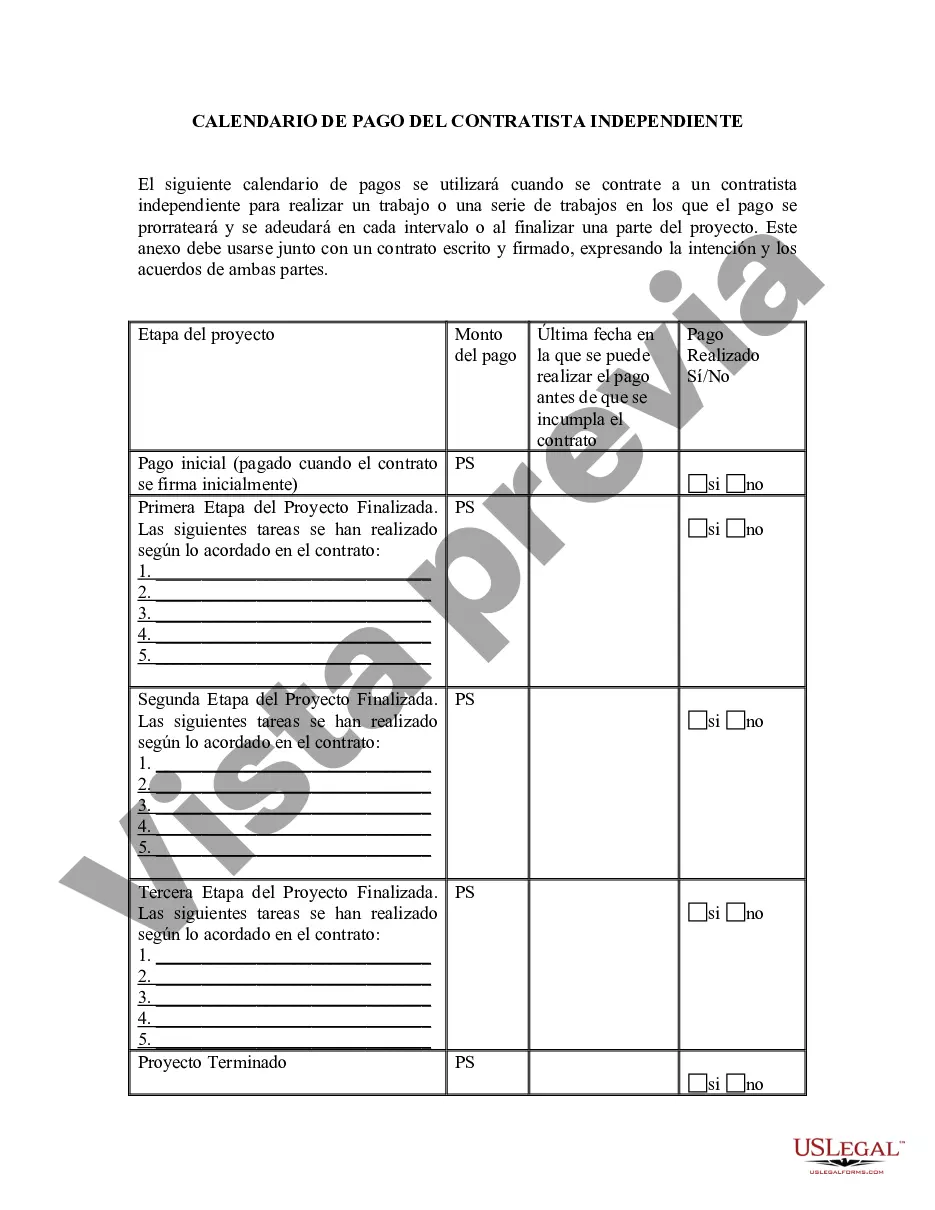

The Chicago Illinois Self-Employed Independent Contractor Payment Schedule refers to the specific timelines and frequency at which independent contractors in Chicago, Illinois receive payment for their services. It is crucial for both contractors and businesses to have a clear understanding of these payment schedules to ensure a smooth working relationship and avoid any payment disputes. One common type of payment schedule followed by self-employed independent contractors in Chicago is the bi-weekly payment schedule. Under this arrangement, contractors receive payment every two weeks or twice a month, allowing them to have a regular and consistent income flow. This is beneficial for contractors who have ongoing projects or long-term contracts, as it provides them with a predictable payment schedule. Another variant of the Chicago Illinois Self-Employed Independent Contractor Payment Schedule is the monthly payment schedule. In this case, contractors receive payment only once a month, usually at the end of each calendar month. This payment schedule is commonly implemented for projects with longer durations or when contractors prefer receiving a lump sum payment at the end of each month. It's important to note that these payment schedules can vary depending on the agreement between the independent contractor and the hiring business. Some contractors may negotiate a custom payment schedule to accommodate their specific needs or preferences. For instance, a contractor working on short-term projects may opt for a weekly payment schedule to ensure they receive payment promptly. On the other hand, some high-value contracts may involve milestone-based payment schedules. In such cases, independent contractors are paid a portion of the total contract value upon completion of specific project milestones. This payment structure allows for a fair assessment of work completed and ensures that contractors are compensated for their services as the project progresses. Adhering to a well-defined payment schedule is essential for both parties involved in the independent contractor-client relationship. It sets clear expectations, minimizes payment delays, and helps maintain a good working relationship. Contractors should thoroughly review and negotiate the payment schedule before accepting any projects to ensure it aligns with their financial needs and preferences. In conclusion, the Chicago Illinois Self-Employed Independent Contractor Payment Schedule is a crucial aspect of the working relationship between contractors and businesses in the region. Bi-weekly, monthly, weekly, and milestone-based payment schedules are some common types observed within this arrangement. Contractors should carefully consider and negotiate the payment schedule to ensure a smooth and consistent income flow.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Calendario de pagos de contratistas independientes que trabajan por cuenta propia - Self-Employed Independent Contractor Payment Schedule

