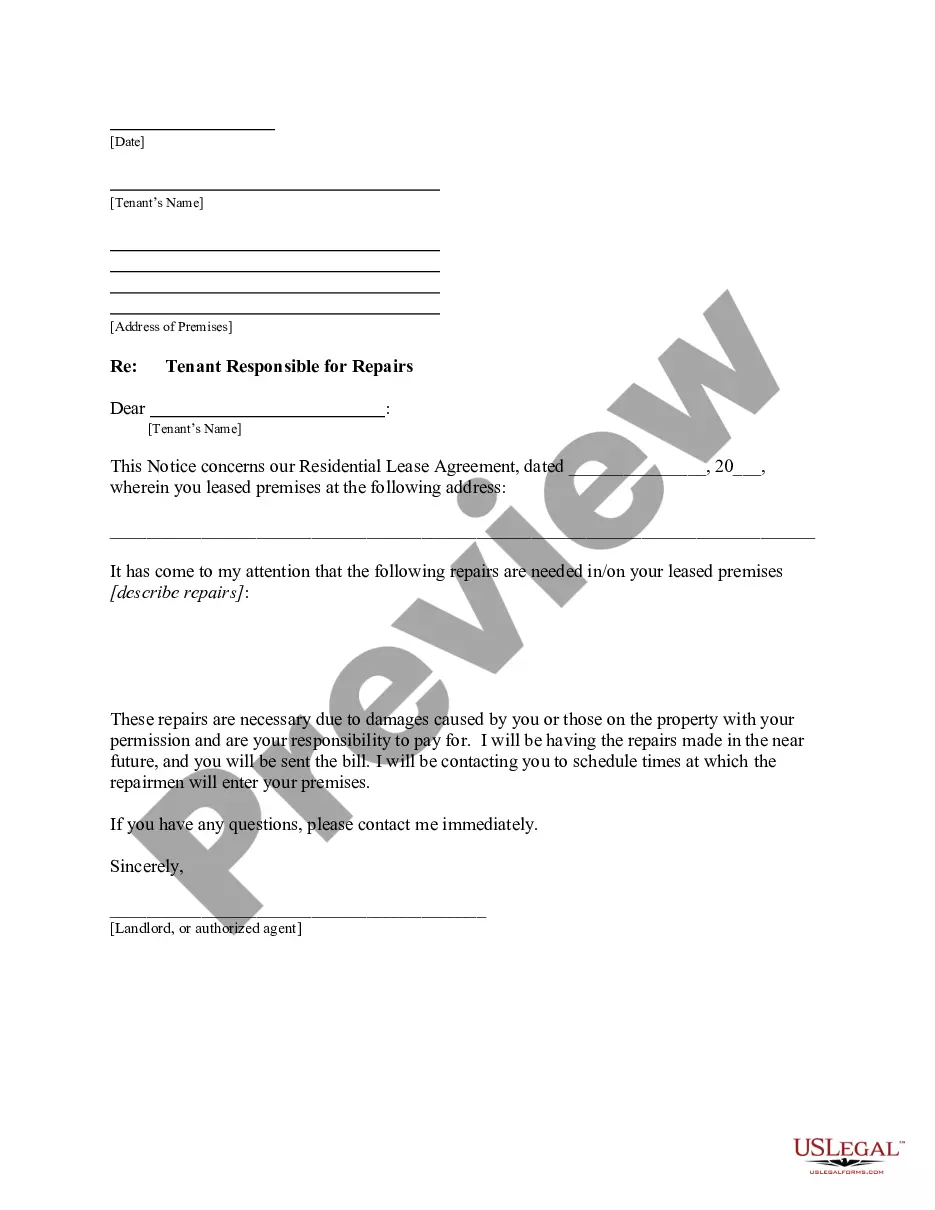

Creating legal forms is a must in today's world. However, you don't always need to seek qualified assistance to create some of them from the ground up, including Philadelphia Design Agreement - Self-Employed Independent Contractor, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to choose from in different types ranging from living wills to real estate papers to divorce papers. All forms are arranged according to their valid state, making the searching experience less overwhelming. You can also find information resources and tutorials on the website to make any activities related to document execution straightforward.

Here's how you can purchase and download Philadelphia Design Agreement - Self-Employed Independent Contractor.

- Take a look at the document's preview and outline (if available) to get a general idea of what you’ll get after getting the form.

- Ensure that the template of your choice is specific to your state/county/area since state laws can affect the validity of some documents.

- Examine the related forms or start the search over to find the correct document.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Pick the option, then a suitable payment gateway, and buy Philadelphia Design Agreement - Self-Employed Independent Contractor.

- Select to save the form template in any offered file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Philadelphia Design Agreement - Self-Employed Independent Contractor, log in to your account, and download it. Needless to say, our platform can’t take the place of an attorney completely. If you need to deal with an exceptionally difficult case, we advise using the services of a lawyer to examine your document before executing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of customers. Become one of them today and purchase your state-compliant documents effortlessly!

Form popularity

FAQ

Una contratista independiente es una persona que es contratada para hacer un trabajo especifico. Se dice que es su propia jefa porque controla como y donde se realiza el trabajo. Estas personas tienen mayor libertad y solo se comprometen a hacer la funcion especifica que acordaron con la persona duena de una compania.

Los expertos recomiendan que se guarde por lo menos 25% de su ingreso del trabajo para pago de impuestos. Como contratista independiente debe usar los formularios 1099-MISC recibidos de sus clientes, asi sabra el total a declarar en impuestos. Despues debe presentar la declaracion con el formulario 1040.

Comenzando en el 2018, un menor que puede ser reclamado como dependiente tiene que presentar una declaracion de impuestos una vez que su ingreso exceda su deduccion estandar. Para el ano 2021, esta es lo mayor de $1,100 o la cantidad de ingreso de trabajo mas $350.

Usted debe pagar el impuesto sobre el trabajo por cuenta propia y presentar el Anexo SE (Formulario 1040 o 1040-SR) si se da alguno de estos casos. Sus ganancias netas del trabajo por cuenta propia (sin incluir el ingreso como empleado de una iglesia) fueron de $400 o mas.

Si ganaste mas de $400 en efectivo durante el ano fiscal, el IRS te considera trabajador por cuenta propia y debes presentar un Anexo C, ingresos y gastos comerciales y pagar impuestos sobre el trabajo por cuenta propia (Seguro Social y Medicare, lo mismo que la retencion de un W-2).

Si el total de ingresos durante el ano fueron en efectivo y no recibiste un formulario W-2, deberas solicitar un Formulario 1099-MISC a tu empleador al final del ano fiscal. El 1099-MISC se usa para reclamar los ingresos que recibiste como contratista independiente.

Los expertos recomiendan que se guarde por lo menos 25% de su ingreso del trabajo para pago de impuestos. Como contratista independiente debe usar los formularios 1099-MISC recibidos de sus clientes, asi sabra el total a declarar en impuestos. Despues debe presentar la declaracion con el formulario 1040.

El trabajador realiza un trabajo que esta fuera del curso habitual del negocio de la entidad contratante; y. El trabajador se dedica habitualmente a un oficio, ocupacion o negocio establecido de forma independiente de la misma naturaleza que el relacionado con el trabajo realizado.

Trabajadores independientes que pueden declarar costos y gastos....Deducciones especiales en los trabajadores independientes. Intereses por prestamos de vivienda. Los pagos por salud (medicina prepagada, seguros privados de salud) Deduccion por concepto de dependientes. Gravamen a los movimientos financieros (4x1.000).