Travis Texas Self-Employed Independent Contractor Payment Schedule: A Comprehensive Overview The Travis Texas Self-Employed Independent Contractor Payment Schedule refers to the payment timelines and procedures followed by independent contractors residing in Travis County, Texas. As self-employed individuals, independent contractors handle their own finances and receive compensation for the services they provide. The payment schedule ensures that contractors receive their rightful payments in a timely and efficient manner, fostering financial stability and security. 1. Bi-Weekly Payment Schedule: One of the common types of payment schedules, bi-weekly payments occur every two weeks, typically on predetermined days of the week. Independent contractors can rely on this regular payment interval to manage their cash flow effectively. This schedule offers consistency, allowing contractors to plan their expenses accordingly. 2. Monthly Payment Schedule: Some Travis Texas self-employed independent contractors may opt for a monthly payment schedule. In this case, they receive their earnings once a month, usually on a specific date. While it may require more extensive budgeting and financial planning, monthly payments can help streamline financial responsibilities and create predictability. 3. Per Project/Invoice Payment Schedule: Another type of payment schedule often adopted by Travis Texas self-employed independent contractors is based on the completion of individual projects or invoice submission. Contractors receive payment after fulfilling their contractual obligations or submitting an invoice, which outlines the services provided along with the corresponding charges. This method allows for flexible payment schedules, as it depends on the completion of each project or invoicing cycle. Travis Texas self-employed independent contractors should remember that the payment schedule might be subject to negotiation and agreement between the contractor and the client. It is crucial to establish clear payment terms and expectations at the outset of any working relationship to avoid ambiguity and potential payment delays. Additionally, it is imperative to maintain accurate records of work performed, including project details, hours worked, rates, and any agreed-upon terms. These records are valuable when requesting timely payments and can serve as evidence in case of any payment disputes. Travis Texas self-employed independent contractors must also consider tax implications related to their payment schedule. Since they are responsible for paying self-employment taxes, contractors may need to set aside a portion of their income regularly to fulfill their tax obligations at the federal, state, and local levels. In conclusion, the Travis Texas Self-Employed Independent Contractor Payment Schedule outlines the various payment schedules followed by independent contractors operating in Travis County, Texas. With options ranging from bi-weekly to monthly payments, and per project/invoice schedules, contractors can choose the option that best suits their financial needs. Understanding the importance of clear payment terms, record-keeping, and tax obligations is vital for maintaining a successful and sustainable self-employment career in Travis Texas.

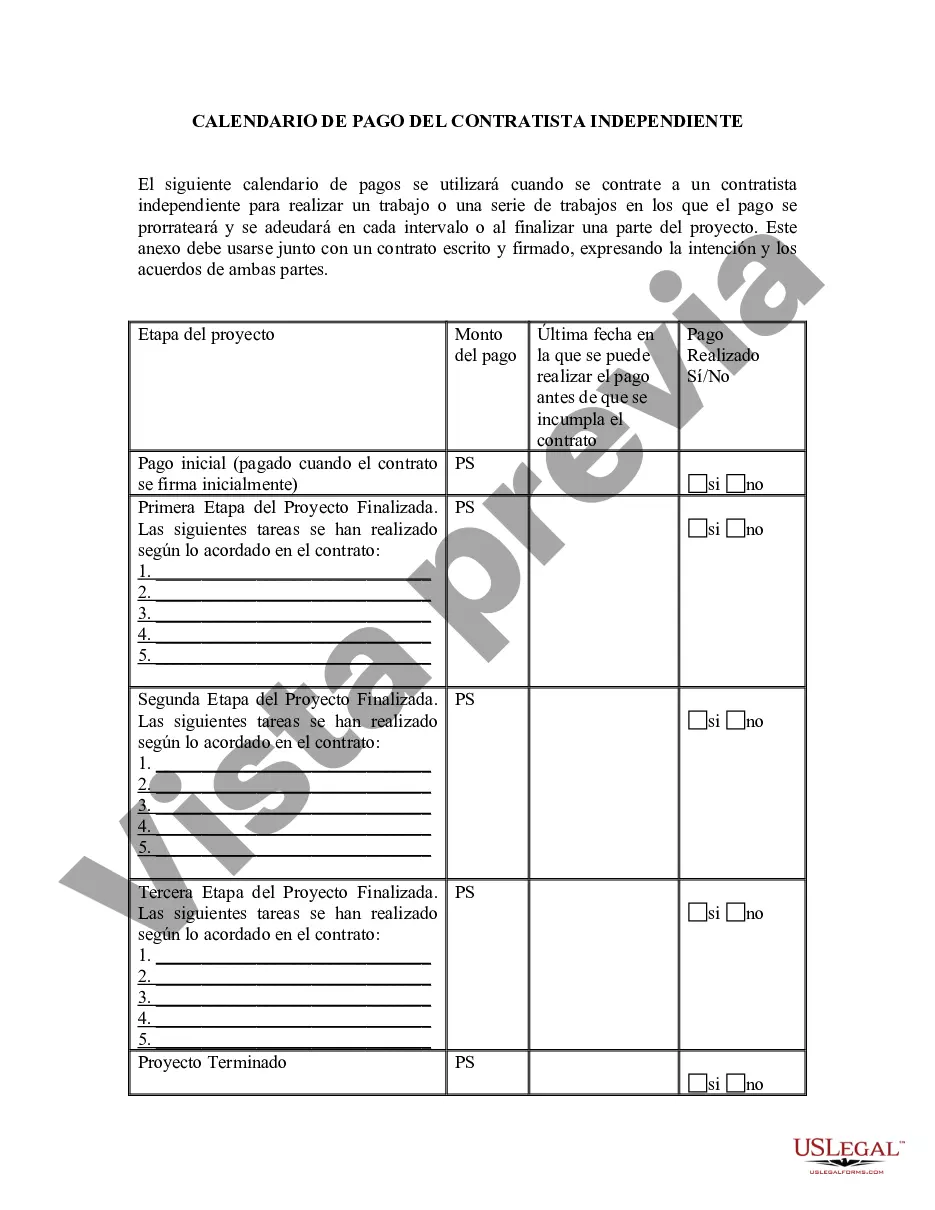

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Calendario de pagos de contratistas independientes que trabajan por cuenta propia - Self-Employed Independent Contractor Payment Schedule

Description

How to fill out Travis Texas Calendario De Pagos De Contratistas Independientes Que Trabajan Por Cuenta Propia?

Dealing with legal forms is a must in today's world. However, you don't always need to seek qualified assistance to draft some of them from scratch, including Travis Self-Employed Independent Contractor Payment Schedule, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in different types ranging from living wills to real estate paperwork to divorce documents. All forms are organized according to their valid state, making the searching process less challenging. You can also find information resources and guides on the website to make any activities related to paperwork execution straightforward.

Here's how you can purchase and download Travis Self-Employed Independent Contractor Payment Schedule.

- Take a look at the document's preview and outline (if available) to get a general idea of what you’ll get after downloading the document.

- Ensure that the template of your choice is adapted to your state/county/area since state regulations can affect the legality of some records.

- Check the related forms or start the search over to find the correct document.

- Hit Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a suitable payment method, and purchase Travis Self-Employed Independent Contractor Payment Schedule.

- Select to save the form template in any available format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Travis Self-Employed Independent Contractor Payment Schedule, log in to your account, and download it. Of course, our website can’t take the place of an attorney entirely. If you have to deal with an exceptionally difficult situation, we advise getting a lawyer to examine your form before signing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of users. Join them today and purchase your state-compliant documents effortlessly!