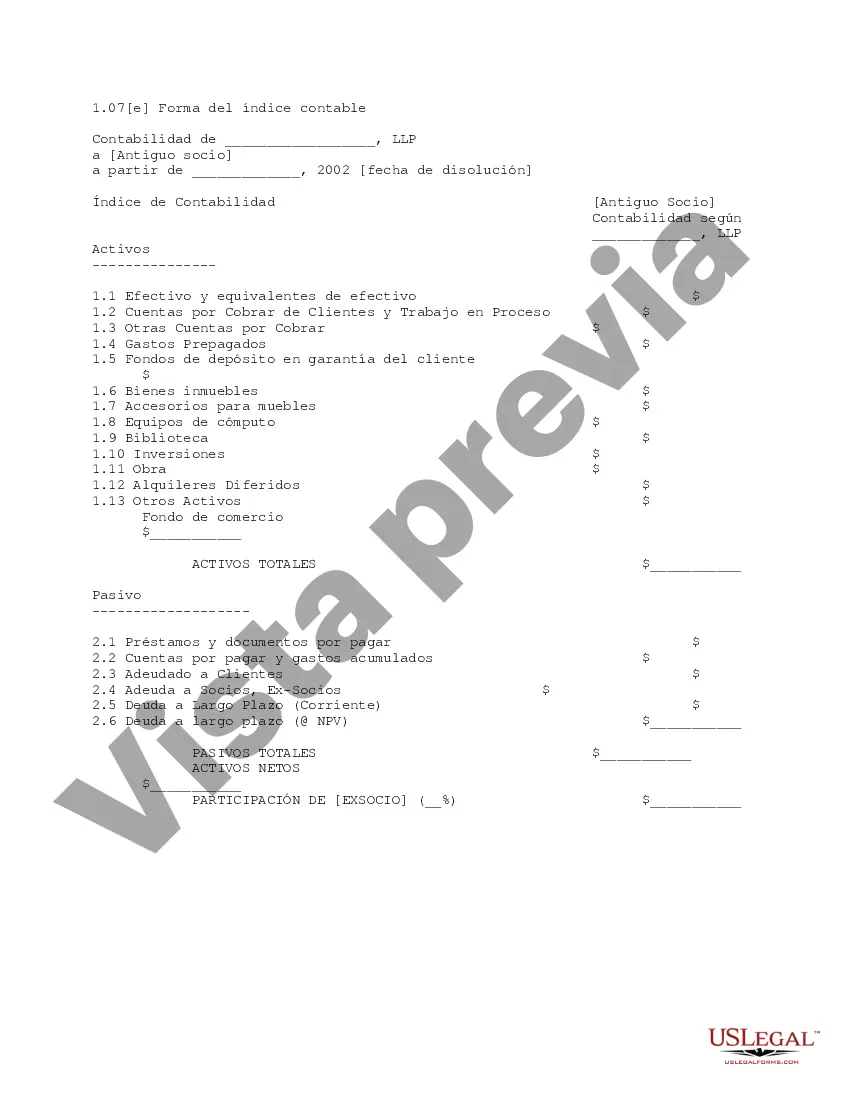

Clark Nevada Forma de Índice Contable - Form of Accounting Index

Description

How to fill out Forma De Índice Contable?

A documentation process consistently accompanies any legal endeavor you undertake. Initiating a business, applying for or accepting a job proposition, transferring property ownership, and various other life circumstances require you to organize official paperwork that differs from jurisdiction to jurisdiction. That’s the reason having it all gathered in one location is quite beneficial.

US Legal Forms represents the largest digital repository of current federal and state-specific legal documents. Here, you can effortlessly locate and download a form for any personal or business purpose relevant to your area, including the Clark Form of Accounting Index.

Finding templates on the website is incredibly straightforward. If you already possess a membership for our service, Log In to your account, search for the sample using the search bar, and click Download to store it on your device. Subsequently, the Clark Form of Accounting Index will be accessible for future use in the My documents section of your account.

If you are using US Legal Forms for the first time, adhere to this brief guide to acquire the Clark Form of Accounting Index: Ensure you have accessed the correct page with your local document. Utilize the Preview mode (if available) and browse through the template. Examine the description (if any) to verify that the template meets your needs. Look for another document using the search feature in case the example does not suit you. Click Buy Now when you find the required template. Choose the appropriate subscription plan, then Log In or sign up for an account. Select the preferred payment method (via credit card or PayPal) to proceed. Choose the file format and download the Clark Form of Accounting Index onto your device. Utilize it as necessary: print it or complete it electronically, sign it, and submit where needed.

- This is the simplest and most dependable method to acquire legal documents.

- All the templates available in our library are expertly drafted and verified for compliance with local laws and regulations.

- Prepare your documents and manage your legal matters effectively with the US Legal Forms!