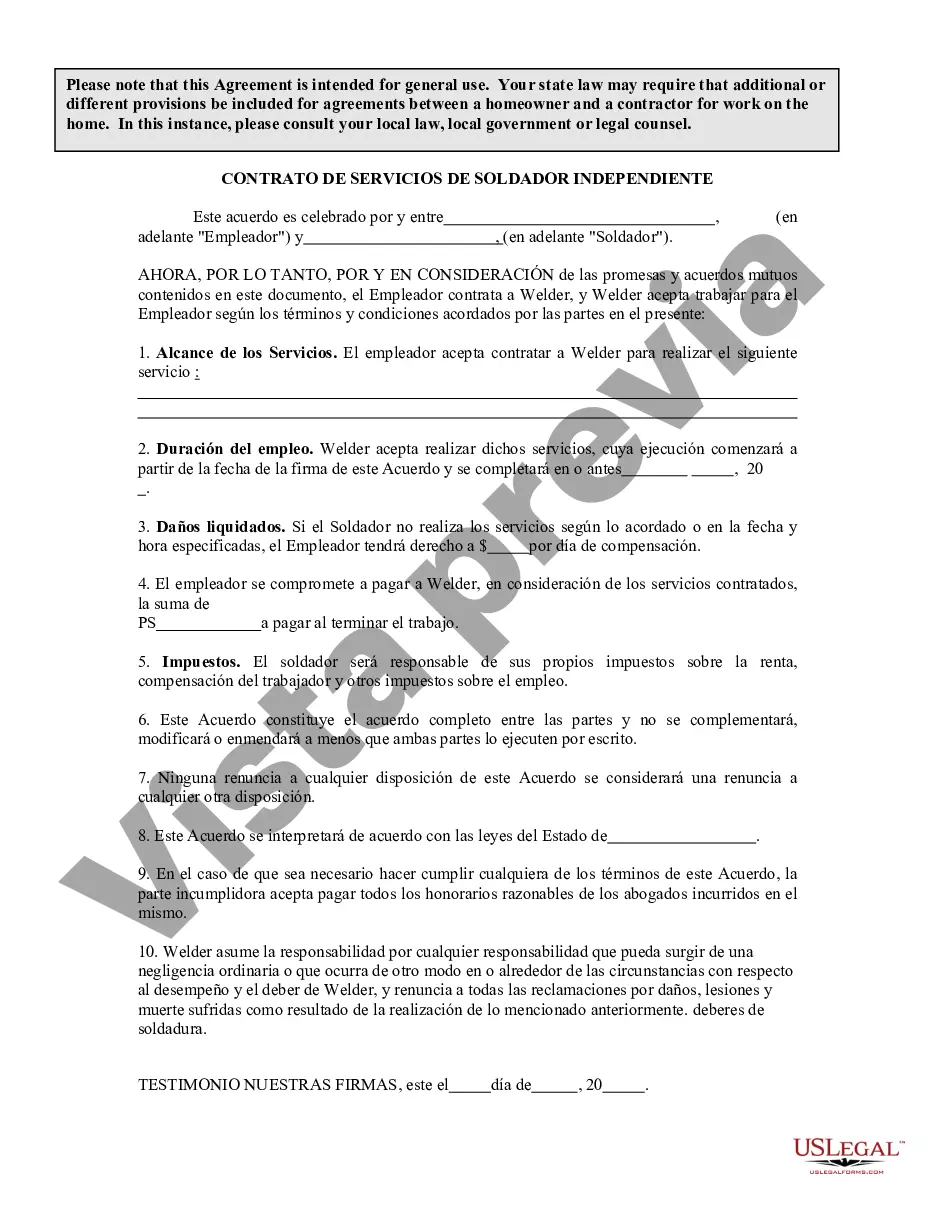

Travis Texas Contrato de servicios de soldador independiente por cuenta propia - Self-Employed Independent Welder Services Contract

Description

How to fill out Contrato De Servicios De Soldador Independiente Por Cuenta Propia?

