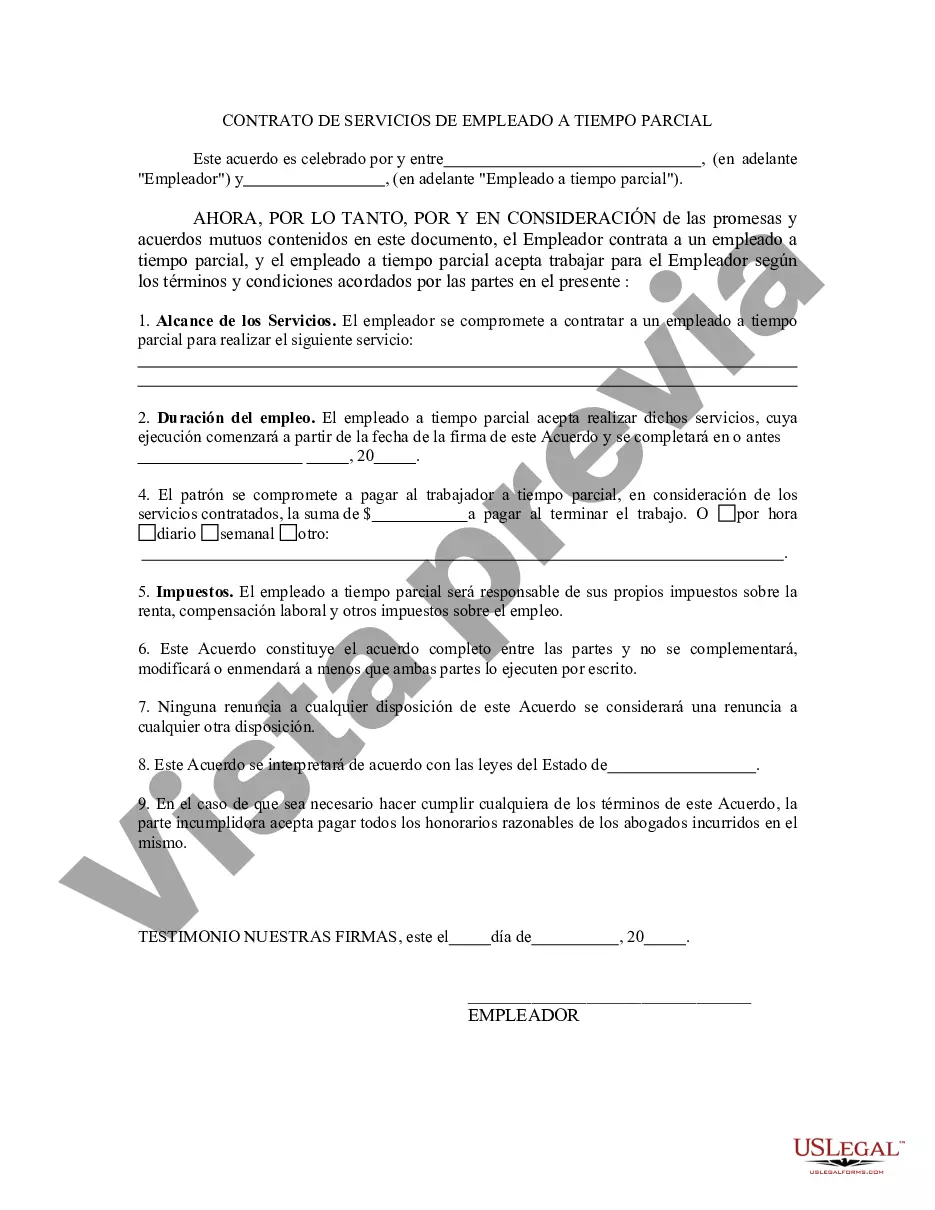

King Washington Self-Employed Part Time Employee Contract is a legal agreement between a self-employed worker and the company they work for on a part-time basis. This contract outlines the terms and conditions of the employment relationship, ensuring both parties are aware of their rights and responsibilities. One key aspect of the King Washington Self-Employed Part Time Employee Contract is the classification of the worker as self-employed. This means that they have control over the way they perform their work and are responsible for their own taxes, insurance, and other obligations typically associated with self-employment. The contract includes details about the specific tasks the part-time employee will be responsible for and the agreed-upon working hours. It also outlines the compensation structure, including payment rates, frequency, and any additional benefits or reimbursement arrangements. Additionally, the contract may specify intellectual property rights, confidentiality agreements, and non-compete clauses to protect the company's proprietary information and prevent conflicts of interest. There might be different types of King Washington Self-Employed Part Time Employee Contracts, depending on the nature of the work and the specific requirements of the company. For example, some contracts may be project-based, where the self-employed worker is hired for a specific task or duration. Others may be ongoing contracts, where the worker provides services periodically over a longer period. It is essential for both parties to carefully review and understand the terms and conditions of the King Washington Self-Employed Part Time Employee Contract before signing it. This ensures a clear understanding of rights, obligations, and provisions, minimizing potential conflicts in the employment relationship.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.King Washington Contrato de Trabajador Autónomo a Tiempo Parcial - Self-Employed Part Time Employee Contract

Description

How to fill out King Washington Contrato De Trabajador Autónomo A Tiempo Parcial?

If you need to get a reliable legal document supplier to obtain the King Self-Employed Part Time Employee Contract, look no further than US Legal Forms. No matter if you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the appropriate form.

- You can select from over 85,000 forms categorized by state/county and situation.

- The intuitive interface, variety of learning materials, and dedicated support make it easy to find and execute various paperwork.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

Simply select to look for or browse King Self-Employed Part Time Employee Contract, either by a keyword or by the state/county the form is intended for. After finding the needed form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to start! Simply locate the King Self-Employed Part Time Employee Contract template and check the form's preview and short introductory information (if available). If you're confident about the template’s terminology, go ahead and click Buy now. Create an account and choose a subscription plan. The template will be immediately available for download as soon as the payment is processed. Now you can execute the form.

Handling your legal matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our extensive collection of legal forms makes these tasks less expensive and more reasonably priced. Create your first business, organize your advance care planning, draft a real estate agreement, or complete the King Self-Employed Part Time Employee Contract - all from the comfort of your sofa.

Join US Legal Forms now!