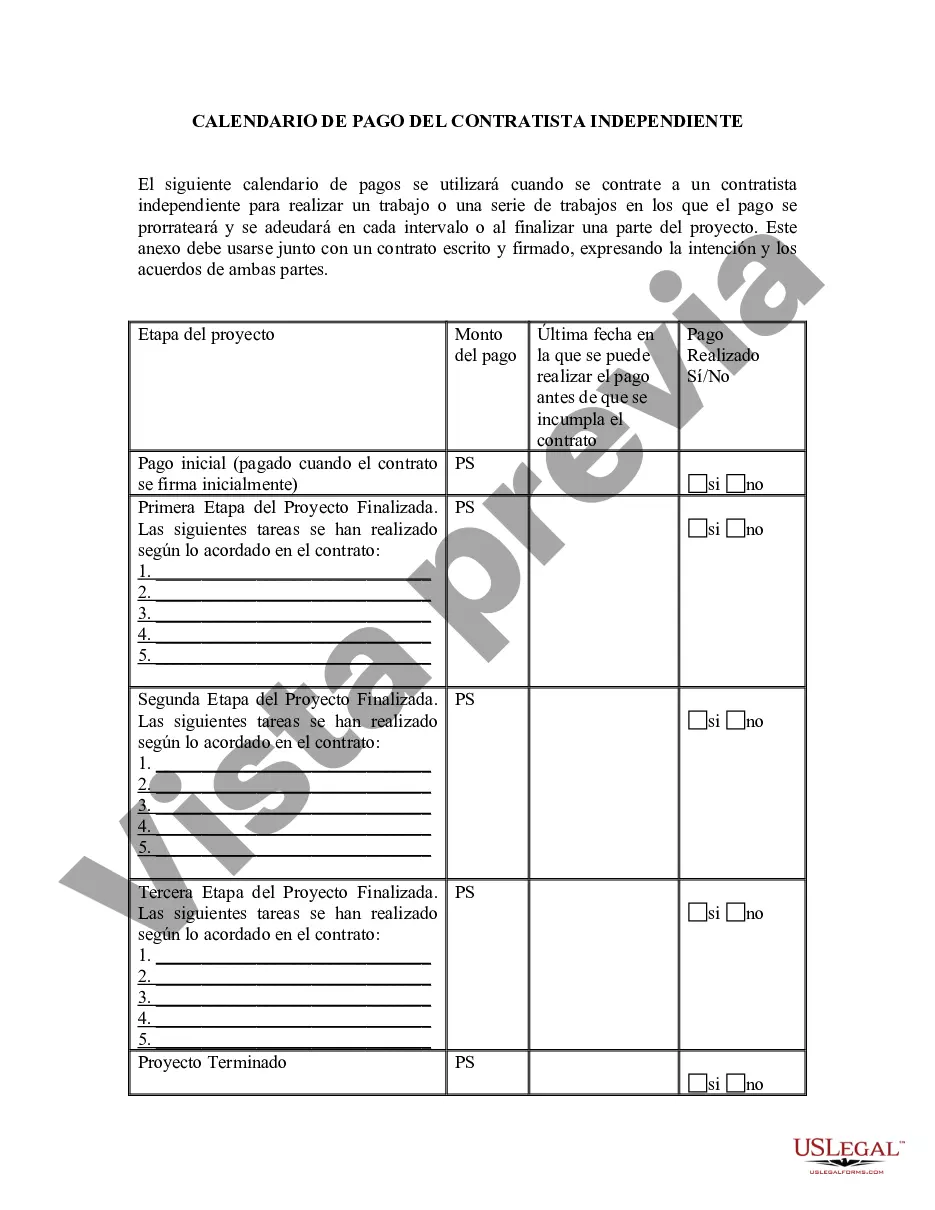

Collin Texas Self-Employed Independent Contractor Payment Schedule refers to the specified timelines and methods through which self-employed independent contractors in Collin County, Texas, receive payment for their services. As self-employed individuals, independent contractors are responsible for managing their own finances and invoicing clients or businesses they work with. There are different types of payment schedules that Collin Texas self-employed independent contractors may follow, depending on various factors such as the nature of the work, contract terms, and agreement with the client or employer. It's essential for individuals to understand these schedules to ensure timely and efficient payment for their services. Here are some common types: 1. Hourly Payment Schedule: Some independent contractors charge an hourly rate for their services. In such cases, they keep track of the number of hours worked and bill the client accordingly. The payment schedule for hourly arrangements may vary, with contractors often billing weekly, bi-weekly, or monthly. 2. Fixed Fee Payment Schedule: Independent contractors may also work on a fixed fee basis, where a predetermined amount is agreed upon for the completion of a specific project or task. In this case, the contractor may request payment in installments based on project milestones or a specific payment schedule outlined in the contract. 3. Retainer Payment Schedule: Certain independent contractors establish retainer agreements with clients, allowing them to secure guaranteed income. Under this arrangement, the contractor receives a set fee upfront or at regular intervals, regardless of the number of hours worked or projects completed. This payment schedule is often negotiated and agreed upon before commencing the work. 4. Commission-Based Payment Schedule: For independent contractors who work in sales or earn income based on commission, payment schedules can be based on the achievement of sales targets or the completion of specific milestones. Payments may be made weekly, bi-weekly, or monthly depending on the agreed terms with the client or employer. 5. Task-Based Payment Schedule: In some cases, independent contractors may charge per task or service provided. The payment schedule for task-based contracts can vary depending on the number of tasks completed, frequency, or specific deadlines. This approach may involve billing upon completion of each task or on a regular schedule, as agreed upon between the contractor and client. It's important for self-employed independent contractors in Collin Texas to clearly define and communicate payment terms with their clients or employers, ensuring a smooth payment process. This helps establish transparency, build trust, and avoid any payment-related disputes. Keeping detailed invoices, tracking hours or tasks, and adhering to the agreed payment schedule ensures a consistent income stream for independent contractors, enabling them to manage their finances efficiently.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Collin Texas Calendario de pagos de contratistas independientes que trabajan por cuenta propia - Self-Employed Independent Contractor Payment Schedule

Description

How to fill out Collin Texas Calendario De Pagos De Contratistas Independientes Que Trabajan Por Cuenta Propia?

Whether you intend to open your company, enter into a contract, apply for your ID renewal, or resolve family-related legal issues, you must prepare certain paperwork corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal templates for any individual or business case. All files are collected by state and area of use, so picking a copy like Collin Self-Employed Independent Contractor Payment Schedule is fast and easy.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you several additional steps to get the Collin Self-Employed Independent Contractor Payment Schedule. Follow the instructions below:

- Make sure the sample meets your individual needs and state law requirements.

- Look through the form description and check the Preview if available on the page.

- Utilize the search tab specifying your state above to find another template.

- Click Buy Now to obtain the sample when you find the right one.

- Select the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Collin Self-Employed Independent Contractor Payment Schedule in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you can access all of your previously purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!