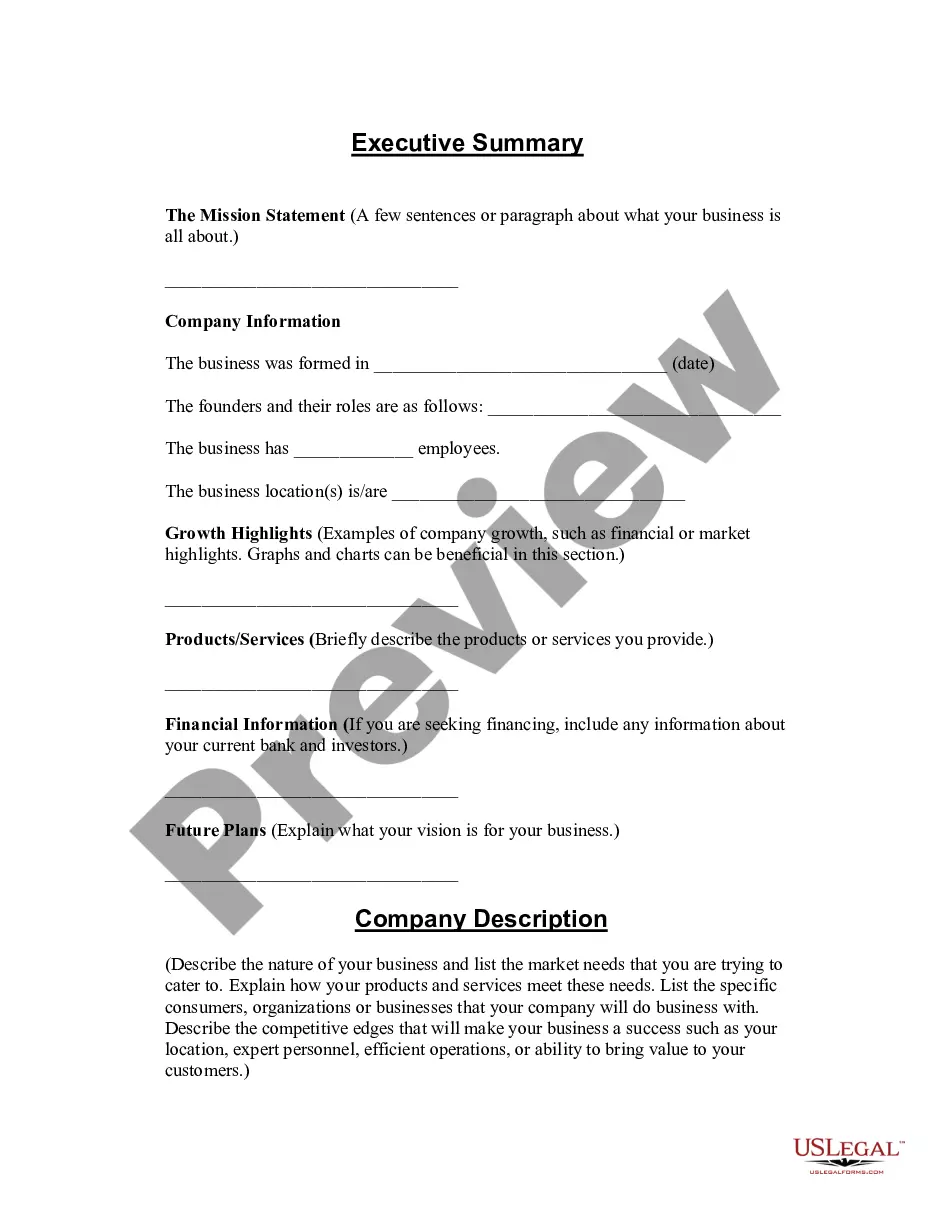

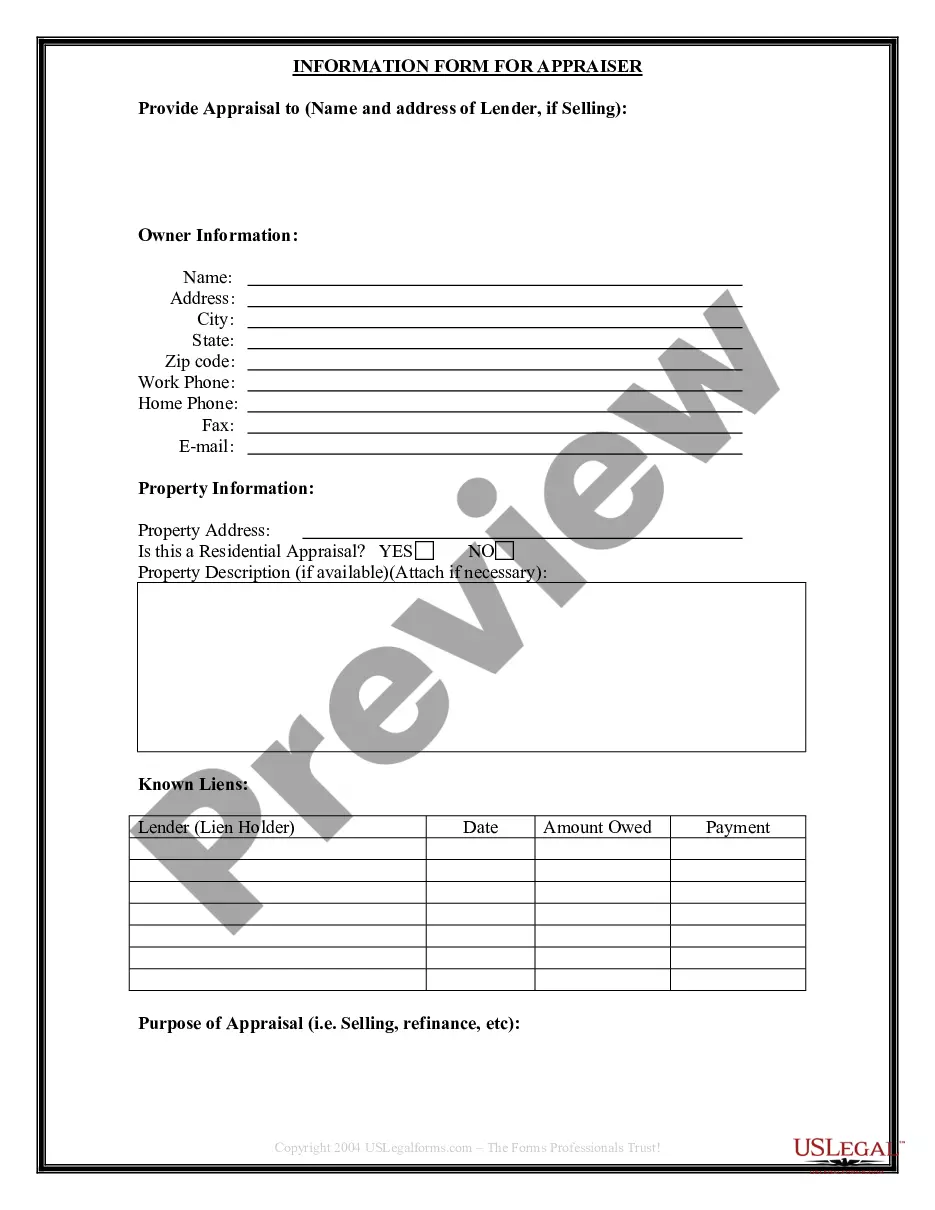

Whether you intend to launch your enterprise, engage in a contract, submit your ID renewal, or address family-related legal issues, you must organize specific documentation that complies with your local statutes and regulations.

Locating the appropriate documents may require considerable time and effort unless you utilize the US Legal Forms library.

The platform offers users over 85,000 expertly crafted and authenticated legal forms for any personal or business situation. All documents are categorized by state and purpose, making it quick and straightforward to select a copy like the Travis Self-Employed Independent Welder Services Contract.

Documents available in our library are reusable. With an active subscription, you can access all previously acquired documentation anytime in the My documents section of your profile. Stop wasting time on an endless search for updated formal documents. Enroll in the US Legal Forms platform and maintain your paperwork in order with the most extensive online form collection!

- Ensure the sample aligns with your individual requirements and state legal standards.

- Browse the form description and review the Preview if it's available on the page.

- Use the search feature, specifying your state above, to locate another template.

- Click Buy Now to acquire the document once you've found the correct one.

- Select the subscription plan that most fits your needs to proceed.

- Log in to your account and pay for the service using a credit card or PayPal.

- Download the Travis Self-Employed Independent Welder Services Contract in your preferred file format.

- Print the document or complete it and sign electronically via an online editor to save time.

Form popularity

FAQ

Si el total de ingresos durante el ano fueron en efectivo y no recibiste un formulario W-2, deberas solicitar un Formulario 1099-MISC a tu empleador al final del ano fiscal. El 1099-MISC se usa para reclamar los ingresos que recibiste como contratista independiente.

