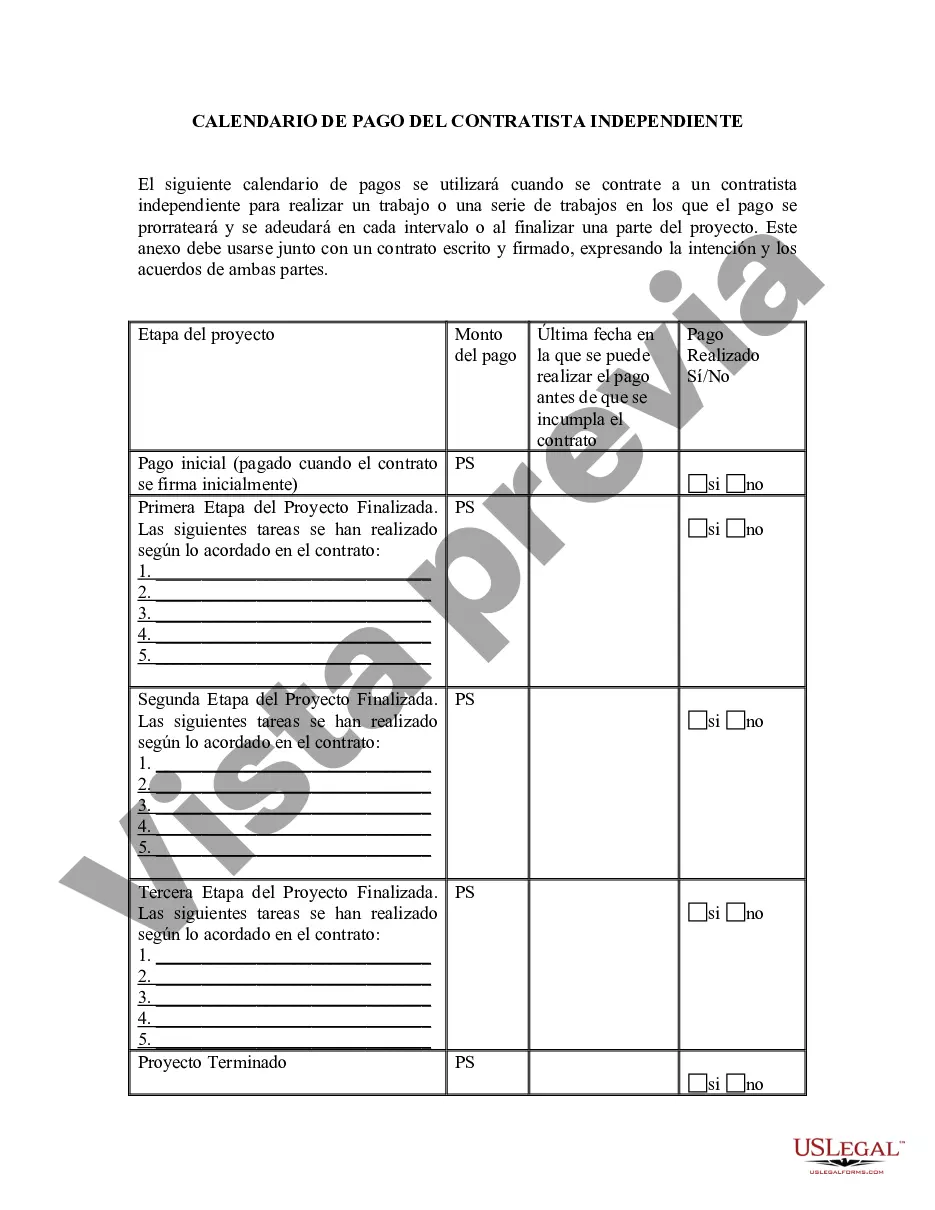

Maricopa, Arizona Self-Employed Independent Contractor Payment Schedule As a self-employed independent contractor in Maricopa, Arizona, it is crucial to understand the payment schedule and its various aspects. The payment schedule refers to the frequency and timing of when payment is expected for services rendered by self-employed individuals. Comprehending the payment schedule helps contractors effectively manage their finances and plan for cash flow. In Maricopa, Arizona, self-employed independent contractors have the flexibility to negotiate their payment terms with clients or businesses they work for. However, it is essential to establish a clear payment schedule beforehand to avoid confusion or delays in receiving payments. The payment schedule typically outlines the frequency of payments and the due dates. The most common types of payment schedules for self-employed independent contractors in Maricopa, Arizona, are: 1. Weekly Payment Schedule: Under this schedule, contractors receive payments on a weekly basis. This option ensures frequent cash flow, making it suitable for contractors with regular expenses or those working on shorter-term projects. 2. Bi-Weekly Payment Schedule: Bi-weekly payment schedules involve payments being made every two weeks. This option may suit contractors who prefer a slightly longer payment period while still maintaining a consistent income. 3. Monthly Payment Schedule: Contractors who work on long-term projects or have a stable income stream might opt for a monthly payment schedule. This schedule provides a lump sum payment at the end of each month. It is vital for self-employed independent contractors to establish clear payment terms and deadlines with their clients, ensuring mutual understanding and prompt payment. They should have a written agreement or contract that outlines the