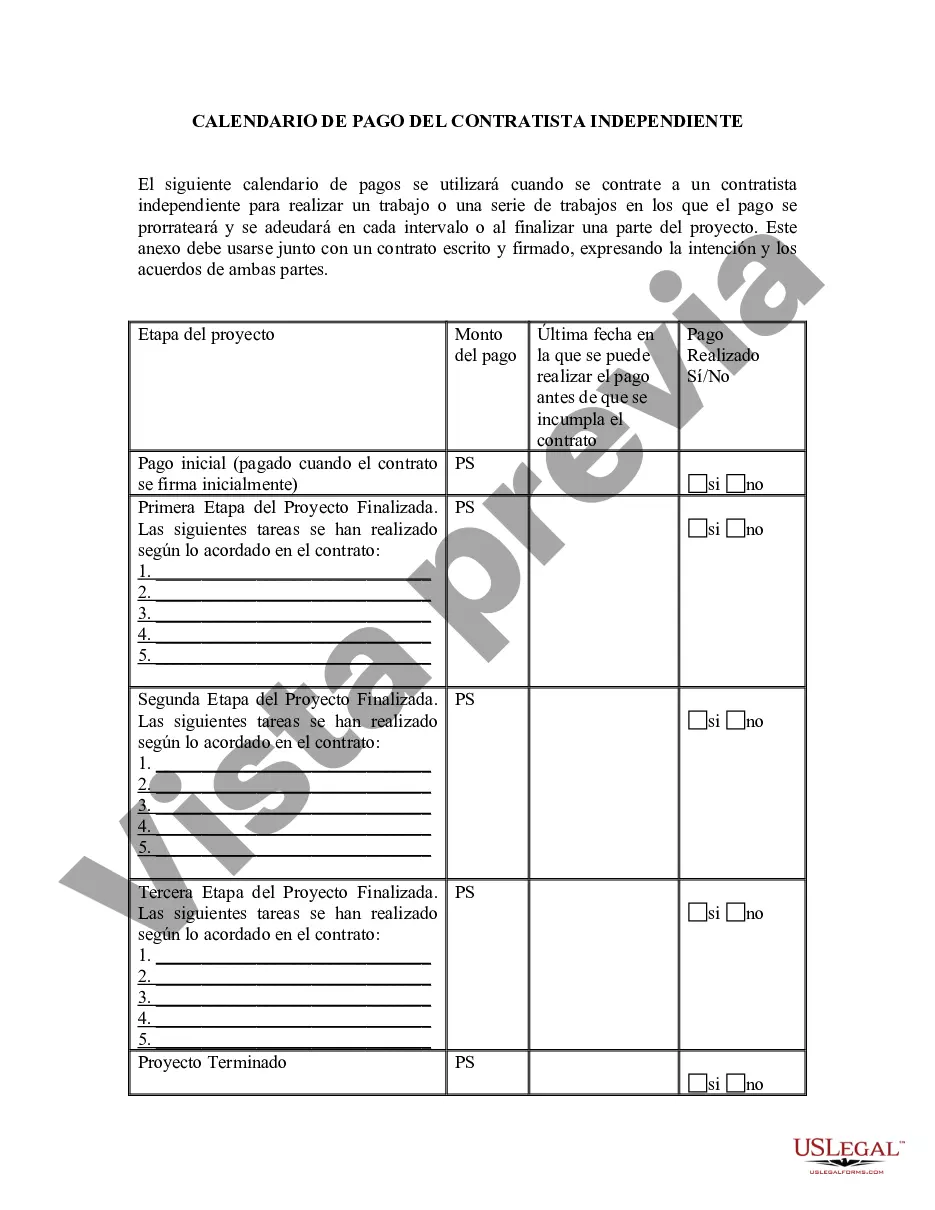

Oakland, Michigan Self-Employed Independent Contractor Payment Schedule: Explained As a self-employed independent contractor in Oakland, Michigan, it is crucial to understand the payment schedule that governs your work and income. A payment schedule is the agreed-upon timeline between you, the contractor, and your clients or customers for receiving payments for your services. This detailed description will provide you with insights into the different types of payment schedules and their significance for independent contractors in Oakland, Michigan. 1. Net 30 Payment Schedule: Net 30 is a common payment schedule in which your client agrees to pay you within 30 days of receiving an invoice for services rendered. It means that once you submit your invoice, you should expect payment within the next 30 days. This payment arrangement is a standard practice in many industries and allows contractors to maintain a regular cash flow while giving clients sufficient time to process payments. 2. Net 60 Payment Schedule: Similar to Net 30, Net 60 refers to a payment schedule where your client commits to processing your payment within 60 days from the date of invoicing. This payment term may be suitable for long-term projects or clients who require additional time for payment processing, such as larger corporations or government entities. However, it is important to gauge if the extended timeline aligns with your financial needs. 3. Bi-Weekly Payment Schedule: Bi-weekly payment is a schedule in which you receive payments every two weeks. This payment frequency can be advantageous for independent contractors who rely heavily on a consistent cash flow. With this schedule, you can predict your income and plan your expenses accordingly, often helping to facilitate better financial management. 4. Weekly Payment Schedule: Some clients or industries may opt for a weekly payment schedule, wherein you receive your payments on a weekly basis. This arrangement ensures a quick turnover of funds, providing financial stability to contractors who prefer a more regular income source. Industries such as construction, transportation, or gig economy platforms commonly adopt this payment frequency. 5. Milestone-based Payment Schedule: In certain projects or contracts, payments may be tied to specific milestones or deliverables. This type of payment schedule ensures that you receive compensation upon completion of pre-agreed milestones, such as project stages or goals. Milestone-based payments are particularly common in creative fields or complex, long-term projects where progress is measured in discrete phases. Independent contractors in Oakland, Michigan should carefully review and negotiate payment terms with clients before commencing work. It is essential to establish a clear and detailed payment schedule, including invoicing procedures, payment methods, and any penalties or late fees for delayed payments. By setting up a transparent payment framework, you can help avoid misunderstandings and maintain steady cash flow while delivering your services effectively.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oakland Michigan Calendario de pagos de contratistas independientes que trabajan por cuenta propia - Self-Employed Independent Contractor Payment Schedule

Description

How to fill out Oakland Michigan Calendario De Pagos De Contratistas Independientes Que Trabajan Por Cuenta Propia?

How much time does it usually take you to create a legal document? Considering that every state has its laws and regulations for every life scenario, locating a Oakland Self-Employed Independent Contractor Payment Schedule meeting all regional requirements can be tiring, and ordering it from a professional lawyer is often pricey. Many online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online collection of templates, collected by states and areas of use. In addition to the Oakland Self-Employed Independent Contractor Payment Schedule, here you can find any specific document to run your business or individual affairs, complying with your county requirements. Specialists verify all samples for their actuality, so you can be sure to prepare your paperwork properly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed form, and download it. You can pick the file in your profile anytime later on. Otherwise, if you are new to the platform, there will be a few more actions to complete before you obtain your Oakland Self-Employed Independent Contractor Payment Schedule:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document utilizing the related option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Oakland Self-Employed Independent Contractor Payment Schedule.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!