Usted debe pagar el impuesto sobre el trabajo por cuenta propia y presentar el Anexo SE (Formulario 1040 o 1040-SR) si se da alguno de estos casos. Sus ganancias netas del trabajo por cuenta propia (sin incluir el ingreso como empleado de una iglesia) fueron de $400 o mas.

Una contratista independiente es una persona que es contratada para hacer un trabajo especifico. Se dice que es su propia jefa porque controla como y donde se realiza el trabajo. Estas personas tienen mayor libertad y solo se comprometen a hacer la funcion especifica que acordaron con la persona duena de una compania.

Los expertos recomiendan que se guarde por lo menos 25% de su ingreso del trabajo para pago de impuestos. Como contratista independiente debe usar los formularios 1099-MISC recibidos de sus clientes, asi sabra el total a declarar en impuestos. Despues debe presentar la declaracion con el formulario 1040.

Los expertos recomiendan que se guarde por lo menos 25% de su ingreso del trabajo para pago de impuestos. Como contratista independiente debe usar los formularios 1099-MISC recibidos de sus clientes, asi sabra el total a declarar en impuestos. Despues debe presentar la declaracion con el formulario 1040.

Conceptualmente se considera como trabajador independiente a la persona que explota de manera autonoma, o por cuenta propia, una actividad economica.

Trabajadores independientes que pueden declarar costos y gastos....Deducciones especiales en los trabajadores independientes. Intereses por prestamos de vivienda. Los pagos por salud (medicina prepagada, seguros privados de salud) Deduccion por concepto de dependientes. Gravamen a los movimientos financieros (4x1.000).

Impuestos de los trabajadores por cuenta propia Para el 2021, los empleados pagan 7.65% de su ingreso en impuestos del Seguro Social y Medicare y sus empleadores hacen una contribucion adicional de 7.65%.