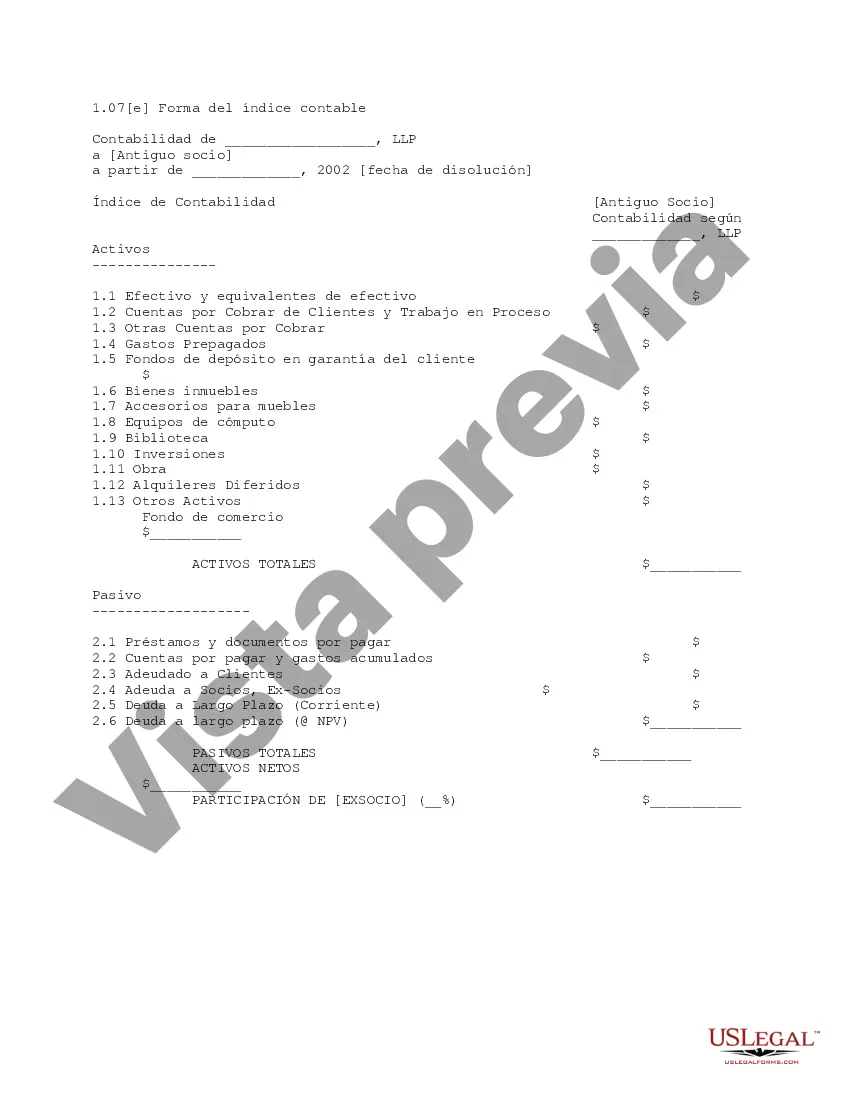

The Dallas Texas Form of Accounting Index is a systematic framework used to organize and track financial information in the context of business accounting practices. This index is specifically designed to cater to the needs of businesses in the Dallas, Texas region and aligns with the localized accounting regulations and requirements. The Dallas Texas Form of Accounting Index serves as a standardized template for recording financial transactions and aids in the preparation of financial statements, tax filing, and compliance with industry-specific regulations. It provides a structured way to categorize and organize financial data, making it easier for businesses to analyze their financial performance, monitor expenses, and make informed decisions. Different types of Dallas Texas Form of Accounting Index may include: 1. General Ledger Index: This form of accounting index is the central repository for all financial transactions within a business. It categorizes transactions by accounts such as assets, liabilities, equity, revenues, and expenses, providing a comprehensive overview of a company's financial status. 2. Accounts Payable Index: This index specifically tracks and records all outgoing payments made by a business, including bills, invoices, and other financial obligations. It helps businesses keep track of their payable amounts, monitor payment deadlines, and maintain strong relationships with vendors and suppliers. 3. Accounts Receivable Index: This type of index focuses on tracking and managing incoming payments from customers or clients. It ensures that all revenue generated by the business is properly recorded, aids in tracking outstanding invoices, and helps facilitate effective credit control and debt collection practices. 4. Inventory Index: An inventory index tracks the quantity, cost, and valuation of products or goods held by a business. It helps companies analyze their inventory turnover, manage stock levels, and accurately assess the value of products for financial reporting, cost control, and sales forecasting. 5. Payroll Index: This index is specific to tracking employee compensation, deductions, and benefits. It ensures accurate payroll processing, tax withholding, and other payroll-related obligations, providing a reliable record of payments made to employees. Overall, the Dallas Texas Form of Accounting Index plays a crucial role in maintaining accurate financial records, enabling businesses to make informed decisions, comply with regulations, and effectively manage their finances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Dallas Texas Forma de Índice Contable - Form of Accounting Index

