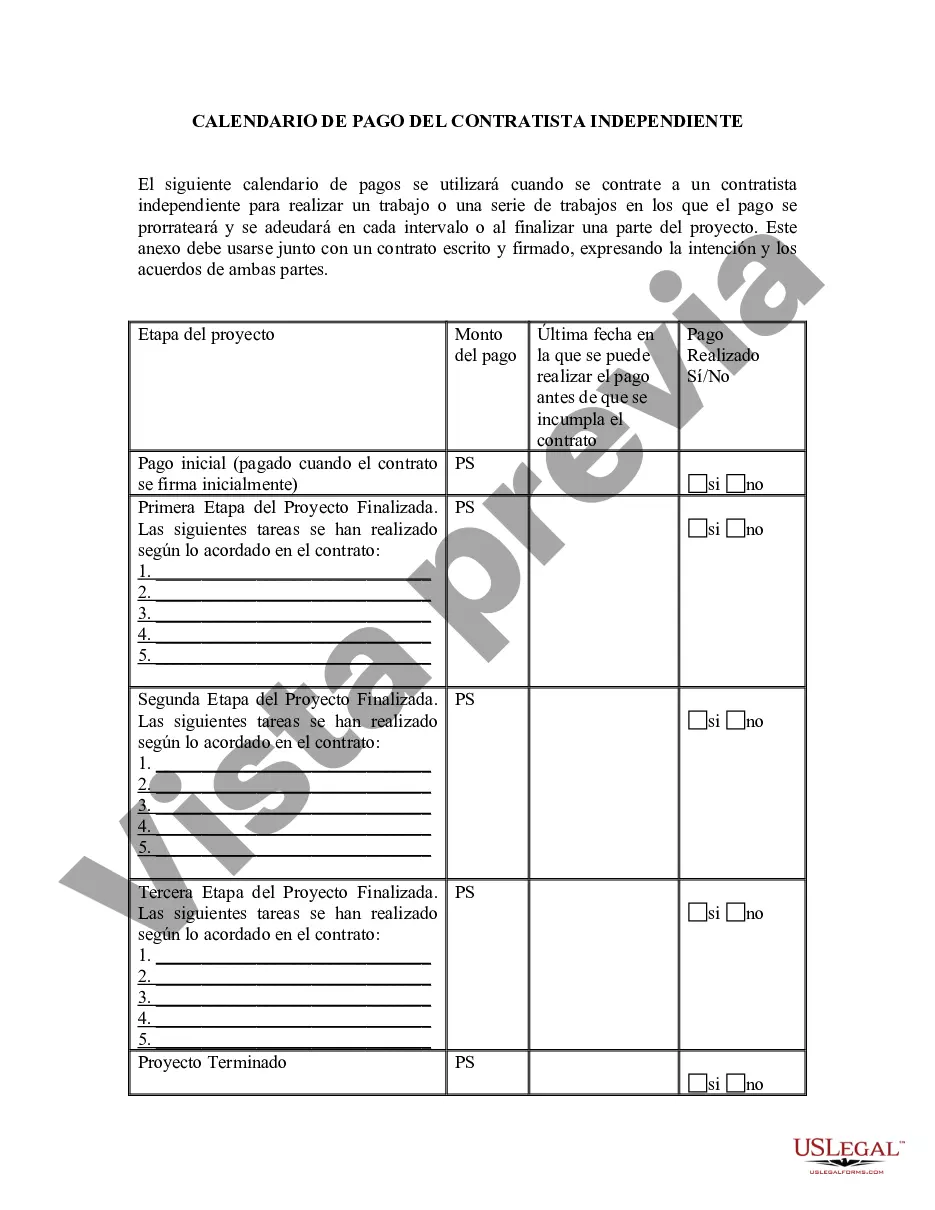

The Nassau New York Self-Employed Independent Contractor Payment Schedule refers to the established time frame and frequency for compensating self-employed independent contractors operating in Nassau County, New York. This schedule outlines how and when contractors will receive payments for their services rendered, taking into consideration local regulations and best practices for fair and timely compensation. The payment schedule ensures transparency, fairness, and accountability by specifying the designated dates or intervals for payment disbursement. It helps contractors plan their finances, ensuring a steady income stream and aiding in their overall financial stability. Key elements of the Nassau New York Self-Employed Independent Contractor Payment Schedule may include the following: 1. Payment Frequency: This refers to how often contractors can expect to be paid, which can vary depending on the terms agreed upon between the contractor and the hiring entity. Common payment frequencies may include weekly, biweekly, or monthly disbursements. 2. Payment Due Dates: These are specific dates on which payments are expected to be made. They help contractors anticipate when funds will be available, enabling them to meet their financial obligations promptly. Due dates are typically set in accordance with the contracted service period, but they can also be subject to negotiation. 3. Accepted Payment Methods: The payment schedule may specify the approved methods of payment for contractors, such as direct deposit, wire transfer, physical checks, or digital payment platforms. This ensures that the selected payment methods align with contractors' preferences and are convenient and secure. 4. Payment Terms and Conditions: This section outlines the contractual terms and conditions related to payments, including any late fees or penalties for delayed payments or bounced checks. It may also include details regarding invoice submission, required documentation, and resolution processes for payment disputes. While the Nassau New York Self-Employed Independent Contractor Payment Schedule generally follows these key elements, there may be different variations or types available based on individual contracts and industries. Some possible examples include: 1. Fixed-Date Payment Schedule: This type of payment schedule establishes specific dates for compensation, such as paying contractors on the 15th and 30th of each month, regardless of the project or service duration. 2. Hours-Based Payment Schedule: This schedule calculates payments based on the number of hours worked by the contractor. It may follow a regular weekly or monthly payment cycle and include timesheets or detailed record-keeping to ensure accurate payment calculations. 3. Milestone-Based Payment Schedule: For longer-term projects, this type of payment schedule sets milestones or project phases. Contractors receive payments upon successfully completing each milestone or reaching specific project-related goals, ensuring ongoing progress and accountability. 4. Retainer-Based Payment Schedule: Some contractors may agree to work on a retainer basis, wherein they receive a predetermined monthly fee for being available for a certain number of hours or specific tasks. This payment schedule provides stability for the contractor and guarantees a continuous income stream. In conclusion, the Nassau New York Self-Employed Independent Contractor Payment Schedule is designed to establish clear guidelines and expectations for compensating self-employed contractors. By outlining payment frequencies, due dates, accepted payment methods, and related terms and conditions, this schedule ensures fair and timely payment practices while meeting the needs of both the contractor and the hiring entity.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nassau New York Calendario de pagos de contratistas independientes que trabajan por cuenta propia - Self-Employed Independent Contractor Payment Schedule

Description

How to fill out Nassau New York Calendario De Pagos De Contratistas Independientes Que Trabajan Por Cuenta Propia?

A document routine always goes along with any legal activity you make. Staring a business, applying or accepting a job offer, transferring ownership, and many other life scenarios require you prepare formal paperwork that differs from state to state. That's why having it all collected in one place is so helpful.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and get a document for any personal or business purpose utilized in your county, including the Nassau Self-Employed Independent Contractor Payment Schedule.

Locating templates on the platform is remarkably simple. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. Afterward, the Nassau Self-Employed Independent Contractor Payment Schedule will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guide to obtain the Nassau Self-Employed Independent Contractor Payment Schedule:

- Make sure you have opened the right page with your local form.

- Make use of the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form satisfies your needs.

- Search for another document via the search option if the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Decide on the suitable subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the Nassau Self-Employed Independent Contractor Payment Schedule on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the templates provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!