Houston, Texas Self-Employed Independent Contractor Payment Schedule: A Comprehensive Guide As a self-employed independent contractor in Houston, Texas, it is crucial to have a well-defined payment schedule to ensure timely and accurate compensation for your services. A payment schedule outlines the agreed-upon terms between you and your clients, serving as a reference for when payments are due and how they will be made. It helps maintain transparency and organization in your transactions, minimizing misunderstandings and payment delays. Here are some essential keywords and different types of Houston, Texas self-employed independent contractor payment schedules: 1. Invoice: An invoice is a document that itemizes the services rendered, their respective costs, and the overall amount owed by the client. Creating and sending detailed invoices to your clients is an essential part of the payment schedule process. 2. Down Payment: Some payment schedules may include a provision for a down payment or a percentage of the total fee upfront. This ensures you have some financial security before commencing work or delivering a project. 3. Milestone Payments: For longer-term projects, you may set specific milestones or stages, each with its own payment due date. This type of payment schedule is commonly used in industries such as construction or software development, where progress can be measured incrementally. 4. Recurring Payments: Certain self-employed independent contractors in Houston, Texas, offer ongoing services or products on a subscription or retainer basis. In this case, a recurring payment schedule is established, outlining the interval (monthly, quarterly, etc.) and date when payment should be made, ensuring regular compensation for your services. 5. Net Payment Terms: Net payment terms refer to the number of days within which the client is expected to make the payment after receiving the invoice. For example, "Net 30" means the payment is due within 30 days of receiving the invoice. Establishing clear net payment terms helps avoid payment delays and ensures cash flow predictability. 6. Late Payment Penalties: To protect your interests and encourage prompt payment, it is advisable to include penalties for late payments in your payment schedule. This penalty, typically a percentage or fixed fee, is imposed for payments made beyond the agreed-upon deadline. Remember, as a self-employed independent contractor, it is crucial to have a legally binding contract that includes your payment schedule terms. Seeking professional advice from an attorney or utilizing online contract templates tailored to your industry can help ensure your payment schedule is clear, fair, and enforceable.

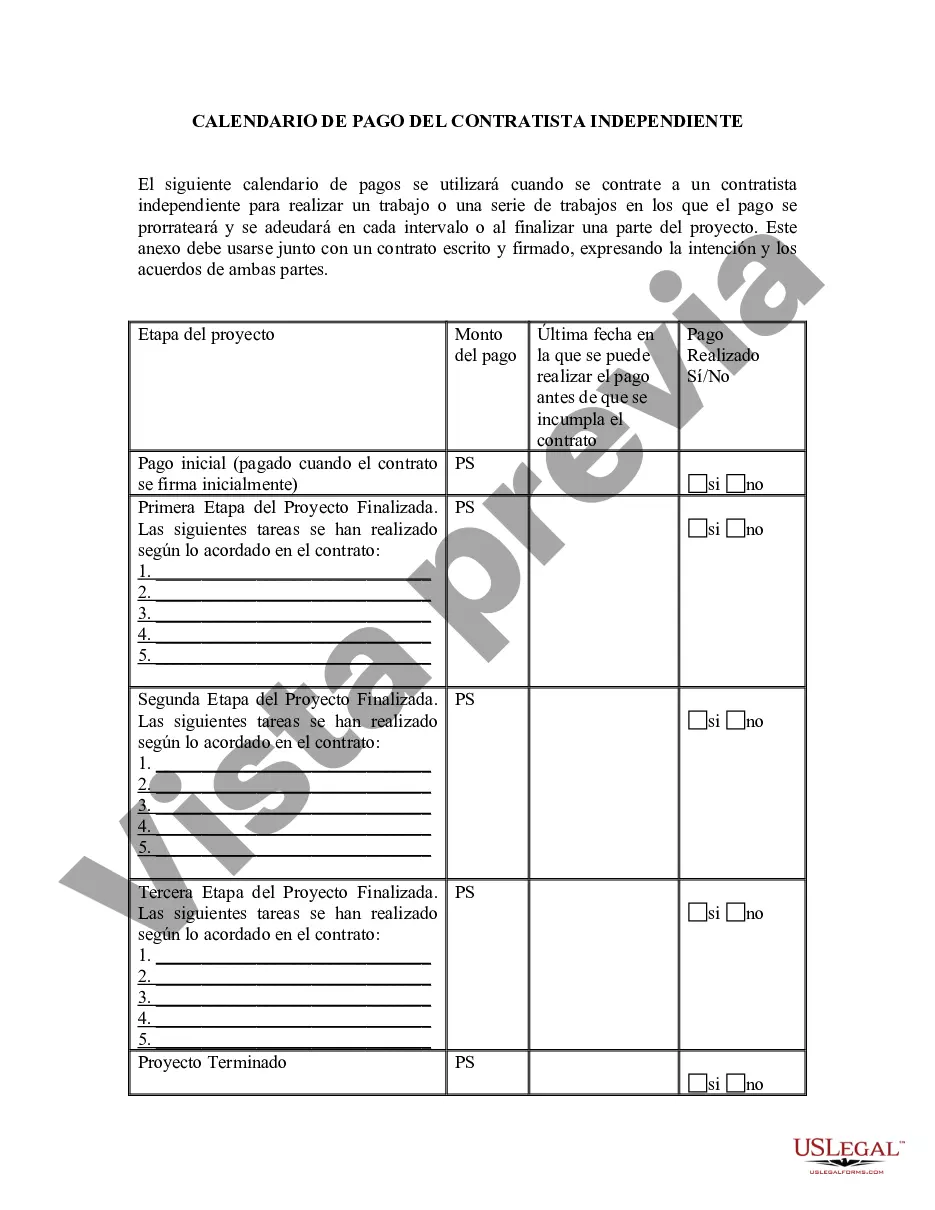

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Houston Texas Calendario de pagos de contratistas independientes que trabajan por cuenta propia - Self-Employed Independent Contractor Payment Schedule

Description

How to fill out Houston Texas Calendario De Pagos De Contratistas Independientes Que Trabajan Por Cuenta Propia?

Are you looking to quickly create a legally-binding Houston Self-Employed Independent Contractor Payment Schedule or maybe any other document to manage your own or corporate matters? You can go with two options: hire a legal advisor to draft a legal paper for you or create it entirely on your own. The good news is, there's a third solution - US Legal Forms. It will help you receive professionally written legal paperwork without having to pay sky-high prices for legal services.

US Legal Forms provides a rich collection of over 85,000 state-compliant document templates, including Houston Self-Employed Independent Contractor Payment Schedule and form packages. We provide documents for a myriad of life circumstances: from divorce paperwork to real estate documents. We've been out there for more than 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and get the needed document without extra hassles.

- To start with, double-check if the Houston Self-Employed Independent Contractor Payment Schedule is adapted to your state's or county's laws.

- In case the document comes with a desciption, make sure to verify what it's suitable for.

- Start the search over if the form isn’t what you were seeking by utilizing the search box in the header.

- Select the subscription that is best suited for your needs and proceed to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, locate the Houston Self-Employed Independent Contractor Payment Schedule template, and download it. To re-download the form, simply head to the My Forms tab.

It's stressless to buy and download legal forms if you use our services. In addition, the templates we offer are reviewed by industry experts, which gives you greater peace of mind when dealing with legal affairs. Try US Legal Forms now and see for yourself!