payment schedule and specifies any penalties or interest charges for late payments. Additionally, contractors should consider setting up efficient invoicing systems to facilitate timely and accurate payment collection. This may involve using electronic invoicing software or maintaining a well-organized record-keeping system to track payments, issue invoices promptly, and follow up on late payments. Overall, understanding and adhering to the Maricopa, Arizona self-employed independent contractor payment schedule ensures financial stability and successful management of one's business. Contractors must communicate clearly with their clients, negotiate suitable payment terms, and implement efficient invoicing systems to facilitate seamless payment transactions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Calendario de pagos de contratistas independientes que trabajan por cuenta propia - Self-Employed Independent Contractor Payment Schedule

Description

How to fill out Maricopa Arizona Calendario De Pagos De Contratistas Independientes Que Trabajan Por Cuenta Propia?

A document routine always accompanies any legal activity you make. Opening a company, applying or accepting a job offer, transferring ownership, and many other life situations demand you prepare formal paperwork that differs from state to state. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and download a document for any individual or business objective utilized in your county, including the Maricopa Self-Employed Independent Contractor Payment Schedule.

Locating forms on the platform is remarkably simple. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. Following that, the Maricopa Self-Employed Independent Contractor Payment Schedule will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guideline to obtain the Maricopa Self-Employed Independent Contractor Payment Schedule:

