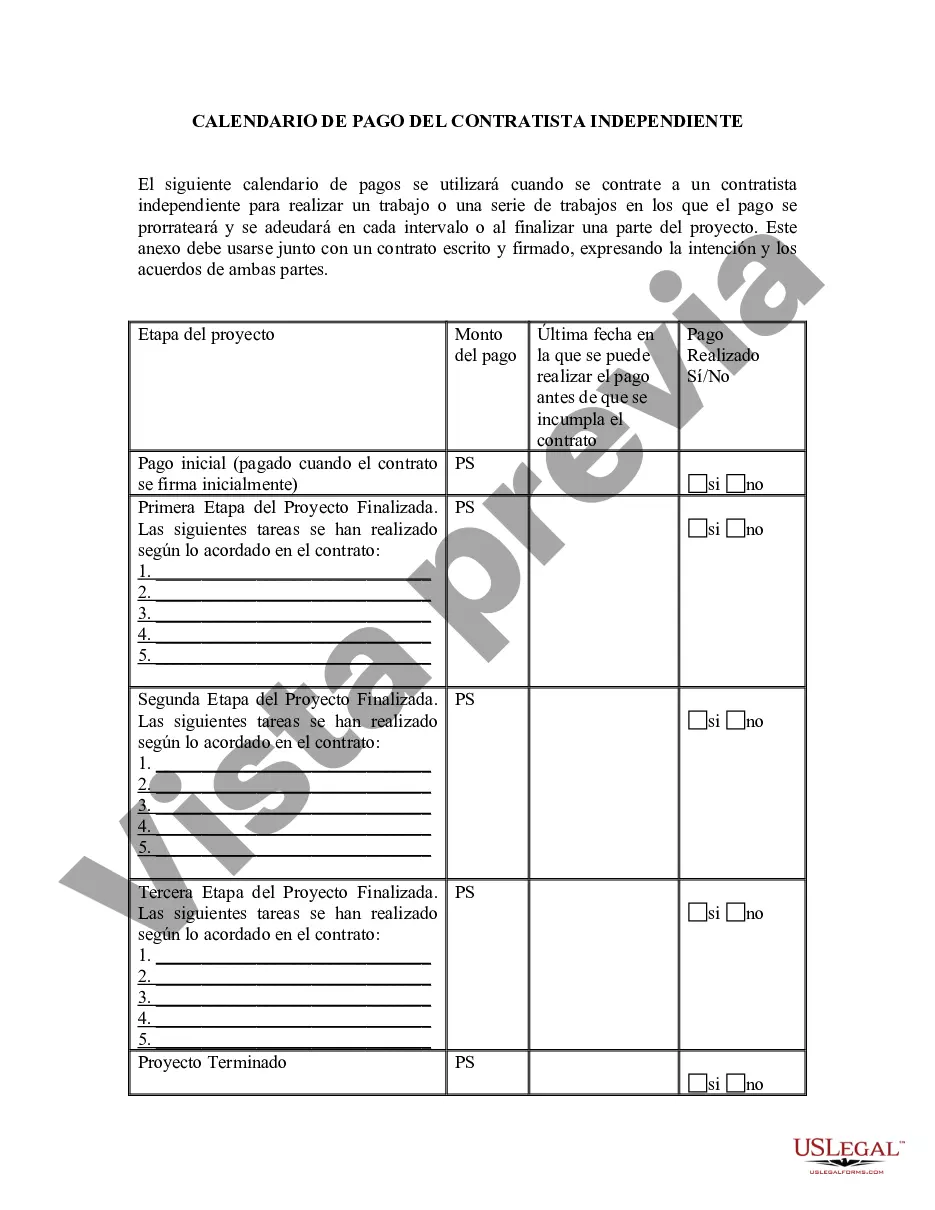

Santa Clara, California Self-Employed Independent Contractor Payment Schedule: A Comprehensive Overview In Santa Clara, California, being a self-employed independent contractor comes with the responsibility of managing your own finances and payment schedule. Understanding the payment structure and abiding by it is imperative to ensure smooth financial transactions and maintain a positive working relationship with clients. This detailed description will shed light on Santa Clara's self-employed independent contractor payment schedule, outlining various types and highlighting relevant keywords for clarity. 1. Standard Payment Schedule: The most common payment arrangement for self-employed independent contractors in Santa Clara follows a standard schedule. This schedule typically involves receiving payment upon the completion of predetermined milestones, deliverables, or at the end of a specified time period, such as monthly, bi-weekly, or weekly. Contractors and clients mutually agree upon the terms in advance to provide financial stability and accountability. 2. Retainer Payment Schedule: Some self-employed independent contractors in Santa Clara opt for a retainer payment schedule. This arrangement involves clients paying an upfront fee, known as a retainer, to secure the contractor's services for a certain duration. Contractors may receive regular payments from this retainer throughout the agreed-upon time period, regardless of specific deliverables or milestones. Retainer payments often provide financial stability for contractors while ensuring a consistent income flow. 3. Milestone-based Payment Schedule: Contractors operating in Santa Clara may choose to employ a milestone-based payment schedule. This type of payment arrangement relies on predefined milestones that mark significant progress or completion of specific tasks or projects. Once a milestone is reached, contractors are compensated accordingly. This approach ensures that clients pay contractors based on tangible achievements, thereby mitigating risks and encouraging project progression. 4. Pay-Per-Project Payment Schedule: In some cases, self-employed independent contractors in Santa Clara may establish a pay-per-project payment schedule. With this structure, contractors and clients agree on a fixed fee for a particular project or task. The contractor receives complete payment upon successfully completing and delivering the project or fulfilling the given task as per pre-agreed specifications. Keywords: Santa Clara, California, self-employed, independent contractor, payment schedule, standard, retainer, milestone-based, pay-per-project, financial transactions, financial stability, accountability, milestones, deliverables, time period, income flow, tangible achievements, project progression, fixed fee, specifications. It's crucial for both contractors and clients to discuss and memorialize the payment schedule in a contractual agreement to avoid any misunderstandings or disputes. By adhering to the agreed-upon payment schedule, self-employed independent contractors in Santa Clara can ensure financial security, maintain professional integrity, and foster long-lasting working relationships.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Santa Clara California Calendario de pagos de contratistas independientes que trabajan por cuenta propia - Self-Employed Independent Contractor Payment Schedule

Description

How to fill out Santa Clara California Calendario De Pagos De Contratistas Independientes Que Trabajan Por Cuenta Propia?

Preparing legal documentation can be cumbersome. Besides, if you decide to ask a lawyer to write a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Santa Clara Self-Employed Independent Contractor Payment Schedule, it may cost you a fortune. So what is the most reasonable way to save time and money and draft legitimate forms in total compliance with your state and local laws? US Legal Forms is an excellent solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario accumulated all in one place. Consequently, if you need the latest version of the Santa Clara Self-Employed Independent Contractor Payment Schedule, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Santa Clara Self-Employed Independent Contractor Payment Schedule:

- Look through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now when you find the needed sample and select the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the file format for your Santa Clara Self-Employed Independent Contractor Payment Schedule and download it.

When finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!