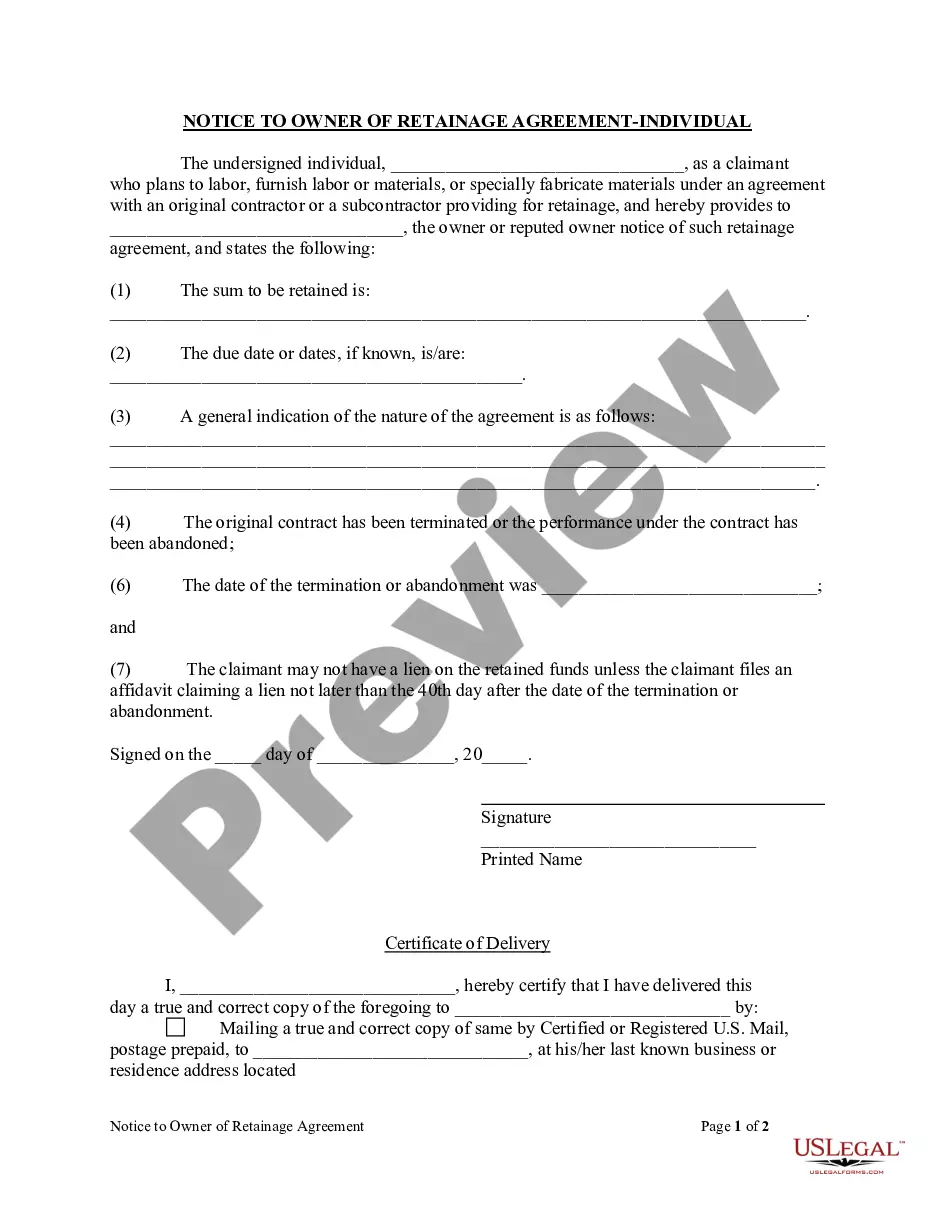

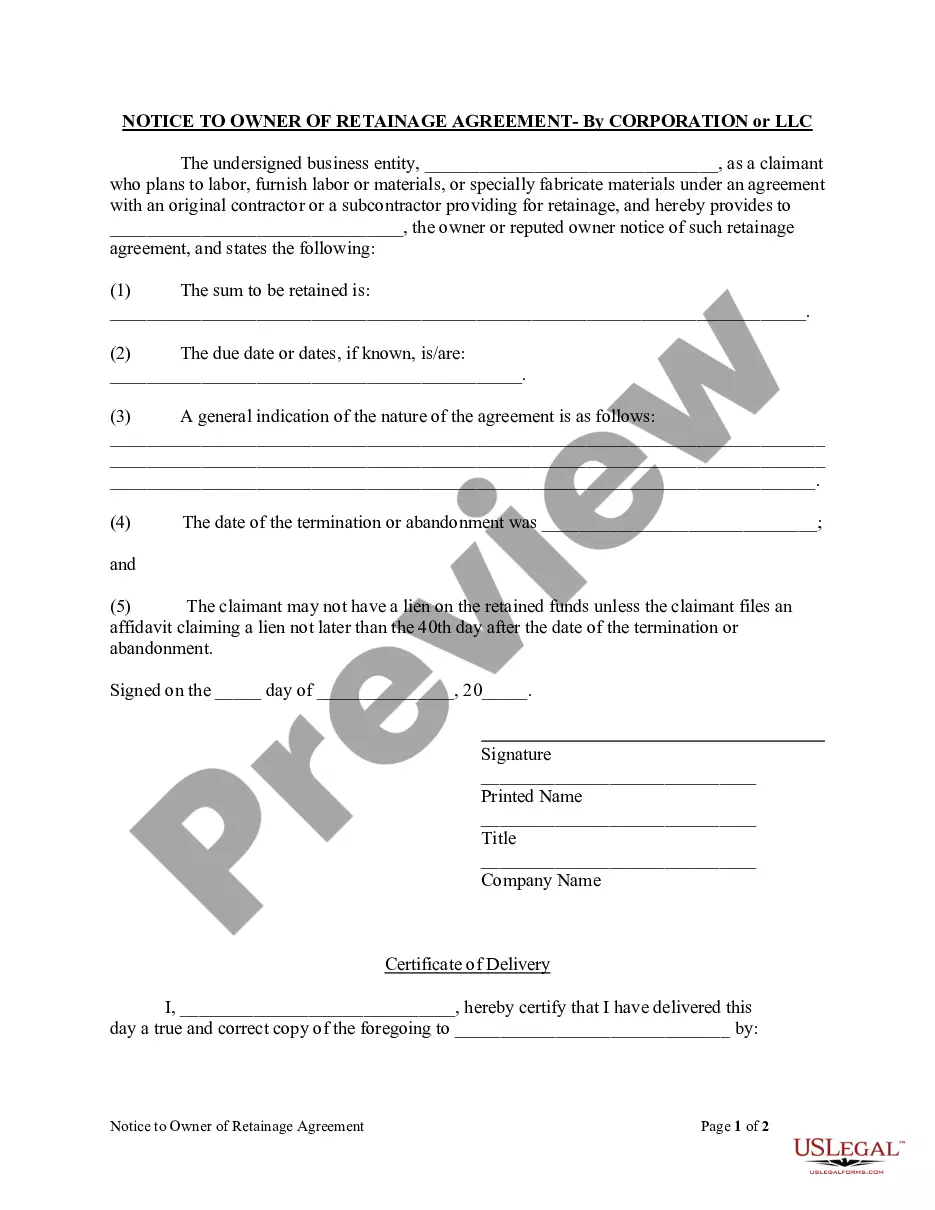

Description

How to fill out Dallas Texas Forma De Índice Contable?

Preparing papers for the business or personal needs is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state laws and regulations of the particular region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it stressful and time-consuming to generate Dallas Form of Accounting Index without expert help.

It's easy to avoid spending money on attorneys drafting your documentation and create a legally valid Dallas Form of Accounting Index by yourself, using the US Legal Forms web library. It is the largest online collection of state-specific legal documents that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the necessary form.

In case you still don't have a subscription, adhere to the step-by-step guideline below to get the Dallas Form of Accounting Index:

- Look through the page you've opened and check if it has the sample you require.

- To achieve this, use the form description and preview if these options are presented.

- To find the one that fits your needs, utilize the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Select the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal templates for any scenario with just a few clicks!