Description

How to fill out Chicago Illinois Calendario De Pagos De Contratistas Independientes Que Trabajan Por Cuenta Propia?

Draftwing documents, like Chicago Self-Employed Independent Contractor Payment Schedule, to manage your legal affairs is a challenging and time-consumming task. Many cases require an attorney’s participation, which also makes this task not really affordable. Nevertheless, you can get your legal issues into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal documents crafted for a variety of scenarios and life circumstances. We make sure each form is compliant with the regulations of each state, so you don’t have to worry about potential legal pitfalls associated with compliance.

If you're already aware of our services and have a subscription with US, you know how straightforward it is to get the Chicago Self-Employed Independent Contractor Payment Schedule template. Simply log in to your account, download the template, and personalize it to your needs. Have you lost your form? Don’t worry. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is fairly easy! Here’s what you need to do before getting Chicago Self-Employed Independent Contractor Payment Schedule:

- Make sure that your document is specific to your state/county since the regulations for writing legal papers may differ from one state another.

- Learn more about the form by previewing it or reading a quick description. If the Chicago Self-Employed Independent Contractor Payment Schedule isn’t something you were hoping to find, then use the header to find another one.

- Log in or register an account to start using our service and download the document.

- Everything looks good on your end? Hit the Buy now button and choose the subscription plan.

- Select the payment gateway and type in your payment information.

- Your template is good to go. You can try and download it.

It’s easy to locate and purchase the needed document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich collection. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!

Form popularity

FAQ

Usted debe pagar el impuesto sobre el trabajo por cuenta propia y presentar el Anexo SE (Formulario 1040 o 1040-SR) si se da alguno de estos casos. Sus ganancias netas del trabajo por cuenta propia (sin incluir el ingreso como empleado de una iglesia) fueron de $400 o mas.

Los expertos recomiendan que se guarde por lo menos 25% de su ingreso del trabajo para pago de impuestos. Como contratista independiente debe usar los formularios 1099-MISC recibidos de sus clientes, asi sabra el total a declarar en impuestos. Despues debe presentar la declaracion con el formulario 1040.

Si tu (el alumno) puedes ser declarado como dependiente, deberas declarar impuestos si: Tu ingreso derivado del trabajo es mayor a $6,350. Tu ingreso no derivado del trabajo es mas de $1,050. Tu ingreso neto comercial o por cuenta propia es de al menos $400.

El trabajador realiza un trabajo que esta fuera del curso habitual del negocio de la entidad contratante; y. El trabajador se dedica habitualmente a un oficio, ocupacion o negocio establecido de forma independiente de la misma naturaleza que el relacionado con el trabajo realizado.

Se consideraran trabajadores independientes o por cuenta propia las personas naturales que ejecutan algun trabajo o desarrollan alguna actividad, industria o comercio, sea independientemente o asociados o en colaboracion con otros, tengan o no capital propio y sea que en sus profesiones, labores u oficios predomine el

Si el total de ingresos durante el ano fueron en efectivo y no recibiste un formulario W-2, deberas solicitar un Formulario 1099-MISC a tu empleador al final del ano fiscal. El 1099-MISC se usa para reclamar los ingresos que recibiste como contratista independiente.

Una contratista independiente es una persona que es contratada para hacer un trabajo especifico. Se dice que es su propia jefa porque controla como y donde se realiza el trabajo. Estas personas tienen mayor libertad y solo se comprometen a hacer la funcion especifica que acordaron con la persona duena de una compania.

¿Que es el impuesto para empleado por cuenta propia? Es un impuesto que representa 15.3% de sus ingresos como trabajador independiente. Este procentaje se divide asi: 12.04% es para cubrir impuestos del seguro social.

Personas natural que realiza una profesion, oficio o actividad economica con o sin trabajadores a su cargo y sin estar sujeto a un contrato laboral en el desarrollo de dicha actividad.

Comenzando en el 2018, un menor que puede ser reclamado como dependiente tiene que presentar una declaracion de impuestos una vez que su ingreso exceda su deduccion estandar. Para el ano 2021, esta es lo mayor de $1,100 o la cantidad de ingreso de trabajo mas $350.