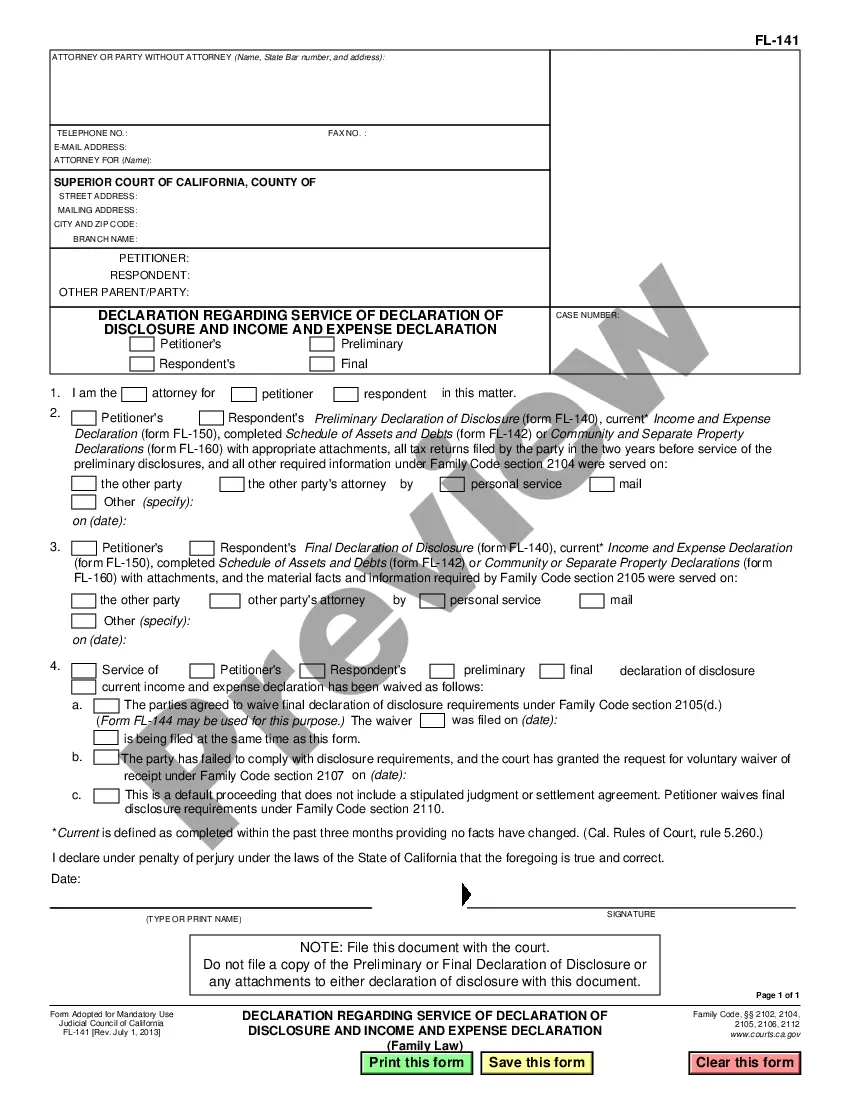

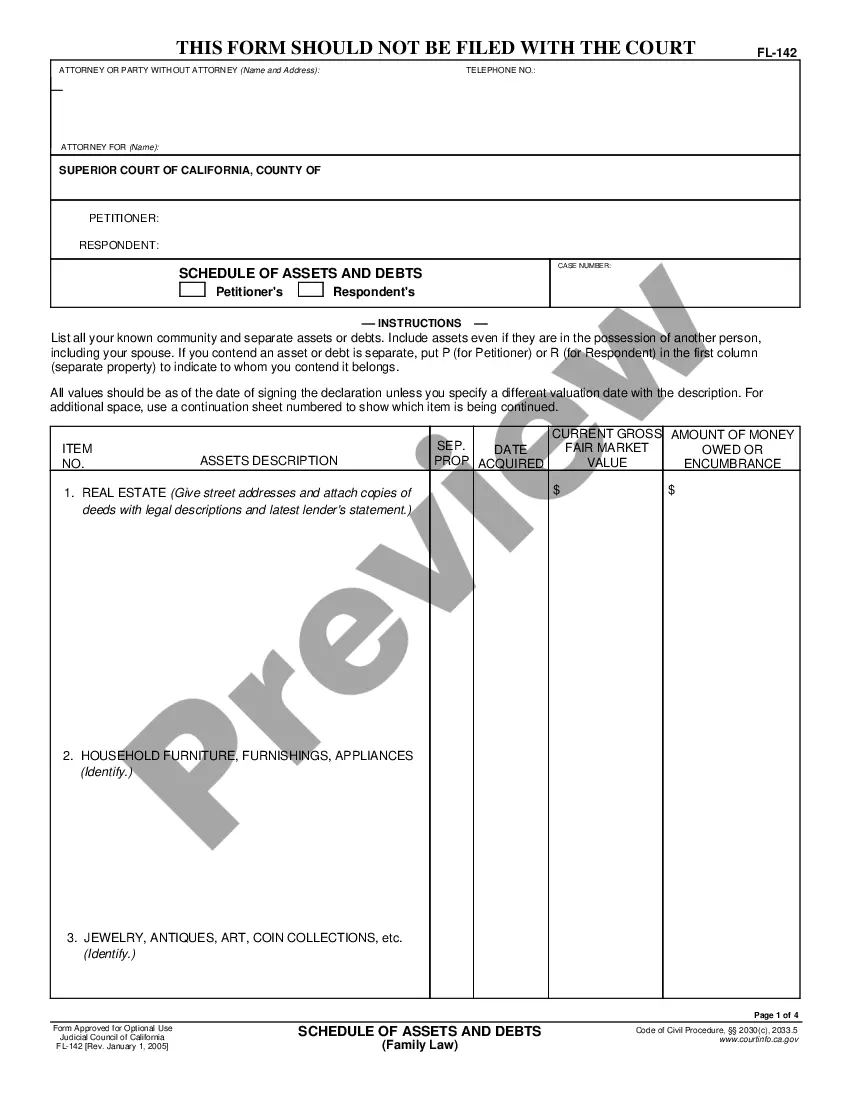

- Ensure you have opened the correct page with your local form.

- Make use of the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form satisfies your requirements.

- Look for another document via the search tab if the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Select the suitable subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Maricopa Self-Employed Independent Contractor Payment Schedule on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal documents. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!